Is there anyway we can identity next bear market? rising interest rates and inflation can be one of the factors any other things we can identity would be great help to investing community…but isnt a old rule that it’s always good to stay invested in a business which is doing well even in bear market to create massive wealth and prices will catch up?

Another negative trigger for market - SBI posting loss - first time in 17 years. Reports loss of 2416 Cr. in Q3.

All psu banks in for a good correction in coming week.

This is more on a expected lines when you merger all the bad performing psu with SBI…I think this should give some good entry points those who want to buy psu’s i think

Sunday Morning Mind-Chow:

In case of Index investing, the days of buy and hold are probably gone (or were never there). If one wants the security of Large Caps, then one has to employ every advantage to get decent returns.

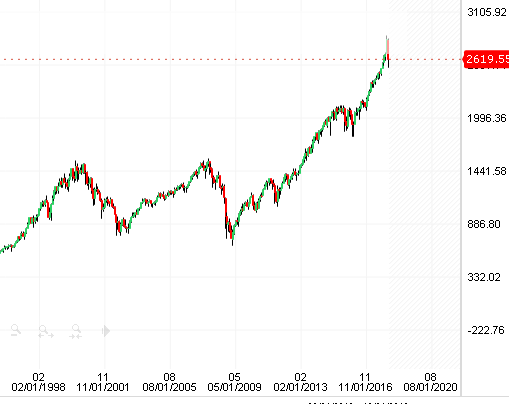

Consider the case of SnP 500.

If one had an average purchase price of 1000 in 1998, then

in year 2018 at Index 2600 one made a CAGR of 4.90%

This is unimpressive even by US standards. Considering we have taken a near bottom price of acquisition and topmost price of sale.

The problem is, the investor is doing “buy and hold”. This strategy needs to be further optimized.

What I take away from this is, when one is Index Investing, he buys low, like he has sworn to do, he must also sell high. This will give an additional return, depending on the aggression that is factored into the “selling-algorithm”.

Simply speaking, selling high has given a return of 12% CAGR. If one is able to sell even 30% of PF at 12% cagr, then he is adding 4% to overall gains. That is almost doubling the overall gains in the long run.

In other words, there is a time to buy, a time to hold and a time to sell. Just buying and holding Index Stocks is as good as making FDs, and now there is tax in both.

Not sure how many know him but my respect for this man has gained with his every passing interview. The current situation always looked like tussle between hope which will sooner or later play out in reality (Q3 looks like the reality ) and too much expectation n not a bubble but may be a higher quantity crash (15-20%). He explains beautifully the similarities between 1987 crash n current situation. Besides that too, his interviews including this one worth a watch. Realize reading more and more history is so important

Thanks for posting this one. So sharp, precise and no nonsense.

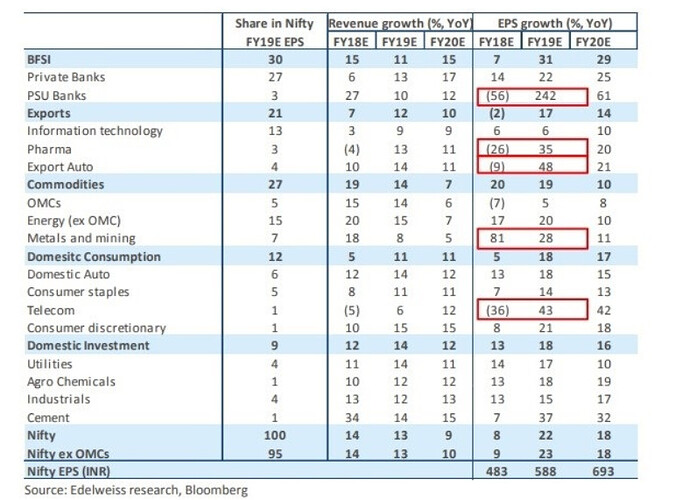

The real story in P/E debate lies in the denominator. Optically Nifty at current range of 10,383 looks so reasonably valued that it throws opportunities for all of us to go and start buying the fall. But looking closer at Edelweiss table, one need to understand that the Team has projected an earnings growth forecast of 22% and this throw up Nifty P/E at 17.6 times (at FY19 EPS). 22% growth is super normal expectation, given we wont have similar run up in metal earnings, there wont be the base effect playing its role (Demo and GST) like in case of FY18 and also in Q1FY19. The major disappointment in the earnings from Q2FY19 onwards will also result in considerable realignment of Index.

I am looking at the FY18 numbers, which is just one quarter away. The EPS as per report in NSE website is around 415 (as of Q3). But as per Edelweiss report, it would be 483 after 4Q. So wanted to understand the difference.

The difference would be because NSE provides standalone figures while the analyst report would be looking at consolidated earnings.

As per NSE website the latest standalone EPS is only 407/-. (PE of 25.75 and Nifty level of 10391 works to an EPS of 407/-). It had fallen from 413/-. May be due to addition of poor results like that of SBI.

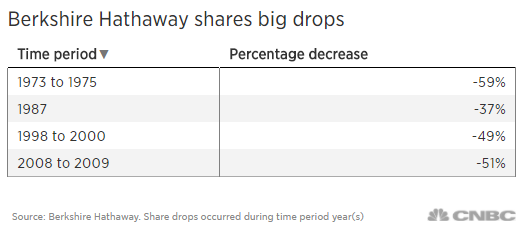

Interesting statistic from Berkshire Hathaway:

… so such a drop has happened pretty much once every decade since the 70s to such a great company.

All stocks go down when there’s panic on streets, though difference is quality stocks would bounce back and recover quickly while the dud ones never come back.

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”- Charles Mackay

Perhaps we “should expect sub moderate gains” in the near future.

Corrections are important. In a way, they show us who is man and who is boy among stocks.