Today analysis by Business Standard newspaper assures that the recent fall in Natco Pharma’s price is actually an opportunity to buy for the long term investors.

Here is the news:

"Natco Pharma’s niche portfolio an opportunity

Despite delay in generic Copaxone launch, the firm’s

strong prospects make the risk—reward favourable

Natco Pharma, which had reported a strong June quarter performance, has seen a steep correction in its share price thereafter. The reason being an indication by marketing partner Mylan towards a delay in the launch of generic Copaxone, a drug used for the treatment of _ multiple sclerosis.

Mylan indicated that all major launches, including generic Copaxone, would be deferred to 2018, from 2017, looking at the ongoing challenges in the US and uncertain regulatory environment. The news comes as a disappointment to the Street, which was factoring the gains in FY18.

However, the stock price correction can be considered as a good opportunity for long-term investors, as business prospects remain healthy.

Natco’s business model in the US challenges large and complex product patents with small but effective portfolio of complex molecules that face limited competition. Thus, it has been able to launch prod- ucts at regular intervals, a key performance driver. The latest launch was of Tamiflu generics in December 2016, which has contributed over ’ $100 million to its revenue.

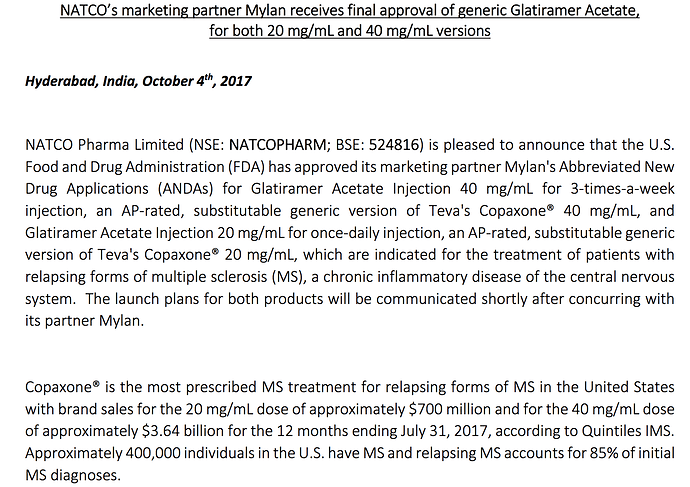

The drug major is nowbetting big on Copaxone.

Natco Pharma and its alliance partner Lupin have recently got approval for Fosrenol chewable tablets, a renal treatment generics drug. With this, the company eyes a reasonable market share of $10 -20 million. Other products which can contribute signifi- cantly to its performance include oncology treatment Revlimid and hypertension drug Tracleer. Its oncology drug Vidaza injections and Doxil generics have been launched, and are expected to contribute to its numbers in the September quarter.

The US contributes around 40 per cent to Natco‘s top line. It also derives a sim- ilar share from the domestic arena. The growth in its niche portfolio is shaping well in India. Natco’s strong foothold in the Hepatitis-C segment (about a fourth of domestic revenue) may have witnessed price control but analysts said the launches would lead to sustainable growth. The oncology segment, too, is growing well, contributing about a fifth to the company’s domestic sales. The manage- ment said Natco was now focusing on increasing invest- ments in India and the rest of the world markets. Though some may have perceived it negatively, it is a good propo- sition looking at the challeng- ing environment in the US. Its India revenue have grown fourfold in the past three years. There was a 39 per cent growth in FY17. The rest ofthe world markets also offer good opportunities, looking at the low base of Natco.

Ranvir Singh, analyst at Systematix Shares, say the strategy is positive and besides, the company has continuedto surprise with its US launches regularly.

Factoring the delay in Copaxone launch, analysts at Axis Capital have cut their FY18/19 earnings per share by 15 per cent, but still arrive at a discounted cash low-based target price of Rs. 940. Their analysis suggests a bull case target of Rs.1,120 and a bear case target price of Rs.825. Clearly, there are gains from the current level of Rs. 704."

20170906-Natco-BS-GoodForLongTerm.pdf (320.1 KB)