Is “Shaily Medical Plastics” separate company, or a division/subsidiary of Shaily Engineering Plastic?

Q4 FY20

Good Q4 FY20 results by the company. Company benefitted from the lower base effect but it is good to see company getting back to previous level of sales, margins and profits. Also despite being affected by covid, as early as 14th march, they managed to do reasonably well on the sale front.

Key Points

- Commissioning of Carbon Steel Plant at Halol was delayed on account of Covid-19 and is now expected to be commissioned in June 2020.

- To commence trial production of Carbon Steel Products in June 2020.

- Witnessed improvement in margin in FY20 on back of higher contribution from Healthcare segment. FY19 margin was profile impacted on account of labor shortage, power disruptions and change in ordering policy from a key client

- Gross margins improved from 39% to 45% yoy.

- Operating Margins improved from 15% to 19% yoy.

- Debt increased to Rs. 146 cr from Rs. 120 cr yoy.

- Tax charged at 8% only in Q4.

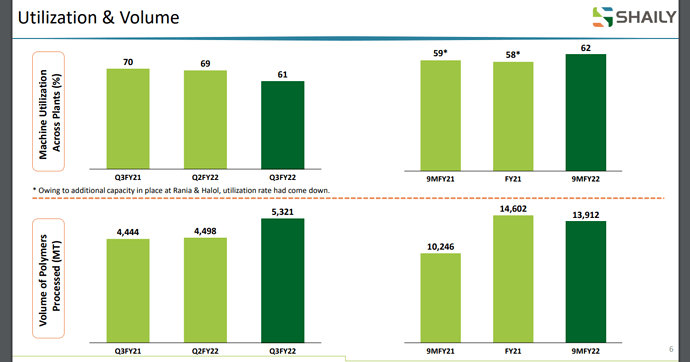

- Machine utilisation was 65%.

- Volume of polymers processed 3267 mt (2961 mt), yoy growth of 10%.

- FY20 sales: Domestic 69% and exports 31%.

- Future outlook

- Expect 2-3x revenue growth from Healthcare segment on back of faster penetration within existing and new clients as well as large pipeline of products.

- EBITDA margin should be sustainable on annual basis on back of higher utilizations in existing facilities and increasing contribution from Healthcare segment.

- Limited investment in capex.

- Covid Impact

- we suspended operations at all our facilities viz. Rania and Halol. This had a significant impact on our operations during the last 10 days of March 2020 and upto April 22, 2020 until our operations partially resumed at both the facilities. Production and supply of goods commenced on 22nd March at our Pharma facility on limited basis, located Rania, Vadodara, Gujarat and rest of the plants started from 23rd April 2020, also on limited basis after obtaining for necessary permissions.

- Our facilities are currently operating at partial capacity, keeping in view of the government regulations and production will be enhanced in a phased manner.

- Company’s labour force constitutes of local labours hailing from neighbouring villages.

- We foresee no major impact on manufacturing on-account of nonavailability of raw materials

- Due to the suspension of operations there has been significant reduction in revenues and which in turn has adversely impacted profitability. Company has undertaken various cost savings initiatives to conserve cash in such critical times.

- Covid-19 began impacting our normal business Operations on 14th March 2020 by affecting our supply chain and our ability to ship. As a result, we lost sizable revenue due to disruption leading to lower profits for the quarter as compared to forecasted.

Regards

Harshit Goel

Is there any positive development on “change in ordering policy of key client”? I am trying to find out whether this change is a temporary negative for company or is it something long term/ permanent

Today was AGM of Shaily, kindly share brief notes if anyone has attended?

The AGM lasted for 15 minutes only & only 1 member asked question,not much was asked in the AGM.

with more visibility on IKEA’s new stores in India(after hyd and last month mumbai , now gearing up for bangalore and ncr) , visibility on revenue growth should get better.

Have tried to cover Shaily Engineering in detail. Hope this helps the Valuepickr community. Happy investing

Company has been investing in new products and capacities for the last 2 years. It seems to be ready to reap some benefits now. Some snippets from last investor presentation.

In the q3 concall management has guided around 600 cr top line ( 360 cr CY) . With improved margins ( possibly due to operating leverage) looks like a PAT of 60 cr is doable in FY 23. With the present PE a market cap of 2200 cr looks possible. That’s a double in 2 yrs… key monitorables are proposed capex of 150cr coming online , IKEA business continuity ( 60% of revenues still in IKEA) , scaling up of pharma business ( higher margins ) and scale up of toys business.

Shaily Engineering Q4FY21 Earnings call notes

-

After much delays in construction as well as equipment installation, we have finally successfully commercialized operations at our carbon steel furniture plant in December 2020. This was one of the most technologically advanced projects which we had undertaken outside our core area of expertise. And unfortunately, due to the pandemic we had 0 to minimum support from suppliers of various equipment to set up with this all. Despite such challenges, today, the operations are running fairly smoothly. This shows our uniqueness and ability to grow in the most difficult of times.

-

I’d like to announce the resignation of Mr. Anil Kalra in the position of Chief Executive Officer due to health reasons. Unfortunately, Mr. Kalra contracted COVID in the month of March. And since his return from the hospital has continued to have some health issues. We are actively looking for a new CEO and a vacant position over a period of time.

-

We have started construction of our new plastic plants at our new campus at Halol. There has been no delay due to lockdown, and we expect the plant to be fully operational in the first half FY '22. This will help us service new orders, especially in the home furnishings orders.

-

Overall, throughout the year, we have built a very robust order book, which shall help us grow in the years to come. We anticipate fairly substantial growth in the current year. Looking at our order book, we are fairly confident of achieving a much higher rate of growth in the current year.

-

In a mere 1.5 years since we entered into the toys business that’s been matured, and we have now made our position even stronger with large orders from one of the world’s top 3 to brands and are en route to becoming one of the preferred Indian suppliers in the toy industry.

-

Machine utilization rate was 56% in Q4 FY '21 as compared to 64.5% in Q4 FY '20. This was basically due to increase in the number of machines, which we added for the toys business in our Halol and Rania facility.

-

Exports during the quarter stood at 77% of total revenue as compared to 68% in the same period last year. As for FY '20, exports stood at 73% as compared to 69% in FY '20.

-

Our revenue stood at INR 109.8 crores during Q4 FY '21 as compared to INR 79.6 crores for the same period last year, showing a growth of 38%. The double-digit growth is accrued on account of supply on Carbon Steel furniture and increased business on all other segments of business .

-

EBITDA margin in FY '21 was impacted in the second half due to withdrawal of MEIS benefit by the government post December.

-

Peak revenue potential for the new investments that we have made in the new plastic facility as well as carbon steel and toys is likely to happen by Q4. Somewhere between Q3 and Q4 of FY '22, which means that at that point, we will have a run rate that represents the peak potential we have for the current capacity. So if you were to look at from its current asset base, then look at revenue, you should probably look at somewhere between 2 to 2.5 times, an average of 2.25 is peak revenue from the current assets.

-

On the healthcare in the presentation. Yes, we are anticipating 2 to 3x growth. So we’re roughly looking at growing the business at somewhere between 35% and 45% year-on-year basis for the Healthcare business .

-

Capex in FY22: INR 80 crores to INR 90 crores, which also includes the new plastic facility which we are setting up and expansion of the pharma facilities. FY '23 will have a similar number as the current year. About 50 to 70 cr is what we would okay.

-

overall inventory levels have gone up because we are executing multiple projects on the toy segment where inventory has come in quarter 4, which we will start looking at – commercial again now commercialize those projects in Q1. So we expect as we move forward, we should basically be able to improve the working capital cycle between Q1 to Q3

-

I think we could scale up the Toys business to where we are on our Home Furnishings business over the next probably 4 to 5 years .

-

How you are visualizing the healthcare pen segment over the next 2 to 3 years?

We have existing orders for instance and supply in the current year. We have orders for all the other bit liraglutide, teriparatide. Again, small batches, small [indiscernible] batches, they’re still somewhere between 100,000 pens to 0.5 million pens. In the next financial year, we see this ramping up on 2 molecules, particularly to about 3 million pens. And then FY24 onwards, we’re looking at scaling up substantially. -

Margins are sustainable. And as we move forward, we expect margins to grow in the coming years. We are seeing a gradual ramp-up on our steel furniture business, where we expect full ramp-up to happen probably by Q3 . And that’s when we would basically – suppose that we should be able to see improvement in margins there .

-

Apart from pharma, we probably have a list of 20 to 24 customers. And the top 6 or 7 would contribute to 85% of our revenue.

Been tracking this co closely since 2016 and finally stopped tracking a year back. $100mn (~600-650cr based on that time USD/INR rate) sales target has been guided by the management atleast since 2017. So just be mindful of that and build assumptions accordingly.

PS - not invested.

Management is aware of not able to deliver their own targets and acknowledged the issues they faced in the past 2 years. To correct it, they hired a professional CEO to fix operational inefficiencies. This started reflecting in results for past one year. Now they have a strong order book, capacities, efficiencies. All they need now is to execute it well and fill the CEO vacancy soon to look after operations.

Conference call highlights

Demand outlook: Demand outlook: The company expects some minor hiccups in demand due to fresh lockdowns but the management is positive the FY22 topline will be in line with their estimate of ~| 550 crore. This is expected to be aided by commencement of new facilities and higher growth in the healthcare and toys segment

Capex:Capex: Shaily is planning to incur a capex of | 80-90 crore in FY22 and expects the same amount of incremental capex in FY23 as well

New Plant: New Plant: The company recently commenced operations of a carbon & steel plant in December 2020 and expects peak revenues in Q3-Q4 facilitated by the added capacity and in line with the current capacity

Healthcare business growth: Healthcare business growth: Shaily expects the healthcare segment, which is the second largest contributor to the company’s topline to grow at a rapid pace of 35-40% in the next fiscal year and continue the growth momentum in years to come

Working capital days: Working capital days: The company is currently sitting on higher than usual inventory, which is lengthening its working capital days but the management is positive that it will return to its normalised number of 75-85 days by FY22

Looks interesting trading at 34x FY22 P/E with great growth ahead very similar to Acrysil.

Marquee investors like HDFC MF, Ashish Kacholia and Whiteoak.

Disclosure: Invested

Latest publically available note on the company. What is interesting is this:

- The management expects | 560-600 crore revenue in FY22 (implied growthin H2FY22 is 36% YoY) aided by new business confirmations, addition of new clients and increased contribution from new business segment.

- Shaily sees ~25% revenue CAGR in next five years led by 2-3x revenue growth in the healthcare business. Additionally, higher revenues from new categories like toy segment will drive company’s incremental revenue growth. Looking at strong demand pipeline, Shaily has decided to increase the manufacturing capacity of toys, healthcare and home furnishing products by infusing fresh equity of | 150 crore

Home furnishing: Positive on its relationship with Ikea and scale up of carbon furniture. Looking to add new clients in this segment.

Health care: Several injectors pens (insulin, peptides & others) will be commercialized over FY23-FY25, which will increase revenues 2-3x in next 3-5years. Most profitable segment and company is doubling capacity here.

Toys: Has the potential to reach home furninshings levels in 3-5yrs as it adds new clients.

Disclosure: Invested

No idea, they don’t share it but according to concalls seems like health care is high margin segment.

Hi. I have studied the company over the past few days. Please find below my write up on it which I have reproduced from my blog. Overall the next year should be good. All planned capex is more or less over and as capacity utilisation goes up bottomline should swell.

Understanding the Core of Shaily Engineering Plastics Limited

Founded in 1987, Shaily Engineering Plastics Limited, with a market cap of about 1,500 crores, represents a classic example of enduring business in the plastic manufacturing industry. The company has built its reputation on understanding and manipulating polymers to produce diverse plastic items. From toothbrush bristles to robust furniture for IKEA, Shaily showcases versatility and expertise in handling various polymers.

Strategic Business Choices: B2B Focus with a Quality Obsession

Unlike mass market B2C businesses, Shaily strategically positioned itself in the B2B sector. Their partnership with IKEA, where about 50% of their business originates, is a testament to their commitment to quality. The company’s trust-based relationship with IKEA allows them to bypass quality checks, directly shipping products to global stores. This approach has led to impressive 40% gross margins, underlining Shaily’s ability to command a premium for its quality.

Diversification and Innovation: Healthcare and Beyond

Shaily’s foray into the healthcare sector, particularly in manufacturing plastic injections for diabetes management, reflects their ambition to tap into larger, lucrative markets. Their expertise is not limited to IKEA but extends to high-quality requirements in healthcare, including medicine bottles and caps. The company’s approach to healthcare, paired with its ventures into the toy industry, demonstrates a clear pattern: a focus on sectors where quality is paramount.

Financial Prudence and Expansion Strategy

The company’s asset turnover ratio and its cautious approach towards capital expenditure reflect a financially prudent strategy. Shaily’s involvement in the design process, right from ideation, creates a unique value proposition. Their move towards building generic products in healthcare, like injections, indicates a shift from pure customization to balancing between bespoke and standard offerings.

Challenges and Opportunities: A Balanced View

Despite these strengths, Shaily faces challenges, including over-reliance on IKEA, leadership concerns with the second-generation management, and a recent decrease in promoter shareholding. The company’s shift from overly cautious capex to more aggressive investments, especially in healthcare, poses both risks and opportunities for growth and efficiency.

The Future Outlook: A Wait-and-See Approach

As an investor, observing Shaily’s progress is crucial, especially considering their high valuation at 50 times earnings and 17 times cash flow. The key lies in their ability to optimize their underutilized capacity and capitalize on the healthcare segment’s potential growth.

Closing Thoughts

In conclusion, Shaily Engineering Plastics Limited presents a complex yet intriguing investment opportunity. With its deep-rooted expertise in plastic manufacturing, strategic business decisions, and challenges in diversification and management, it’s a company worth watching closely.

P.S. My internal blogs/drafts for this post are below.

Disclaimer: The views expressed in this blog are personal. I may or may not hold investments in the stocks mentioned.

Internal Blogs

Monday, 29 January 2024 at 10:29:44 AM

I have studied about this company yesterday. This is an old company. It was started in 1987 by someone who was really passionate about plastics engineering. He continues to own the firm and now his next generation is also involved in running the firm. This is a small company with a market cap of about 1,500 crores.

They basically make stuff out of plastic. That is where the majority of their revenue comes from today. So plastic is great. It is cheap to produce and India has a lot of world class refineries and chemical companies who basically process crude oil to make polymers. Polymers are the raw material which is needed by any plastic goods manufacturer to make stuff. So this company buys polymers and then processes those polymers to make different plastic items which then have diverse applications.

So the IP of the company is in understanding how to handle different types of polymers to produce different end use plastic items. For example the bristles of a toothbrush are made of plastic but so is a plastic drinking water cup. The manufacturer needs to really be an expert in figuring out how to handle the polymers required to make these different kind of items.

Now this is a company which has been listed since 2014. So they are pretty well known to the analyst community and others now. That is why they have been given enough time by the market to prove what kind of operation they can run. And I think for now the market is not too impressed. They continue to have a relatively small market cap even when there is a huge bull market going on right now. Why is that? I will get to it in time. For now let’s get back to understanding the company and what it does.

So now that we have established that the company understands how to manipulate polymers, let us look at how did they decide to build up their business. Instead of choosing to be a mass market B2C business like Nilkamal they decided to instead build a B2B business. I don’t know why they chose this route. May be when they started in 1987 it was easier to get a B2B business off the ground as compared to a B2C business. But anyways, even amongst B2B they are pretty clear on what is it that they would like to do. They would not want to reach out to every kind of customer. Instead they would want customers where their skill and expertise is respected. So they don’t do really commodity products. For example they won’t do low value plastic cups and sell that to everyone. Instead they tried to go after the cream of businesses. Approximately 50% of their business comes from IKEA. They are one of the 16,000 suppliers that IKEA has globally. About 5 years back they did 22 million Euro kind of business with IKEA annually. That is the kind of customer that they want. One who is really focused on quality and therefore would not hesitate to give them a slight premium. Let me give you an example of this. Whatever they manufacture for IKEA is not quality checked by IKEA. Instead the company directly ships products to IKEA stores globally where they are put in front of the customers. Now think about how much vetting would IKEA have done with them. It is very difficult for anyone to trust their supplier blindly like this. But that is the kind of relationship that the company wants to have with its customers. And the company is well rewarded by the buyer for this kind of honest and competent behaviour. The company makes about 40% gross margin. So they make something for 60 and sell it to their customer for 100. And yet the customer is not trying to move away from them and give business to someone else who would instead make the same thing for 60 and sell it to the customer for 80. So I hope that now I have established that this company really believes in doing quality work and therefore they only reach out to customers who value that obsession with quality.

Now other than IKEA the company also supplies to some other kind of business verticals. The one that they are really focused on right now is Healthcare. So think about diabetes. Now people who have diabetes need to take certain kinds of injections at certain frequency to make sure that their sugar is in control. People depend on pharmaceutical companies to come up with such kind of injections. Shaily manufactures such kind of plastic injections. And they manufacture millions of them. Not only diabetes, even with other diseases you sometimes need injections which the customer can administer to himself. And that is what this company is now trying to crack. I mean they already have revenue flowing from this kind of business but the TAM is so big that they want to continue to grow revenue in this area. Actually plastic in itself is such a big TAM that even some niches are 100 billion dollar annual opportunities. The problem is that competition is cut throat and therefore you will not get a huge wallet share. You will only be able to increase your wallet share over time. Another good part about being in healthcare is that the margins that the company can make in this business vertical are very good. They are better than what they would be able to make by supplying items to IKEA. So IKEA sort of takes care of the volume requirement of the business. But the bump in margins should come from the company cracking the healthcare market. Other than injections the company also manufactures medicine bottles and caps. Again this requires expertise. You do not want to compromise on quality because you don’t want the medicine or syrup to react with the material of the packaging it has. So anything which has to do with people putting it into their mouths, you need to build trust. Think about a company which makes biscuits. Now that company wants to make sure that the machinery and equipment it purchases to manufacture those biscuits is top notch. And that is why the biscuit company has a rigorous vetting process before they allow anyone to install machinery at their premises. Similarly pharmaceutical companies are very stringent about the kind of supplier that they have. I think sometimes the machinery, equipment and packaging supplier may also need approval from the regulator (like the FDA) to supply to the pharmaceutical company. So once you become a supplier of repute in healthcare, it sort of becomes like an annuity business.

Other than healthcare and furnishings/furniture, the company is also into toys. Again toys for kids use a lot of plastic parts and you want all those plastic parts to be top quality because kids are very happy chewing their toys. So they have a top 3 global toy manufacturer as one of their customers. Again big TAM and over time the company should continue to increase its wallet share in this market. And once again a customer who is very conscious about the quality of plastic that they supply. I am noticing a trend here. They only want to be in industries where the customer is obsessed with quality. So may be they will always be able to grow their revenue slowly (we won’t see jumps like 300% yoy). But they will always be able to maintain high gross margins due to the premium they will command for their quality.

Now let’s come to how prudent the company is with regard to their finances. The company is extremely conscious about asset turnover ratio. So they are very clear that they will only put up capex which would give them an asset turn of 2-2.5x in a couple of years. This is only possible when the company has a great relationship with its customers and therefore is pretty certain that whatever they produce will be picked up by their long standing customers. Actually this ties in to one advantage they have. They get involved with a customer at an ideation stage. They brainstorm with the customer that what is the specific requirement of the customer and then they design the specific mould for that customer. The mould is basically what would transform polymers into the final plastic product as required by the customer. So at each step of the process this is like a co-creation between two partners. Now this sort of in a kind of lock-in for both partners too. Shaily knows that there won’t be too many other customers who would want the exact same mould. And the customer knows that there won’t be too many suppliers who can give them something to the exact specification that they want. I think this is how till now the company has done business.

Now the company is focusing on sort of adding one more dimension to this. They are trying to build their own products which are more generic in nature. This strategy is what they are trying in their injections. They are trying to understand what does the healthcare market need and then they are designing injections accordingly. Then they are seeking regulatory approval from FDA etc and then once that happens they are doing to big pharmaceutical companies and letting them know that this is the kind of work that they have already put in. And they are trying to drum up business from those customers. The negative of this approach is that this involves the company building the branding and sales muscle in addition to product expertise. Till now they have just been able to build good product expertise and then they have sort of gotten customer by customising their offering to the exact need of the customer. Now they are also trying to understand the fine line between customising too much and not customising at all. So we will have to see how the company performs in this new ball game. The benefits are obvious. If they build a superhit injection which does not need to be customised a lot for any pharmaceutical company then suddenly sales would see a huge jump.

So typically for such businesses we are worried about money getting stuck in working capital. This company does give credit to its customers but it has made sure that its working capital cycle is manageable at 78 or so days. And most importantly they have kept the cycle constant over many years. They have not allowed this to slip up or change drastically.

Now let us talk a but about R&D. I am still studying how do they do this. I think some of the R&D they clearly borrow from foreign intellectual partners. I remember they mentioned about how an Italian company has a very good technology to make caps for syrup bottles and how they are licensing that tech to manufacture those same caps in India. I think a lot of this can happen going ahead especially as western companies look to move their supply chains away from China. And this company has good credibility in the eyes of foreign companies. So I think this company should continue to get a lot of such business.

Let’s talk about the negatives a little. I think the management is too risk averse. Let me illustrate. They do capex and then within a couple of years receive asset turn of 2-2.5x. No problem with this. But I think they deliberately undertake small capex. So they can always show good asset turns quickly. But they don’t have any big operating leverage as a result. There is no huge capacity underlying which can be unlocked only if there is a sudden requirement of their product. Now that I think about it in a way it is a good thing. After all it’s better to undertake capex when you are sure of the off take. Instead of spending money first and then hoping to generate enough business to utilise your built up capacity properly.

Another risk or unknown for me is that how involved and competent is the second generation of the promoter. The founder of the company was truly obsessed about this product line. And he also had a lot of expertise in executing this business. I don’t know whether his son is equally driven about this product. He does attend all con calls and also answers questions with confidence. I am looking at more evidence to get the conviction that the current management also love doing this business.

Finally recently the promoter share has come down from 53% to 41% or so. I don’t know the reason for the same. Maybe some of the promoters got classified as public shareholders. So I am still trying to figure out why did this happen. Usually this is a bad sign. Someone who has built a company from scratch would like to maintain his control over the company. Founders are known to be paranoid about giving up their majority shareholding in the company. So why did the founder do that here? I am trying to find out. More thoughts in the next update.

Wednesday, 31 January 2024 at 11:49:37 AM

So I have now studied more concalls of the company. This post therefore is more of a rant. I am not very happy with what I have seen. Let’s start.

First the absolute neglect to the principle of resilience. The company has had approximately 50% or more share of business from one customer which is IKEA. Now that share is more than 69%. Now obviously the company would claim that they have started supplying new products to IKEA. And why would they say no to taking on more business from IKEA. These are valid points. May be from the outside I cant appreciate how IKEA business is resilient. Even if IKEA stops sourcing a couple of products from them IKEA would always be sourcing the remaining ones so the overall business from IKEA should never take a huge hit. But I am still not comfortable. Some time back IKEA delayed orders and changed its inventory policy. I do not know the details of what was the change in their policy but I do know that the revenues of the company and the capacity utilization rate got hit for a couple of quarters. And we are at risk of being in the same position today. Analysts and others have been pointing this to the company for years and I am sure the management also realises this. But at the end of the day the numbers show great lack of diversification in revenues.

Next is the incompetence of the management in hiring a CEO. They let go of a CEO during Covid due to health problems. This happened in first half of 2021. We are now in 2024 and the company management has still not found a CEO. The company’s day to day operations continue to be run by the owners. Now I am of the opinion that the owners are diligent but I dont think they have the execution muscle of a professional CEO. I dont think the owner is going to put in the same number of hours in drumming up sales especially since he is the son of the founder of the company. And I think not being able to generate sales is the biggest problem that the company has. They need a CEO who has great sales muscle and who can travel to all their international customers and drum up more business. Hopefully better sense will prevail and the owners would put this as their first priority in order to grow the business.

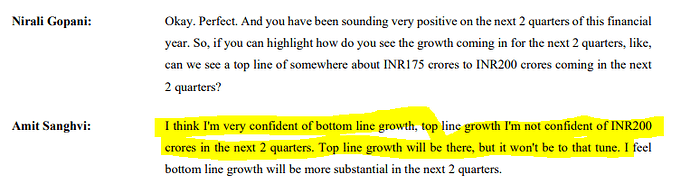

The next problem I have is that the current management gives out targets during analyst calls and then dont meet them. I dont have a problem in them not meeting their targets. I have a problem in them giving out targets to the analysts in the first place. Some years back the management put out a target that they will reach annual sales of 100 million USD by 2020. Did not happen. Has till date not happened. And the management has not learned their lesson from this. They still continue to give targets or make other kinds of commitments during concalls. Business is such an uncertain thing. An entrepreneurs life if difficult in all ways possible. Why would you want to add more complexity to your life by putting a target on your back.

Ok, now let’s talk about some other aspects of the business. Earlier I was worried that the management is too conservative and that they would only invest in capex when they are 100% sure that they will be able to generate asset turn of 2-2.5x within a year of doing the capex. Now the management has abandoned that extra cautiousness which is good. But the problem is that they have gone to the other extreme. Right now the asset turns are at 0.9x. This is bad. The management claims that they are now trying to grow in the healthcare business. And for healthcare you need to first put up the plant and then get all the necessary approvals for the plant and then you got to drum up sales from pharmaceutical companies and then finally your capacity starts getting utilised. May be they are right. And if they are right then over the next year we should finally start seeing asset turn improve and capacity utilisation improve. Right now the capacity utilisation is around 50%. The company is still profitable with EBITDA margins of 15% or so. Hopefully over the next couple of years as the capacity utilisation improves to 75% or so we should see operating leverage play out and a lot of money should start hitting the bottomline.

But how will the company improve this capacity utilization? The company claims that there are basically three divisions today which make up the bulk of the revenue. One is IKEA. Here capacity utilization is already good. Some capex has been done recently. And that particular capex will convert into good asset turn soon. I am not too worried about that. Then there is the toys division. This I am slightly worried about. The company entered toys a few years back and did a capex of about 30 crores. But they have not been able to convince the customer base to give them a premium. And the company does not want to do run of the mill commodity work for anyone. So the company and the market are both at odds. The company wants to do innovative groundbreaking work. But the industry is only going to allow more regular commodity work. And therefore we are in a situation where the capacity for toys is underutilised and I think it will remain so for the coming time. The management may instead look at repurposing some of the assets which were dedicated to this division to other areas of business. Let us see if that happens.

The third division is something which is of huge interest to us. That is the healthcare division. This makes up about 8% of the revenue that we do today. The company is really focused on growing this vertical. The margins in this business are top notch and obviously it is a huge global market too. The company has dedicated significant capex to this division but capacity utilisation is not great here right now. If the company does manage to grow this business at 50% annually (as they have guided) then this business would give a huge impetus to the overall story of the company. On the one hand we would see improvement of the overall EBITDA margin towards 20% and on the other hand we would hopefully have lesser dependence on single large customers. So taking a bet on this company is essentially taking a bet on this vertical of the company. The company has shown some impressive ramp up here. For example they were doing 2 million injections a few years back. Now they are close to doing 15 million injections annually. This is important because as a plastics manufacturer you must be sure that the injection that you design should not react with the specific molecule which makes up the medicine. And therefore this is a very precise thing to achieve.

Philosophically the management has always gone after high value business where gross margins are not a problem. Even in the recent commentary the company has said that we are looking at manufacturing finished items where 70-80 components are needed to come up with the finished item. On top of that the manufacturing of the said item should not be completely automated. Instead the manufacturing should be a mix of people and automation. That is where the company has huge advantages because it is based in India. In fact this kind of opportunity is the biggest moat of India right now. We have cheap labour with decent skills. When combined with state of the art automation we are able to manufacture easily for a low cost. So that is where the company wants to go. Whether they will get enough business of this type we would have to see. On paper this seems like a reasonable plan because it plays to the strategic advantage of the company. But whether actually the company is able to generate meaningful revenue by doing this kind of work remains to be seen. This is the call option on the company.

For now I am going to sit back and see how things progress. The company is selling for 50 times earnings and 17 times cash flow from operations. I am going to may be buy this company when due to some external reason there is a crash in the price and the company is available at 5 times cash flow. Over the next year the company is not going to spend a lot of money on capex. They have spent a lot over the past 5 years and as a result they have built huge capacity which is only 50% used right now. Therefore the next year the company should grow its earnings massively. All the incremental revenue that comes from utilisation going up to 75% from 50% should come to the bottomline. Let us see whether this actually plays out in this manner.

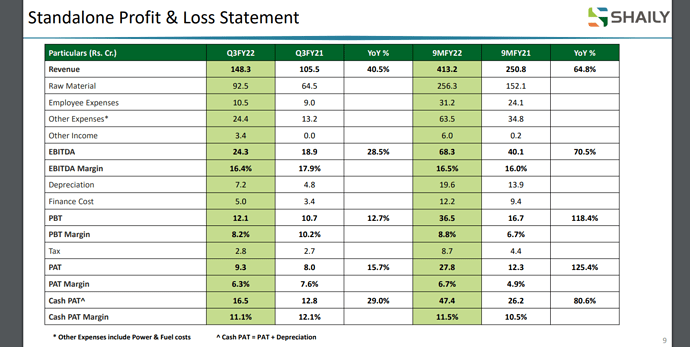

Shaily posted a good set of Q3 FY24 results. Revenues increased by 17% yoy and a significant increase in EBITDA, PAT seen. There is superior expansion in EBITDA/PAT margins both yoy/qoq.

| Q3 FY24 | Q3 FY23 | YOY | Q2 FY24 | QOQ | 9M FY24 | 9M FY23 | YOY | |

|---|---|---|---|---|---|---|---|---|

| Revenue | 158.44 | 136.26 | 16.28% | 157.57 | 0.55% | 473.31 | 472.57 | 0.16% |

| EBITDA | 32.96 | 19.72 | 67.14% | 26.56 | 24.10% | 87.17 | 69.91 | 24.69% |

| EBITDA % | 20.80% | 14.47% | 43.74% | 16.86% | 23.41% | 18.42% | 14.79% | 24.49% |

| PAT | 14.52 | 5.67 | 156.08% | 10.83 | 34.07% | 37.95 | 25.22 | 50.48% |

| PAT % | 9.16% | 4.16% | 120.24% | 6.87% | 33.34% | 8.02% | 5.34% | 50.24% |

Management mentioned in last concall that sales will be flat qoq in Q3 compared Q2.