Good News started flowing for Inox Wind.

Likely that INOX Wind’s expansion of business scope (now includes being a developer of wind assets, versus just manufacturing of equipment) is at significant risk. INOX has been touting its reduction in receivables over FY18 but much of this is likely not actual cash collection, but simply reallocation of receivables. A closer look at the annual reports points to this.

Many orders seem to have been cancelled/reversed in FY18 for the standalone entity; amounts to more than half the gross revenue. (source: notes in Annual report).

Related party transactions account for a substantial portion of sales from INOX Wind to a fellow subsidiary - are cancelled orders made to external customers being parked here? This was paid for by holdco and optically reduced INOX wind’s receivables. (source: related party transactions in annual report)

Why have raw materials inventories increased so dramatically over FY18, a year which hardly had build-outs? Highly unlikely that in such an uncertain environment, the co would have bought substantial raw material in anticipation. The concept of ‘goods in transit’ in inventories points towards cancelled/reversed orders and reallocating receivables towards inventories?

INOX management has been very clear about not investing in auction wins (rather using that to fuel its manufacturing order book) and selling the subsidiaries to IPPs. But a) equity investments have been made after FY18 by the subsidiary of INOX Wind which has won such orders, b) regulations demand 10% of equity required to be brought in by promoters (in this case, INOX), c) CERC order has allowed sale of equity stake only after 12 months after the ‘last’ SPV has started supply of power - as expected INOX has challenged this order. [If there is one takeaway, it should be this]. There are plenty more regulatory hoops.

INOX has hardly tied up any capacity from the substantial order wins (at very aggressive pricing) - it is very uncertain who will purchase these SPVs (especially from second, third and fourth auction tranches which are at even lower pricing than the first). Discoms would be pleased with these rates, but would the developer make any ROI? a rational power generator will be loathe to purchase such assets? [key risk].

Even in FY18, a year with barely any business operations (sales had dipped 90% YoY), there have been delays in execution (read SJVN annual report; SJVN is INOX’s customer; there are also other cases). Creditors, too, have recently filed cases against the developer. Am not even bothering about the auditor resignation (this had spooked the market) since, in the context of all else, that is a rather small issue.

Other manufacturers (Suzlon etc) have not participated in these auctions - the new promoters are aggressive, but generally financially savvy - they probably don’t see how such rates can render the business profitable?

The optical reduction in receivables seems to have been reported to placate the rating agency which was monitoring this one variable closely, and has upgraded the outlook (twice!), turning a blind eye to the specious accounting, industry problems and regulatory issues.

There are so many existing risks that the 90% fall from highs offers NO margin of safety for a business whose operations itself are at substantial risk. I would be VERY wary of this stock.

Promoters holding is 75 perc with annual capacity of around 1500 mw manufacturing capacity of wind turbine (capacity to generate annual revenue of around 9000 cr per annum). Number one indian player Suzlon balance sheet is already damaged beyond hope of repair . Also with rupee depreciation against dollar by 15 perc no MNC players like gamesa etc are likely to supply wind turbine at low prices as their cost structure and return expectation is in dollar .Whole wind energy ecosystem is under considerable stress since last 2 years due to change in auction regime and worst of the sector is behind us and situation likely to improve going forward for all players. At current valuation level worst seem to be priced in as current worth is less than replacement cost of manufacturing plant and slight improvement is operating performance can support the price. Key risk is only if wind energy expected target of 60000 mw from current 35000 mw is not realised by 2022. Also current higher prices of crude likely to support renewal energy in medium term.

As per my analysis of Inox wind Share Holding pattern, I feel that big investors (other than institutional) are accumulating the shares from last 15 months. I have observed that continuously from last 15 months, each quarter retails share holders are getting out and big individual investors are accumulating this share. I feel that without having adequate knowledge/information about the business of a company, Big investor would not accumulate the shares specially when whole industry was in question mark of survival (auction regime started last year and this big investors are accumulating shares from around the same time). You can see that after June 2017 continuously Retail investors are getting reduced and big individual investors are accumulating shares. In June 2017 big investors (other than institutional) has only 0.84% holding and now in Sep 2018 it has been reached to 5.17%. See below my analysis.

Disclosure: I have invested in Inox Wind.

I do not fully follow the big investor but here I see the combination of Industry Fundamental & Big investor accumulation hence I have high confidence. Cherry on this confidence is that current market price is very low compare to history.

My Fundamental Consideration are as follow:

- Govt traget is 10 GW each year till 2028. Let’s assume govt does not meet their target 100% but atleast they can meet 50%. Wood Mackenzie is expecting meeting 76%.

- Inox wind BEP is around 350-400 MW which is very low so they can survive easily this transition time.

- by executing 820 MW in the past they achieved around 20 RS. eps. with around 10% marging which I feel that they would maintain.

- Getting 20% market share (5 GW *20% = 1 GW per annum) is not a big deal for INOX wind. you can see that all 4 auctions Inox wind has got/coved more than 20%.

- I did follow their last few quarters concall and I feel that what they guided has delivered almost around the same.

- As per their last concall, they already have the orderbook visibility for the next two year so I feel only execution is pending.

Q-2 Result is on 5th Nov 2018.

This is very likely as the odds of recovering those receivables during the time the company claimed to have done so, was very low. I suspect Gujarat Flurochemicals, the parent has made hay in this whole thing with the IPO and then fudging the books of Inox Wind for its own benefit. I think the resignation of auditors also had something to do with this.

And now CARE has withdrawn its rating, apparently at the request of the company.

https://www.bseindia.com/xml-data/corpfiling/AttachLive/67e6527b-d8a5-45e4-b051-a4baef7206ab.pdf

Q-2 FY 2018-19 Investor Presentation.

I attended a con call and good news is that Management expect to launch of new Higher MegaWatt turbines in few week.

@hash611 wonderful analysis!!!. Drastic reduction in AR perplexed me too and the ultralow bids were always a suspect from a viability perspective.

This kind of rounds it all. What bothers me is the competency of the rating agencies. If they are not able to uncover a simple reallocation of AR which presumably was the most stickiest of the issues, I am.not sure of the can uncover larger risks in a corporation. Rating agencies have a role to play in the ecosystem and not sure if they are up to it.

INOX may end up badly like any other over leveraged business. Thanks again this was a good find!.

The rating agency has reported the reallocation issue that has been explained to them by the management. That explanation is not just vague, it is opaque and obfuscatory in nature. It is not as simple to uncover - crooks are smart, cops and detectives need to be smarter.

The low bidding could lead to a systemic failure of the auction process itself. Manufacturers know their costing well - it is queer that no other manufacturer won bids in the auction process. Desperation?

Don’t see an easy solution for the business - the upside for an investor is that the downside is limited to INR 90 or so, per share held.

I would be careful with the parent entity too.

Inox wind sings agreement for lauching 3MW turbine.

https://www.bseindia.com/corporates/anndet_new.aspx?newsid=95856688-b4e2-4013-a524-51e5ef034dd5

Inox Green IPO is the next big trigger

The Inox Wind IPO was a disaster for all those that believed in the Green Energy theme back then

Hi All,

Any views on the big fund infusion by promoters in the company? There are lot of reports that wind energy installation will increase because of change in bidding process by government.

Thanks

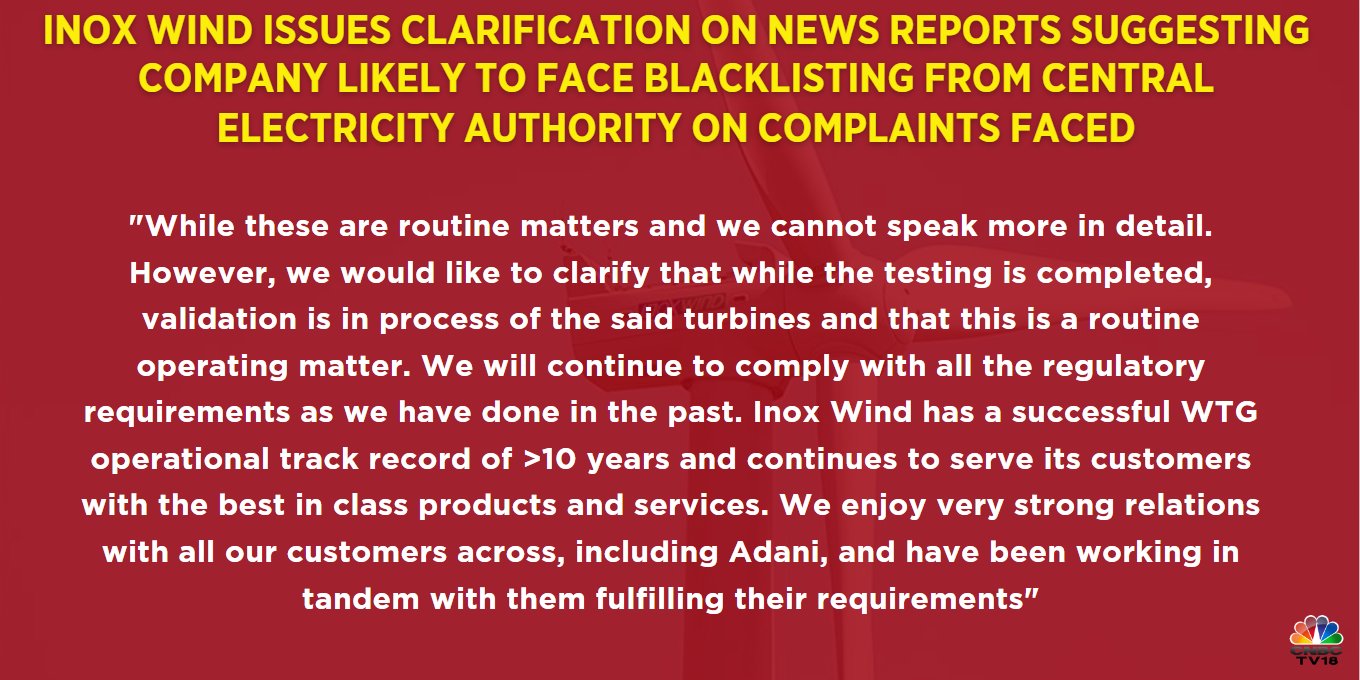

It seems the wind turbines that Inox Wind sold to Adani Group are not functioning properly

There is mention of CEA blacklisting Inox Wind in the above article

They are using MNC technology for controls system and few days ago in the con-call they said that performance is good for 3MW product which is new product.So not sure if this article is made the small thing big or it is the actual case.

https://www.globenewswire.com/news-release/2023/05/31/2679314/0/en/AMSC-Agrees-to-Deliver-nearly-20-Million-in-Wind-Turbine-Electrical-Control-Systems-to-Inox-Wind.htm

Meeting happened on 15th May but article is released today after 20 days which looks a bit fishy.

Management has come on TV channels on 31st May and sounded bullish so they must be aware of this issue and confident of handling it, othwerwise they wouldn’t; have been so bullish on the call.

I have written to IR, let’s see if they will clarify. Their phone number is going to voice call

I have feedback from the industry that Inox Wind turbines are not that great.

There are project management / commissioning issues

However, CEA is not party to any contract with Inox Wind

It is just a certifying authority.

I don’t think the cerifying authority “blacklists” a vendor.

Certification can always and everytime be denied.

CEA also gets certification fees everytime certification gets denied.

To my mind at this moment, the article looks exaggerated

@fundoo

Let us know what the response of the IR is.

Amey, it will be good if multiple people send email to the IR sk that they feel pressure to respond.

Their email is: Investors.iwl@inoxwind.com

Hi guys, Lest understand their current order book and execution

- This is the current order book of INOX, now this 350MW from SECI consist of 50MW of Nani Virani SPV and 200MW is from SECI III and 100MW from SECI IV.

@amey153 sir if you could please explain how will this be recognized. I mean 160cr would be through revenue and 100cr directly into equity??

300MW at 5cr/5.2cr per turbine can generate a revenue of 1500cr to 1600cr so if they execute this they would probably incur a loss of 200cr. Is this the way we can look at it??

-

They have been wining orders from NTPC till now and this months we have the NTPC auctions. So is there a possibility that hypothetically they win good orders from NTPC and they don’t proceed with SECI III & IV and what ever CWIP they have done they write that off.

-

Now from 350MW of NTPC order 150MW execution some what started between MAY - AUGUST 2022. So this would most probably be completed in Q1/Q2 FY24 generating revenue of roughly 700cr to 800cr. The balance 200MW execution started in Q1FY24 hence this can at the earliest be completed in Q4FY24 or Q1FY25.

-

The balance 501MW form adani will only be commenced once they have the certification which is in the final stage.

-

CONCALL

If they want to grow revenue multiple times then SECI III and IV is must. So 350MW from SECI and 150MW from NTPC. Looks like their next year revenue would be 2500cr. But will they be able to profit out of it. @amey153 sir any comments on this??

Next year interest cost can be 200cr so they save close to 140cr form here as well.

FY25 will have revenue from 200MW NTPC and 500MW from adani and in this they are confident of generating 14% to 15% EBITA. 700MW is like 3500cr revenue and EBITA of 550cr. They want to be debt free in next 12months. FY25 looks pretty good.

POSITIVE TRIGGERS

- NTPC auction in july so if they can win from here

- Certificate for 3MW series turbine

- Execution of 500MW (looks very likely) 2500cr revenue ( Doubt on profitability)

TECHNICAL

Looks very interesting, There are only 2 things which I am not very clear about or which are potential risk.

- SECI III and IV profitability

- Delay in getting the certification for 3MW series

@amey153 Sir if you could please give your view

Disc - Interested, not invested yet