Agreed. We have consolidated PE for 3rd QTR FY17, so it makes sense to compare the consolidated PE growth YoY and QoQ.

You mean EPS, not PE.

Corrected. Thanks for pointing out.

Nice article on Global Economy Macro risks - is another 2008 in offerings ?

Do you mean P/E of 20 - 22 at the consolidated level? Can someone help me with the long-term average of consolidated P/E (point to an earlier post)?

One thing to keep in mind is that growth in an inflationary environment is less valuable than otherwise. We are likely to experience higher inflation so per unit of growth is that much less valuable now than it was earlier in benign conditions.

I always find Ken Fisher’s perspective practical, refreshing and too often correct.

Hi

offcourse PE is an output with EPS and Nifty levels inputs. But since we cant get the one input ie. EPS directly from NSE site, what is wrong in reverse calculating it from output and the other input ie. Nifty levels. Am i missing something?

Regards

As I understand, there is nothing wrong in getting the EPS based on NIFTY PE and NIFTY levels.

But when we use the same NIFTY EPS (that we calculated above) and use it to calculate the NIFTY level when NIFTY PE will be 20; that does not seem right.

Not sure if what I wrote was confusing or clear. @deevee can correct me if I mis-interpreted his words.

Yes you are right sir, it is not prudent to use the same EPS for future predictions of nifty levels at fair valuations. At least we should consider possibilities of earnings upgradation which has allready started and there is a chance for gaining more steam. The present EPS standalone as per NSE site is 413 which is almost 6% up Qon Q…

Regards

In recent calculations of Nifty levels I have used the upgraded EPS of 413…

The most recent PE value and Nifty closing value give an EPS of 413.

If one wants to calculate based on future EPS, which would be higher by about 10% then that would be alright too. Because it is just a reference point to know when Nifty50 is expensive, normal or cheap.

The use of EPS could lead to differences due to share issuances, buybacks, etc. These vary systematically with the boom and bust cycles. So, EPS is not the preferred method; although, it can work as an estimate.

Who is Ken Fisher in this video- the anchor?

Ken is a self made billionaire and chairman of Fisher investments. He also happens to be son of legendary Phil Fisher

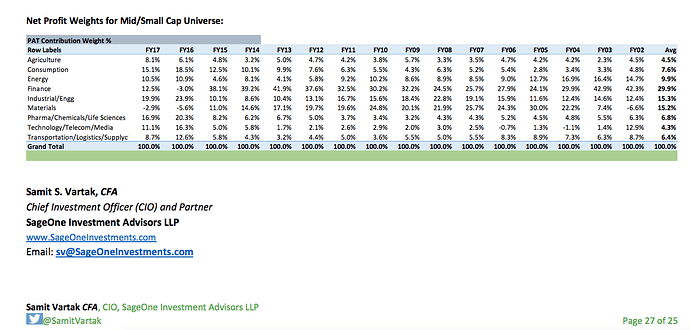

Very interesting statistics. If one looks at normalized PE for whole universe and normalized PE for mid/small cap (on page 2 and 3), it is very evident froth is not in Nifty stocks but it is elsewhere.

Isnt this thread pretty simple one? Sell/Caution at higher PE and Buy at lower? I feel whoever wants to invest only at or below PE17 should be the most relaxed people without need of trying to re-assert themselves repeatedly because it is not a question of IF but WHEN. You need to have lot of patience and temperament though for that kind of investing style. Just re-assess your own investing style and stick to it. For bulls, its always case of staying fully invested with coming to cash in some percent(20-50) once it is trading at abnormal PE’s. This is a great thread started by top contributors although I am not able to understand cluttering of this thread in last 1 year(900 out of 1000 messages) though without much knowledge (few exceptions) getting added.

@tusharsp Tushar, you rightly pointed out that this thread is not adding value.

I expect that as the participants mature as investors, this thread will have minimal posts/messages at PE > 22… and a lot of buzz at PE < 17. Alas, exactly the opposite is happening.

Why behave like one is Nifty 50’s promoter who is willing to buy at any price, when several books, by eminent and successful fund managers, say that you can do better. A fund manager has strict rules. You don’t.

This thread should be about honing skills in “Buying Low”. And not about, “Its alright to buy at any price” kind of argument.

This thread should also not be about predictions. Except for one off remark.

@jamit05 & @deevee, you have done a great service to us by highlighting the risks at current P/E levels and showing P/E normal distribution curve at the right time. It is quite understandable that momentum / fully-invested folks were in a bad mood yesterday after seeing the 1000 points drop on the Dow.

Yes, this thread is “pretty simple.” Just like investing is simple - Buy Low, Sell High. But most folks don’t get it. Investing in stock markets is about both numbers and behaviour. If the markets were all about numbers, then Efficient Market Hypothesis would probably be right and we would all be better off buying index funds. I would argue that investor’s behaviour is probably more important than numbers for long-term wealth creation. Else, next bear market could wipe out all your prior gains.

Why is it not okay to assert / caution when someone else says “upside is infinite”? A couple of big down days like this week is all it takes for such investors to go from ‘sky is the limit’ to ‘the sky is falling’. Like Buffett says, only when the tide goes out do you discover who’s been swimming naked.

Why is it not okay to re-assert when others keep repeating that earnings will catch-up in the near future? There are no facts about future, only opinions. In a sense, we are all blind men trying to describe an elephant.

Patience is required not just for investing. It is required when listening to the opposing views. Have a great day!