Prices would go up when no one expects ![]() . Be patient… even hdfc has to go through consolidation phase and financial especially small cap are consolidating. Sbfc has not beem able to cross listing price, mfi has beem smashed by loan waiver news. If you have then wait else let it cross 315/320 range to add. L

. Be patient… even hdfc has to go through consolidation phase and financial especially small cap are consolidating. Sbfc has not beem able to cross listing price, mfi has beem smashed by loan waiver news. If you have then wait else let it cross 315/320 range to add. L

But ROE remain concerning, maybe causing lower valuation

can anyone explain

It will improve as they built the infra first and will scale now. look at their ROE and ROA targets for next year.

Now with societe genral picking up share from open mkt , now the price movement start…lets wait to see where it can go… my bet is on 500 in this leg

I have recently started looking at the company after quite a few mentions by my friend. I am making a very generic statement which I told him as well when he said, “I dont understand why stock is a rangebound”.

The way I look at it is, given interests rates have been high for last 1.5 years, SBFC would feel the pinch max. Larger banks would cut into markets of NBFC and SBFCs as the rates are high and they can if they have to take some hit on credit quality. So the good parameter would be how fast UGRO lending book is growing specially in last 1-1.5 years.

Happy to stand corrected if I am missing any major point.

Agree to what you said. As the rate cycle peaks out and starts to reverse, NBFSs and particularly fundamentally strong one will be re rated. Ugro has incredible addressable market and it all depends on how fast they can raise funds, at what price and lend them to good quality customers.

I was going through the guidance of CreditAccess Grameen Ltd one of the alleged competitor of Ugro in Micro financing. Management guided for 20-25% loan growth and ROA - 5.4 - 5.5% from FY25-FY28.

This looks incredible to me as per this the Mcap could be around 70k cr at the end of FY28.

I am wondering how the micro finance industry is growing at this insane rate and how big is this market segment, why even the big players like Bajaj finance is also exploring this market?

Ugro Capital is also banking on providing micro financing to small retailers for increasing it’s ROA. Do you think Ugro can be a substantial player in this industry? If this is possible, we are looking at a multibagger with a potential of 15-20x from here in the next 10years.

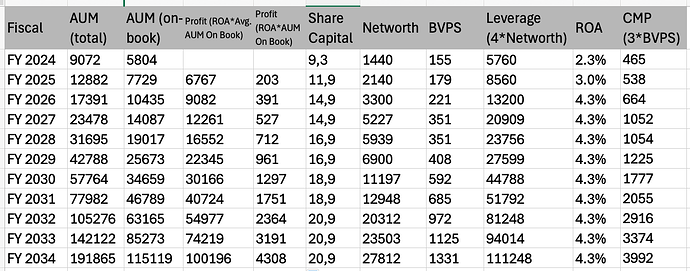

Hi Deepak, could you explain the rationale and assumptions behind 15x?

There is a lot of scope however in the short term, I feel competition is rising and there are headwinds with growing NPAs. Ujjivan lowered guidance and said its credit costs will normalize ( Source : recent concall ). Thus in the short maybe the thesis may not pan out

Assumption:

AUM growth of 30% continuously for the next 10years. IMHO it is doable, the TAM is huge, if management has a good control over the ALM, this rate of growth shouldn’t be a problem.

ROA on continuous basis = 4%

Co-lending percentage = 50%

Fund raising in 2028, 2030 and in 2032 by QIP of 2cr shares in each fund raise.

Note:

- Not considering any AUM and PAT addition from Myshubhlife acquisition and any other potential future acquisitions.

- ROA of 4% is on the lower side, it could be higher going forward basis controlled credit cost.

- Valuation of 3xBVPS is also on the lower side. It could easily trade at 4xBVPS if market wants to give the premium valuation.

- I have taken leverage of 4xNet worth, however as per RBI NBFCs can go upto 7x. If Ugro choose to leverage the balance sheet to 5x, they do not need to frequently raise the capital and ROE matrix will be improved substantially.

Note2: This is a very naive and superfluous analysis with several assumptions, however I sill think Ugro capital has very scalable business model and market at some point in time reward it.

Invested and biased.

Hey, Please cross verify.CreditAccess Grameen is a Microfinance company which gives joint liabiltiy loans to women whereas Ugro has a part of book which gives loan for mico enterprise which is different from microfinance. Hence, both the companies are not comparable.

From my understanding Micro finance means giving small ticket size loans, it could be given to a group of women (self help group) or to a small merchant (micro enterprises). Hence, both the companies are targeting same set of customers but for different purpose. Join liability loans given by CreditAccess Grameen is actually also a type of income generation loans.

It’s just Ugro is just focusing on cashflow based lending and targeting MSME customers, but CreditAccess Grameen has also loan products for home improvement loans aka consumer loans.

I am not explicitly comparing both the companies but discussing the micro financing opportunities.

Both businesses are different. One is B2B lender (MSME) and 2nd one is a retail lender.

What a shitty update seems all mometum lost … aum increase of 200 cr qoq … now it seems why mkt are always correct… this deserve max 2 bv… what happened to credit gap storification… either foreclosure have increased massively or new branches have failed to increase loan book … only fear is that they might degrow ![]()

In the presentation they have mentioned the reason of lower AUM. It is not clear if why new disbursement has reduced significantly because of same strategy. I agree nothing positive in the update.

Notable rundown in lower yielding

SCF AUM (Vendor and Dealer

finance) over last 2 quarters. Focus

now on building higher yielding

Retailer financing book

Do they asked vendor to prepay if not then reason for this dismal growth…now would have to listen to managment concall .

If you look loan book grew at 9% CAGR in previous 4 Qtrs and gross loan origination at 7.5% CAGR.

If we extrapolate this the AUM and GLO should be 9725 Cr and 2219 Cr.

Actual numbers in current quarter (9200Cr and 1840Cr). So total degrowth due to less new loan is 2219-1840 = 379 out of total of 9725-9200 = 525.

So it seems all of the de growth in loan book is attributed to both foreclosure and and de growth in new disbursement (could be attributed to rundown as per commentary in presentation). But mostly it seems like this is the reason and not foreclosure.

Disc: Invested and Biased

Not sure but SCF (supply chain financing) is a low yielding, short term loan. Since the capital itself is scarce in this high interest rate environment they would like to focus on higher yield retailer financing(including micro enterprise financing).

This is what everyone is doing in the peer group. This could have limited short term impact on the AUM but will result in the higher ROA in quarter to come. They have a larger data set now to assess the credit worthiness of MSMEs and could be leveraged to acquire quality customer.

This aligns with the management guidance and commentary. Having said that, let’s see what management has to say in the concall.

What’s negative here is management has not quantified the exact impact of this rundown.

The problem would not be in results as they took a deffered tax hit in q4 and anyways aum is 42 percent more than last q1 but now even to increase 3000 cr this year they would have to disburse 1600/1700 cr per quarter with foreclosure and payment of old loan and with bank competing for same set of customers this becomes a herculean task