I used to track it long back and don’t hold it now. I thought the company undertook outsized capex with deteriorating balance sheet and income statement. I also did not understand some of their M&A decisions. It seems that it is headed for better days for multiple reasons and the key is combined effect of operating and financial leverage. It also faced tough competition from Chinese players in the key segments particularly ingredients while the blend segment is growing steadily. Now with virus outbreak many clients will decisively shift or de-risk their operations going forward. It used to generate ROCE of 20%+ till FY16 and needed a catalyst like China virus to get back its mojo. Its Dahej plant is delayed but coming online at a very interesting time. Only thing that could worry folks is short term demand issue due to global slowdown.

@sumi00 Thanks very much for your comments. I just want to have one question on the management quality in terms of future outlook/commentary versus the actual execution?

Do they walk the talk or they over commit and under achieve?

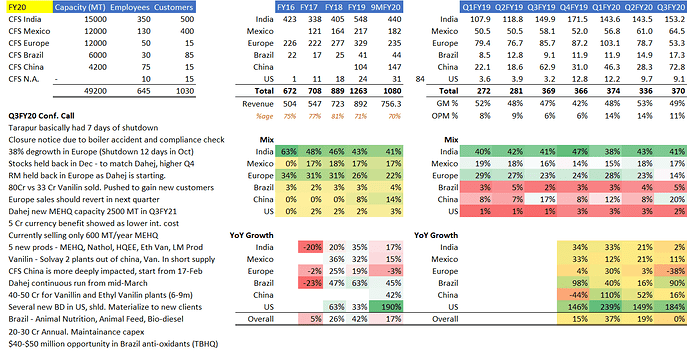

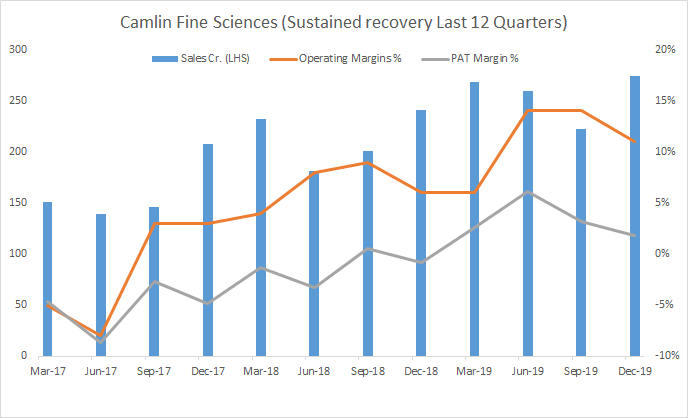

Continued recovery with good margin traction. Getting ready with Dahej commercial production by mid-March 2020

Good call with Management

Management is walking the talk, however this is a fairly complex capex and hence expect things to stabilize over the next couple of quarters. Dahej would be a game changer in terms of margins not revenue, so expect meaningful impact on the bottom line in FY21.

Exposure to China / virus ?

A major risk faced by them highlighted in earlier posts seemed to be Chinese competition so may be positive to that extent.

Also, disinfectant and allied products seemed to be one of their products - need to understand how much portion of their revenue these products were.

They also seem to have have a Chinese subsidiary so that may get impacted. Need to track dependency on China for raw materials and new capex related products.

For all you guys waiting for the Dahej project - GPCB has rejected Camlin’ application for the consent.

Usually, this happens when there are major flaws in the pollution control treatment. Most likely a piece of equipment has not been installed as promised in the application or the environmental clearance.

Does this mean that their commercial production is going to get delayed further? They have been delaying Dahej project for too long.

-

In concall for Q4FY19 results they had mentioned commercial production to start in October 2019 and in Q3FY20 presentation the timeline was extended further to Mar 2020.

They have also changed their stand when it comes to captive consumption of HQ from Dahej plant. In Q4FY19 they said captive consumption of 2000T with the remaining 4000T to be sold in the market whereas now the narrative is 100% captive consumption. Please correct if wrong. -

I know through my network that boilers have been erected by their supplier at Dahej. So even if they have not installed pollution control equipment (provided that’s the reason for the rejection), they ought to complete the project.

-

Internet suggests that Ravenna, where their Italian plant is situated, is not under lockdown at present. Wonder what their RM situation and capacity utilization is.

Update: Whole of Italy is now under lockdown.

I have no doubt that the Dahej project will be “completed”. I use “” here because there are several issues that need to be examined before reaching any conclusion regarding the continuity of the project.

-

The rationale given behind the project is to save costs. I believe the management has highlighted the cost savings due to the cheaper labour and fuel costs. At the same time the management has ignored or rather not given enough information about the most important cost - the cost of phenol. The ecosystem around phenol is still being established in India and Deepak is the only major phenol player. Deepak has filed for safeguard and now even anti-dumping duties for imports of phenols.

All over the world, phenol is available via pipeline for di-phenol plants and local availability is generally plenty. -

A simple sensitivity analysis is sufficient to calculate the impact of phenol

- yield of phenol to 1 kg HQ+ 1 Kg CAT = 2.15 as given by the management in a previous conference call.

- India is a net importer of phenol and hence CFS will have to rely on Deepak as well as imports. I believe that CFS has already procured Phenol for the Dahej project (as mentioned in their investors presentation). As far as my understanding goes, phenol is expensive in India compared to other countries due to the lack of the ecosystem.

- If CFS manufactures 10,000 MT of HQ + CAT it will require 10,750 MT of phenol as per the above calculation (please check my math!!)

Please do your own sensitivity analysis - a $ 50 per MT extra cost results in huge expenditures overall! Add to this the cost of opening L/C, interest costs, storage costs and the cost of melting the material … keep guessing!

What is most confusing is that CFS is drowning in Catechol. Since obtaining funding from IFC, CFS has been running all their plants to full capacity and building up a massive inventory as given in their financials. Trade data of imports of catechol versus exports of downstream products indicates that either CFS has a huge inventory of Catechol or of finished goods. Essentially it is not able to consume the Catechol that is being manufactured in Italy. With this massive inventory build up, CFS can generate paper profits - by valuing the inventory appropriately to suit the requirements of investors.

So, what is the real rationale of starting another plant in Dahej? What will happen to the catechol / downstream inventory already. In Jan 2020 CFS imported ~ 850 MT of Catechol from Italy. With China being closed and likely to be going slow for a while, what happens to all this inventory?

Rejection of Application : This is a serious matter. Normally, GPCB would never reject a consent application unless there is a major flaw. Most equipment is fabricated or constructed for such plants and you can assume anything from 1 month to a quarter. FYI, CFS had applied for the consent in December, and the visit was in March. They will have to reapply after complying - so I really cannot say how long this process will take.

HQ from Dahej : In the last conference call, the management indicated that they will make MEHQ to compete against Solvay and Cleanscience. I cannot imagine a better way to make more losses. Cleanscience has a process that starts from anisole and therefore more competitive than the HQ route. Competing on price against Cleanscience is sure shot way of running up losses. I do not know what calculations the management has made to make them change their strategy regarding HQ. Let’ hope some serious thought has given to it.

Lastly, di-phenol plants are notoriously difficult to stabilise. One can expect this plant to have a gestation period of at least 2-3 quarters.

Where is the cash going to come from to absorb the losses during the gestation period?

Excellent set of results ![]()

We see a good set of working capital YoY : 17,421.46 (2020) ← 5,237.16 (2019)

EPS : 1.36 (2020) ← 0.39 (2019)

We see high set of receivables (Balance Sheet) : 32,348.22 (2020) ← 26,185.91 (2019)

Company has high set of long term borrowings - this is basically due to expansion

https://www.bseindia.com/xml-data/corpfiling/AttachLive/c84aa23e-26dc-4448-a9b7-eccbe8093a9b.pdf

Radhakrishan Damani buys stake during December 2019 : It seems the phenol prices are back on track :

Thanks to @edwardlobo for the price chart link in Deepak Nitrite

Can some help me with their order books? The industry is fragmented and very hard to keep track off…!!

Disc : Invested

Am not an SEBI analyst, kindly do your due diligence in reading the forum and details about the company and consult your financier on the same.

Raising 180cr by selling 22.5% stake at current price - Link

Funds will be utilized to buy stakes in China and Mexico subsidiary. Planning to move China subsidiary tech in India amid growing tensions against China Will also launch new products in health & wellness segment.

This should provide necessary funds for Capex and a good strategic partner.

@sanjay210 @Prdnt_investor @nithin_Shenoy any comments?

Disclosure: Invested

Please correct me if I’m wrong, but the shares are being sold at the current market price and not at a premium.

~ current market cap ₹ 600 cr

Additional infusion of ₹ 183 cr

~ 23 % equity stake for the new investor (183/783)

I had mentioned the need for funds, the delay in Dahej and other issues in my previous post.

If there are any further comments from my side, I’ll surely post them here.

I would like to know how the mutual funds will react though.

The same was with case of Deepak nitrite however Deepak stands far too away from the explosion

I stand corrected, edited my post. Thanks for highlighting.

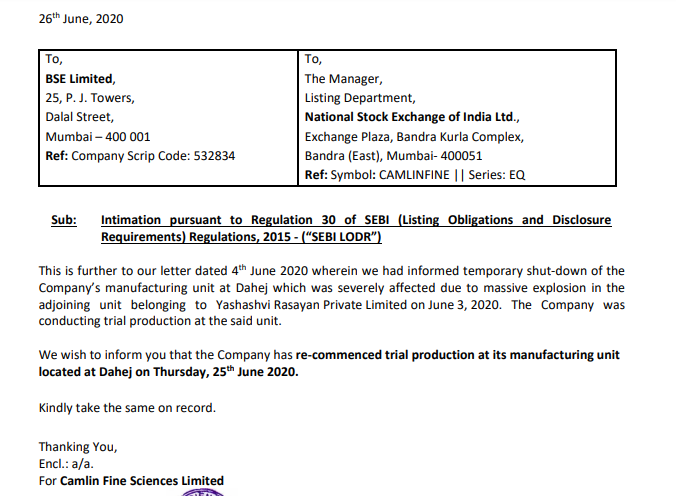

Trial production at Dahej has also resumed - Link

Management has guided that commercial production will start from Q2

Just heard the con call.

Firstly, the PE fund is comprised ex Fairfax people. Infinity is based in Atlanta (not UAE as a cursory website search shows).

CFS Wants to move the Chinese and Mexican operations to India at a cost of Rs 170 Cr combined. They expect a loss of revenue on account of the shift.

Moving a chemical plant, particularly a sophisticated plant like Vanillin is not easy. There was no mention of Guaicol, but I presume Guaicol will be made in Dahej. CFS currently does use the vapour phase technology for the manufacture of Guaicol. Hence, this will be a new technology intensive project for them.

The investment is in 3 tranches. I suppose it is based on CFS achieving targets.

We have to wait and watch what happens in Dahej next. The consent issue has not yet been sorted out.

Seems like some honest management :

Have been tracking for sometime and only witnessed great consistency in equity dilution. First they dilute to buy assets in those countries and now spend more to bring them back here in India. I can understand about China but what makes them to move Mexican plants?

Right now most of their products that are subsidiary’s business is being used as internal consumption because all that comes to India and then Camlin India sells it.

Since now they will start producing here itself then three things will happen

one the cost of production itself will go down

second, the forex fluctuations will go away

third - internal consumption not getting captured in the consolidated numbers that will be freed and so the subsidiary can sell this product in the world market.

So, technically itself your numbers will start going up, reported numbers will start looking bigger although right now they are the same numbers

but they are shown as an internal consumption.

Covid impact :

China 60% capacity currently

India - Not mentioned

Italy 100% capacity currently

Planning to derisk the China busines due to Geo political unstability and CFS customers also are increasingly supporting to move out from China

– The trade bariers, virus and western world trying to move away from china

– There are no movement/migration from Mexico as they have strong business there and no disruption (colombia, peru and rest of mexican plants are doing great)

– US & EUROPE - Are encouring us to move to India

– 180 cr + 100 cr = total cash flow of 280 cr

– 100 cr for mexico

– 70 cr for china

– 30 cr for working capital/liqudity

– Balance 80 cr is for capex of ehtyl vanilin and for downstream products

– FY21/FY22 - integration will happen

– Dahej plants are already on production

– Ethyl vanilian, china consolidation next year & mexico consolidation this year FY21

– All the benfits will be seen in within next 2 years

– Vanilian cost of product is about 12-14 dollars and we can see a growth of 1 dollar per product

– True Benefit FY21?-- Current margin 12%-14% we can achieve margin of earnings in year or next year -19%-20%

Risks :

– During transition the stock/inventory will be affected from 100%-50% during transition expect some bad quarter (roughly impact of 5-6 months)

– For Transition the deal needs to be done then it will take 3-4 months for dismantling

– The agreements are in place for acquistion - its not done deal

Others -

Call option for 61 lakhs the promoter has a option price 72 per share price for next 3 years with shareholder approval

Just an update - Camlin got the consent for Dahej, but only upto March 31st 2021.