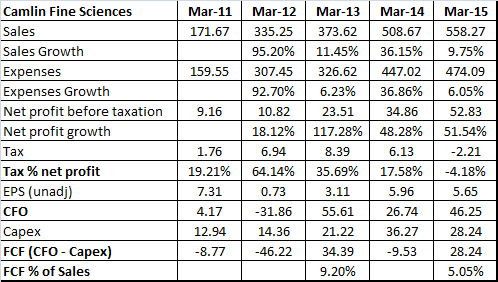

CFS — Please check the financials and ratios from stock screener.

Till very recently a single product company, product is TBHQ which helps extending shelf life of food products. For them, RM supply was a major challenge … They overcame it by buying a closed and loss making Italian company from Borregaard which gave them access to di-phenol technology to manufacture main RM which is BQ (Hydroquinone). Incidentally there are only 4 players in the world with this technology. And they paid Rs. 18 Cr. to buy 8000 T capacity. By spending another 4 cr last year, with de-bottlenecking and use of some indigenous technology, they increased capacity by another 4000 T … So, by paying Rs. 22 Cr. they are having an asset generating Rs. 300 Cr. revenue with huge scope for margin improvement.

The production of HQ gives rise to another low value down stream product Catechol… But further downstream of Catechol comes high value / high demand product like TBC, Guiacol, Veretrol, Guafenesin and Vanilin (synthetic vanilla) thus adding to wider product portfolio and de-risking the business with visible possibility of improving the margin level. Incremental capex for the downstream is low (as it is more a technical breakthrough) so incremental asset turn would be high.

Now company is planning a HQ plant in India with investment of Rs. 170 CR without stretching B/S much with mix of QIP and debt… They are doing it in 3 phases as per my information. At full utilization level, at today’s cost, total sales would be above Rs. 2000 Cr. by 2019. The land and regulatory approvals are in place. Meanwhile, company has already started producing more of downstream blends customised for end customer. If they can continue increasing the blending capacity then margin expansion would be huge (not factored in yet, optionality) with reduction of sales of TBHQ and Catechol. Already a new sales force is in place in different countries and they are doing customised blending through converters in China and elsewhere.

Overall, by FY 19 if the present plan works out, there would be complete transformation in the company from single low margin chemical company to a custom manufacturer of specialty chemicals for ready to eat / cook food sector… They have always walked more than half way (backward integration, blend development, deployment of new marketing team, on ground expansion work etc)

I think Vanilin has a huge and growing market with Solvay as the main manufacturer with plants around very costly western locations. The other listed player Evolva is a loss making biosciences player based out of Switzerland and has pioneered Vanillin from Yeast fermentation. Incidentally the company is valued at 500m USD (in the Swiss exchange) with revenues of just usd 10m and losses for 2014! Solvay in its annual report mentions Borregaard, Jiaxing, Thrive, Wanglong, Liaoning Shixing, Camlin, Anhui Bayi as present and potential competitors. None of the others mentioned by Solvay has huge capacity plan apart from Camlin… (As far as I could gather)

My scuttlebutt tells there were family issues for the promoter which has recently been settled. Recent promoter selling of stock was a result of that and possibly have no bearing on company performance.

The story would take time to unfold but I think it is positioning itself well for a lucrative space of food preservation and flavouring. The technology of HQ manufacture is a moat in my understanding.

The listing of SH Kelkar has given us some idea of the possible valuation of the company as I feel Camlin FS is the only comparable company to SH Kelkar.

It is not a recommendation and views invited.

Disclosure: Invested. Presently <5% of total portfolio.