Business Overview:

Yatharth Hospital & Trauma Care Services Limited is a leading healthcare provider in the National Capital Region of Delhi, India. It operates three super specialty hospitals in Noida, Greater Noida, and Noida Extension, with an additional 305-bed hospital in Jhansi-Orchha, Madhya Pradesh. The total bed capacity is 1,405, including a robust critical care program. All hospitals are accredited by NABH, and those in Greater Noida and Noida Extension are also accredited by NABL.

Led by Dr. Ajay Kumar Tyagi and Dr. Kapil Kumar, each with over 17 years of experience, Yatharth has strong brand equity. It engages in various branding activities, including medical camps, community outreach programs, and continuous medical education. Empaneled with insurance providers and government organizations, the company’s operational beds grew at a CAGR of 27.52% from 864 in March 2021 to 1,405 in March 2023.

As of March 31, 2023, company engaged 609 doctors and offer healthcare services across several specialties and super specialties. For better and more focused patient care, company have carved out the following super specialty as Centre of Excellence (“COE”): • Centre of Medicine • Centre of General Surgery • Centre of Gastroenterology • Centre of Cardiology • Centre of Nephrology &

Urology • Centre of Pulmonology • Centre of Neurosciences • Centre of Pediatrics • Centre of Gynaecology • Centre of Orthopedics & Spine & Rheumatology.

Competitive Strength:

- Diverse Specialties and Payer Mix: Yatharth is among the leading super-specialty hospitals in Delhi NCR, offering a broad range of healthcare services across specialties and super specialties. Their Centers of Excellence cover areas such as Medicine, Cardiology, Neurosciences, General Surgery, Nephrology & Urology, Pediatrics, Gastroenterology, Pulmonology, Gynecology, Orthopedics & Spine, and Rheumatology.

- Comprehensive Healthcare Services: Operating at all levels of healthcare from primary to tertiary, Yatharth positions itself as a one-stop destination for patient needs. They completed a significant number of surgeries and dialysis procedures, showcasing their capability and reach.

- Diversified Revenue Streams: Yatharth’s revenue diversification across specialties, hospitals, and customer mix provides a de-risked business model. This allows them to implement effective pricing and marketing strategies to attract a varied customer base.

- Attractive Quality Staff: The success of Yatharth is attributed to its ability to attract highly qualified medical professionals, including doctors, nurses, paramedical, and support staff. The team includes regular faculties and attendees at premier medical conferences.

- Experienced Management Team: Yatharth is led by an experienced and qualified management team. The combination of healthcare and management professionals in the corporate setup, along with a diverse Board, contributes to the company’s growth and adherence to high corporate governance standards.

- Advanced Medical Equipment and Technology: Yatharth invests in advanced medical technology and equipment to support practitioners in delivering timely and efficient healthcare. Their commitment to introducing cutting-edge medical technology across all aspects of healthcare services demonstrates their dedication to staying at the forefront of the industry.

- Stable Operating and Financial Performance: Yatharth has maintained stable operating and financial performance over the past three fiscal years. Their growth in revenue and profitability is attributed to operational efficiency, streamlined functions, process innovations, and the maintenance of economies of scale. The company strategically manages capital expenditure, optimizing available space and working efficiently with equipment suppliers.

- Strategic Capital Expenditure: Yatharth’s prudent capital expenditure approach involves acquiring land on a long-term leasehold basis and constructing civil structures independently. This strategy helps in maintaining a lower capital expenditure per operational bed while expanding their footprint.

Key Strategies:

- Enhance Quality and Efficiency:

- Recruit experienced doctors and deepen expertise.

- Focus on advanced specialties with high demand.

- Monitor and manage operating expenses.

- Expand Scale:

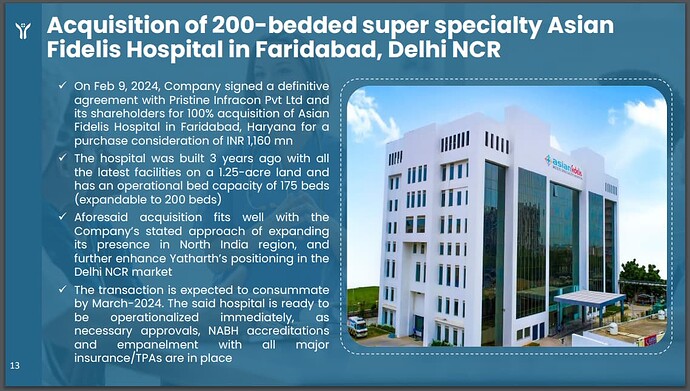

- Grow organically and through acquisitions.

- Explore opportunities in adjacent regions.

- Increase bed capacity in existing hospitals.

- Introduce New Specialties:

- Add radiation therapy for oncology.

- Establish organ transplant units.

- Attract Skilled Professionals:

- Engage quality medical professionals.

- Strengthen collaborations with institutions.

- Leverage Technology:

- Adopt robotic surgery and cutting-edge tech.

- Regularly update equipment.

- Grow Medical Tourism:

- Position as a preferred destination.

- Capitalize on India’s cost advantage.

- Establish ties with tourism firms and embassies.

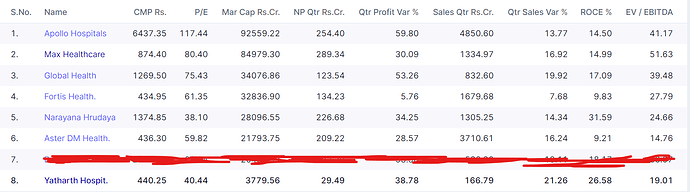

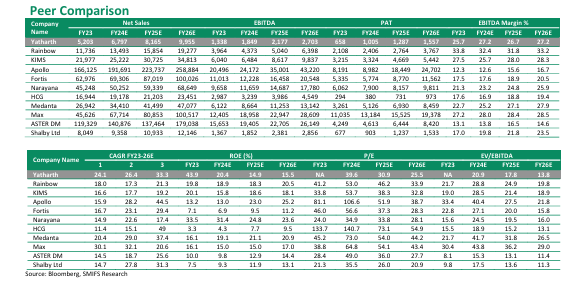

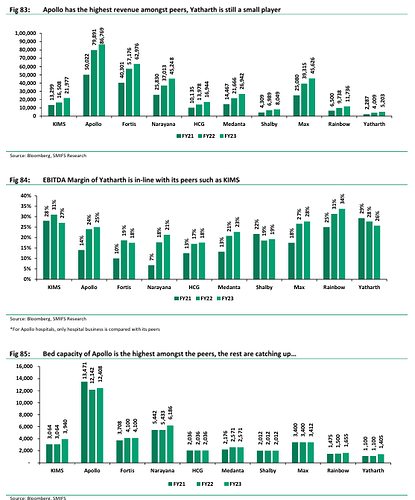

Peer Comparison:

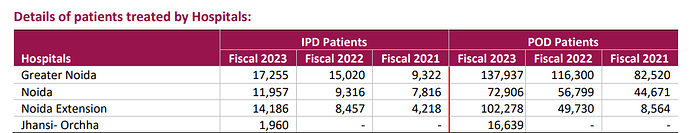

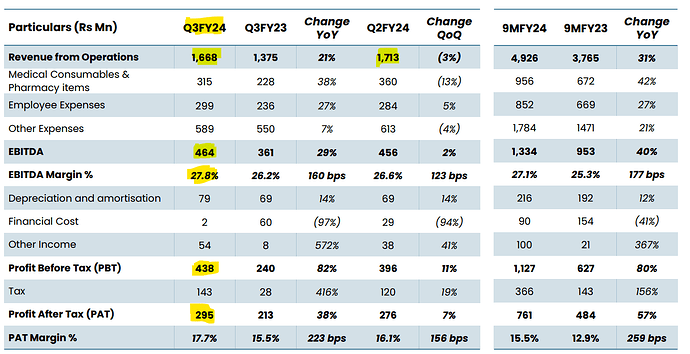

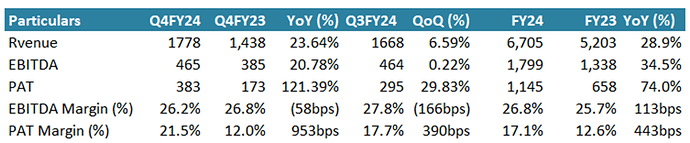

Financial Performance:

Expansion and Diversification:

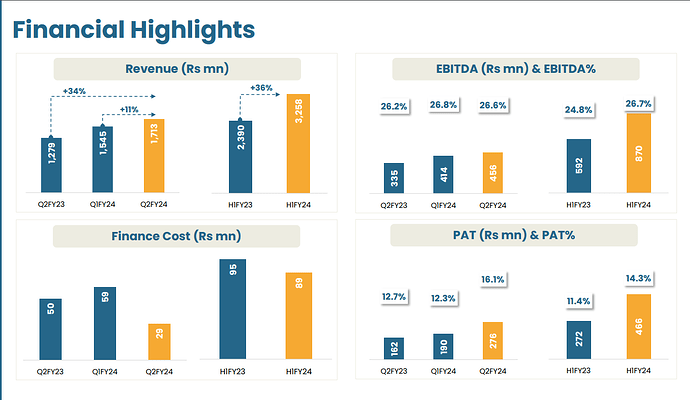

- The company is focused on diversifying its range of medical specialties and introducing new ones across all its hospitals, with double-digit growth seen in most specialties.

- The company is committed to enhancing its suite of Oncology services and aims to offer robotic surgeries and a comprehensive suite of Oncology treatments by Q4 of this fiscal year.

- The company has concluded around 100 kidney transplants and is expanding its organ transplant and medical tourism business.

- The company aims to double its bed capacity over the next 3-4 years through a mix of greenfield and brownfield expansion.

- The company plans to acquire one hospital before the end of the fiscal year and has a Capex plan of around ₹800 crores for the next three years.

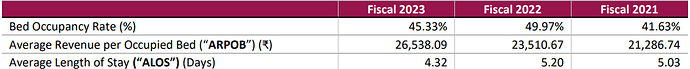

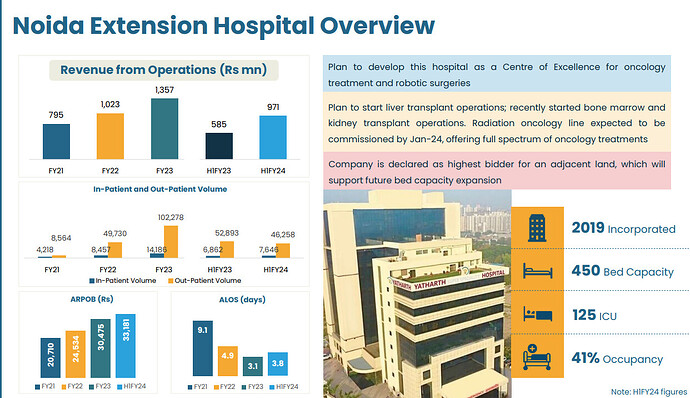

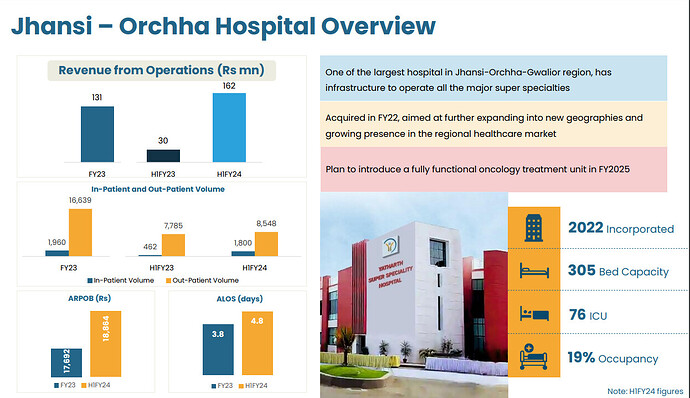

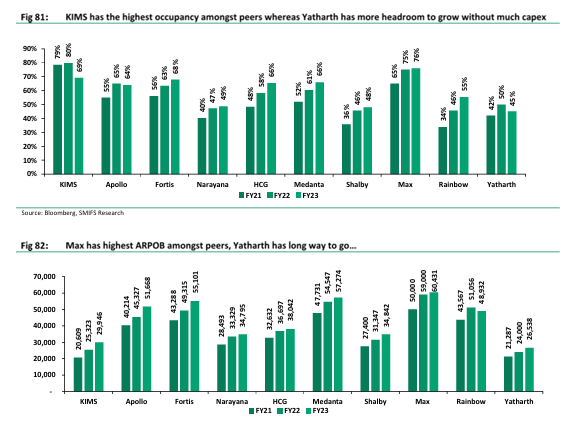

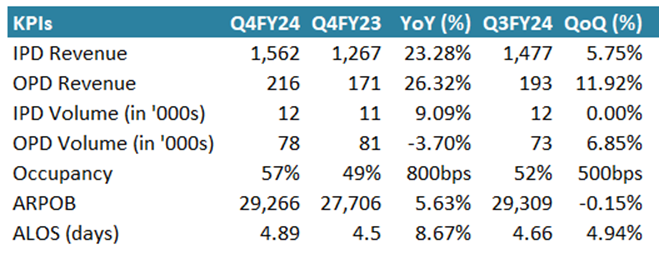

Occupancy and Hospital Overview:

Risks and concerns

• YHTCL is highly dependent on doctors, nurses and other healthcare professionals and its business and financial performance will be impacted significantly if company unable to attract, retain or train such professionals.

• The Company depends on the strength of its brand and reputation. Failure to maintain and enhance those brand and reputation, and any negative publicity and allegations in the media against this, may materially and adversely affect the level of market recognition of, and trust in, the services, which could result in a material adverse impact on company’s business, financial condition, results of operations and prospects.

• If Company unable to increase its hospital occupancy rates, it may not be able to generate adequate returns on its capital expenditures, which could materially adversely affect the operating efficiencies and also the profitability.

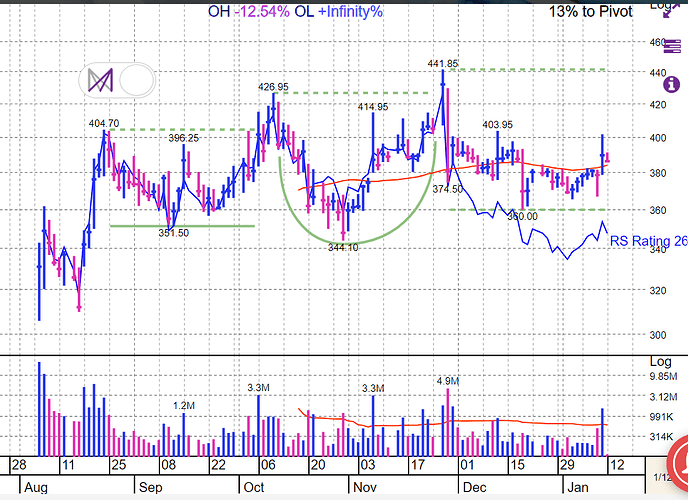

Technical:

Trading above 50 DMA of 381.

Under consolidation.

Pivot Point is 441.

In short:

- Company may demonstrate operating leverage.

- Attractively priced compared to peers, specially Global Health which is most near peer.

- Aims to double its capacity in next 3-4 years.

- After IPO it become net debt free, effect of debt repayment will be more visible in Q3.

- Jhnsi Hospital occupancy is only 19%, which expected to improve.

Last company presentation: https://www.bseindia.com/xml-data/corpfiling/AttachHis/a8a49c05-2bd4-43b1-8cf4-9712c11581d2.pdf

Disclosure:

Invested and looking to add