Universal Autofoundry Limited (http://www.ufindia.com/)

Company Overview

Incorporated in 1971, the Company is engaged in the manufacturing of Iron Castings. They manufacture castings components in Grey Iron and S.G. (Ductile) Iron, primarily for automotive sector. Castings are supplied in Machined, Semi Machined and as cast condition with surface treatment as per customer’s need. Suspension Brackets, Differential housing, Hubs, Brake drum, Flywheels, Adjuster Nuts, Pulleys, Dampers, etc. are some of the items that find application in the commercial vehicle and engineering industry.

They have more than 65,000 sq. ft. size area manufacturing plant located at VKI Area, Jaipur, Rajasthan, which has an existing installed capacity of 7,800 MT p.a. for the manufacture of grey iron and ductile iron castings. In addition to that, they have another capacity of 11,400 MT p.a. with their group foundries. They cater to the requirements of many of the major automotive and engineering goods manufacturers in India and all over the world.

Product Categories

Commercial Vehicles: Suspension and Engine Mounting Brackets, Engine Bearing Caps Block, Differential Iron, Flywheels, Wheel Hubs and Pulleys.

Tractors: Lift Arms, Differential Cases, Cylinders, Adaptor Plates, Brake and Control Housing and Rocker and other Brackets.

Passenger Cars: Pulleys.

Earth Movers: Brake Drum Casting.

Construction: Anchor Body.

Clients

Ashok Leyland, V E Commercial Vehicles, Escorts, TAFE, JCB India, AIlena Auto Industries, Rane Automative etc.,

Business Analysis - SWOT

Strengths

-

I think the key strength for the business that it is at a safe distance from the much-touted EV disruption. Most of their Revenues come from parts for heavy vehicles. Considering the fact that it will be several years before the world, let alone India, gets ready for electrifying heavy commercial vehicles, I would say UAF is well shielded.

-

The company has several Quality Certification on its side, including the IATF 16949 for a Quality Management System, ISO 14001:2004 for Environmental Management Systems and BS OHSAS 18001:2007 for Health and Safety Management Systems. All of these seem like standard certifications to have, with the exception of the IATF 16949, which looks like a little more difficult to obtain.

-

Since foundries require heavy Capex and good power facilities, there should be a good barrier to entry.

-

According to the management, they have a market share of approximately ~5% in an otherwise largely unorganized market. While this doesn’t make them anywhere closer to even the top 15 producers, they seem to be placed well among the medium-to-smaller players.

-

Besides these, the company has listed down some of their ‘Business Strengths’, in case you want to take a look. I think they are just generic statements.

Weaknesses

-

The market size is approximately Rs. 1,900 Crores. However, the industry is really saturated with about 5000 units all over India and majority (90% according to the management) being MSMEs. Even if you ignore the ones without proper Quality Accreditation, the tally still stands at a tall 1500 units.

-

According to the management’s own admission, young Engineers generally do not look forward to working in foundries, since it doesn’t pave way for a lucrative career.

-

Power Costs in India for Foundries seem to be doube/triple of the power costs in China or Germany, the major competitors. Power is about ~20% of the industry’s input costs.

-

The industry is quasi-commoditized, dependent on the bigger CV/PV/Tractors segment to aid growth and is susceptible to raw material price movements and demand-supply mismatch. In fact, the industry was in a down cycle for the past few years (Source 1, Source 2).

Opportunities

-

There are several articles online (Example 1, Example 2) claiming that the Foundry industry in India is likely to grow in double digits in the coming years. The management also seems to think so.

-

Power is about ~20% of the industry’s input costs. With the government making moves towards a better power infrastructure for the country, this would be a substantial help to Foundry players.

-

The new Manufacturing policy of India envisages to increase the share of Manufacturing GDP substantially (15% to 25%), but this isn’t specific to the Foundry industry of course.

Threats

-

By far the biggest threat seems to be China, who is the world leader in Foundries. India ranks second, but China seems to have the upper hand (Source 1, Source 2).

-

Labor unrest seems to be a perennial problem in the industry. The management themselves have admitted that they have very little pricing power. Both of these seem to put a pressure of the company’s Margins.

-

It looks like there’s very little technology upgradation in the Indian Foundry industry (Again, due to a lack of attractive employment opportunities). This could eventually become a massive roadblock, as other developed countries march ahead.

Financials (Source)

On the Financials front, the company seems to be doing extremely well. Revenue Growth averages at ~18% for the last 5 years, Profit Growth at ~35% and the Return Ratios at ~25%-28% or so. The Cash Flows also seem quite consistent.

The negatives seem to be the high Debt (1+ D/E Ratio) and high Working Capital Requirements (~20% of Sales).

Profit & Loss Statement

Balance Sheet

Cash Flow Statement

Concerns / Red Flags

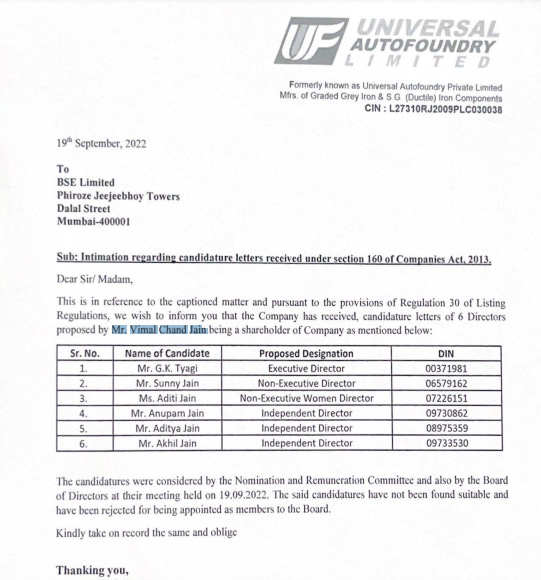

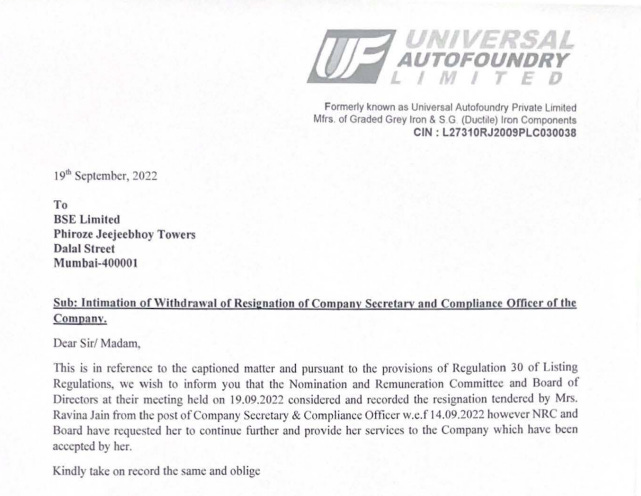

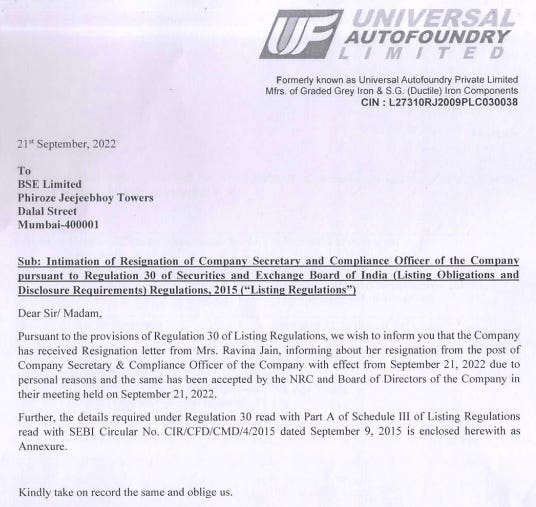

Lack of Board Independence: The people in charge of the company seem to be related to each other in one way or the other. Even some of the top shareholders seem to be that way.

Related Private Businesses: The company has listed down the names of several other private businesses in UAF’s ‘Contact Us’ page. A quick look at Tolfer tells us that these are indeed companies doing similar businesses and managed by more or less the same set of people. A MoneyControl article written during the IPO of the company confirms the same.

Related Party Transactions: As expected, the company has Related Party Transactions with the related private businesses. It looks like the related businesses do the machining work for UAF. The Trade Receivables from them forms a ~22% part of the overall Trade Receivables total.

Unlikely Association: Out of the above related companies, one “company” is named ‘Indian Metalfoundries Institute Private Limited’. They have listed themselves to be in the ‘education’ business. However, UAF recently made a Rs. 0.5 Crores investment in the institute. Investing in a company which is already managed by the same group of people seems a little out of place, notwithstanding the question of why they would invest in an educational institute in the first place. There are no comments about how they plan to utilize this new association. What’s interesting is that the company has also made a loan amounting to Rs. 0.5 Crores to the institute last year, of which Rs. 0.3 Crores is receivable in 2018. Being a Debtor and a Shareholder of the same company sounds possibly oxymoronic to me.

Promoters-Lenders: Almost ~50% of the company’s entire Debt seems to have come from the promoters and more surprisingly, their relatives too.

Bad Credit History: The company wasn’t always in such a good financial position. In 2010, ICRA Rated a bulk of the compnay’s Debt as LB+, which is a pretty low on the ‘Non-investment Grade’ Ratings (Source). In fact, at that point, they had a D/E of ~18 (Yes, you read that right).

Low Interest: What’s really bugging me is that regardless of such a poor credit position in the past, the company has historically paid an interest of ~10-11% on their outstanding Debt. The loans seems to have jumped around, from SBBJ to IndusInd to others.

Salary Structure: This is just nitpicking, but the CFO earns ~2.3x the Salary of the Directors/MDs, which I found a little weird.

Dislcaimer

I do not own any shares in the company. The company popped up on my Screener and I eventually looked into it. I wanted to begin a thread on it in order to get better clarity on the concerns I have listed down.

Important References

IPO Prospectus

Intimations to BSE

Annual Reports

The Institute of Indian Foundrymen

Status of Indian Foundry Industry (2012 Presentation)

Foundry Industry 2020: Trends and Challenges