There are times when you don’t have choice and there are times when you have choices which make decision making difficult .

I tried playing BULL in BEAR three times in my life : 2001–2003 , 2008–2009 and 2012–2013 and have made many mistakes …

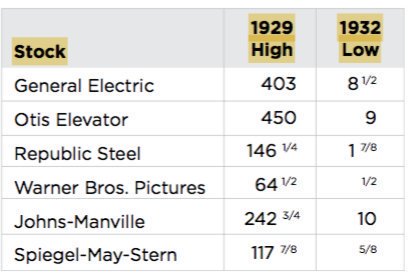

Buying best Quality @ peak prices — In 2001–2003 bear market, only stock that seemed unshakeable was Hindustan Lever. Management quality was great and great business franchisee and most of my friends wanted to join and work for that company . I bought it when it fell by 10% from all time high and loaded up as it kept falling. For next 4 years stock hardly moved while India had greatest bull market of all time.

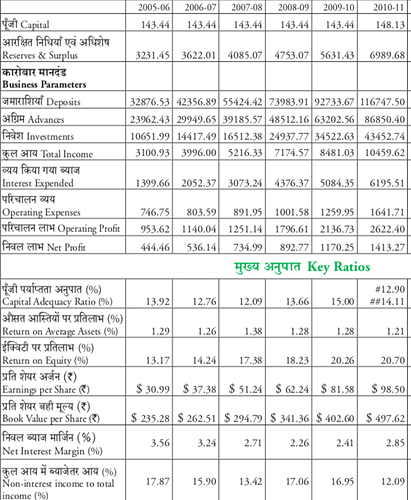

Position Sizing : In 2008–09 bear market , I had matured — with over 9 years corporate experience and as business head , I knew what are great business and what makes them tick . This time I was extra careful not to buy at peak valuation . So I could avoid all landmines of poor quality stocks and bought tracking positions in quality FMCG and pharma stocks at reasonable valuation . But the biggest mistake was I so anchored with 2003 prices that I kept waiting for big correction and tracking position never expanded … expect for one stock which I understood most as I worked for that company . So subsequent gains from 2009 onwards for other stocks expect one hardly made any impact on my overall networth.

Buying Junk stocks : In 2012–13 bear market, I was more confident as I had made good money in earlier cycle on account of being lucky on one stock ( my employer ) in which I had decent allocation . but I thought I should learn more about investing . I started reading Ben Graham , Mr Marks and many blogs that talked and preached value investing. For first time I started buying Junk business with good dividend yields ( because I wanted to increase my passive income ) — so called penny stocks mostly in areas on auto ancillaries , OMCs , Retail , packaging , telecom, textiles , commodities etc… Then 2013 Fed announced tapering happened and these stocks fell by nearly 20%-30% and I was scared for first time . My broker came over to my place and told me to sell all my stocks and buy Quality FMCG and Pharma stocks . I kicked myself for shifting to mid caps and small caps. But I did not sell as when I checked the prices the dividend yields on my stocks moved to near 10% . Now suddenly I started “Justifying” my purchases saying it is better than tax saving bonds and I shifted fixed income money to these so called junk stocks … This could have been disaster move as many stocks had avg. business quality …

For some strange reasons post 2014 onwards these stocks moved up became 5/10/20 bagger and I found experts calling these avg. businesses as “Quality stocks with Moat” — this is the point I gave up believing Investing is a skill and some person can become better investor with time . It is game of probabilities and luck . All one can do is increase probability of success , but luck will determine your returns …

So will I try to be BULL in 2018–2019 market … Yes as this game is addictive … tough to get out unless thrown out