Q1 results are not that great

MCX - Q1 FY19 (Cons)

Net Income (23.1%) 72.87 Cr vs 59.19 Cr YoY

Net Profit of (-72.1%) 7.33 Cr vs 26.30 Cr YoY

EPS (in Rs.) 1.44 vs 5.17 YoY

https://www.bseindia.com/corporates/anndet_new.aspx?newsid=bc893702-2abe-480b-a1c5-729da429851a

the net profit was down bcz of one time exceptional item, excluding that net income was flat YoY.

Exceptional item was unrealized/notional loss on bonds and shares

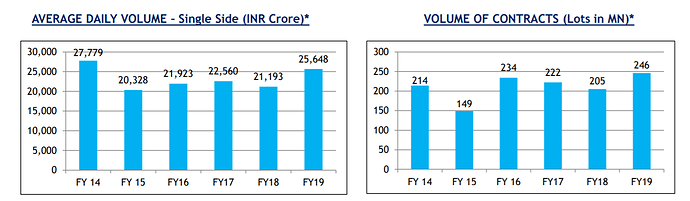

MCX ADTV is now hitting 30,000 Crores. A year or so back it was 20,000 Crores. The incremental volumes should ideally start contributing to the profits as op-lev is huge in this business. Options are also now hitting ~ 1000 Crores ADTV number, the month gone by saw ADTV at 2500 Crores for options!

Competition, has also entered and that space remains to be seen how it will play out. BSE ,as stated earlier, has launched their commodity derivatives platform on 1st October. Interestingly NSE hasn’t yet launched their commodity derivatives, it was supposed to launch on 1st October like BSE.

NSE launching on 12th October

Quoting from an article:

“We expect people who are familiar with BSE and not trading on MCX to trade with us. Of the 1,400 registered members, 450 have already taken membership in the commodity exchange,” he said.

The above is what MD and CEO, BSE, said. So, is BSE targeting non-MCX client?

|10/23/2018 6:54:10 PM| |

The Exchange has sought clarification from the company with respect to news Flash appearing on ET NOW - October 23, 2018 titled “MCX board discussed potential merger with NSE in today’s meeting”.

Reply is awaited.

Source: BSE Announcement.

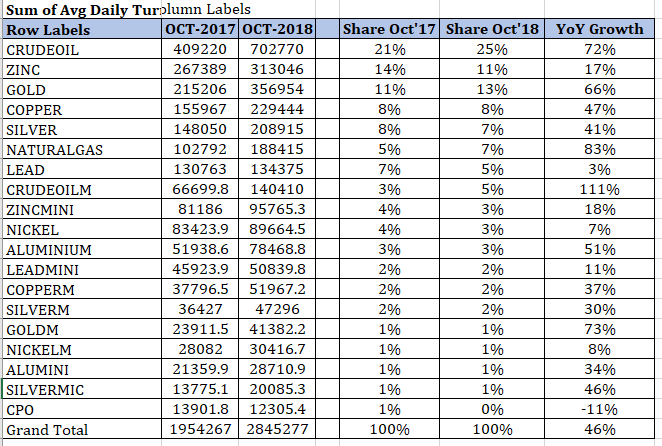

As BSE commodity exchange started from 1st Oct, wanted to check how MCX has done in Oct and it looks like some performance. From crude to almost every commodity with more than 5% share performing really well with overall YoY ADT growth of 46%.

Also, attaching a very interesting article with point of view on multiple commodity exchanges.

Is there space for more commodity exchange-Financial Express.pdf (3.5 MB)

Disclosure: Invested

Can u please comment anything with respect to its price performance over last 1-2 years with respect to its earning performance ??

Is it the fear of new entrants in commodity or some other specific factors that’s not allowing its earlier levels of 1000 in price to come .

Disclosure - Invested from higher levels from last 2 years and thinking to add , so trying to take perspective from experts

MCX Ltd

Highlights of Q2 FY19 and H1 FY19 Results

Key Highlights

- Turnover grew by 1.2 % over last quarter same year.

- Volumes in month of September and October were 27,000 Cr per day in terms of ADT over last 45 days.

- Big event last quarter was banking subsidiary went live with their broking activities and access security is now a member which has commenced operation on MCX. Company now have firm dates from SBICAPS, HDFC Securities, Yes Securities and ICICI Securities now and company expect them to be trading on the exchange within the next three months.

-

There were positive moves from regulator side also like

- SEBI has cleared the proposal for allowing participation in Eligible Foreign Entities (EFE). This will now enable entities based outside India to work through authorised stock brokers and take hedge positions in commodities where they have exposures in India.

- RBI did not allow international hedging of gold from the first of July has resulted in a lot of people hedging on the domestic exchanges and at MCX the open interest which used to be in the range of about 7.5 to 8 tons on the gold contract has now crossed 15 tons and that is a very, very big development for company. This will open market for institutional participants.

- SEBI is working on introducing an index as a product within the commodity segment that has gained traction.

Q&A

- As there is traction in ADT how has been the growth on number of contracts traded in various commodities?

- Volumes has grown across all commodities and in some commodity volume decrease and it is natural like in cotton volume decrease because it is a lean season for cotton. In crude, while the volatility and the price has been up the volumes are marginally down maybe about 4% or 5%. So overall good increase in volumes are seen.

- In crude when the prices starts moving up and volatility is high than why company volume doesn’t go up ?

- It is not only function of volatility it is because the amount of trading is also in some ways related to the contract size and increase in price does sometimes have an effect with the volume being slightly lower. Volatility was also slightly lower than last quarter.

- Company ADT has gone up by 12.5% but revenue has increased by 6.5 % so is there a decrease in yield ?

- Compare to last quarter ADT is up by 1.22 % but there are three things which would have impacted this for it to be slightly lower than that number. On positive 1.22 % company volume is down by 0.28 % but again in terms of overall revenues the number of trading days is gone down by 1.5% as compared to the last quarter and there is also a liquidity enhancement scheme which is running in gold options contract that is given as a rebate in future prices and the impact which company had take in the last quarter was only 72 lakh because the scheme has started midway in the quarter, but for this full quarter the impact is 1.67 Cr. So because of these reasons there was decrease in revenue compare to positive ADT movement.

- As company had started charging LES and company had set benchmark beyond that company want the options volume to go which will start charging the client so does company reached that benchmark ?

- Company is not charging in this quarter and company is looking at percentage to future. There are some contracts which are doing well like crude oil specifically in terms of the overall percentage of daily clients is very healthy. There is very good participation from retail clients and therefore some of these contracts expect good traction over the next couple of months, but overall yes it has been slightly slower than expected and impact of LES has not come through yet in terms of the volumes even in gold. So, the volumes in gold options has been good, but the participation has not climbed in that same proportion that company expected.

- Kindly give updates on the custodian sides and AIF start ?

- SEBI had constituted a subgroup consisting of custodians, exchanges some investors as well as key clearing members and the whole group went through the current regulation the concerns came up with sort of white paper which explain to SEBI what company wanted to achieve and within the current guidelines company can still achieve that for the commodity derivatives market that paper was submitted to SEBI about maybe month and half ago.

- Company believe that address the concerns that the market participants are custodians had and yet is within the overall framework that SEBI has for this market. Now company is waiting for SEBI to take final call on these clarification and move forward.

- What kind of threshold company is looking for options percentages before charging the same ?

- Company target is to get closer to double digit percentage.

- After start charging to clients did liquidity enhancement scheme also continue to be present in parallel or then that has to be shelved?

- Company may discontinue the liquidity enhancement scheme in gold option because the sort of risk return in term of spending compare to return that company get in terms of enhanced participation was not coming through.

- How much company would spend in second half of current FY19 ?

- It is not spending it is a rebate that company is giving and till now rebate given on the liquidity enhancement scheme was approximately 2.4 Crs. Now for the rest of the financial year company do not not expect to give any rebates on liquidity enhancement scheme because for this quarter at least there is nothing that has been approved and company do not see an immediate need for putting in something in the next quarter as well.

- In software support charges line item company pay 4.5 Cr plus and 10.3 % transaction revenue so what would be the incremental charges that go towards into this cost line?

- Those are expenses which company display on BSE in terms of expenses line under software support charges and product license fees. So, what comes in there is essentially the cost which are payable to FT for technology which is fixed cost . There is product license fees that is payable to exchanges like CME, LME etcetera for the product licensing with their contracts. There has been increase because of increase in CME license feed and that has started from 5th September. So that is the reason for product license fee portion gone up.

- How is the competition impacting the company performance ?

- In term of volumes competition has started in bullion. Volumes have not taken any hit compare to last quarter. If volumes will come into other exchange or incremental volumes and it is increasing the pie that is a great sign probably the market is increasing overall in size and therefore company don’t see a big threat for company to immediately react by doing anything on the pricing side

- How has been the development on the securities from distribution and how much of the impact initially does it have any and how company is looking at it going forward ?

- It is a great event for company in terms of the fact that the bank distribution is now getting on boarded. These are very large organisations which have a very wide footprint, but to activate all of those touch points does take time which is why it has taken as about 6 months to get them on boarded and start them trading. In next 2-3 years banking alone will add 10-15 % to volumes.

- Comparing Axis with other players like HDFC, ICICI and SBICAP as well, so how is it going is it maybe beyond expectation or there also some delay and further postponement ?

- Company have fir dates from all organisations and it is timing which company is expected. In last two or three calls that the general gestation period for bank subsidiaries to get really going is anywhere between six to nine months. Company admitted Axis securities as a member in January. They have started trading in August so that is like a 8 month period which is exactly what was an expectation. So this is in line with expectation.

- From overall revenues how much has been the transaction income and how has been the treasury/investment income?

- From overall revenue of 71.1 Cr company income from treasury is 22.17 Cr and 5 % of total revenue will be non-transaction revenue like membership fees.

- What is company outlook on its merger with NSE ?

- By continuing entrance of new exchanges into commodity market it is enlarging the market. It does not mean that company will have too much threat because there are enough examples that when the market grows people grow together in it.

- In terms of merger company has clarify it on BSE website and nothing further to add on it.

- What are the recent development happening in the company and on the sector particularly ? What kind of volumes company is expecting in next 3-4 years ?

- Company is seeing growth in line with expectation over last couple of quarters in market that is 8-10 % growth that company expect in a year.

- Key factors which will grow the market are distribution going up because of bank subsidiaries, because of new products kicking in like options and indices and finally new participant coming in like mutual funds and for the participants those are the other factors which will add to the growth. So in next 4 years company expect 15 % CAGR growth YOY.

- How is the mix in the market playing out like in coming years gold is now 12 % and earlier it was 40 % ?

- Company was at a certain certain percentage prior to demonetisation in terms of the overall volumes and post demonetisation it changes. This mix will not change in near future.

- Kindly elaborate on traded volume and revenue growth because there is a 6 % difference there ?

- 1.2% ADT movement on a year-on-year basis has panned out and this YOY movement is same for 2017 versus this time, company have moved from 67.26 Crs to 71.1 Cr and that is like a 6% increase that 6% increase comes mainly from ADT movement which has gone (+12%), but it is offset by realisation which is gone down by about 1.38% and the LES impact that is 1.67 Cr against NIL.

- From where is the realization impact come ?

- It is the mix in terms of r broker mix because company have some tiered pricing. So obviously as volumes have slightly grown faster in the larger brokers the realisation goes slightly lower because they are the ones who have the benefit of the two-tiered pricing that company have.

- Is there is a budget on absolute amount of LES ?

- Company has already spent 2.4 Cr in first half and company have no intention to continue LES going forward.

- Does increase in competition will increase risk for realization because still the realisation are on a higher side?

- The sort of volumes that company is seeing in the initial period gives company comfort that liquidity is not moving if at all there is some more liquidity getting built up in another exchange which is a great thing because the market may be expanding. So from that perspective at this point of time company not see much pressure in terms of realisation and company is confident on it.

- In interaction with large members what is the concentration of the member or does company have any interaction faced any kind of an issue where the members want to shift to say NSE or BSE because it is more favourable to trade and all the segments in one exchange?

- Company have not had any migration concern . Company believe liquidity is very sticky and as long as company can provide a product on platform which is absolutely like by people till that liquidity will not go away. There is no other benefit people would also get by just moving elsewhere because again in terms of moving capital between segments it takes anywhere between 20 to 25 minutes even one has to move between the exchanges today. So that is not a big advantage from a broker’s perspective even if it is seen to be an advantage otherwise.

- What kind of cost increase company can see going forward ?

- On YOY basis company has maintained cost consistently . In six lines of expense that company report on BSE website in that first three employee benefits expense or something which is more like a fixed cost, but the next two are mainly the software support and product license fees are a fully sort of variable cost, but combined it will remain 2-3 % YOY increase and company expect to maintain it for next two-three years.

- As computer expenses are down by 18 % on YOY basis so will there will be increase in expense of computer and tech expenses ?

- Company have incremental benefit here that are e getting is because there maybe some older technology which company were facing away or there are certain expense which not pick up anymore on the computer because company have done automation. It is a 2-3 % kind of expense line item so it is difficult to track.

- Does company see non-agri business crowding out as competitors are entering into that segment ?

- There will no crowding happening there. From a liquidity perspective it should remain at one trading point and company do not see why it should migrate away.

- In terms of new product launch company is exploring trading opportunities but with that company have to look that whether they are meaningful trading opportunities and meaningful products. Many of the products especially in the agricultural segments are sensitive, has had history where there has been regulatory interventions. it is very difficult to get into those products and in the non-agricultural segments there are very few commodities now left which are permitted for trading in India and have not been explored by any of the exchanges

- What are the other means left with company to scale up the option side as envisaged apart from LES ?

- Company will be seeing on products where there is no need of LES and company will aggressively pursuing member participation, investor education and that is the only way to go in terms of getting this product across more people. So the strategy will still remain to get many and more brokers on boarded and then to get as many more clients on boarded through investor awareness.

- With unified broker license and unified exchange coming in what is the view on margin fungibility ?

- The benefit of margin fungibility to the end client has already materialized and has been fully exploited by clients and by market with the unified membership that is available and many clients has already very happy using that because as an end client of he is engaging with a member who has the participation on different exchanges for the end client it is still all on one screen and the margin is fast-moving. In terms of its impact for the members it is one that there is not yet a real opportunity because company don’t have a currency or equity segment and other exchanges still do not have a meaningful commodity segment. So from a broker perspective that is not something A) a possibility today and B) to the extent they want to move capital. It take half hour to move capital from NSE to company commodity segment. So it is a big advantage .

- Any updates or anything that company would like to share in terms of participation from corporates ?

- Company will continue to see good progress in terms of corporate participation, it is also evident in the sort of open interest build up and that is company seeing in some product it is more than other. In gold it is a very good story because it has been aided by the fact that some of the larger corporate which used to hedge internationally are now being forced to hedge domestically and that is adding in a big way, but other than that company would continue to make progress in planned number and the incremental corporate is quite good.

- How the book value has decreased to 240 from 271 ?

- This is on account of dividend distribution which happened in first week of September.

- Is regulator is like SEBI and RBI are been liking only hedging and all they talk about only hedging rather than the trading. So does it mean that people like NSE and BSE they have to significantly invest on the other part of the ecosystem like warehouses and delivery based items. So with that does MCX has a better advantage compared to NSE, BSE ? What today exactly is roughly the amount of delivery based trading on overall basis earlier it used to be less than 2% on an overall basis on a financial year?

- There is o change in the delivery percentage.

- As a regulator they are keen to see hedgers participate and that hedger participation is linked in some way a physical participation but it is not mandatory. There are even hedgers who participate even on MCX and they do not really take or give delivery, but yes the fact that the regulators want more hedgers to participate means that one need to create products where deliveries can be made and that would require investment in warehousing and the whole ecosystem which having done that over the last so many years is something which is the natural advantage for the company when it comes to a competitor.

- Does the 7.5 ton to 15 ton regarding gold to open position something similar to that maybe there are lot of corporate going outside India to do the hedging. Is there any real development happening there so that they will not go outside and do more within India just like how will gold companies doing now and at a couple of time ?

- This was a regulatory intervention but from a market perspective company is sure that Indian market t become liquid then they provide a longer term hedge and that what will attract the international investors come back here. Currently, the fact that there is CTT and other taxes makes some of the aspects of Indian market not so efficient and therefore till that keeps happening we will have investors investing overseas.

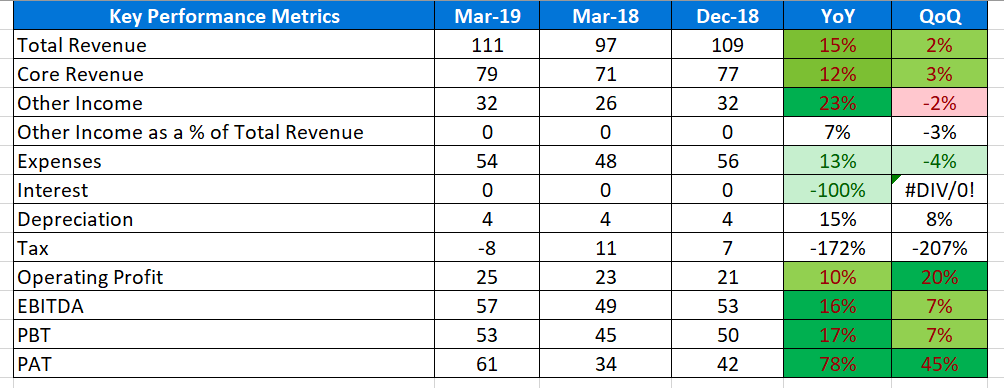

Strong set of numbers from MCX

MCX LTD

Highlights of Q3 FY19 and Nine Month FY19 Results

Financials

- There is minor increase in the cost this quarter. There is about 4.5 Cr of about one off cost which are very specific that company has to take this quarter and company is very confident that in terms of cost based yields absolute be in terms of previous number while the variable cost remain in line with the revenues

- The one off include 2.5 Cr of legal expenses in which there were some old cases that were closing out or certain matter that came up during this quarter but these are very certainly one-off cases and company will not have this expense going forward.

- There is 2 Cr of Regulatory expenses these are related to discussion going on with IPF and ISF which SEBI has fined could not be booked to those funds So on ongoing basis there will be no impact

- There was a 50 lakh expense increase from CSR perspective that will not be there in going forward.

- Fix cost will not go up more than 2-3 % on per annum basis

Key Highlights

- ADT for the December ending quarter was 26,614 Cr which represent the highest ever turnover on quarterly basis

- Growth was driven by bullion and energy. Gold has mover more than 10 % over last quarter and open interest in gold contract has conclude in a big way and now cross 20 metric tons contracts

- Also seen highest open interest in silver and crude contracts and options contract as well

- Volatility is now coupled with more participation . In terms of unique client code that are registered with exchange there is a minor dip because lot of member are combining their equity and commodity memberships and there are other consolidating happening. During this process there is weeding out of inactively users and this is what led to a small dip . But actual traded clients in the exchange has significantly gone up in the last quarter as well.

- In FY17-18 company have about 2,71,000 unique clients traded on the exchange and in nine and half month company has touch that number already so that is a phenomenal increase of more than 20 % in terms of number of clients trading on the exchange.

- These are the result of members who are combining their equity and commodity are showing uptick in their volume. Also by combination of sales force members are now reaching out to a wider audience and that really increase the participation in the commodity space. There has been little delay in Onboarding of bank subsidiaries in terms of going live. Company now have two bank subsidiaries live on the bank and two more will go live within this month. But for the subsidiaries which are live are showing good numbers

- On some portion of the tax free bonds which company still holds except that company now don’t have any exposure to long tenure debt in mutual fund portfolio and that helping company well in terms of the returns that is seen on treasury portfolio.

Outlook

- Company is confident that institutional investors will be allowed in the market during this quarter because regulatory imp edition from a custodian base services which was coming earlier has been removed by SEBI in the last quarter in their board meeting and that make a path to institutional investor coming to this market.

- SEBI will allow index based trade to be traded on the exchanges because it is a big portion of entire equity market turnover in the derivative space and there fore company believe that there is strong potential in India

- Company is going to convert metal base contract from cashless contract to deliverable contract this is going to start in month of march and continue over a period of 4-5 months. There is no reason to think that turnover will be significantly impacted. There will be some impact but not to big. Because even bullion is a physical contract but it do not intend people from trading.

Q&A

- How much volume is coming from the new trading members as a result of distribution compare to lot of attraction on the prices as well ?

- Even if the underlying price of the commodity goes up positive impact in terms of price impact volume and it been generally better for traded volumes . It is not necessarily related to the total value of the contract and this is seen because at the end of da if the contract size increases then volume will itself adjust in number of lots that are traded. So underlying there is not any big impact from a sentiment perspective of positive movements always been better for turnover .

- Those who have already combined their membership and working on a unified license are definetly doing better than those who continue to have seprate memberships. So the rate of growth is definitely higher in second category.

- Is there any impact of liquidity enhancement scheme ?

- In terms of LES it was 1.67 Cr in September quarter compare to this quarter it was 44 lakhs in the revenue. So LES expense was netted off this quarter. So company already have positive impact of 1.25 Cr this quarter and company don’t have LES going forward so it will add another 40 lakh going forward.

- What will be the normalized tax rate going forward ?

- It will be lower than the earlier norm so for next couple of years company expect it to be in range of 20-22 % as against 26-27 % which was there last year.

- Did company is now comfortable in term of option chain for charging and did com[any will start monetizing in next fiscal as well ?

- This will be the last quarter where company will not be charging for options.

- What impact will be there from product mix change ?

- Product mix change did not impact company realization because on the top three product which give more than 95 % of revenue are having same charges . Bullion , Base Metal and Energy have same charge sheet. The issue is some of the larger member grown faster than the other members with the result that realization has dropped in last quarter.

- Does higher players like bank subsidiaries come will lead to higher volume but lower realization ?

- Yes there will be always pressure on realization as larger member keep coming in.

- What company is doing in terms of options to reach the goal post that company has set for itself ?

- In terms of reaching the goal company is little distance away. Awareness is the biggest thing that company will continue to do. There are minor changes that company is approaching to SEBI. The changes will allow big hedgers and option writers to come in but this something which is in dialogue to SEBI and may take a couple of month to come in for implemented which is changing in some of the way and evolvement will happen in the money and out the money but those are the only specific things that company is trying to change in the contract design. Other than that company will focus on awareness.

- Does other income increase due to yield change in M2M ?

- Yes and now company have consciously come out of the product there wont be much volatility if the rates were to increase from here on.

- What was the amount of profit that company got additional because of the yields coming off and what are the total funds that company have in treasury at the moment ?

- The B-Tax yield on the mutual fund portfolio which was 300 basis point higher than company YTM which was a one off because of yield movement. On a 700 Cr portfolio that will be roughly around 2 Cr. That is purely movement on account of yield changes. So company has invested around 700 Cr in mutual funds. Company also have Fixed deposit portfolio also and tax free bond as well and plus company have funds at its clearing house also . So all put together company have around 1300 Cr treasury.

- Now NSE and BSE are also coming with commodities platform so do company see any volume shifting so does company see any kind of negative impact coming towards pricing a bit just to retain current customers ?

- Newer exchanges will expand the market but will it but will they will pull out volume from existing contracts will be a doubt and investing contract will not lead to profit. So that should be the experience going forward.

- Company will retain its market share in the product that company have to the extent that newer exchange have come up with newer products and that is something that will expand the overall market but that in the long run will benefit company. So if newer exchanges get new products something different and innovative obviously the market will expand and the Pie will expand but for the existing ones company don’t see too much pressure therefore company had not decrease its pricing and not intend to.

- In the 20 % trading member that increase during the financial year is there any profiling done on them are they speculators , genuine hedgers so how structure will be these members ?

- Now according to SEBI company have to analyses the value addition members. But at this point of time profiling is not done yet.

Management Comments

- In terms of business company is focused on commodities and don’t have any intention to look at any other divergence. Company is focus on Spot exchange as and when regulation allow for it.

- All fix cost will remain in the range of 2-3 % per annum increase plan.

The strong Month over Month ADT numbers finally lead to growth in profitability ![]() Also, with all additional employee and technology cost done, with rising volume in most of the commodities, operating leverage kicking in. Very good set of numbers:

Also, with all additional employee and technology cost done, with rising volume in most of the commodities, operating leverage kicking in. Very good set of numbers:

I see you (@suru27) have interest in various exchanges . I had couple of questions on them

-

Exchanges are entering each other domains - How do you think this will change equations in future .

-

Globally transaction fee as part of revenue is declining , how do see Indian exchanges preparing for this eventuality.

Do you see different exchange adopting varying strategies to counter them and which of those strategies appeal to you .

Please see two articles on pgurus.

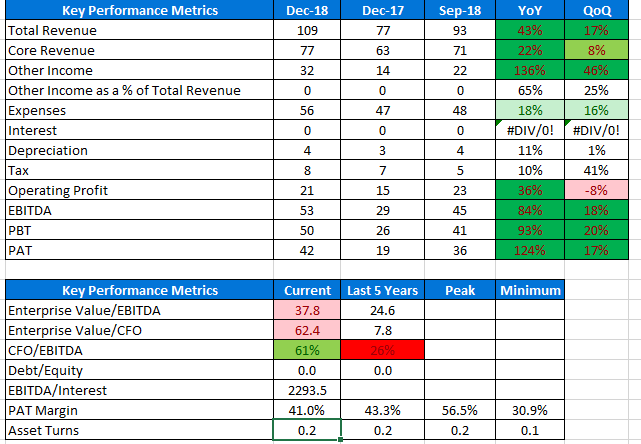

Very Good results from MCX with Rs 20/- dividend.

Good results from MCX. Though PAT looks way higher due to tax effects, still, both on toline and PBT level, company did above 15% YoY growth. ADT numbers have shown good growth after many years though income per unit transaction has declined. So, major growth has come from volume rather than pricing as average realization is down from Rs 2.19/lakh to Rs 2.16 on YoY basis.

Investor Presentation:

https://www.bseindia.com/xml-data/corpfiling/AttachLive/01631e51-493e-4a0c-98ef-50898ed41d04.pdf

How do you calculate income per unit transaction? I know that they mentioned a figure of 2.16 on the call yesterday, but have you any idea of how this figure was derived?