Websol Energy Systems Ltd

The company is one of the leading players in the solar photovoltaic cells and modules manufacturing segment. The Company enjoys a prominent presence in this sector due to its vast experience of two-and-a half decades. The Company commenced its business as a fully export oriented unit, mainly serving Europe (specially Germany and Italy) and US. The Company manufactured quality products for exports and its panels have been successfully functioning for the last 26 years.

Business analysis

The company enjoys protection from Cheap Chinese goods and tariff was imposed to protect it.

Fy21

“The government announced an increase in customs tariff that becomes effective from April 2022. We believe that this will make it possible for much of the country’s long-term appetite for cells, panels and modules to be serviced from within, a validation of the country’s Atmanirbhar Bharat (Self-Reliant India) commitment.

The result is that what was a pricing differential between the landed cost of Chinese solar products and our price of 25% a few years ago is likely to decline considerably by FY2021-22.”

The question needs to be asked is why tariff protection is needed for it to sell its goods if the company enjoys any competitive advantage.

The company enjoys certifications from its customers and due to a long time in the industry it has been able to create relationships

FY21

:”The Company’s product certifications and strong relationships lead to sustainable offtake. The Company is ranked as one of the largest and most competitive solar photovoltaic manufacturers in India with the cost of production being among the lowest across all Indian PV manufacturers. “

The company faces poor demand scenario time and again as we see in various places of its AR

Fy20

“WHAT WAS A 25% PRICING DIFFERENTIAL BETWEEN THE LANDED COST OF CHINESE SOLAR PRODUCTS AND OUR PRICE IS LIKELY TO DECLINE TO NIL DURING FY 2020‑21

During the year under review, your Company could not utilise its full capacity because of overall industry scenario and lack of demand. Also there was huge pressure from China on pricing end. After implementation of Safeguard Duty and other positive measures taken by the GOI we expect that your company will perform in FY 2020-21. We are hopeful that support from GOI will be continuing to green energy”

Further it is reliant on Government support for selling its products.

We see similar problems in FY 19 as well where it faced both volume and price pressure. The company faced high raw material cost of 84% as evident from screener. Also there was Exchange fluctuation loss of 5 crores. It seems whatever could go wrong for the company went wrong. Also we see that the company has not been able to pay undisputed Delhi Vat.

Fy19

“Lacklustre demand and heightened price erosion on account of increased product dumping by China comprised the main challenges that had an adverse impact on our financial performance. The company’s revenue from operations declined []% to Rs. 68.56 crore in 2018-19, from Rs. 183.27 crore in 2017-18. Other income grew by []% to Rs. 17.29 crore during the year. Lower revenues and higher fixed costs depressed EBIDTA to a negative Rs. 7.29 crore, from Rs. 26.79 crore reported in the previous year. This impacted profitability, with the company slipping to a net loss of Rs. 28.90 crore in 2018-19, from a net profit of Rs. 1.83 crore in the previous year. Aiding by positive government policies, the company is taking a number of measures with a view to restore profitability in the near-term.”

Further this loss would have been higher if not for sundry balances written back of 13 crores.

We see similar challenges in FY 18 as well where Chinese prices led to deterioration of business of the company. Further we see that the company had to enter into settlement with lenders.

Fy18

“The scenario is challenging as well. Over the last few years, some of the largest Chinese manufacturers commissioned some of the world’s largest solar cell and module capacities, a competitive positioning that made it possible for them to sell at progressively lower costs. As a result, there has been a virtual meltdown in realizations. This decline has made it imperative for manufacturers like us – and across the world for that matter - to match Chinese prices.

During the year under review, your Company was not able to utilize the manufacturing capacity at its optimum. During this financial year, the Company completed OTS with all banks and their total dues were paid. A loan with ARC is outstanding and will be paid in installments as per their sanction with no interest payable on the outstanding loan as per the terms of the sanction.”

In Fy 17 , the situation was not as bad and it was able to utilize capacity. And it proudly proclaimed that it did not default on its FCCB bonds, but it neither paid them off.

Fy17

“During the year under review your company was able to utilize the manufacturing capacity at its optimum. During the year your company has settled all NPA bank accounts through OTS. Your company has also been able to improve the efficiency of the output of its finished goods. Addition to the installed capacity to the production facility during the year has added to the earnings of the Company.

Further, the Company had Foreign Currency Convertible Bonds (“FCCBs”) amounting to US$ 16,800,000 and interest accrued thereon is US$ 11,680.000 which matured on November, 2012. The same were neither converted into Equity Shares nor was any payment made for their redemption. However, the Company, in Extra-Ordinary General Meeting of its members held on May 26, 2016, has obtained the sanction of its members to re-structure the FCCBs on revised terms and conditions including reducing the value of FCCBs to US$ 12,000,000 and complete waiver of accrued interest. The re-structured FCCBs are scheduled to be redeemed latest by May 1, 2021 if not redeemed or converted earlier than that date. Consequently, the Company is not in default on account of borrowing through FCCB route.”

We further note that the Capital reserve has made by writeback of loans. So company conveniently claims its debt as its equity. Further we see that in Audit report over the years repeatedly no confirmation is received from parties

We see that the company has been always bullish about the prospects of renewable energy over conventional sources. However in 2016 it admitted that coal is here to stay. This points out that we can never be sure of what company projects about the future of its industry. We also see in 2016 that undisputed dues are not paid by the company.

FY16

“Finally, a large part of the solar system cost is import linked. A scenario where the INR depreciates very significantly would lead to a rise in solar costs for India relative to coal. This would delay the rise of solar. For the same reason, it is important for the government to plan a hedge against this scenario by adequately encouraging localisation and the creation of a domestic ecosystem.”

In 2015 we see that the company had better prospects which led to profits. We see that the prospects of the company are cyclical with some good years and some bad years. We also notice that company is talking about protective duties since much earlier which happened only in 2021. Also we see that at optimum capacity also the company has not been able to generate profit.

Fy15

“During the year under review your company was able to utilize the manufacturing capacity at its optimum. Sales have increased, there by company was able to make cash profit amounting to ` 376.51 lacs. The concerned Government department is in the process of initiating the imposition of anti-dumping duty on imports of solar cells and modules and has at the same time outlined the requirement of domestic content under various solar schemes to revive the industry. These positive steps will help your Company to augment its sales and profitability.”

We also notice the precarious condition of the company when in audit report it was mentioned:

“As regards delay in payment of undisputed statutory dues mentioned in para 11(f)(i) of the Annexure to the Auditors’ Report, it is submitted that it was due to the adverse financial condition as well as non-realization of receivables in time and that the same will be paid in due course of time together with applicable interest, if any. b. As regards the delay in the repayment of the principal sums and interest thereon to the banks / financial institutions mentioned in para (ix) of the Annexure to the Auditors’ Report, it is submitted that it was due to continued losses incurred by the Company, however the co is under the process of OTS with the Consortium banks. c. With reference to point no 11(f)(iii) of the audit report it is hereby clarified that the delay by a month in transferring the amount to IPF was purely unintentional. As the transfer involve other outsiders and intermediaries in the same and so the whole process of transferring the said amount was delayed due to some procedural requirements which took an exceptional amount of additional time in getting due clearance. d. As regard FCCB, mentioned in para 11(e) of the Auditors’ Report, the bond holder is still holding the bonds which were expired and his status is now unsecured creditor. Company is approaching RBI for negotiation for settlement with the Bond Holder.”

This shows that the poor condition of the company in the past where it defaulted on government dues and also on its debt. Also the company was referred to BIFR

We see that even with capacity utilization , the company was in losses. This shows the brutality of the industry.

Fy 14

“During the year under review your company was able to uƟ lize the manufacturing capacity at its optimum but the sales realization continued to remain lower thereby resulting in losses for yet another year.””

We see the volatility in the prices prevalent in the industry in 2013 where the finished goods, raw materials and INR depreciation wiped out the company.

2013

“During the current financial period of nine months (ie. 2012 – 13) as well as the last financial period of fifteen months (ie. 2011-12), we witnessed a significant decline in the global prices of the raw materials and finished goods coupled with the devaluation in the Indian Rupees vs US Dollar which resulted in a sharp decline in profitability leading to erosion of entire net worth of your Company.”

Again there was a crash in RM prices which led to crash in realizations , forex loss and demand reduction. This is again proof of industry economics.

2012

“We witnessed a substantial over 60% fall in raw material prices, which percolated down to reduce finished goods prices. The Company suffered a huge blow owing to losses in outstanding contracts, pre-order contracts and production. Raw material prices collapsed 60% between April-November 2011, moderating end product selling price from 14 per unit (three years ago) to 4 per unit now.”

Foreign exchange: Volatility in foreign exchange affected profitability with the result that we suffered a forex loss of `60 cr in 2011-12

Subdued demand in Europe: We witnessed slackening demand in the EU region on account of its economical troubles. However it is expected that this highly fragmented industry is likely to consolidate on account of increasing collaborations between Indian and European firms where subsidy cuts in key markets like Germany and Italy will result in a global oversupply of solar panels.”

Further the company had to restructure its debts and also defaulted on its dues :

Fy 12

“Debt restructuring: With prices falling drastically and capex invested three years ago, we had to renegotiate debt as interest rates remained high. In March 2012, we underwent bank restructuring in which our working capital loans were converted to term loans with a moratorium of two years and repayment period of seven years. The capex loans were also restructured with a moratorium of two years and repayment period of seven years

The Company has made delayed deposits with appropriate authorities the amount deducted/accrued in the books of accounts in respect of undisputed statutory dues including Provident Fund, Employees State Insurance, Income-tax, Sales-tax, Wealth Tax, Service Tax, Custom Duty, Excise Duty, Cess and any other statutory dues as applicable to it. As per the information and explanations given to us the following undisputed amounts in respect of the abovementioned statutory dues were outstanding as at 30th June, 2012”

We also notice an interesting aspect where all around increase in fees payable in a terrible year 2012

“Amounts paid / payable to Auditors – (a) Audit fees 3,12,500/- (Previous period 1,50,000/-), plus the applicable service tax. (b) In other capacity in respect of certification work 62,500/- (Previous period 37,500/) plus the applicable service tax. (c) For Audit under section 44AB of the Income Tax Act, 1961 93,750/- (Previous period 50,000/-), plus the applicable service tax.”

Management remuneration

Reasonable 80/90 lacs but it was taken during loss times of the company as well. This also shows promoters will use company irrespective of its financial conditions

Ratio Analysis

SSGR

We find that the company has always had a negative SSGR. This is evident when it had to default in its debt, as it was living beyond its means.

The NFAT has always fluctuated between 1 and 0.62. We see that the asset turns are low. So to achieve high ROCE, the company has to have high EBIT from DUpoint analysis. But we find the highest margins achieved in its history from screener is 11 % in 2011 and in 2021 it has 22 % operating margin, but with lower raw material costs. So if RM costs normalizes can we expect higher margins. Thus unless there is massive demand, the company will not achieve higher ROCE.

Related Party

Nothing material w.r.t size of the company

Valuations

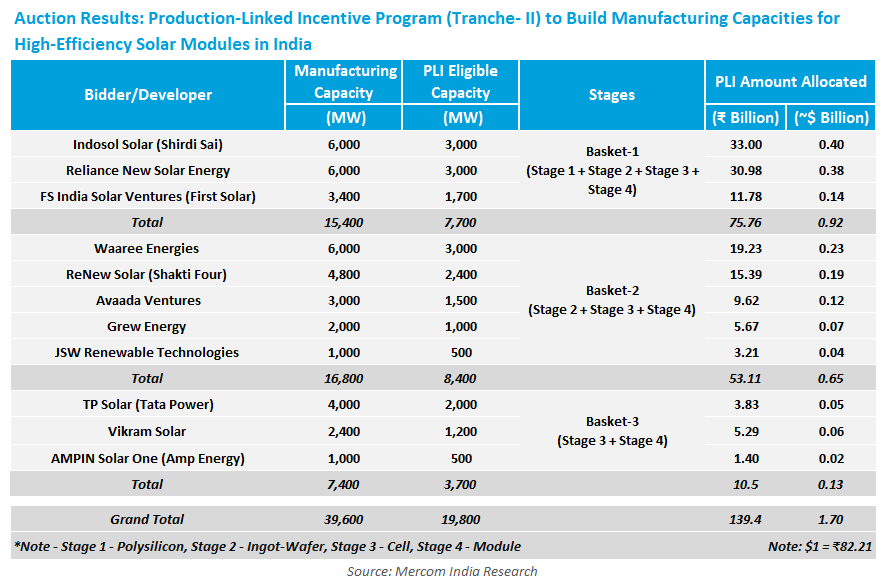

The company trades at a PE of 35, with high margins (due to lower RM costs 56%). If we normalize the PE it will come to 40/45 range. So the company is expensive given its chequered past. But the question we should ask ourselves has the future come for solar industry. The biggies of Indian corporate have entered it and are doing acquisitions. With protective duties in place, can this be a La Opala moment for this Calcutta based company.