@kb_snn it will be really helpful, if you can let me know how to analyze this shift. Should I start with import/export data and then see which companies get effected by that?

China Import and export data is one important data point but if you don’t want to go through that then look at “Facilitators of trade” which have quasi monopolies or high Market shares who will gain when there is more global trade from India –

Ports , Containers handlers , CV manufacturer ( finance companies ) etc .

Corporate Banks that can gain from increased making LC & Export Credit etc + Fee incomes

SEZ providers ( e.g construction companies like Mahindra Lifespace )

Losers : Many …

Chinese industries will focus aggressively towards Asia and also possibly India for replacing US market

Also in case you want to discuss on any of the above themes in further detail , lets take this to another thread BULL in BEAR Market so that we don’t clutter this thread

Interest rates are rising, which is bad for stocks.

But rates are rising because the economy is growing, which is good for stocks.

High growth could cause inflation, which is bad for stocks.

But inflation could boost earnings, which is good for stocks.

Repeat until crazy.

Courtesy : Morgan Housel

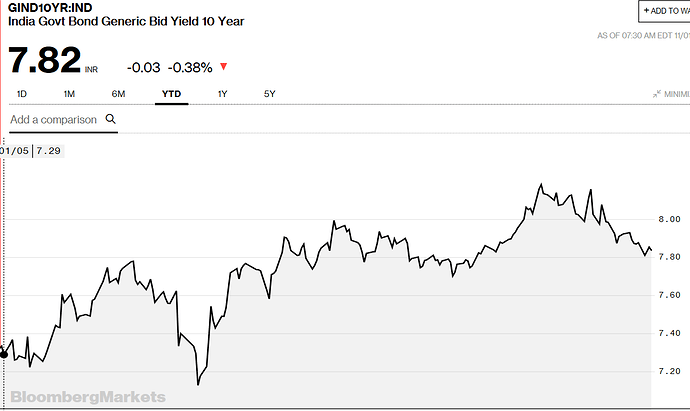

Crude is retreating and is under $75. Technically it looks like it could slip to $65-$70 levels within a month. That’s the “good times” levels. At least one macro is softening.

And so are interest rates in India.

Source: Bloomberg - Are you a robot?

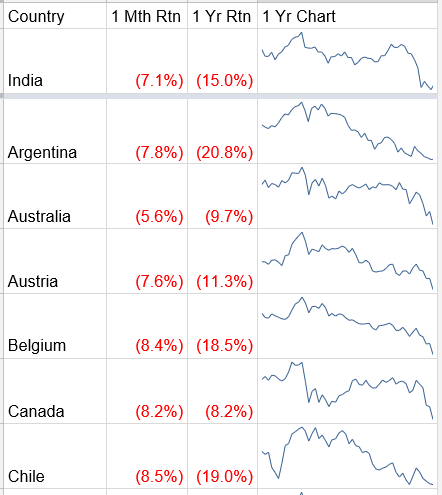

However, the selloff in global equity market appears to have gathered pace with developed markets taking the lead in Oct.

Here is a link to my Global Equity Monitor that I built using country ETFs that trade on NYSE and prices from Goolge Finance.

This sheet uses ETFs that track major equity index in respective countries and priced in USD. So equity returns are inclusive of currency movement wrt USD.

As the data in the sheet shows, equity sell off is happening globally. Emerging markets began to correct earlier this year while developed markets have joined the sell off in last 4-6 weeks. With developed markets joining the sell off, we can start counting down to the bottom. Since this sell off is driven by tightening liquidity, I think it may not be very bad, or deep or prolonged. Selloffs created by bursting bubbles, global recessions etc are much worse. Just my humble opinion.

What goes up comes down… No one invites recession it happens because of failure of countries and that too major economies. Right now the world is roughing it out in Nationalism & protectionism. A protracted stance and no global consensus is bound to impact growth rate of the world but if there are no defaults or major disruption recession seems unlikely. But be prepared for a slower global growth despite moderate oil & rise of dollar.

Last consumer demand hope for the FY18-19 was festival season (Onam, Dushera (Navratri) and Diwali) but all are trends are disappointings -

Auto sales - Though manufacturer’s pushed up sales fig by pushing inventory to dealers’ showroom, dealers are not able to sell. Demand is lower than last year in festive season.

Jewellers are also disappointed with muted festive gold demand -

No crowd for festive real estate discount sale -

But Nifty is likely to make fresh highs… It is a recorded feature, that retail investment is high when Nifty PE is above 24…

Bingo for retail garments industry as well. A friend who manages a big retail garment chain in Pune told me the same thing.

Regards,

Suhag

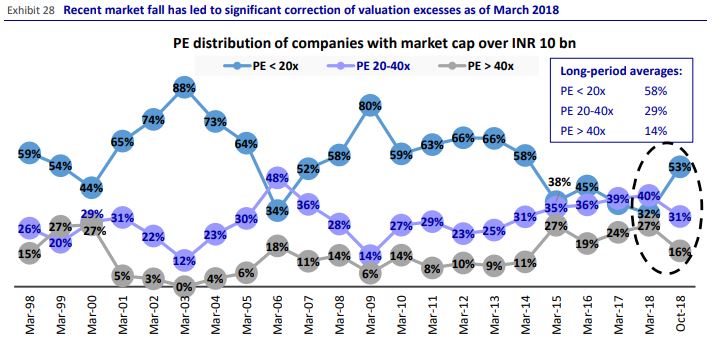

Interesting chart from MO’s 23rd Annual Wealth Creation Study -

Some sanity has returned to the market in Oct '18 after crazy valuation excesses in last couple years.

Source:https://www.motilaloswal.com/site/rreports/636766965804335553.pdf

Sir- can you please share which price action, are you referring to Nifty/Sensex charts.

2 sides to every story

I find nothing strange here. One of them is talking solely about mobile phones while another is talking primarily about apparel. The former continues to be affected by online retailers offering discounts while the latter looks to be wresting back control. That much is clear by reading the two articles.

As for the quality of journalism - See this

The ET article speaks of retail chains by names - Shoppers Stop, Reliance Trends, Lifestyle, Future Group, Arvind Brands, Max and FabIndia and goes on to quote Rakesh Biyani of Future Retail, Rajiv Suri of Shoppers Stop, Alok Dubey of Arvind Brands, William Bissell of FabIndia with very specific information on how the festive sales has been, which is to say very good. This makes the numbers more credible.

The Times Now article mentions a few mobile store chains but has no credible quote. The only quote I found was by some Subhasish Mohanty of Spice Hotspot - Is this the sort of information you want to base anything on?

I find articles like these mostly irrelevant for Investment decision-making.

Stocks may See Major Surge if History Repeats on D-St

IN PAST 12 YEARS Every time the index has fallen about 14%, it had recouped all the losses the next 3 months; Many factors now favourable for Indian stocks: Analysts

Rajesh.Mascarenhas@timesgroup.com

Mumbai:

Over the past two months, the Mumbai markets have been in a bear grip. The Nifty declined more than 14% from its high, pointing to the vulnerability of Indian equities to the falling rupee, rising oil prices, and widening trade deficits.

But long-term believers in the Mumbai miracle should not lose hope. Every time the index has fallen about 14% in the past 12 years, the next three months have seen the benchmark recoup all the losses, showed a study by Elara Securities. The only exception to this pattern was 2008-09, when the global financial industry had to ride out its steepest decline since the Great Depression.

Currently, the Nifty has recovered about 5% from its two-month low reached October 26. Since 2006, there have been 15 instances, barring the 2008-09 crisis, in which Indian stocks fell more than 10%. During these deep corrections, on an average, the Nifty declined 14% and the average duration of such corrections is 58 days.

After each bout of corrections, the Nifty recoups most of the losses over the next three months, thus offering a 15% return, according to the Elara study. On these 15 instances, the Nifty reclaimed its peak in 11 within six months after each round of declines.

Two notable prolonged corrections were in 2012 — 105 days due to the Eurozone crisis, and in 2015 — 125 days due to the China slowdown, steep drop in oil prices and increasing NPAs. Periods of prolonged corrections were also followed by periods of slow recovery. In both instances, the Nifty took about 6 months to regain its peak.

There are four instances when the Nifty failed to reclaim its peak levels even after six months of bottoming out and in all these instances, the corrections was prolonged — ranging from 52 days to 97 days.

Various factors indicate a recovery in Indian stocks, said analysts.

“We expect the market to rebound from the current levels due to valuation comfort, easing crude prices, a pause or deceleration in currency depreciation, underperformance of ‘Defiant’ sectors like IT and pharma, a rally in ‘Rebounders’ like metals, and easing market volatility,” said Ravi Muthukrishnan, head — institutional equity research, Elara Securities.

Asian Paints, Britannia Industries, Colgate, GlaxoSmithKline Pharma, Kansai Nerolac, Crisil, Dabur, and Marico are some of the leading stocks that have performed through the latest round of corrections.

If there is a trend, it looks like big ticket spending is slowing down while small ticket spending is rising up among the Indian consumer. House and car (and also jewellery) for which people have to take up large debt (except jewellery maybe) are trending down while mobile phones, apparel, fmcg, travel (going by hotel occupancy rates, domestic passenger growth in flights) are trending up. I suspect this might just be the new normal going forward as the current generation prefers to rent than own. The happiness of owning things is replaced by the fleeting yet robust happiness of renting/consuming where the large EMI outgo is replaced by smaller but repeat pleasures, without responsibility.

Does this mean economy is slowing down considerably?

CV (Ashok Leyland up 17%, Tata Motors up 22%) and Tractor (Escorts up 29% and M&M up 17%) sales for October indicate otherwise though passenger car segment is trending down. A bulk of sales in the last few years for passenger cars must have come from ola/uber fleets when there was a considerable euhoria among ola/uber drivers - this correlates with Maruti Dzire sales in the period well. Now the current capacity should be sufficient going forward and that cycle may have peaked last year, going by the avg driver monthly earnings which has come down considerably indicating oversupply. Even the cars purchased are sitting idle at home for most people as congestion makes them unusable and everyone has a two-wheeler to supplement for such scenarios. Metro constructions should only lower passenger car demand for the foreseeable future IMHO.

Housing sales is the backbone of the economy and I don’t think real sales will pick up dramatically unless prices become reasonable/affordable. I have a very negative view towards RE sector barring a few players who are almost debt free and showing sales and holding large land parcels. This is the bigger problem and there can be no real economic growth unless this sector is fixed by letting a few entities go bust. This will of course affect the rest of the economy even which is small-ticket consumption driven and also the markets but this will be a step in the right direction.

These are trends emerging and a rising rate scenario will make these more pronounced going forward I think.

Diwali sales happen almost weeks leading to Diwali culminating at Dhan Teras. No one plans to buy anything on Diwali as almost everyone is busy on festivities. So view is almost always clear by Diwali itself.

CV sales are up due to increased Govt infrastructure spending in last couple of years based on higher Govt revenues riding on low interests, higher global growth and benign crude. Let’s see how the infra spend holds when the tables turn. As far as tractor and other agro equipments are concerned, it’s not a reliable indicator as, as such a substantial number of farmers have no intention of paying back and intend to wait till next farm loan waiver. ![]()

If passenger car sales are down due to Ola/Uber bubble burst, why are two wheeler sales are down by 15-35%? Does it not indicate rural distress?

Not sure where those numbers are from but what I saw indicated the contrary for October.

Hero Motor Corp recorded 16% growth. Honda 12%. RE 3% (they had production issues I think), TVS Motors 26%. Bajaj Auto 32% and recorded highest ever monthly sales. Suzuki 34% growth. All YoY growth.

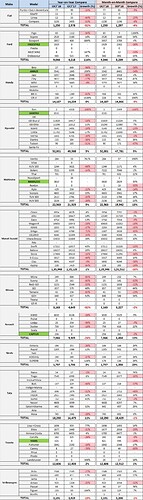

Found this chart for October 18 car sales. Trying to find similar breakup for two wheeler sales which will clear the air about this confusion.

Ford and Fiat are dying brands in India. We should not read too much into these. Maruti, Huyndai, Honda, M&M and Tata should be reasonable indicators.

The image enclosed by @devaki.tripathy does include auto sales by all manufactures, please just click to expand it or have a look at the same at http://www.autopunditz.com/news/indian-car-sales-figures-october-2018/