Apollo Tricoat Limited (ATL) journey:

It was initially incorporated as “Potential investment and finance ltd” in 1983 and acquired by Mr Saket Agarwal by open offer in 2016. Subsequently name was changed to Best steel logistics with major areas of business as warehousing,logistics and trading activity of steel.

In 2018 Mr Rahul Gupta(RG) son of Mr Manoj Gupta(Chairman of APL Apollo tubes) has acquired controlling stake and changed company name to Apollo tricoat ltd and started setting up plant near Bangalore for manufacturing of tricoat tubes.

By FY18 end RG has increased his shareholding to 31.25% (80,30,000 shares) from 5.41%(for FY17) by preferential allotment of eq shares and warrants(48,00,000 @Rs.120.00)

During OCT 2018, LAXMI UDYOG LTD ( Subsidiary of APL Apollo tubes) did purchase agreement with RG to acquire his eq shares, 43,00,000 eq shares after warranty conversion @ Rs.120 and 79,30,000 shares from public with open offer @ Rs.135. As per latest shareholding promoter and group hold 64.33% in ATL.

This whole process looks complicated to me, request vp expert @phreakv6 to comment.

(What I have written below is based on annual reports,scuttlebutt,plant visit,discussion with people involved in steel industry. My interpretation may be wrong in few things.)

Apollo tricoat has set up its plant near Bangalore for manufacturing of tricoat tubes,designer galvanised tubes,narrow sections…etc.(to know the difference between pipes and tubes@ HERE)

Normally steel tubes are produced from from HR coils. When plain HR coil converted into tube it has to be wielded at the point of contact and tube has to be covered with zinc to prevent rusting. Once tubes are made into round tubes they are cut and dipped in zinc bath. Making round pipes and zinc coating by dipping in zinc bath is easy but making in rectangular or square shape and zinc coating is not easy. When tube is made into rectangular/square shape zinc coating inside is not uniform and when air is blown inside to clear zinc impurities the distribution of zinc inside the tube gets altered.

To overcome the above, plain HR coil itself is dipped in zinc bath and later converted into tubes/rectangular section tubes which is called as GP Pipes(G- GALVANISED, P-PLAIN HR COIL).Problem with GP pipes is loss of zinc coating at the junction of wielding making it prone for corrosion.

Apollo tricoat has got inline galvanizing technology from a US company for which they seems to have paid good money. Using this technology the HR coil converted into tubes/sections, wielded, coated with three layers. Interior of steel tubes by zinc paint,outside by zinc galvanisation which is in turn covered by polymer coating making it corrosion resistant with smooth surface. The whole process happens inline continuously without any loss of continuity during the whole process.

Presently one line of tricoat tube has recently started with production capacity of 7,000 tons /month on two shift basis. The present line is still facing minor stabilization issue which will be solved completely. Trial batch has been dispatched and seems to well accepted by market. Present line can produce 0.5 to 2.5 inch size tricoat tubes. Different sizes of tubes can be produced by replacing the machine parts through which HR coil passes through. HR coil of different dimension is used depending on requirement ,size…etc

Benefits of technology: Greater corrosion resistance,greater yield, and tensile strength(see the presentation). As tube is wielded before coating,even the wielded area is as corrosion resistant as rest of the tube(which was problem with GP pipes).

Benefit to company is better margin compared to GI pipes (Rs.5-10/kg more than GI pipes/EBITDA margins are 2 times more compared to GP pipe as mentioned in APL concall) due to cost saving by inline process and less use of zinc.

ATL has target is to sell 30,000 tons of tricoat tubes for FY20. Another line for tricoat tubes will be installed in next 1-2 years.

Uses: Tricoat tubes will offer more life,better strength and corrosion resistance for roof top sheds.(kerala seems to biggest market of 30,000 MT per month for galvanised pipes.). Green House is emerging in India, through tricoat tubes we will be offering pre fabricated solutions to greenhouse supplying contractors.In developed countries its compulsory to use steel tubes for electrical conduit instead of pvc in high rise buildings. Presently there is no such trend in India but we can explore the market in future.

They have technology agreement with US company not to sell the technology to any other company for five years. Once ATL install another line in next 1-2 years US company can not provide technology for another five years. Apollo has to buy specific machinery provided by US company as nobody else can do. Don’t think anybody else will do it also as its expensive technology. Even globally just 4-5 countries have such product line and in each country its monopoly.

(Technology provider seems to be “ALLIED TUBE AND CONDUIT” which is a part of listed company “ATKORE INTERNATIONAL”. Allied tubes and conduit has patented FLO-COAT® inline galvanising technology which is similar to Apollo tricoat technolgy. My limited to search to look for market size,margins of Flowcoat tubes through Atkote international AR did not yield much results. For more details refer http://www.atc-mechanical.com/mechanical-tubing/flo-coat/ and http://www.atkore.com/about-atkore/.)

Another line for door frames, designer galvanised tubes is in progress and will be operational in few months. Here HR coil goes through normal galvanising process but the tubes will have designs over the surface which is used for various domestic household uses like gates,window frames,railings…etc. Nobody else in India have this technology or producing it.This We have learnt from others outside India with the help consultant we are going to produce it. We will be making profiles and sent to our other division where it will be modified as per customer requirement. We will be replacing wood products by our steel products.

Steel companies produce thicker sections of HRC. Presently hrc coils of 1.4 to 1.2 mm is not available in market. We are putting cold rolling mill where these hr coil will be converted to thinner sizes using which small size section tubes of ¼ inch to 1.5 inch will be made. Thin sections by cold rolling mills of ¼ inch to 1 ½ inch for meeting customer requirement of frames,railings etc. This will be operational in six months. We have procured all the necessary machines and planning to commission every line over next few months ( including GP line?).

As we are supplying these pipes to premium market we want to pack both ends with plastic caps for better management during transportation. We are thinking to install machines for making plastic caps. For 200 tons of pipes per day dispatch requires 1000 to 2000 caps per day.

Hybrid pipes: plan for 10,000 tons capacity in a new plant nearby. Here galvanised steel tube is coated inside with PVC. This hybrid pipes can be used for drinking water purpose and it can be replacement for CPVC pipe.

Tricoat tubes will be sold through same distributors of APL tubes.Normal credit period of around 30 days. Raw materials will be sourced from JSW steel.

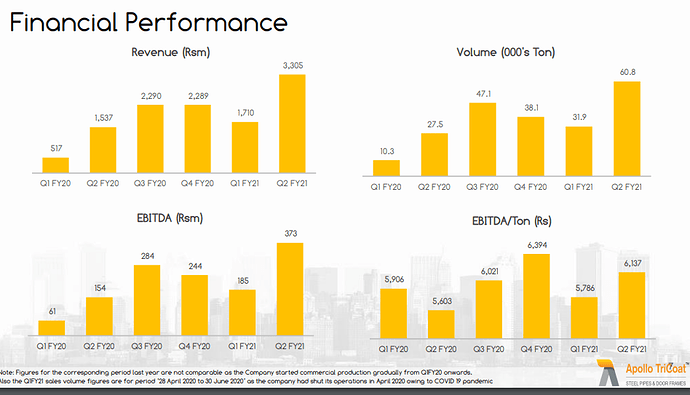

As per APL tubes concall EBITDA for GP pipe is around 5,000/ton. Going by the commentary tricoat will make 2 times the EBITDA margin i,e 10,000/ton(RS.10/KG)

Even if Tricoat able to sell 30,000 tons in FY20, they will be earning EBITDA of 30 Cr for FY20.

Financials: Does not have value as past business was entirely different. Below is performance of company (best steel logistics)

Questions:

- Acceptance of product: As its new technology with stated benefits of corrosion resistance,long life and better strength. Will customer note this differentiation and buy this new product?

- Even though ATL has agreement with US company,seems like there are companies in other countries which are using the same technology. Any Indian company may tie up with them and increase the competition.

- Why it’s monopoly business in different countries? Why only limited no of lines are functioning? Does the market size of tricoat inline galvanised tubes is limited? Or is it difficult to replace GP pipes?

- Higher margins are to some extent is due to less amount of zinc utilisation. What is the quantity/value of zinc required per ton of tricoat tubes v/s GP pipes.

- Can they pass on increase in raw material cost(predominantly steel) to customers. Even APL tubes couldn’t do it effectively is last few quarters.

- Better margins may be due to fact that they are going to use APL tubes distributors? What will be the expenses if they have to pay for it or end up using separate distributors?

- What will be the logistic costs if they have to supply all over India from single plant location?

- At the end its commodity conversion business. Does it deserve valuation of 530 Cr market cap.

Disclosure: tracking position.