Vaibhav Global - A Small Fish in a Ocean

Apr 17

Estimated time to read - 15 minutes

Brief –

The company is business of jewelry & lifestyle retailing directly to customers in US, UK & Germany. The company caters to 2% of addressable market size. Vaibhav Global is somewhat like Naaptol.com (just for ease of understanding) where different products are displayed through TV & web. But subtle difference exists between Naaptol.com & Vaibhav Global.

Company –

The company was incorporated in 1989 primarily sold jewelry to other business (B2B) segment. By 2004, it gained acceptance from WalMart, Sterling, Macys, Zales, Friedmam, White Hall and Sears & focused majorly on B2B segment.

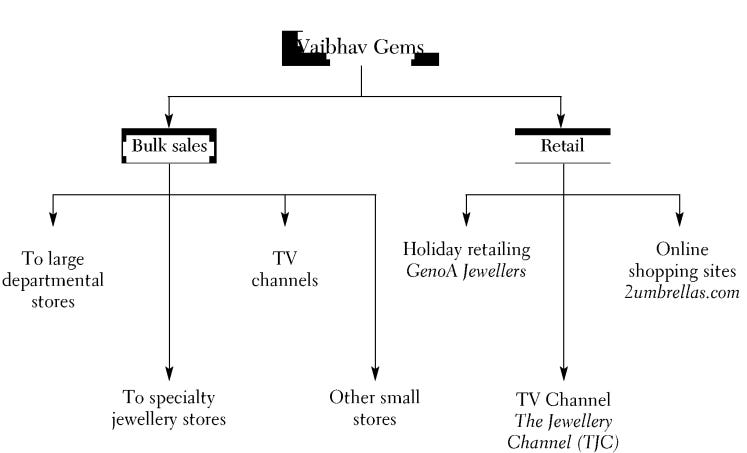

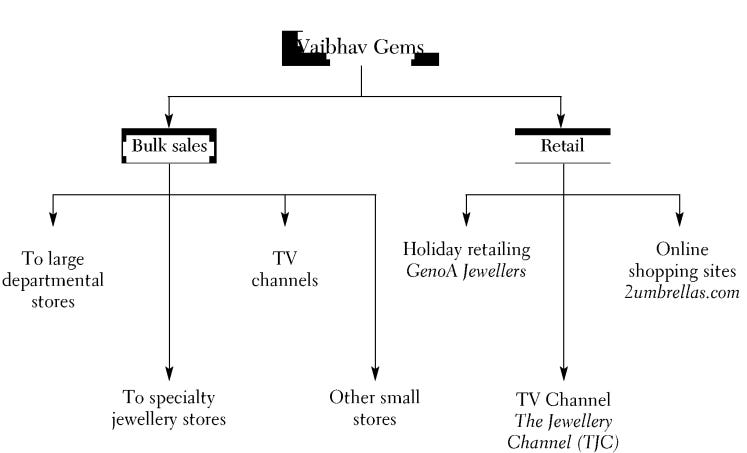

By 2006, the sales mix looked like this -

Source - annual report

B2B Segment -

-

Large departmental store = sales to Walmart

-

Speciality Jewellery store = sales of jewellery to standalone jewellery stores

-

TV channels = sales to TV channels like QVC, HSN, etc.

B2C segment –

-

Holiday retailing – sales to customers onboard on a ship where company rented premises on cruise

-

TV channel = company launched own TV channel named The Jewellery Channel for US & UK markets

-

Online shopping site = launched own website for jewellery sales

In 2006, company also acquired STS group which had front end presence in US, UK, Canada, Japan & Hong Kong. The company sourced products from China, Thailand, India, Russia & Bangkok. Company’s sales were majorly B2B & premium pricing. The company’s strategy, revenue & profits were moving in the positive direction until . . . . .

2008 crisis occurred –

The Global financial crisis had a deep impact on US & UK economy from where the company generated majority of its revenue. As the company sold premium jewelry priced in the premium range its sales were affected. In order to survive the downturn, company aggressively reduced prices of its jewelry. Also, the company shut down physical operations in Germany, Canada & Japan.

New beginnings –

While liquidating inventory the company found out that low priced jewelry ($40/ piece) had higher acceptance in the market compared to premium segment ($130/ piece) & there was none following the discount jewelry at that point in time. So company ventured into direct retailing to customer through TV aggressively with low priced jewelry through own channel named The Jewellery Channel (TJC) in UK & Liquidation Channel (LC) in US in 2011.

To sum up –

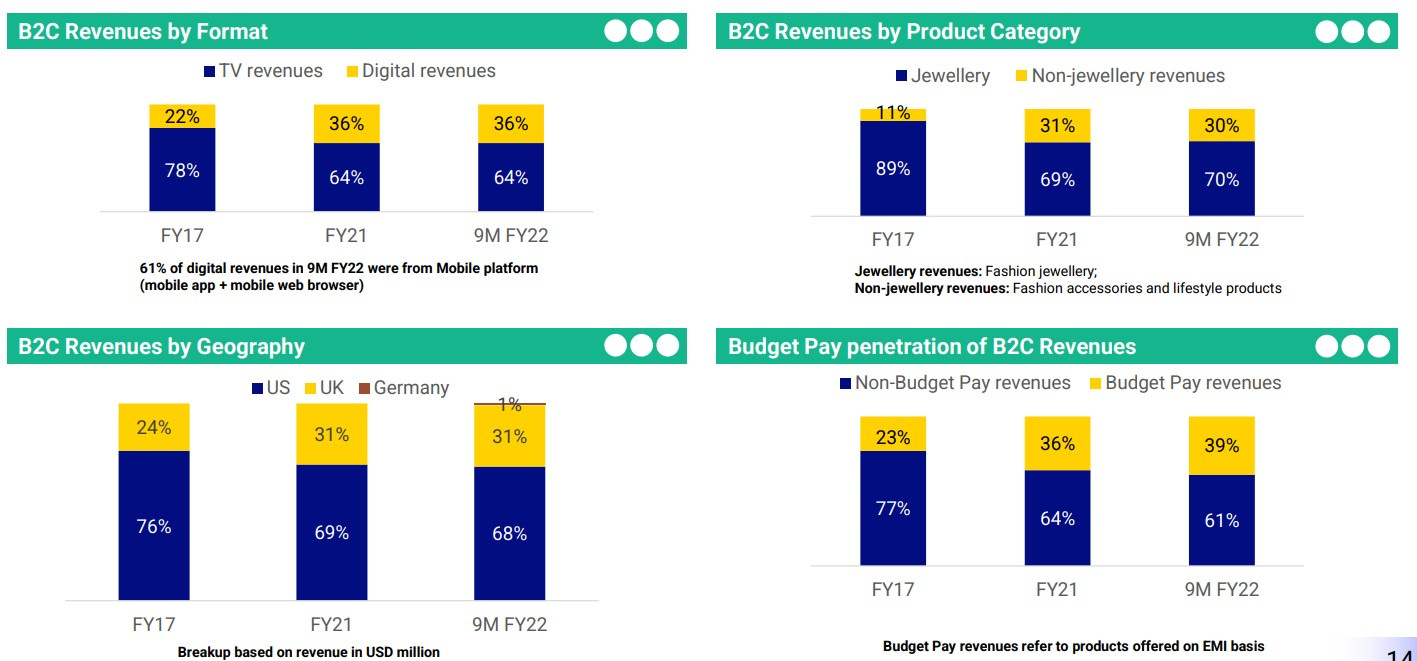

Company initially started as B2B, ventured into physical retailing but due to Global financial crisis the company faced survival crisis**. The company entered Corporate Debt Restructuring (CDR) whereby the company requested lenders to delay debt repayments for a period of 3 years & at the same time the promoter infused 94 crore in the company in 2008 in order to survive the downturn.** The company revamped business model by selling lower priced jewelry & started marketing directly to customers through TV in US & UK where majority (60%) of costs are fixed, 30% variable & 10% semi variable.

Company flourishes –

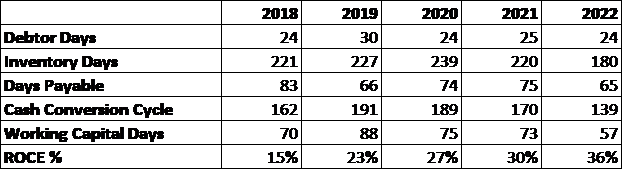

From 2012, the company hired professional team for TV & web sale of B2C platform as the company already had own manufacturing facility along with sourcing facility from various countries. The jewelry business is more Operational expenditure (Opex) led rather than being Capital expenditure (Capex) led as it requires more working capital.

In 2012, of 645 crore of revenue 85% of revenue was derived from B2C segment reflecting the acceptance of company’s products. The company’s working capital was being blocked in inventory rather than debtors.

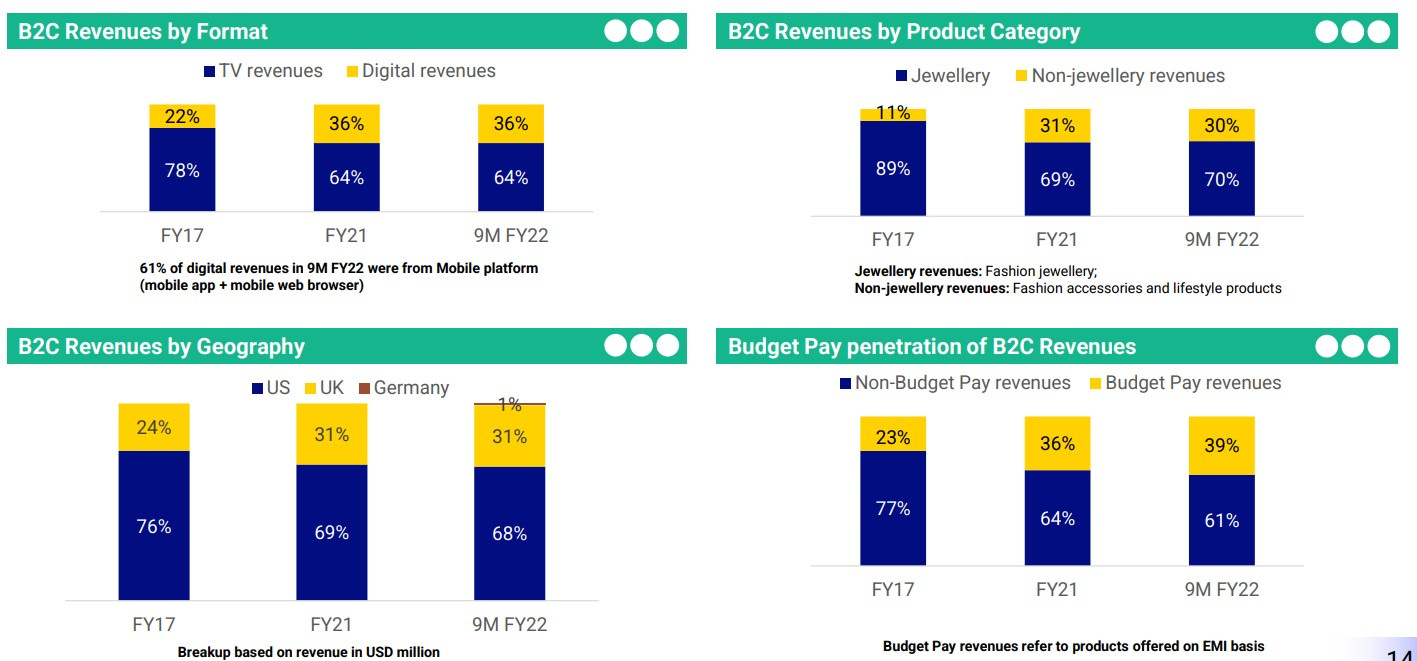

Revamped current business model –

1. TV sales -

The company retails its various products through TV & simultaneous live stream on web . On the show various hosts promote the product & customers can book their orders by calling on IVR (automatic order booking through call). The company retails fashion jewelry rather than jewelry which majority is made up of gold which is sold in India majorly.

Company’s product made from gemstone, silver & gold

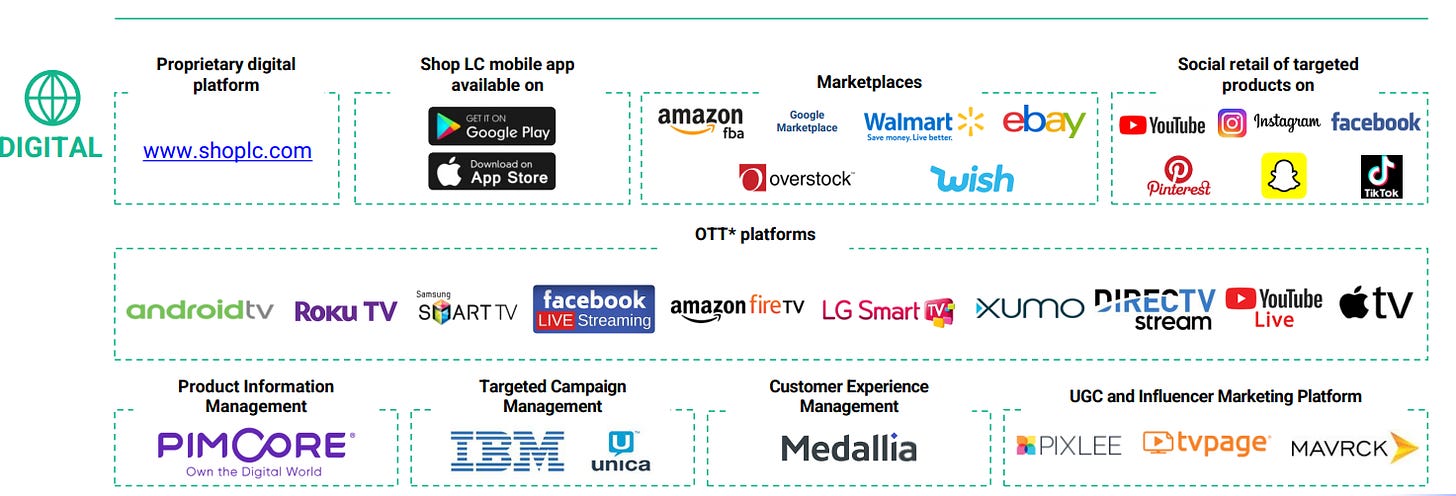

2. Web sales -

a. Rising auction - To clear old inventory the company launched reverse auction mechanism whereby the company would price a product at $1 & customers can bid against each other & raise the prices until a winner bids out other.

b. Catalog – where people can search items available on website & buy what they like

c. Streaming of live tv on web – the program being aired on TV is streamed simultaneously on company’s website for customers.

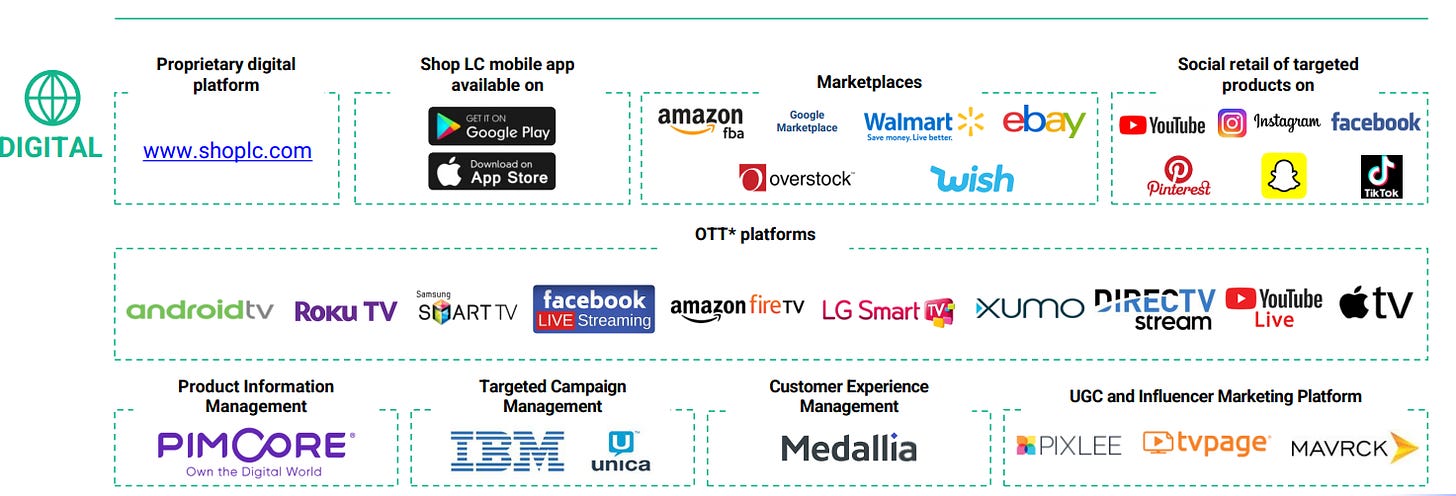

d. Marketplace & influencer sale - the company sells through Walmart.com, Amazon & Ebay in various geographies like Canada, Australia, etc. Also, it has tied up with various influencers on social media to promote live stream buying.

3. B2B sales –

sales to other TV channels, jewelry shops or stores (like Walmart). But the company is focusing on reducing B2B sales & increasing B2C sales.

New initiatives post 2014 –

1. Launch of Budget Pay in 2016 – The facility of budget pay allows customers to pay for their products priced above $20 to be paid in installments. With the first installment paid right away & rest deducted from credit card. The credit risk is with the company & company shows the budget pay/ EMI sales in debtors. Company management states that cost of EMI sales outsourced to 3rd party is higher than company manages to. The current default rate is sub 2%.

2. Increased contribution of lifestyle division – The lifestyle division consists sales from handbags, apparels, etc.

3. Ventured into manufacturing of textile – The company has started manufacturing of lifestyle products at own facility along with purchasing products from 3rd party vendors. The company hasn’t disclosed much about what it is manufacturing till yet.

4. Moved to SAP Hybris in 2015 & further to salesforce platform in 2021 – The company has consistently transformed its platform in order to improve customer web experience & own warehouse management. It first transitioned to SAP Hybris (a product by SAP for e-commerce retailers). Then it moved to Salesforce which allows a better integration compared to SAP Hybris.

5. Launched TV & web operations in Germany in April 2022 – The company has once again entered Germany market post failure in 2008. The company expects to burn $5-10 million annually in Germany market for next 3 years & from there on it predicts path to profitability.

6. Rebranded US channel to Shop LC & UK channel to TJC in 2017

7. Launched TJC (UK) membership where customer can get orders shipped free.

8. Professional management team for managing day to day operations.

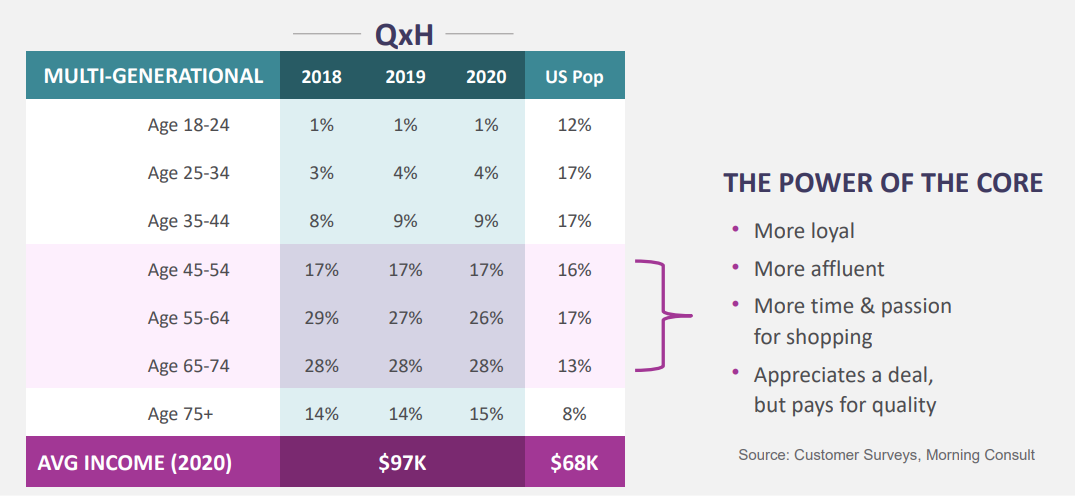

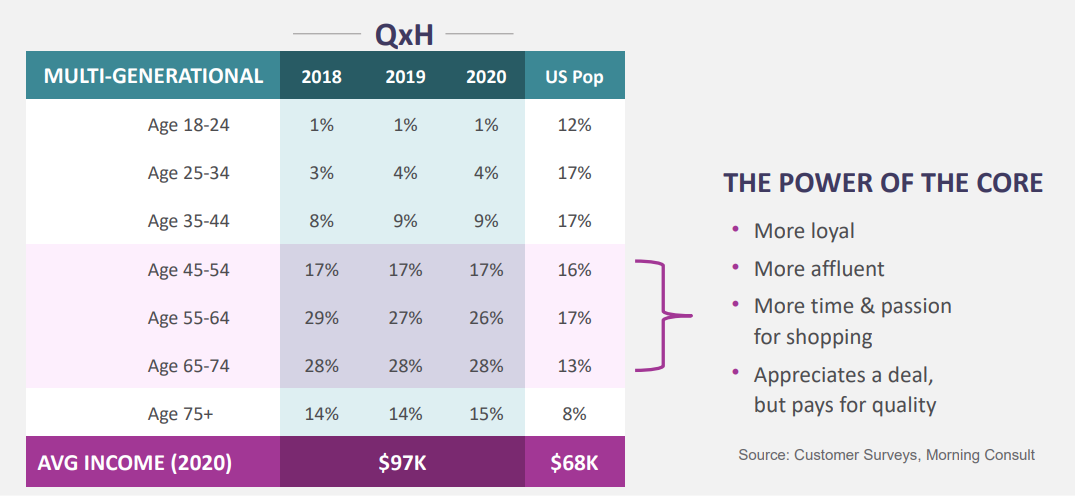

9. Company focused on creating, sourcing & selling products to women above 40 years of age.

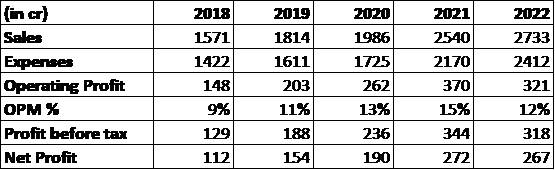

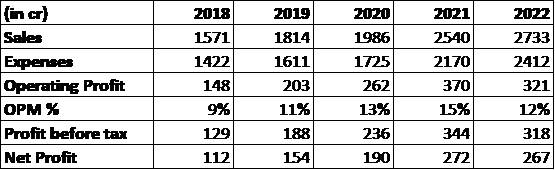

Financials –

Source - screener

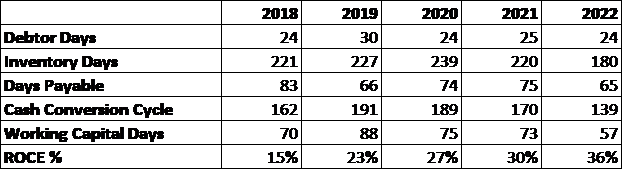

Key ratio –

Source - screener

Competitors –

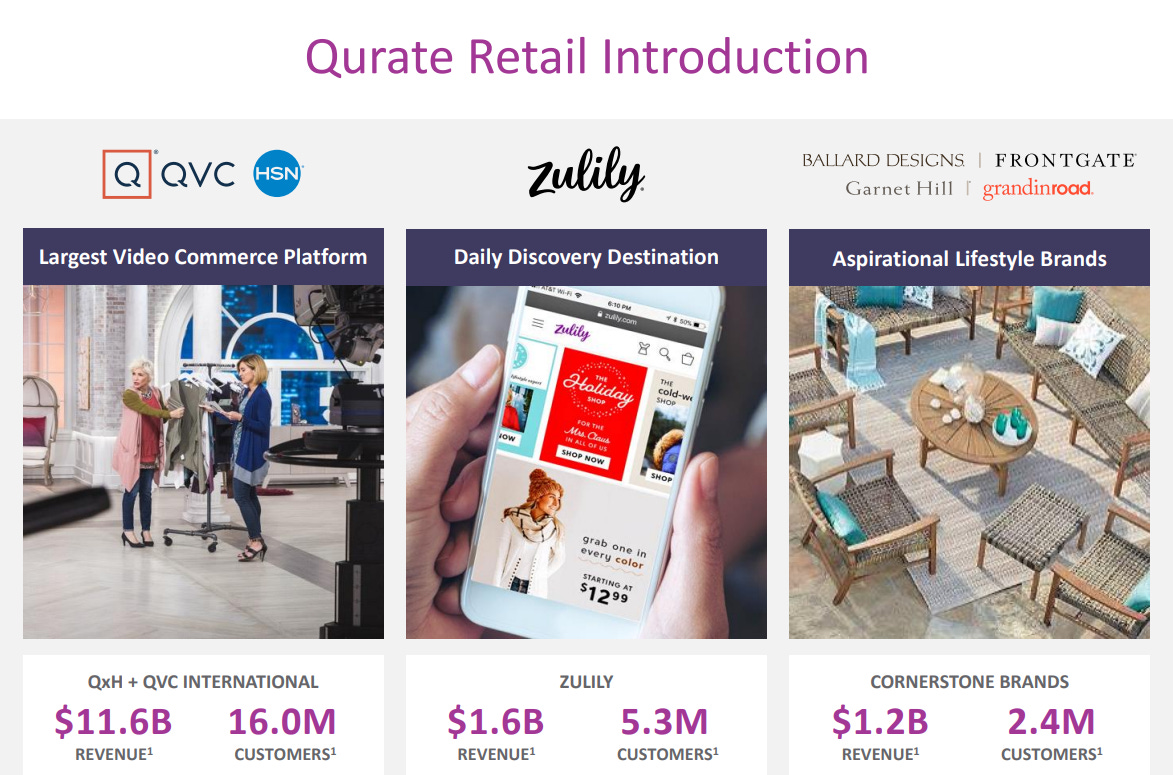

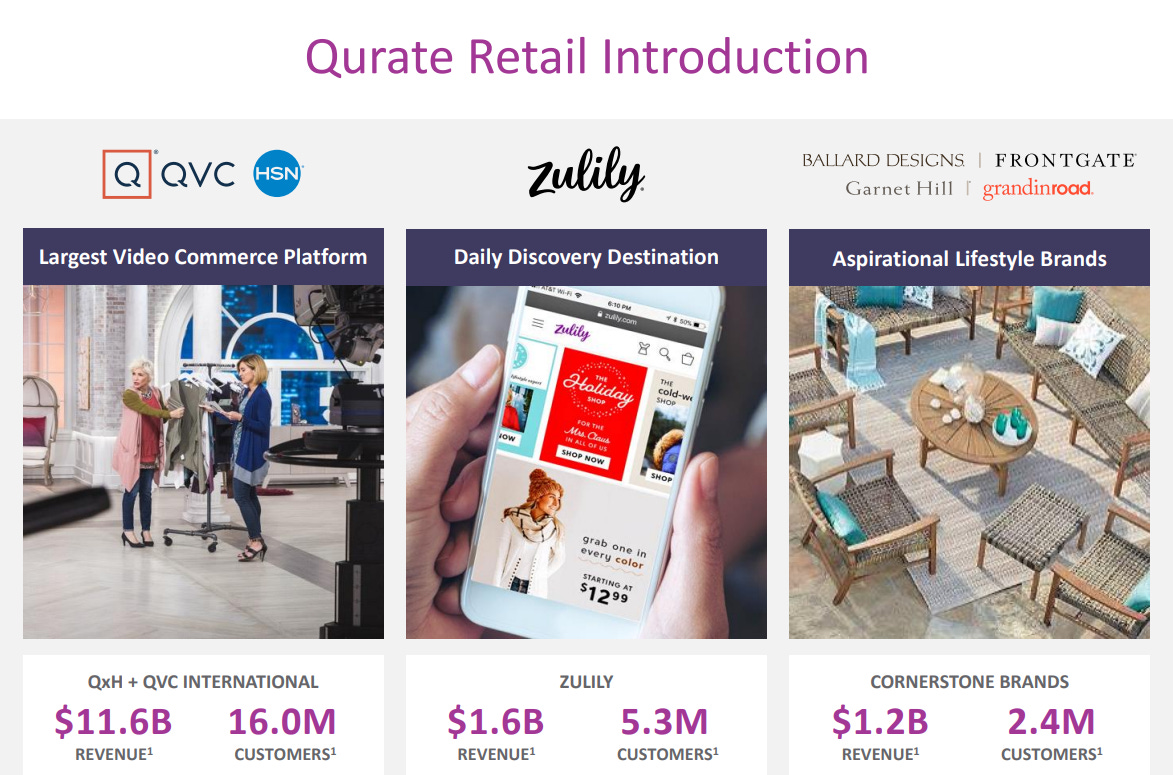

1. Qurate Retail Limited (QVC) – leader in TV shopping in USA. It sells everything & hasn’t restricted itself to particular category. Majority of items are sourced from 3rd party vendors. It also has higher average selling price compared to Vaibhav Global. The company also acquired competitor HSN (Home shopping network) which was number 2 in the market which further cemented QVC leadership.

Source - investor presentation of QVC

2. The Jewellery TV (JTV) – Due to company being privately held not much information is available in the public domain. But according to Vaibhav global management, JTV is also present in discount jewelry segment where it gives tough fight to company.

Management -

- Mr. Sunil Agarwal - Managing Director - Mr. Sunil Agrawal is a commerce graduate with an MBA from Columbia University, New York (USA). A first-generation entrepreneur, he established Vaibhav Enterprises in 1980, intending to professionalize the Gems and Jewellery Trade. He has traveled widely and garnered immense knowledge of gemstones and jewellery. He has brought this expertise to bear on the success of the Company. He has represented the Company at most significant international trade shows and jewellery fairs and is also credited with pioneering the commercialization of popular gemstones like Tanzanite.

Conclusion –

The company started as a B2B platform moved to B2C over next 20 years. It has also continuously transformed itself to meet the changing needs of customers in house jewelry rather than sourcing from 3rd party manufacturers in jewelry like QVC. Management sells 3rd party products when 60% gross margin exists for company & majority of time it takes inventory risk which allows lower pricing compared to competitors which keep sales return clause.

The dominant contributor of revenue is still jewelry which is expected to reduce with time as lifestyle products are brought in. Company’s management constantly tries products on trial & error basis. The management seems to be clean & has been able to grow in a competitive market with cut throat competition. Also, the German market entry is expected to boost topline & bottom line & even if it doesn’t work majority of costs are already being expensed off.

Disclosure - invested.