Thank you Hitesh bhai for detailed reply. It is always helps to build conviction when you hear experienced seniors views especially when price is in correction mode.

Latest Rating report gives many insights on the company

Disc: 3% of PF.

Thank you Hitesh bhai for detailed reply. It is always helps to build conviction when you hear experienced seniors views especially when price is in correction mode.

Latest Rating report gives many insights on the company

Disc: 3% of PF.

Understanding operating leverage properly is perhaps the easiest step with the largest payoff.

Does Transpek have Operating Leverage? Let’s analyze. This requires looking at cost-structure.

To summarize, the sales has grown 81%, but operating profit has grown 120% from Fy17 to Fy19 as the salary expense remained stable and economies of scale kicked-in. Kind of disproportionate growth.

The above operating leverage is when Fy19 had only two quarters (Q3 & Q4) of full DuPont contract. Benefit could be larger when Transpek gets a full operational year of high margin contracts (say Fy21). Add to this corp tax rate cut benefit from 35% to ~25%, the net margin improvement will be a lot larger.

Q3Fy20 will provide glimpse of steady state OPM%; seems to be first quarter of full operation in Fy20.

Key points -

Disc: Invested. Reentered in early Jan’20 after a wait on sidelines. No major transaction in last 30 days.

Q3 result:

YoY: topline is flattish while COGS is down from ~55% to 45% leading to OPM inching towards ~30%. If OPM sustains, next 12 months EPS will be likely > 200.

@hitesh2710 ji , what is your view on flat topline and sustainability of OPM?

Disclosure: Holding from Nov at lower levels and is ~5% of portfolio.

Results have been good. While topline has remained largely flat, my guess is that the higher margin MNC order has kicked in all during the quarter and that is the reason for margin improvement. March 2019 quarter had even higher margin at 30% opm and pbt at 47 crores as compared to the 37 crores seen in q3 fy 20 numbers. Q2 fy 20 results were affected because as I mentioned before, in chemical plants it takes some time (few days) for optimisation once the operations resume and then only full production start.

I expect this kind of momentum to sustain going forward because as per some scuttlebutt, the MNC contract is going on in full swing and the client wants transpek to manufacture more products for them besides more quantity of same products. If and when the company bags another one or two such multi year long term contracts, this company can go into another orbit but one needs to see if and when that happens.

disc: invested and have added more at lower levels below 1300.

Hello @hitesh2710 ji Thanks for sharing your views. Do you think the above point will be a blocker for topline expansion going forward?

Just thinking, if company is running at full capacity can the topline grow (probably at lower opm) as per above arrangement.

The company earlier had 3 satellite manufacturing centres with tolling arrangements at sister concerns. I got some feedback from a local source that another two such satellite tolling arrangements are also added. (but I could not cross verify this news, am still in the process of getting answers. )

Plus the company always has the option of going to another state if getting permissions for expansion from GPCB is an issue and I think there could be some development on that front.

Only problem is that management does not meet easily and whatever information we get is from employees or other sources which is difficult to cross verify.

For me, right from the time of attending AGM, capacity expansion was never an issue. I always think that if strong relationships leading to good orders are there, in a country like India, for a company like Transpek putting up capacities is only a matter of time.

Sir, any risk of single client concentration?

Pre MNC Order, it was diversify clients. However, with one order coming from a major MNC the client concentration risk has increased for sure. Two factors to consider is that the MNC has also closed down manufacturing of the product it sourced from Transpek. So it is kind of serious long term strategic arrangement then a mere commecial sourcing based on price. Secondly, in case management is able to add more products/clients it can diversify the bets. So definitely there is client risk but then that is other side of coin when one enter in long term strategic relationship. The only way to diversify that risk is to have mutiple coins, in case mutiple such arrangement which Hiteshbhai suggested in previous post in my opinion. ![]()

Good development in Transpek - https://www.bseindia.com/xml-data/corpfiling/AttachLive/a1632371-c857-48e4-b01f-3d12cc9de81e.pdf

This will address the concern on the growth possibility. Co has been doing pretty well from the past MNC contract, more such contracts can take them to a different level.

Disclosure: Invested. Added more post Q3FY20 results.

Why to give dividend and then go for a loan/equity dilution? How do you see this?

This sounds excellent & that can be the reason that interim dividend may sound less.

The cost of the project is estimated to be 120 however part funding is given only for 60. Any thoughts about the remaining funding ?

Any more insights into the new project?

Disc: Holding since few years & adding still

I think we are asking questions too soon. As of now the company has been just recently incorporated, they will have to do land acquisition etc and then project implementation. Logically whole thing may take atleast 2-3 years to commercially start contributing to numbers.

Hi

My guess is that the company will infuse 30 crores by equity and 30 crores from cash flows. And at subsidiary level 60 crores debt might be taken. Subsidiary formation probably is to take advantage of lower tax rates for new projects. (all this is educated guesswork)

Dividend is lower which is a welcome step as company will need to invest for capex.

Coming to what we know about the management, this is an extremely conservative management and will never announce anything unless it is cut and dried. So I guess some things which probably are done deals are:

Site finalisation and maybe even paperwork.

Assurance of orders from clients, and probably of a longer term nature otherwise a company of this type will not put up such a sized capex which is sufficiently large for a company its size.

Timelines of project will be anybody’s guess but I think it should be commercialised within 2 years max unless there are any regulatory or other hitches. FY 21 revenues should give idea about company’s peak revenue and margin potential as that would be a full year of peak capacity utilisation and full impact (year round) of the MNC order.

Margins should be sufficiently high to go for such capex and hence I personally am not too concerned on that front. Company would obviously not go for capex for some commodity products and hence capex would be for some kind of higher margin products.

Contribution from capex - Company did 90 crores capex for Dupont order and one can see revenues move from 360 crores previously to nearly 600 crores annualy now which gives additional revenues of 240 crores and asset turns of 2.5 times, at a higher margin.

Above is rough cut guesstimates based on back of envelope calculations. More clarity will emerge from AGM or from any interaction in any form from the management.

disc: invested and have added since past few months.

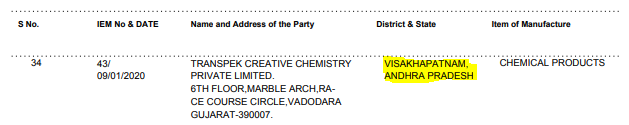

District and State of the new site; indicative information. Geographic redundancy.

Source: https://dipp.gov.in/sites/default/files/iem10012020.pdf

As there were discusison, The name of IEM is fully owned subsidiary which was disclosed in 26Feb2020 press release to BSE. On Jan 6 2020, the company got incorporation, applied for IEM on Jan 9 and informed BSE on 26Feb.

Hello all

1 Attached please find few pictures and articles when I was trying to browse for Dupont and mainly for Kevlar and nomex…

When I had last interacted with the management, Crude is the key raw material for Transpek and if it is low, margins will for sure be better.

In my view, Transpek has potential to come out strongest out of the current crisis as it’s product seems key input into PPE

I am given to understand that the material requirement in medical PPE is of lighter material like PP and HDPE.

Face masks and shields are mostly made of PP.

Tyvek, the DuPont material used in PPEs is also made of HDPE

http://www.fyberforma.com/material/

Nomex and Kevlar are denser materials and generally used for fireproof, bulletproof protective equipments.

From Wikipedia page of Nomex

Hence I feel it would be premature to assume that Transpek’s product is a key input in Medical PPE.

Quick research shows that Transpek supplies Terephthaloyl chloride and Isophthaloyl chloride to Dow which are mostly used to produce Kevlar and Nomex.

Dow used Tyvek to produce PPE and this used Ethlyl polymers and not choloride isomers. So limited research shows that Transpek may not be directly supply chemicals for PPEs.

Pls do your own research as I may be wrong in my deductions due to the limited time spent.

Hi, can you guide about the Investment in Transpek-Silox Industry Private Limited ( 9,49,315 shares for Rs 131 crores). Can’t see much information in AR. Significant investment considering balance sheet size of ~600 crores.

As per old annual reports the Investment was Rs 2.91 crores and now the same is considered at Fair Value which is Rs 131 crores. Also as per Silox Website it is mentioned that in 2007 “SILOX acquires an additional 15% of its Indian subsidiary Transpek-Silox Industry Ltd’s capital, raising its stake to 83.28%.”

But no recent updates.