Urban enviro waste management

Market capitalisation: ~168Cr

Pe ratio: 24

ROCE:38.5 %

ROE:126 %

Debt to equity: 1

CMP: 389

Promoter holding: 51.19%

Introduction:

company was originally incorporated as Nagpur Waste Handling Private Limited in the year 2011. Subsequently, name of the Company was changed from Nagpur Waste Handling Private Limited to Urban Enviro Waste Management Private Limited in the year 2022.

During the Financial year 2023-24, URBAN got listed on 22nd June,2023 on National Stock Exchange (SME platform). (IPO issue price was 100)

Urban enviro waste management Ltd is a municipal solid waste management company (MSW). It offers services like door to door collection, road sweeping/cleaning, segregation, transportation of waste, processing and bio mining Of legacy waste. It offers these services across Cities in Gujarat, Rajasthan, Madhya Pradesh, and Maharashtra, primarily catering to local municipalities. The company also carries on the activity of providing human resources like staff, workers, and skilled/semi-skilled laborers required by various industries and organizations.

Sector overview:

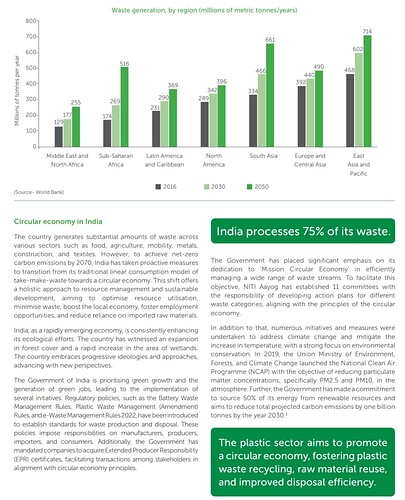

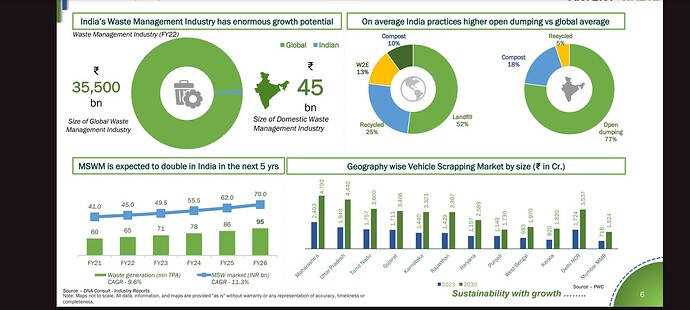

The waste management sector in India is critical due to the country’s rapid urbanization and population growth. Effective waste management is essential for environmental sustainability, public health, and resource conservation.

India generates approximately 65 million tonnes of municipal solid waste annually.

Per capita waste generation is around 0.5 kg per day in urban areas.

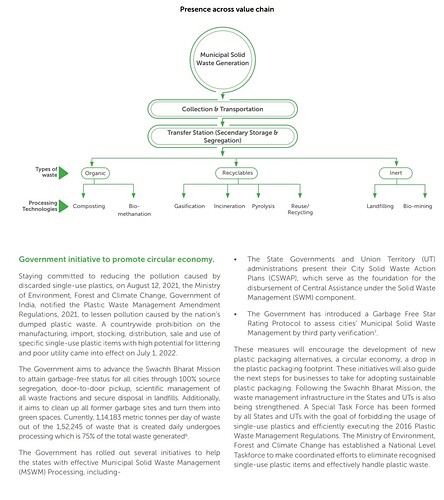

Government initiatives like The Swachh Bharat Mission (Clean India Mission) aims to improve waste management infrastructure and practices across the country.

Policies such as Extended Producer Responsibility (EPR) for e-waste and plastic waste management are driving change.

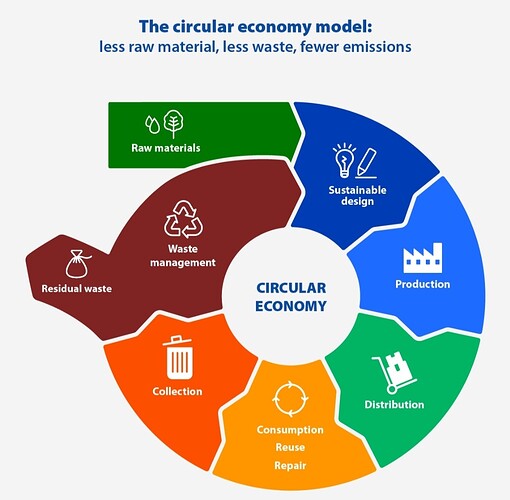

The world is shifting towards a circular economy

Taken from Antony waste (AWHCL) annual report 2022-23:

Taken from Antony waste investor presentation:

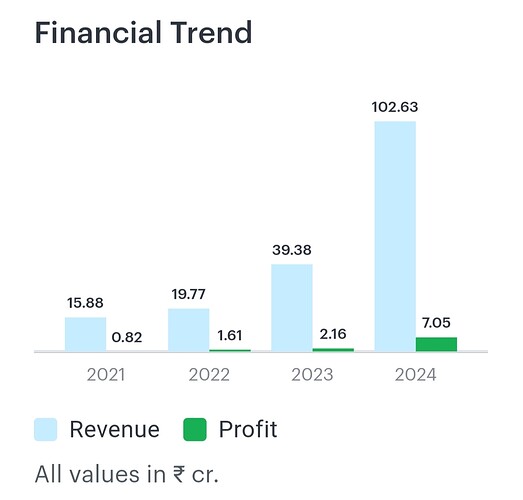

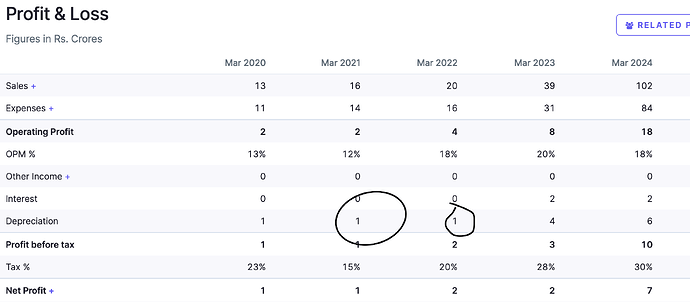

Financial performance:

The company has been increasing its topline and bottom line at a rapid pace

The company also has positive cash flows

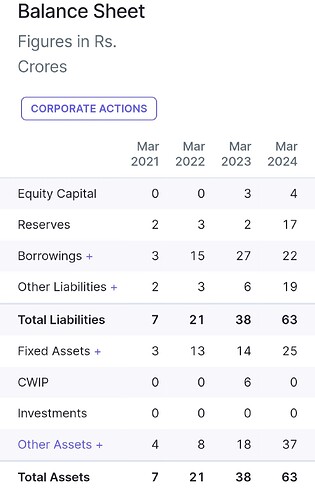

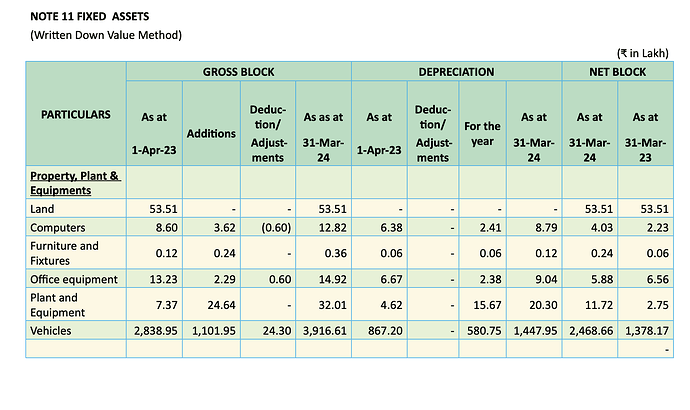

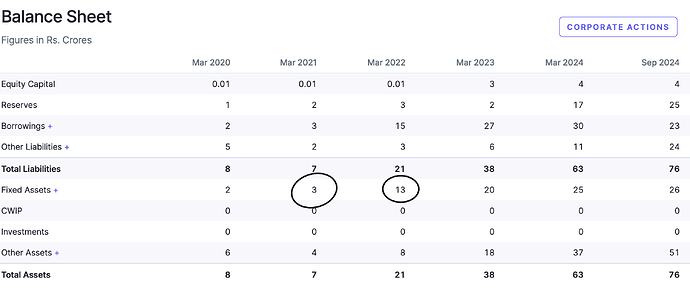

The company has a debt to equity ratio of 1 which some investors may find on the higher side but some beleive its manageable. The company has almost doubled its net block from 14cr in 2023 to 25cr in 2024.

Peers:

All of these companies may not be an apple to apple comparison

Antony waste management

Gem enviro management

Resgen

Organic Recycling Systems

Eco Recycling

Race Eco Chain

Valuation:

~1.65 times market capitalisation to sales ratio.

Company is trading at 24pe, which is not very expensive but doesn’t offer much margin of safety.

Investment thesis/key triggers /positives:

-

High growth company

From FY2020- FY2024:

50+%CAGR growth in sales

45+%CAGR growth in net profit -

Waste management sector has a lot of potential and tailwinds in the current socio-economic scenario.

-

The company has increased its workforce in the last 1-2 years.

-

Even after such high growth rates, being in a B2G business it has positive operating cash flows.

-

It has received ~100cr+ worth of orders.

-

Tough to find a company growing at such high growth rates at a pe ratio of 24.

-

Government initiatives like The Swachh Bharat Mission (Clean India Mission)

Policies such as Extended Producer Responsibility (EPR) may be a huge growth driver for the waste management industry as a whole.

Risks

-

Information/data scarcity:

There is very less information on the company and its management, there are no concalls, investor presentations. -

Investing in SME company is riskier and may lead to 100% loss of capital.

-

One of the main reasons for its high growth rates are its small size, once the company matures, these growth rates won’t be sustainable in the long term.

-

Read some articles on how some waste management companies are trying to

mix soil with collected waste to get more billed amount from Govt. -

B2G risk and high receivables risk.

Disclosure: not registered, not a buy/sell recommendation,

Invested.