hahaha… Growth is just knocking the door…Take it with a pinch of salt… Check the volatility in major base metals, energy as well as bullion.

Agreed it is an assumption but seeing the nature of business and the way market has opened and still new reforms coming after SEBI FMC merger… It is just about who eats the pie…I would say who eats the new pie served in the dish… But existining pie remains with MCX as it is…I am ready to stay here for years assuming current pie remains in the dish… I may go wrong but probability are minute seeing the practicality of these businesses driven by volume as well as considering MCX’s pact with various international partners… Again as said I may go wrong as there are inherent risk in all businesses… Assumptions are part of an investor… An investor invests because he assumes something to happen with a level of risk he can bear and with amount of patience he can hold…Just my views ![]()

Hi I agree that the current price make it a good deal for the business that you’re getting. But probably we shouldn’t assume the expenses to be capped since they pay a fixed amount of ₹1.5Cr/annum and 10.3% of revenue to the software provider.

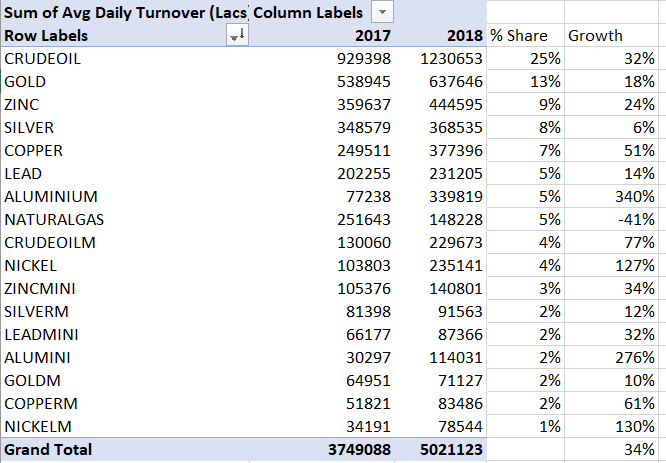

The spike in ADT numbers from Jan’18 after a long pause finally leading to some good results.

https://www.bseindia.com/corporates/anndet_new.aspx?newsid=78804b96-2a63-4e2a-90c0-75ac35d8d12e

Double digit revenue growth and non linear profit growth. Good part coming from other expense reduction. Had highlighted ADT volume spike sonetime in March above

Also, as in long term , concerned about competition ramping up post Sept once BSE jumps into arena, spoke to a senior person who has worked across exchanges. To my surprise, apart from marketplace network effect advantage, it does not seems to have any additional advantage. My thought was MCX might have process advantages in terms of warehouse mgmt etc but seems proven wrong. So, it would be interesting n critical to keep a watch how other exchanges intensify the game. Disc : Recently invested in both MCX n BSE with transactions done in last 3 months

@suru27

Thanks for your comments above. When yoy say warehouse mgnt is not a moat, can you please explain on that? Is it more due to third party providers and they can provide to anyone?

Also, how hard do you think it will be have customers switch to new exchange provided there are enough financial incentives?

Conference call transcript

Thank you. MCX got approvals for more launching more options today and they will start charging in the second half of the year. Interesting times ahead. Looking forward to competition from NSE and BSE.

It is to be noted that before the announcement of universal exchange it was falling like a bad stock but after the news it is trying to recover and trying to go up , i think mr market thinks that due to increased competition mcx could get higher pe if it can sustain its market share.

After a lull of almost 6-7 months, volumes (commodity trading volumes ) r again up yoy from Jan’18. All data available on company site . The risks highlighted still remain

Are the volumes being shown for both futures and options? MCX will not charge for Options till September 2018.

Very encouraging numbers for April and May. So, hoping continuation of good results in Q1’FY19. Below is commodity wise ADT YoY growth rates. Overall 34% growth , almost double than Q4FY18

in 2013 at the peak of commodity bull cycle they did 300 Cr of profits . i.e 15-16x peak earnings its trading today.

Where is the value ? Better buy commodity instead if one thinks commodity bull market has started.

That’s what i guess these numbers shows , people are buying into commodity.

Since CDSL is promoted by BSE, are MCX and BSE being merged??

Certainly this is a strange development in the back drop of NSE and MCX merger talks. Incase NSE/MCX talks materializes, then competitors are also partners(NSE will have a stake in BSE entity).

Getting market share from MCX might not be that easy??

While the article may be right about difficulty in procuring spot settlement prices, it would also intuitively mean that for MCX to protect its ground it would have to pay more convert its non-exclusive contracts to exclusive ones.

The quantum would obviously depend on the ratio of exclusive vs. non-exclusive contracts and the need for MCX to protect itself from competition.

Either way, competition is going to bring margin pressure for the incumbent with reduced pricing power on both the supplier and customer front.

It is an interesting space to observe for the next 2 years as to how changing competition dynamics and regulation bring about changes in the business model.

MCX plans currency derivatives foray…

https://www.thehindu.com/business/Industry/mcx-plans-currency-derivatives-foray/article24323709.ece