Q3 & 9M CY2024 Earnings Conference Call for Varun Beverages Limited discusses the company’s financial performance. The transcript also covers a variety of other subjects, including, the impact of weather events on beverage sales, the company’s competitive landscape in India, and the company’s expansion strategies in both India and Africa.

Financial Performance

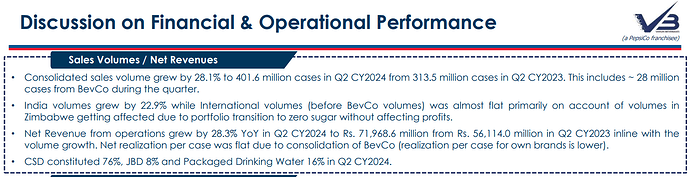

Varun Beverages Limited achieved consolidated revenue growth of 24.1% including the contribution from its recent acquisition of BevCo. The company reported robust growth in both EBITDA and PAT for the quarter. The growth was attributed to the company’s expanded distribution network, increased product penetration, favorable demand trends, and enhanced operating efficiencies.

Weather Events and Beverage Sales

Excessive rainfall in India negatively impacted the beverage industry, especially in rural markets. The company’s management noted that rural areas tend to be affected first by heavy rains. However, the company experienced strong growth in urban markets.

Competition in India

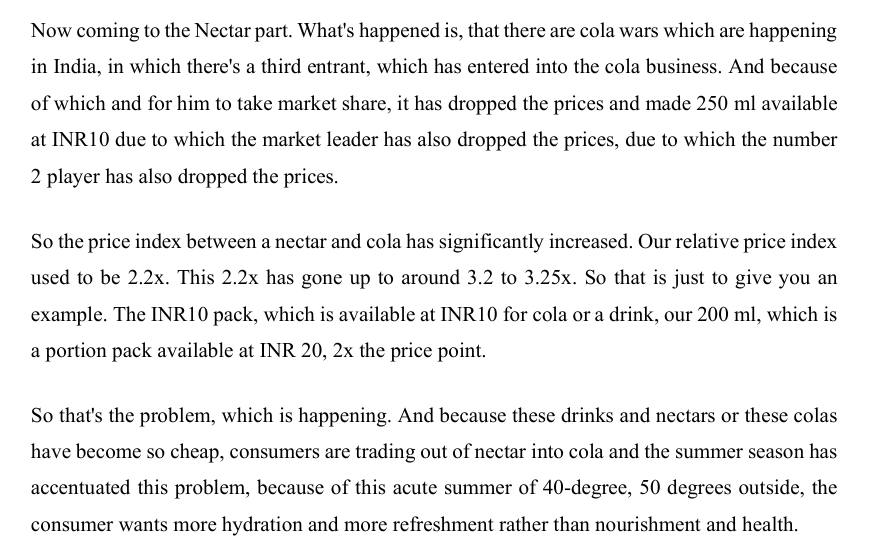

The entry of Campa Cola into the Indian beverage market has intensified competition. Varun Beverages Limited acknowledged Campa Cola as a formidable competitor but stated that they were improving their go-to-market strategies. Management believes that the Indian beverage market is large enough to accommodate multiple players and that there is room for all competitors to grow.

Expansion Strategies

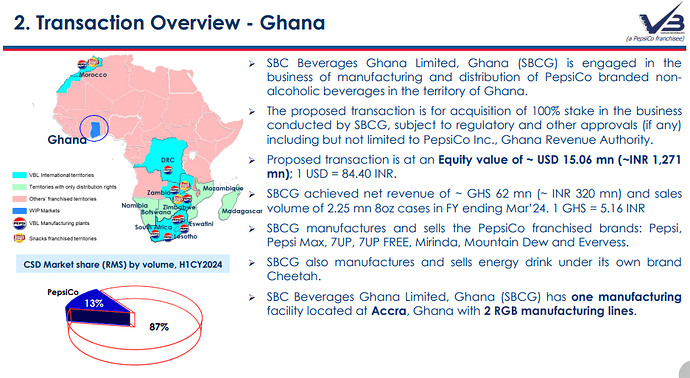

Varun Beverages Limited’s expansion strategy focuses on capturing high-growth opportunities and enhancing both its domestic and global footprint. The company has recently commissioned a Greenfield facility in the Democratic Republic of Congo (DRC) and plans to expand the facility in response to strong demand. The company is also making progress on new facilities across India. The company’s expansion strategy also includes strategic acquisitions, like the BevCo acquisition.

Debt Reduction

The company has a significant debt burden and management indicated that the company will use some of the proceeds from its fundraising initiatives to repay debt and enhance profitability at the PAT level. Management’s target debt-to-equity level is 1.0x.

Here are the key challenges and opportunities facing Varun Beverages in the Indian and international markets:

Challenges

- Competition: The entry of Campa Cola as a formidable competitor in the Indian market poses a challenge to Varun Beverages’ market share. While the company believes there is enough room for everyone to grow in the expanding market, it acknowledges that Campa Cola may capture a portion of the market share, potentially affecting smaller brands or even the stronger players.

- Impact of rainfall: Excessive rainfall in India has negatively impacted Varun Beverages’ volume growth, particularly in rural areas. The company recognizes the impact of heavy rains on the business and highlights the need to consider the second and third quarters together due to the potential for rainfall shifts.

- Global economic factors: External factors such as rising oil prices or potential droughts leading to increased sugar prices pose challenges to maintaining profitability. The company acknowledges these risks, although it is working towards mitigating them through initiatives like a low-sugar product portfolio.

Opportunities

- Untapped market potential in India: The Indian market presents significant growth opportunities with its expanding consumption class and evolving consumer preferences. Varun Beverages sees immense potential in increasing its reach to a larger portion of the 12 million FMCG outlets in India, considering it currently serves around 4 million.

- Expansion in international markets: The company’s global operations, particularly in Africa, are poised for further growth. Varun Beverages is capitalizing on emerging demand trends and enhancing operational capabilities in these markets. The successful commissioning of the Greenfield facility in the Democratic Republic of Congo (DRC), with plans for expansion and backward integration, highlights this growth strategy.

- Growth in South Africa: Despite the initial challenges in integrating BevCo and establishing an efficient backend in South Africa, Varun Beverages expects reasonable growth in this market moving forward. The company’s efforts to improve its go-to-market strategy and correct backend inefficiencies position it for noticeable growth in the coming quarters.

- Strategic acquisitions and expansion into snacks: Varun Beverages is actively seeking strategic acquisitions and exploring opportunities in the snack food business, especially in Africa. The company’s proposed fundraising of Rs 7,500 crore through a QIP will support these growth initiatives, including expanding into new territories, potential acquisitions, and strengthening its balance sheet.

- Innovation and product portfolio expansion: Varun Beverages is actively exploring opportunities to expand its product portfolio, including developing a Jeera Masala Soda in collaboration with PepsiCo. The company sees potential in the expanding Jeera market and plans to launch a product in this category by early next year.

Other Key Points

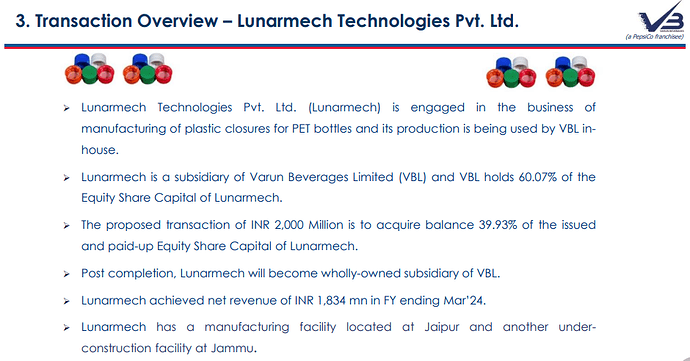

- The company is focused on enhancing operational efficiencies to drive profitability. Initiatives include backward integration in larger plants, leading to freight savings on preforms, caps, and boxes.

- Varun Beverages is committed to long-term growth and aims to sustain its momentum in both domestic and international markets. The company’s proven execution capabilities and focus on strategic investments support this objective.

- The company’s focus on debt reduction will enable it to maintain a healthy debt-to-equity ratio, leaving room for potential strategic acquisitions and growth initiatives.

Business Model Differentiation and Growth at Varun Beverages

Varun Beverages’ business model differs from other beverage companies in India in a few key ways that have driven its success:

-

Focus on Backward Integration: Varun Beverages has made significant investments in backward integration, particularly in its larger plants. This includes manufacturing preforms, caps, and boxes in-house, leading to freight savings and lower production costs. This commitment to vertical integration sets them apart from competitors who may not have invested as heavily in this area.

-

Aggressive Expansion of Go-to-Market Reach: Varun Beverages has consistently expanded its distribution network by adding 300,000 to 400,000 outlets every year. This relentless focus on reaching more consumers, even in areas with existing penetration, differentiates them from competitors who may have a more limited distribution footprint.

-

Strategic Focus on Under-Penetrated Territories: While expanding nationwide, Varun Beverages has prioritized growth in regions with historically low penetration, such as South and East India, and Gujarat. This strategic approach allows them to capitalize on untapped markets and achieve faster growth than competitors who may be focused on already saturated areas.

-

Investment in Production Efficiency: The company has invested in larger, more efficient plants that can produce significantly higher volumes with the same workforce. This focus on production efficiency helps them keep costs low and improve margins, giving them a competitive advantage over companies with older, less efficient facilities.

These strategic differentiators have contributed to Varun Beverages’ impressive growth:

-

Volume Growth Despite Challenges: Even with heavy rains impacting the rural market, the company achieved 6% volume growth in the Indian market, outperforming many competitors who experienced de-growth.

-

Market Share Gains: Since acquiring the South and West regions, Varun Beverages has gained significant market share in the carbonated beverage space.

-

Expansion into New Territories and Categories: The company has successfully expanded into new international markets, particularly in Africa, and is poised to enter the snacks business, leveraging PepsiCo’s portfolio. This diversification will create new growth avenues and reduce reliance on any single market.

Overall, Varun Beverages’ unique business model, characterized by vertical integration, aggressive distribution expansion, a focus on underpenetrated markets, and production efficiency, has enabled them to outperform competitors and achieve sustained growth in both domestic and international markets.

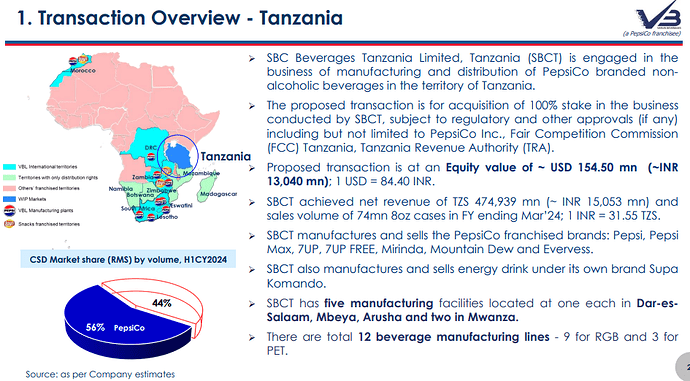

Strategic Implications of Varun Beverages’ Expansion into Africa

- Long-Term Growth: Varun Beverages views Africa as the “next horizon for growth” with a bullish outlook for the next 20 years. The company is strategically expanding into various African countries, with each country expected to contribute a small percentage to the overall turnover, minimizing risk in case of challenges in any specific country.

- Capitalizing on Emerging Markets: Africa presents “immense opportunities” due to its growing consumption class and evolving consumer preferences. Varun Beverages aims to leverage these opportunities by expanding its presence and operational capabilities.

- Portfolio Diversification: Expansion into Africa allows Varun Beverages to diversify its portfolio and reduce reliance on the Indian market. This geographical diversification mitigates risks associated with economic fluctuations or regulatory changes in any single market.

- Strategic Acquisitions: The company is actively seeking strategic acquisitions in Africa to further accelerate its growth. This approach enables them to acquire established businesses with existing market share and distribution networks, facilitating a faster entry and expansion.

- Snack Business Expansion: Recognizing the high potential of the snack food market in Africa, Varun Beverages plans to establish snack food manufacturing facilities in Zimbabwe, Zambia, and Morocco in the coming year. This expansion leverages their existing distribution network and expertise in the African market, creating synergies and additional revenue streams. The company believes that snacks business offers higher return on capital employed (ROCE) compared to beverages, despite potentially lower margins.

Impact on Future Performance:

- Increased Revenue and Profitability: Expansion into high-growth African markets is expected to drive significant revenue and profitability growth for Varun Beverages.

- Enhanced Market Share: Successful execution of their expansion strategy, including strategic acquisitions, is likely to result in increased market share in both beverages and snacks across Africa.

- Improved Operational Efficiency: The company’s focus on backward integration, large-scale production facilities, and efficient distribution networks is expected to enhance operational efficiency, leading to improved margins.

- Stronger Financial Position: The proposed equity share issuance of up to Rs. 7,500 crore will provide a “war chest” for debt reduction, acquisitions, and further expansion. This will strengthen their balance sheet and enable them to pursue growth opportunities aggressively.

Overall:

Varun Beverages’ strategic expansion into Africa is a long-term growth initiative with the potential to significantly impact its future performance. By capitalizing on emerging market opportunities, diversifying its portfolio, and pursuing strategic acquisitions, the company is well-positioned to achieve sustained growth and enhance shareholder value.

Extracted through Notebook LLM using VBL concall transcript