Hey everyone, new here. I am in the market since last 1 year. I was thinking to resarch on something and in between I found this forum. I was thinking to observe all the multibagger stocks, like what do they have in common? I have seen people here have very very good knowledge. So I would love to have your inputs on this one.

That’s pretty easy to answer

- Good management

- Very cheap to begin with

- High cash flows

- Good current and future growth

- Good corp governance

GPIL for example has gone up 12 times in last 1.5 years, and still retains all the above 5 properties despite that.

Multibaggar - > Topline growth X Margin Expansion X Valuation Rerating

This is what i look for to make sense of a possibility of large returns

So what do you suggest guys? where should i start from? should I make a list of few Small caps stocks probably which have price of lower range. Then I should look at their fundamnetals one by one. The companies who are making good profit consistently. Have good cash flow. Have lower Debt to equity ratio. Good net profit margin. Look at their future expansion plans, and what about promoter’s holding ratio? that has to be higher? does that matters? A look at their P.E ration And P.B Ratio? should i do all this? or would you guys like to correct me somewhere? or suggest me something else?

Not sure about your experience till now, in early part of my direct investing i focussed largely on compounding stories to grow the capital and learn more and more about investing, even now large part of my portfolio are in compounding growth stories and a small part dedicated to figuring out large swing bets since the risk of failure is high.

Just to give you one example of a company i am researching is Meghmani Organics, the company is currently trading at market cap of expected FY25 sales and significant increase in EBITDA. If the growth plan materializes revenue will be 2X, EBITDA can be 2.5 ~ 3X and valuation will also be rerated once company delivers the numbers. So such stories have potential to deliver multibaggar returns but it is contingent on company delivering these numbers and business environment not deteriorating hence it is a high risk.

Disclosure- Not invested in this, just gave an example of my thought process

One input I want to give is that

Finding multibagger is not only sufficient. Allocating right amount of money and holding it (EQ and Psychology game) is also important. Which is not an easy task.

Secondly I have seen many people doing hope investments and end up buying worst category of stocks in the hope multibagger. Don’t do that!

At the end overall return on portfolio is more important what ever is the method

15-20% every year for 20 years is 15-38 times If you are able to do so then you are multibagger by your self.

All the best for your investing journey

Can you give another example of such a stock from the past please?

GPIL has lost its cheapness now:

With sharp rise in pellet prices, valuation looks cheap , but it never is

Cash flows high but mis-capital allocation in the form of specialty steel (Management has no experience in this)

Growth will depend on how its experiments will become succesful with capex of Rs3000 cr towards specialty.

Best case for such steel companies is to increase brownfield capacity but since its iron ore capacity has been used up, such brownfield expansion does not make sense.

If you go in with the assumption that every stock you invest into will be a multibagger, you will be disappointed. It won’t work out that way.

Godawari PE is still quite low at 3.37. Considering its ROCE of 55.6%, would you reconsider your view that it has lost its “cheapness”?

The PE of Bhansali is 7.58. The ROE is 42, but the ROCE is still more impressive at 56.8. These have often made my mouth water. It is often talked of highly, but seems to stagnate. Yesterday saw a video of Ashish Chugh where he was recommending buying beaten down stocks if you want a multibagger. But he also said that sometimes a stock may lay dormant for four five years and then come to life. My doubt is because of the shares like Bhansali. The fundamentals appear ok, but it is refusing to come to life. An investor would really feel silly if he remains invested for for years and then finds that his investment was dud. Any advice?

My way usually is to combine momentum and value picking. When, for example, everybody was talking of API, and I was late to enter it, I went looking for cheaper stocks in that genre. This landed me with Laurus. Similarly among the pharma stocks, I found Caplin. In logistics I have found Tiger.

Sometimes it clicks, at other times it doesn’t. Quite often I have lost confidence in myself and sold early. And the stocks, waiting for that moment, shoot up immediately.

Flaw in my scheme is that in depending on PE/RE/ROCE, I am accounting for its past earnings. The right way would be to find stocks which would have great future earning.

Now, here is a question: how do we find a stock’s 2024 earnings (“its 2024 earning is discounted at 25x”)? Is it a guess or we can base it on some definite data? Is it the past CAGR?

I feel like I have been promoted to a senior class without having mastered the syllabus of the junior class sufficiently.

Need advice.

This point is bang on! These metrics are helpful to identify trend when seen over long periods but a specific year’s can be misleading to a base a decision on. The example on Bhansali - FY22 profitability was extremely high due to increased pent up demand post COVID washout in FY21 with low input costs but this company is in a commodity business so margins took a big hit due to inflation in FY23. I expect the stock to languish a bit this year until inputs prices stabilize and Bhansali can make up some margins.

To understand future earning potential, we have to listen to management commentary and growth updates on concalls and AGMs to see what they guide and what they achieve down the line compared to that guidance. Do this across other companies in the same business and we will get an understanding of the sector. Then we can judge future prospects with some confidence. I have found Dr. Vijay Malik’s blog very useful for this sector level understanding Simple steps to learn Stock Analysis - Dr Vijay Malik

The Vijay Malik blog appears useful. I will go through it. Thanks a lot for this and other comments.

Thanks for leading me to Dr Vijay Malik’s site.

I knew most investors lose money in the stock market because they do not do any research. I did some ‘research’, but that has been confined to looking up a company’s PE, and ROCE/ROE. Sometimes I have read up about what the company does, and nothing much more. After reading the article on his site What I learnt from brief analysis of 2,800 Companies - Dr Vijay Malik

my eyes have opened to what a gargantuan task it is.

Also, it has exploded some myths for me. I have been under the impression that if you were looking for a multibagger, every investor’s dream, then you were more likely to find it among small cap companies. Reason was that the large juggernauts become slow moving and were not likely to grow very fast. Perhaps Peter Lynch is also of the same view. The article rebuts this.

Then I thought that a company with a unique business would take money home in bushels. It seems it is not so. Same is the case of a company that has assured business.

May be my task has become tougher, but may be I will be spared a lot of agony in future.

Hey, I don’t have much experience like others. But for me multibagger is mix of 2 things only.

Everyone say FCF and all but I believe if management is good and has vision then Balance Sheets things can be easily taken care of.

The 2 things are Power of Execution and ROIIC i.e. Return on Incremental Invested Capital and how company execute them.

Look at most popular multibagger stock Deepak Nitrate.

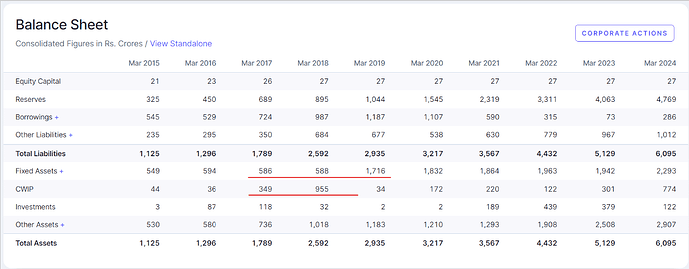

Company has Fixed Asset of 580cr in FY17 and they done big capex which is shown in CWIP 350cr.

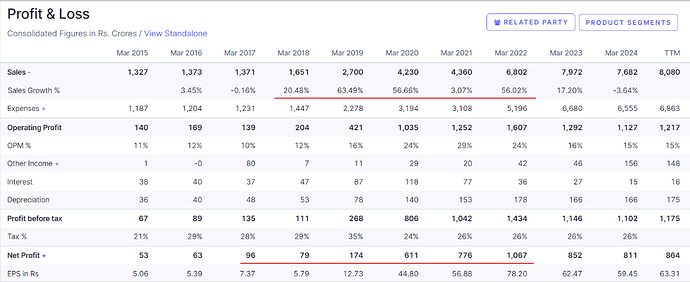

Company is made roughly 100cr on Sales of 1370cr in FY17 and they done 350cr Capex. This shows vision of the Promoter.

And in FY18, they done Capex of 955cr again. And thereafter company has never looked back. Promoter has executed Capex well.

Many companies do capex but they not able to generate sales as the Deepak Nitrite did.

From FY17 to FY22, PAT has been increased from 96cr to 1067cr

PAT Margins has been increased from 7% to 15.7%

Share Price has gone to 3000 from 135rs in 5 years i.e. 86% CAGR growth or 22 times.

Then why mostly people fail to hold stocks like this ?

Answer is easy.

- They do over analysis on the company.

- They don’t have patience to hold company.

- They listen to everyone rather then company management.

That’s all from my side. I may be wrong also. Please correct if I’m wrong at any place.