Background

VST, originally incorporated in 1930 as Vazir Sultan & Son, became an associate of British American Tobacco Plc. (BAT) over a period of time, which holds a 32.2% stake in VST Industries. Post-acquisition of stake by BAT, the named was changed to Vazir Sultan Tobacco Company Limited, and further in 1984 to VST Industries Limited. In the early 1970s, the Government of India directed all companies coming under the Foreign Exchange Regulation Act (FERA) to reduce foreign shareholding to less than 40 percent. Consequently, BAT’s stake in VSTIL got reduced to 32.6 percent.

Post Liberalisation, in 1993, the company has failed efforts in diversifies in real estate, Agri processing and financial services, which resulted in large losses during FY1999. With support of BAT and difficult strategic decision to focus on core business, the company again resumes its part of profitable growth.

In February 2001, Radhakishan Damani, India’s savviest stock market investors, astonished the market by making a hostile bid for cigarette maker VST Industries, owned by British American Tobacco (BAT)., Damani had accumulated below 15 percent in the company over the last year at an average price of 88 per share. But ITC which entered the fray as a white knight and foiled it with support from BAT. Damani still holds 26 percent in VST Industries.

The company is mainly engaged in manufacturing and marketing of cigarettes, and trading of unmanufactured tobacco. VST is the third largest cigarette manufacturer in the country, operating mainly in the lower end category of the industry. VST’s flagship brands include Charminar (since 1994), Charms Virginia (since 1997), Special Extra Filter (since 2004) and Moments (since 2007).

https://www.asci.org.in/journal/Vol.33(2004)/03.%20H.%20Hemnath%20Rao.pdf

Positive:

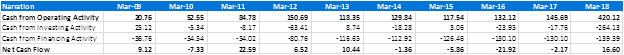

Strong cash generations:

High Entry barrier

As cigarette being not good for health, the government has banned promotion of cigarette through advertisement in television. Also there is good efforts to promote bad effect of cigarette on health, specifically by pictorial warning on cigarette pack, cancer related issues due to cigarette consumption. Also, the government has banned new capacity of cigarette. While all these factors have resulted in degrowth of cigarette consumptions in India, same has also resulted in very high entry barrier in the sector. There are only 3 large players which control around 90%

Negative factors

"Sin" product

Tobacco consumption has been major factor driving cancer and other health related disorder. The government has taken various action on controlling the tobacco consumption including increasing various taxes on cigarette. Being an addiction, the rise in cost/taxes are passed on to the consumer, who has very limited choice to avoid consumption due to addition. Hence, while the cigarette business may provide stable cashflow to investor, it is not be good industry from society value perspective. Also, over a long term, the industry growth is expected to remain negative as reported in Developed market with increasing per capita income and awareness.

Growing illicit cigarette market in India

While there is high entry barrier of entry in Cigarette sector, same is applicable only to organised sector. As per ITC Corporate presentation, the legitimate cigarette industry has declined steadily since 2010‐11 at a compound annual rate of 4.8% p.a., illegal cigarette volumes in contrast have grown at about 5% p.a. during the same period, making India one of the fastest growing illegal

Cigarette markets in the world. So higher tax on cigarette from organised along sector, along with very high portion of pack being covered gruesome images adversely affect safety perception of domestic cigarette in India and increasing share of illicit imported cigarettes.

High Valuation

VST Industries is currently trading 25 times PE on TTM basis. Since March 1997, average PE multiple and Median Multiple for the company is 14.37 times and 14.12 times. Hence, valuation of the company has limited, rather no margin of safety if considered with past parameters.

Rationale for investing

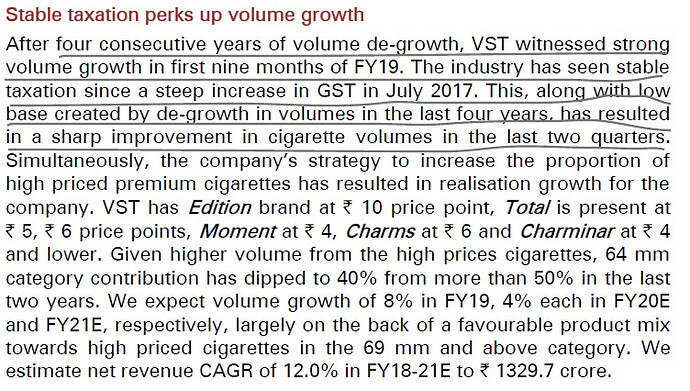

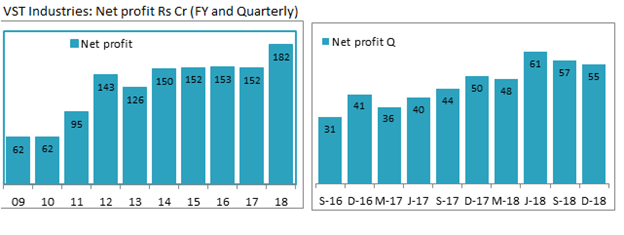

After 4-5 years of negative volume growth, resulting for various factor, VST Industries as well as orgainsed cigarette industry have shown positive growth from last 2 quarters. I have relied in ICICI Direct report on VST Industries in Jan 2019. The relevant portion of report indicating positive growth is enclosed.

Further, December 2018 results TTM EPS Rs 143, with dividend payout ratio of around 70%, may result in increased dividend to Rs 100 per share in FY20 for VST Industries. Since I like stable dividend investment, I expect VST Industries to provide for 2.7% Dividend Yield as on Current price (Rs 3600). The share price movement would depend on how industry growth revive and I have no view on same. Further, at current level, there is limited margin of safety for investor in my opinion. However, this may be good stable dividend generating idea if an investor is looking at investing for 3-5 year horizon.

Past Dividend, Share price and PE for VST Industries

| Year End | Dividend % | Dividend Rs | Share price | TTM PE | Div Yield |

|---|---|---|---|---|---|

| Mar 2018 | 775 | 77.50 | 2,919 | 25.23 | 2.7% |

| Mar 2017 | 750 | 75.00 | 2,880 | 25.95 | 2.6% |

| Mar 2016 | 700 | 70.00 | 1,620 | 17.31 | 4.3% |

| Mar 2015 | 700 | 70.00 | 1,607 | 15.18 | 4.4% |

| Mar 2014 | 700 | 70.00 | 1,649 | 19.14 | 4.2% |

| Mar 2013 | 625 | 62.50 | 1,505 | 18.12 | 4.2% |

| Mar 2012 | 650 | 65.00 | 1,457 | 16.96 | 4.5% |

| Mar 2011 | 450 | 45.00 | 640 | 10.4 | 7.0% |

| Mar 2010 | 300 | 30.00 | 521 | 10.49 | 5.8% |

| Mar 2009 | 300 | 30.00 | 225 | 4.62 | 13.3% |

| Mar 2008 | 200 | 20.00 | 309 | 9.51 | 6.5% |

| Mar 2007 | 200 | 20.00 | 330 | 8.64 | 6.1% |

| Mar 2006 | 125 | 12.50 | 482 | 17.44 | 2.6% |

| Mar 2005 | 125 | 12.50 | 231 | 6.6 | 5.4% |

| Mar 2004 | 60 | 6.00 | 202 | 10.92 | 3.0% |

| Mar 2003 | 55 | 5.50 | 89 | 3.58 | 6.2% |

| Mar 2002 | 45 | 4.50 | 151 | 6.32 | 3.0% |

| Mar 2001 | 25 | 2.50 | 110 | 6.15 | 2.3% |

| Mar 2000 | 10 | 1.00 | 67 | 6.59 | 1.5% |

| Mar 1999 | 0 | 0.00 | 113 | 0 | 0.0% |

| Mar 1998 | 10 | 1.00 | 95 | 22.56 | 1.1% |

| Mar 1997 | 10 | 1.00 | 90 | 18.39 | 1.1% |

Links:

ITC Presentation: https://www.itcportal.com/about-itc/shareholder-value/ITC-Corporate-Presentation.pdf

Screener Data: VST Industries Ltd financial results and price chart - Screener

Cigarette industry data Euro monitor: mid-priced cigarettes: Cigarette sales will continue to be under pressure in India: Report - The Economic Times

Disclaimer: I have been holding VST Industries since last 9.5 years and my view may be biased. I have recently increased my allocation to VST Industries by 20% of my holding in VST Industries in last 15 days. I am not SEBI registered advisor and investor shall consult his/her own investment advisor before making any investment decision.