Wanted to speak to the management of Ultramarine. They don’t have an investor relations department so I called their CS. First, he said they don’t take investor queries. Later, he wanted to know if I’m a shareholder. With such limited information on the company and with such little communication with investors, I’m not sure if they have the best interest of minority shareholders in mind.

Annual Report FY2023 Business Update

- Revenue 541 Cr, +10%

- Improved realisation in Pigments and Sulphonation.

- Could have been better. Logistical constraints & supply chain issues affected.

- Export 151 Cr vs 117cr, +29%.

Pigment Division:

- Revenue 159cr, +21% & Volumes -5%.

- Better mix (performance pigments), better realisation.

- Decline in domestic demand in the 3rd quarter.

- Steep increases in input costs, i.e fuel, freight and key raw materials, caused margin pressure

- Exports 102 Cr vs 82 Cr, +26%

- Fresh Capacity under Subsidiary (Ultramarine Specialty Chemicals Limited).

Surfactants Division:

- Revenue 333cr vs 326 Cr

- Exports 16 Cr, +52%

- Ranipet plant full capacity utilisation but the Naidupeta plant witnessed a drop.

- Affected by extreme volatility in RM prices, restricted ability to pass on.

- Situation improved in the 3rd & 4th Quarter. Plans to operate Naidupeta at better utilization.

Wind Power Generation

- Owns and operate 6 Wind Turbine Generators at 3 locations in Tamil Nadu.

- Capacity of 4.3 MW.

- All the units generated are consumed at the Ranipet and Ambattur Plants.

- Generated 61.84 lakh units vs 55.23 lakh units in the previous year

- Two new machines becoming fully operational.

- Captive consumption 49.36 lakh units, + 6.37 lakh units

ITeS Division:

- Revenue 50 Crores,+ 47% over

- Tight cost control measures, profit 15cr, +47%

- Both the key verticals, e-publishing & health care, witnessed growth

- Focus remains on quality to achieve additional business from the existing clients.

Capex

- New plant to manufacture ingredients for food, cosmetics, personal care has been commissioned in Naidupeta.

- Trial production is underway. The installed capacity of this new plant is 1800 MT

Projects through our Subsidiary

-

Commissioned the green field project to manufacture Pigments at Naidupeta (AP). Capacity is 1500 MT. 8 months of operation, achieved 70% capacity utilisation. Plant is Capable of producing more volume of premium pigments, margins improvement.

-

Another new Pigments Projects at Naidupeta. Capacity of 2250 MT of Pigments. Capital outlay of 80 Crores. Expect some portion of the capacity to come online in FY24.

-

Another Project for complex inorganic pigments. Partially completed, balance in the current FY. Total cost of the project is 37 Crores

Anyone planning to go for AGM on July 21st? will company upload any recording??

In the past few years, company has really ramped up their capex spends. I have summarized their finished and announced capexes over time.

Capex

- FY18: Doing 70 cr. capex for a new surfactant plant in Naidupet (30’000 MTPA capacity; delayed and commercialized in FY21)

- FY21: Greenfield capex of 67 cr. (revised cost: 76 cr.) for premium grade pigments at Naidupet (1’500 MTPA capacity; commercialized in FY22)

-

FY22:

– Capex of 21 cr. for specialty chemicals i.e. ingredients for food, cosmetics, personal care (capacity: 1’800 MT) (commercialized in FY23)

– Capex of 24.4 cr. for mixed metal oxides in Naidupet (expected commercialization in FY23)

– Capex for 61.5 cr. for additional pigment capacity in Naidupet (1’500 MTPA) -

FY23

– Capex of 80 cr. in another new Pigments Projects at Naidupeta (capacity: 2250 MT). Expect some portion of the capacity to come online in FY24

– Another project for complex inorganic pigments. Partially completed, balance in FY24. Total cost: 37 cr.

Disclosure: Not invested (no transactions in last-30 days)

Do we have any details about the new capex for ingredients in food, cosmetics, personal care ?

Any other companies which have done a similar capex/operates in this segment for reference ?

Ultramarine Pigments conducted it’s FY23 AGM today. Here are the notes I have taken. Please note that I might have missed a few points and I have tried to keep my biases on the company/the management out while making these notes.

- The holding company Ultramarine Pigments Ltd. makes Ultramarine Blue, Ultramarine Violet and Surfactants in Ambattur and Ranipet.

- The two subsidiaries – Ultramarine Specialty Chemicals Ltd. and Ultramarine Fine Chemicals Ltd. were started to get tax benefits.

- All subsidiary activities i.e. Pigments and Speciality Surfactants are in Naidupeta.

- The main fuel is not electricity but LNG.

Pigments

- US and Korea are the key markets in pigments contributing 30% in revenues.

- Customers are well-diversified in the surfactants business.

- 80% of pigment sales go to the plastic master-batch industry.

- Ultramarine Blue is not just required to make the blue colour but others including black, violet etc.

- Ultramarine Pigments Ltd. has 13% market share in the pigments industry.

- The pigments business is a very niche market and the company plans on staying as a leader in it.

- Mixed Metal Oxides are pigments for high-temperatures. Ultramarine pigments can be used at temperatures of ~250 degrees Celsius. But from 600 degrees, MMOs come into play. This is why the company entered into this product.

- MMOs go more into the paints industry.

- Pigments contribute 25-30% to the bottom line.

- 1500 MT was completed before expected time hence the new 2250 MT was initiated.

- It takes about 4-5 years for a plant to get to optimal utilization.

Surfactants

- Last year was a bad year for surfactants.

- Nature-wise there are two types of surfactants – commodity and semi-commodity.

- Due to the price fluctuations of the commodity natured surfactants, the ROCE was low this year.

- For speciality surfactants, customers take 4-5 months for product approval, then orders of small batches are given before they go for the product.

Others

- The new 1800 MT plant is in Medium Chain Triglycerides which have food and pharma uses.

- In ITES, the company is in medical billing and some publishing.

- In ITES, customers are chosen where margins are better than normal margins.

- Doubtful debts written off upto 3.1cr was due to a Chapter 11 bankruptcy by one of the US based distributors.

- There is a meagre loss in Branded Detergents but the company will continue to pursue it in a small scale with the hope that it might work at some point.

- The capacity of the pigments division post-capex will be 8000 MT. But the management says that the capacities aren’t very relevant because the product mix keeps changing.

- The 6 new products launched last year were a mixture of MMOs and speciality surfactants. They do not contribute to the revenues a lot but these were developed by the company’s in-house R&D team.

- There is no vacant land left with the company. Infact, the company is looking for more land.

- We can expect a temporary reduction in sales because of the ongoing geo-political situations. The management says that everyone has been hit because of the war and there isn’t much they can do.

- The management is absolutely focused on the bottom line. They do not really care about market shares and revenue growth as long as their bottom line grows.

- Can expect 25-35% ROCE going forward. The low ROCE can be attributed to the commodity type of surfactants but as speciality surfactants come on-board this situation will change.

Ultramarine 62nd AGM Notes-

Ultramarine Pigments-

Ultramarine Pigments is mainly into ultramarine blue and violet pigments, it has manufacturing plants at Ambattur and Ranipet.

Started two subsidiaries Ultramarine specialty chemicals and ultramarine fine chemicals (Set up subsidiaries because the company was gaining some sort of tax benefit)

Subsidiary activities in Naidupet

Compitetion-

Ferro (Nubiola) has been in existence for a long time now, and the company doesn’t see any kind of threat from this competitor.

Huebach Pigments Private Limited, based out of Gujarat, can try to sell products at a loss to gain market share, will they be successful in gaining market share?

Ultramarine says many companies tried, but they were not successful.

Possible Margin expansion due to reduction in Logistics and energy costs-

During COVID, logistics costs increased, and right now costs are back to pre-COVID or below pre-COVID levels.

Energy costs are mainly LNG, LNG went up to Rs 130 per kg and is now back to Rs 80 per kg.

Pigments customer geography-

The US and Korea contribute 30–35% of the market share in pigments. Pigments are sold through distributors.

Surfactants customers geography-

Customers are very well disaggregated in surfactant space.

Pigments –

80 percent of sales to the master-batch industry

Ultramarine blue pigment is also used in making other pigments.

Example: Ultramarine blue is used in every Kia car you see out there, white goods, etc.

Company has 13% of the world market share.

The company is foraying into mixing metal oxide (450 t).

Ultramarine blue cost – 350 to 600 per kg

Mixed Metal oxides costs 650 to 1200 per kg.

Pigments bottom-line contribution is 25–30%.

The company expects revenue degrowth in FY24 in the pigment space.

Surfactants-

There are two types of surfactants- commodity and semi-commodity. The company is trying to get onto the semi-commodity and specialty surfactant sides, where margins are comparatively better than commodity surfactants.

ITES-

Medical billing and some publishing

Margins are better in this division when compared to other players.

The company is not bothered by revenue growth in this segment, it cares only about margins and the bottom line, and it will continue to do so.

Others –

3–4 years for the capacity to be fully utilised.

There are some raw material supply issues, and the company is working on them.

The company is more focused on the bottom line than the top line and expects good growth in the bottom line in the next 3–4 years.

Promoter stake has reduced from 52% to 42% in the last 3 years due to sales by non-operating promoters.

A bad debt of 3.1 crore was written off (US distributor). The company is trying to recover it, but there are very low chances.

The branded detergents segment is currently loss-making, but the company will continue to pursue operations as the loss is very minimal.

6 new products: mixed metal oxides and specialty surfactants (ingredients in laundry), products are in the trial balloon phase and are developed by an in-house R&D team.

Right now, the company does not have any vacant land, in fact, if there is further need, the company will look to buy 40–50 acres of land in Tamil Nadu.

No plans to list on the NSE

There are no plans for share buybacks, and the dividend policy will remain unchanged.

The company has been kind enough to give approval for the plant visit.

Disclaimer - Invested

Are you still tracking this company? Wanted to catch your thoughts now.

Still the reaultsvare good considering the situation of entire segment. Major drop will be an opportunity to invest. They have continuously expanded capacities, ventured into higher value chain of products. Have diversified into surfactants as well.

No reco.

Hold small quantity from lower levels.

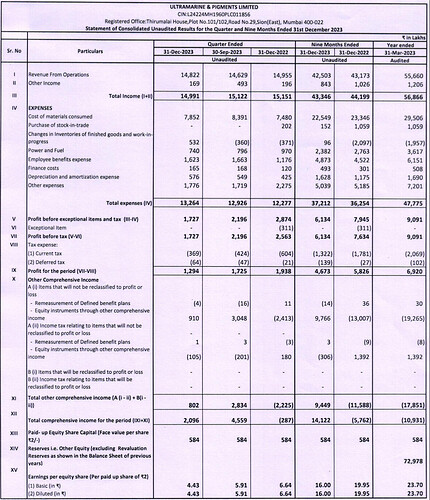

Dip in EPS appears mainly due to increased expenses. Big portion of increase in expenses are due to increased employee benefits, higher raw material costs and changes to inventory. I wouldn’t entirely say this is a bad result, rather an okay one. Since they have expanded capacities, it would be a case of operating deleverage when demand is not up.

Can anyone tell me what is the current capacity in the subsidiary?

Initial 1500 MT was commissioned in FY22. The FY23 Annual report says an additional 2250MT capacity will be added at a cost of 80crs. FY24 annual report says an additional capacity of 1500MT will be added at a cost of 80crs. Have they revised the project downwards or is another new capacity being added?

List of the capexes

- FY18: Doing 70 cr. capex for a new surfactant plant in Naidupet (30’000 MTPA capacity; delayed and commercialized in FY21)

- FY21: Greenfield capex of 67 cr. (revised cost: 76 cr.) for premium grade pigments at Naidupet (1’500 MTPA capacity; commercialized in FY22)

- FY22:

- Capex of 21 cr. for specialty chemicals i.e. ingredients for food, cosmetics, personal care (capacity: 1’800 MT) (commercialized in FY23)

- Capex of 24.4 cr. for mixed metal oxides in Naidupet (expected commercialization in FY23)

- Capex for 61.5 cr. for additional pigment capacity in Naidupet (1’500 MTPA)

- FY23

- Capex of 80 cr. in another new Pigments Projects at Naidupeta (capacity: 2250 MT). Expect some portion of the capacity to come online in FY24

- Another project for complex inorganic pigments. Partially completed, balance in FY24. Total cost: 37 cr.

- FY24

- Capex of 80 cr. in pigments (capacity: 1,500 MT) at Naidupeta. Expect commercialization over 18 months, with part of capacity to be commissioned in FY25

AR24 notes

Business related

-

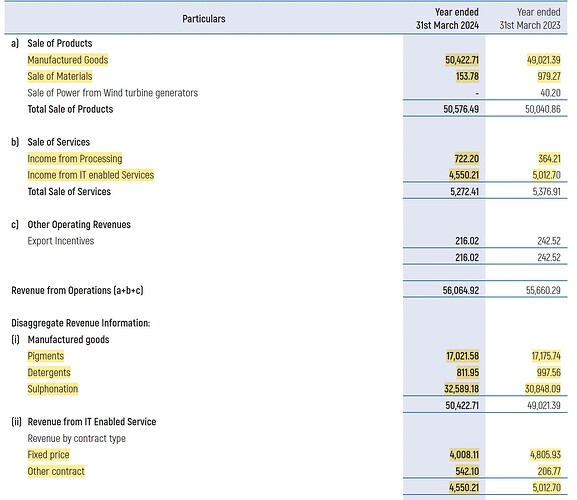

Exports dropped by (-21%) (131 cr. vs 165 cr. in FY23)

-

Export volumes dropped by (-21%). Domestic demand compensated for drop in exports

-

Witnessed pricing pressure across segments due to declining input costs resulting in lower realization. Margins were lower due to high-cost inventory

-

Capacity utilization of Sulphonation plant at Naidupeta improved from H2FY24 and is expected to stabilize in FY25

-

Power & fuel costs : 31.88 cr. (vs 36.17 cr. in FY23)

-

Revenue breakup

-

Other expenses: 68.8 cr. (vs 72.13 cr. in FY23)

Pigment Division:

- Revenue 135 cr. (vs 158 cr. in FY23), -14% and volumes -2%

- Domestic industrial market witnessed robust growth while exports fell

- Expanding customer base in international markets by tapping new areas

- Ultramarine Specialty Chemicals Ltd. achieved a capacity utilization of 82% (revenue of 38 cr. vs 16 cr. in FY23)

Surfactants Division:

- Revenue 343 cr. (vs 333 cr. in FY23)

- Lower realizations. They added more specialty chemicals through in-house development efforts, which will help improve the bottom line

Wind Power Generation

- Own and operate 6 wind turbine generators at 3 locations in Tamil Nadu, capacity of 4.3 MW

- All the units generated are consumed at Ranipet and Ambattur Plants

- Generated 61 lakh units (vs 61.84 lakh units in FY23)

- Captive consumption 61 lakh units (vs 49.36 lakh units in FY23). Green energy contributed 55% of consumption in chemical division

ITeS Division:

- Revenue: 46 cr. (vs 50 cr. in FY23). PAT: 12 cr. (vs 15 cr. in FY23) (exports of 42.08 cr.)

- Scheduled end of certain projects in healthcare caused an overall dip in revenue

Capex

- Subsidiary commissioned a facility to manufacture Inorganic Pigments

- Adding capacity of 1,500 MT in Pigments in the subsidiary at Naidupeta with a capex of 80 cr . Expect commercialization over 18 months, with part of capacity to be commissioned in FY25

- PPE addition is in freehold land (Industrial Park, Naidupet) + buildings and plant & machinery

Subsidiaries

- Ultramarine Fine Chemicals Limited is yet to commence operations

R&D

- One product was commercialized

- Capital: 2.99 cr. (vs 0.3 cr. in FY23). Recurring: 2.17 cr. (vs 1.99 cr. in FY23)

- Total : 5.16 cr. (vs 2.3 cr. in FY23)

Miscellaneous

- Permanent employees : 472 (median remuneration increased by 9%)

- Auditor remuneration : 27.65 lakhs (vs 28.8 lakhs in FY23)

- Shareholders : 22’168 (vs 23’036 in FY23)

- Share price : 306.3 (low), 463.3 (high)

- Investment in Thirumalai : 478.47 cr. (vs 351.36 cr. in FY23) affected by MTM

- Receivables : doubtful of 3.11 cr. (same as FY23). Fully provisioned

- Most bank loans are at 6-9.25%

Disclosure: Invested (no transactions in last-30 days)

Is the 2250 MT capacity active, the last credit report on May 2023, says the total pigment capacity is 7500 MT (6000+1500 in the subsidiary).

The acquisition of Heubach by Sudarshan Chemicals should increase competition for Ultramarine’s pigment business. Sudarshan will try to fill up capacities to drive operating leverage. It might sell products at a more competitive price than Ultramarine.

Secondly, if Sudarshan is successful in utilising the customer base of Heubach, it will be able to penetrate deeper into pigment export markets at the cost of Ultramarine.

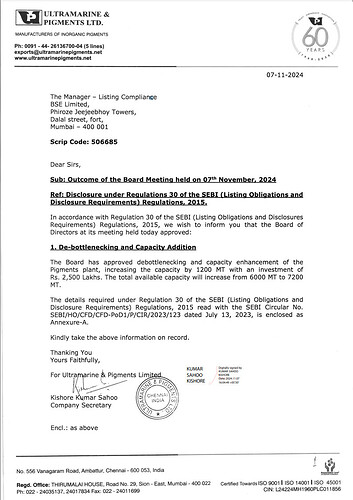

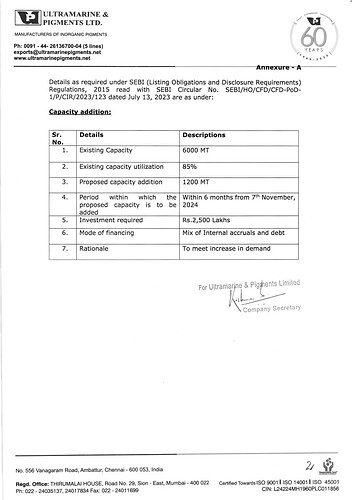

Ultramarine & Pigments Limited announced plans to expand its pigments plant capacity. Key details:

- Current Capacity: 6,000 MT, with 85% utilization.

- Proposed Expansion: Addition of 1,200 MT, bringing the total to 7,200 MT.

- Timeline: Completion within 6 months from November 7, 2024.

- Investment: ₹2,500 lakhs, funded through internal accruals and debt.

-

Ultramarine & Pigments Limited is involved in manufacturing and selling pigments, surfactants, and IT-enabled services. It also generates wind power through its turbines, primarily for self-consumption in Tamil Nadu.

-

The company operates in three main business areas: chemicals and related products, IT-enabled services, and wind power generation. It has three manufacturing plants in Tamil Nadu and Andhra Pradesh.

-

Pigments are its main product, considered commodity chemicals, but the company is developing higher-quality variants at a new facility. Similarly, surfactants are mainly used in detergents and cleaning products, though the company is expanding into specialty chemicals.

-

Its IT-enabled services division, Lapiz Digital Services, provides technology-related services, with growth in the publishing sector and past projects in healthcare.

-

One customer accounts for 25.04% of the company’s total receivables. The company imports raw materials like Alpha Olefin and Lauryl Ethoxylated Oxide and procures supplies from Thirumalai Chemicals Limited and Ultramarine Specialty Chemicals Ltd.

-

A subsidiary recently launched a new facility for manufacturing inorganic pigments. Additionally, a project is underway at Ultramarine Specialty Chemicals Limited in Naidupeta, Andhra Pradesh, to increase pigment production by 1,500 MT at a cost of ₹80 Crores. This expansion will be phased in over 18 months, with partial capacity coming online in FY 2024-25.

-

Ultramarine Fine Chemicals Limited, a subsidiary formed in FY 2022-23, has not yet started operations.

From what I understand there is going to be a gradual shift towards more VAP, improvement in margins due to cheaper inventory. More focus on pigment (higher capex) which is higher margin than surfactant. Very little info is available for this. To get a better understanding of how surfactants and pigments perform, one must look at Sudarshan Chemicals, etc. to get a better idea.

Disc: Studying

Updating their FY25 capex:

FY25

- Q2FY25: Announced capex of 25 cr. in pigments to increase capacity by 1200 MT (from 6000 MT to 7200 MT) – operating at 85% utilization. To be completed Within 6 months from 7 Nov, 2024.

- 750MT of the 1,500 MT was commissioned in FY25 with balance expected to be commissioned in FY26

- Acquired Leasehold rights (99-year lease) for 25.73 cr. for 32.72 acre industrial plot from SIPCOT, Chennai to manufacture chemicals

Disclosure: Invested (no transactions in last-30 days)