Given that Telecom is the flavor of the season, looked at this company. On the surface, the numbers and growth looked impressive, so decided to look deeper. Here are some of my findings and observations

BUSINESS MODEL

– STL business is to build, own and operate telco Poles, Towers, OFC (optical fiber cable) systems and related assets and to provide these passive infra assets on a shared basis to wireless and other communication providers

– These customers use the space on STL towers to install active communication-related equipment to operate their wireless communication network

– So basically, company sets up what is called as passive infra for telecom operators. They obtain the permissions / licenses for erecting the poles / towers and the rent these out to telecom operator

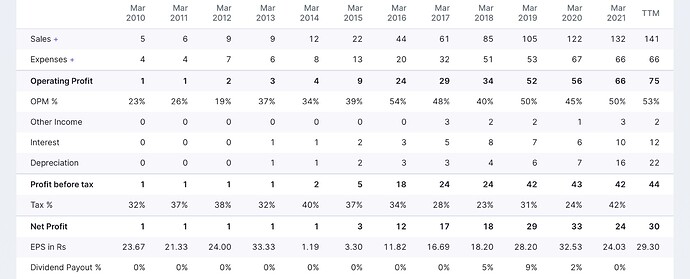

– Passive infra can be shared across operators. In other words, once the company has setup a tower, it can be leased to multiple operators serving in the area. This is called multi-tenancy. So ideally, higher the tenancy, the more profitable a tower asset will be.

In summary, the company

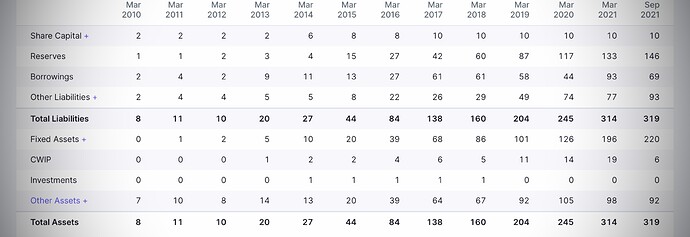

– Invests in setting up sites (Towers / Poles)

– Manages all the permissions, licenses etc that are required to setup and operate the towers

– Offers it to Telcos on rent

– Maintains the towers on continuous basis

– Ensure agreed level of up-time for telcos

– Telcos pay the company as per agreement

– Multiple operators can mount their equipment on the tower, increasing rental yield

– Once a tower is rented, it generates stable, and predictable cash flow in form of tower rentals from the tenants

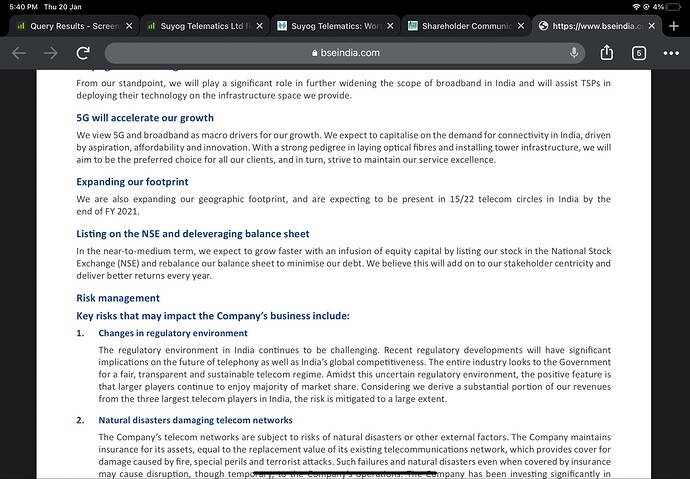

Factors that have helped STL Immensely in its growth

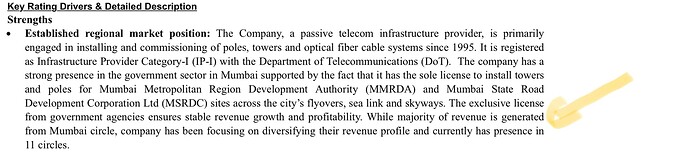

– They have sole license to install towers on all MMRDA, MSRDC sites such as Flyovers, Bridges, Sea-link, Sky-walks, Monorail etc

– If one if familiar with Mumbai, MMRDA is the nodal agency responsible for infra development across Greater Mumbai region, so it manages large swathes of key infra properties in Mumbai, such as the 2 large highways serving the Western and Eastern parts of mumbai and all the 50+ flyovers that are laid on these roads.

– This exclusive license allows grants STL exclusive rights to setup telecom towers on properties of these government agencies

– Its extremely critical for any telecom operator has to have towers along these routes in Mumbai

– In addition it has exclusive rights to setup towers on Foot over-bridges and Sky-walks (pedestrian bridges connecting densely crowded areas around sub-urban train stations to main station concourse), once again extremely critical for the operators serving millions of customers

– The exclusive licence from government agencies ensure stable revenue growth and profitability.

– They also specialise in setting up poles / towers in slum areas, which are very low cost, but again serve a large dense population base

Now the risks from this kind of a business setup are pretty obvious

– More than 80% of their sites are in Mumbai region, and by inference, so does the revenue. Though they claim to be present in 7 circles, the business in other locations is minuscule. Of total 1808 sites, 1009 are on MMRDA, MSRDC, BEST property. Another 390 of their sites are slum based sites. So about 1400 of the sites are definitely based in Mumbai region. They have about 409 small cell sites, some of which are likely to be within Mumbai.

The geographical concentration risk is pretty high. In case of any natural disaster, it could have a huge impact on revenue.

– Exclusive contracts / licenses with government agencies can either mean a very high entry barrier for competition, or in case of change in political dispensation, it could mean complete loss of advantage within days.

– As a corollary, it would be interesting to see how well the company business fares when it steps out of Mumbai for any meaningful expansion. Without the exclusivity it enjoys on home turf, will it do as well in sales, margins, profitability? Will it be able to stand up to the cut-throat competition in other geographies? If not, then the growth will be very, very limited.

– In last 5 years, Telecom industry has seen massive consolidation, with several players disappearing from the market due to M&A, bankruptcy or brutal market conditions. From an average of 8 players per telecom circle, the market now only has 3 players with a 4th state-run entity. So effectively, the tenancy options for passive infra companies is reducing. This implies low tenancy rates. In other words, earlier there were potentially 8 operators available for renting a tower, now there are only 3. This can be clearly seen in tenancy rates of STL. at 1.14. Of 1009 government sites, tenancy if 1035, barely over 1. Of 409 small cell sites, tenancy is 409, exactly 1 tenant per site. Only on slum sites it has a slightly better tenancy of 619 on 370 site.

– Tower business is brutally capital intensive and competitive. Most telcos started with their own infra / tower companies, which have been moved to separate entities. Bharti infratel, Indus tower and several others. STL is effectively in competition with some of these large players. Its unique model of low-cost Pole based sites and Slum-based sites has allowed it to create a niche for itself within the tower infra space, but for growing beyond the govt-contract protected territory of Mumbai, it has to step out and compete with larger players. Whether it has the capabilities to do that, is yet to be seen

Besides the business challenges stated above, there are certain other red flags that I noticed during my analysis of the Financials and AR FY19

- Related party transactions

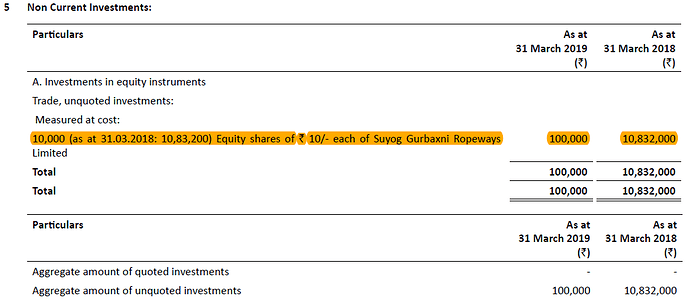

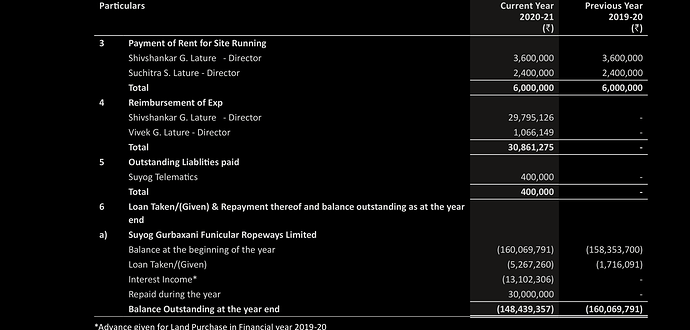

Mr Shivshankar Lature, the MD and Promoter, is also a promoter of another company called Suyog Gurbaxani Ropeway Pvt Ltd. This company has built a Funicular Ropeway system for a temple in Nashik, Maharashtra, which was inaugurated in 2018. The FY AR shows that STL has a small investment in this entity

My knowledge of accounts is quiet limited, so I am not sure why the value of investment in shown to be 1.08 crores as on 31-3-2018, whereas it is shown as 1 lakh on 2019?? Maybe boarders can comment on this.

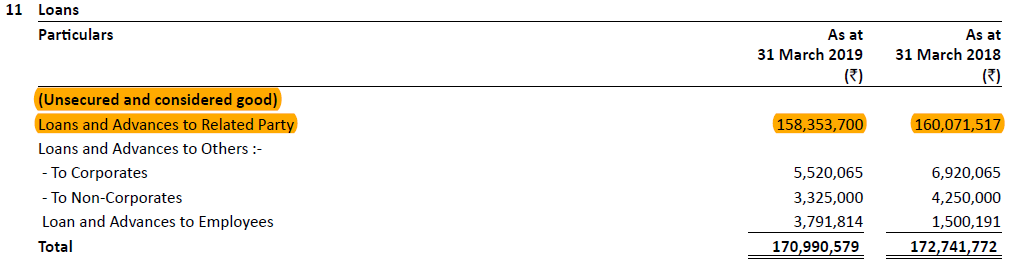

However, what is more interesting (and as @kkumar3 has also mentioned in his previous post), the company has extended a large loan to this entity and an amount of 15.8 crores is outstanding as of 31-03-2019

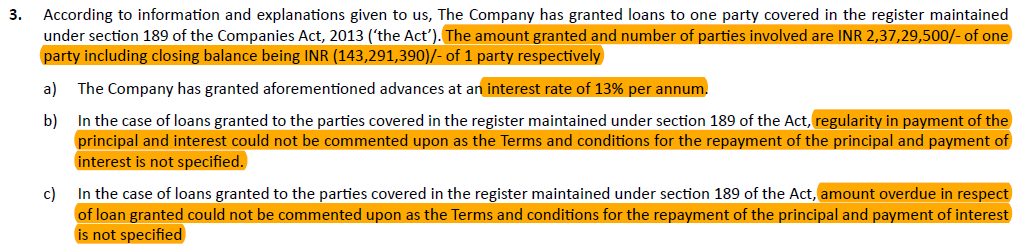

What makes the whole transaction even more interesting is the observations of the independent auditor

As seen above, terms & conditions of the loan are unknown, and any interest / principal amount outstanding / overdue cannot be ascertained.

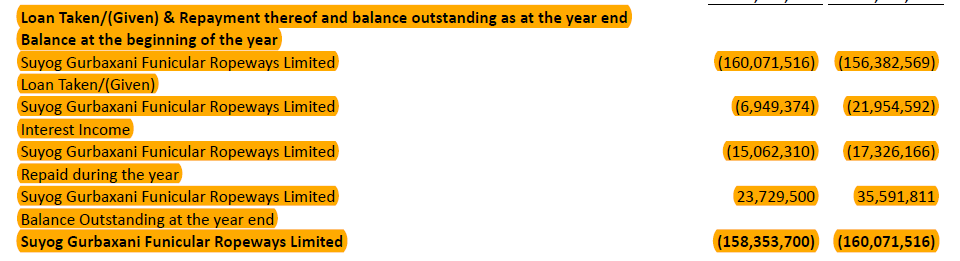

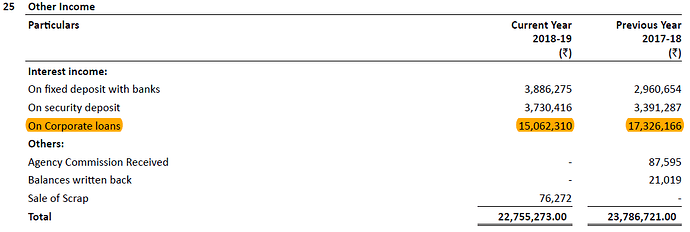

I tried to dig deeper to find more information on the loan, and whether interest is being serviced at 13% as mentioned in auditors remarks

Again, I would like to stress my limited knowledge of accounting, and I may be wrong here, but 1.5 crores interest on a loan outstanding of about 15.8 cr, @13%… it does not add up.

More importantly, considering that STL itself has a debt of 57 crores, there is no point in lending a large sum of 16 cr to a related party. The business is capital intensive… and as per the AR FY19, company is looking to raise more capital (debt / equity) to the tune of max 200 cr!

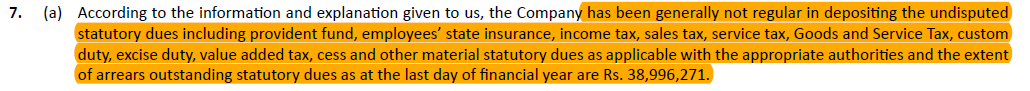

Then, there is some more stuff, from audit report…which are also red flags, and also just bad hygiene

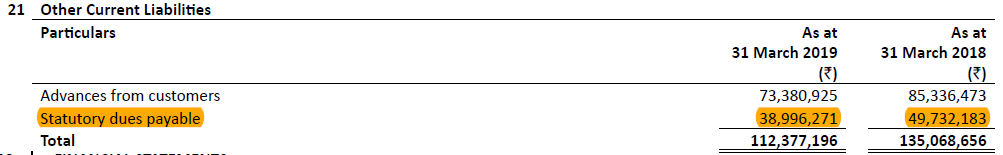

Please note, these are UNDISPUTED statutory dues which remain un-deposited!!

They have even been accounting for interest due on pending statutory payments

-

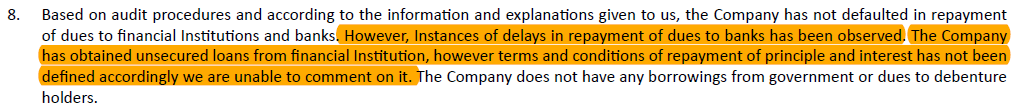

Here is another instance of lousy administration

-

Another blip…

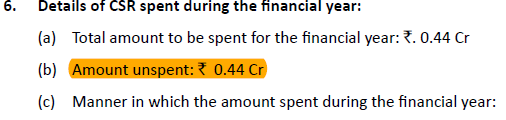

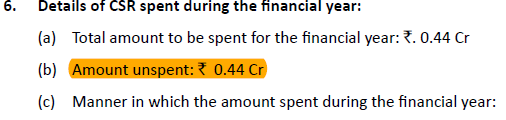

- And then this…

While there are no provisions for this year, this entry caught my attention, where they have made an allowance for bad debt in the previous year to the tune of 4.9 cr. It would be interesting to dig deeper in previous years AR and financials to find out the reason for this, but may be that’s for another day.

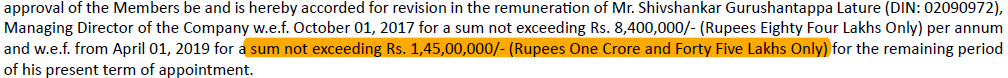

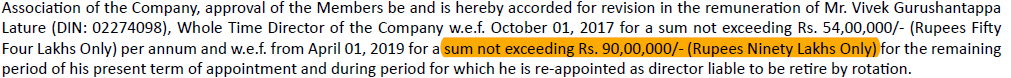

- Finally, the last bit on remunerations. The promoters have taken a hefty pay-rise last year. Though its well withing the allowed limits, and the company fiances appear healthy on books… yet it does say something about management mind-set.

Whole promoter family has taken a significant pay hike.

In summary… like a lot of micro-caps, this too has its share of management issues. The business is no doubt promising, especially in post-covid era of work-from home situations and heavy dependency on 4G mobile broadband, and the impending roll out of 5G services, over next 5 years. But to capitalise of those opportunities, the company has to diversify to other geographies across India and for that it has to compete with biggies as well as niche local players. Whether it has the financial, technical and entrepreneurial wherewithal to do that and be successful, remains to be seen. So till then, my approach will be to keep a watch.

Disclosure: Not invested, but keeping a watch