Thanks for the analysis. What are the scenarios if one invests more than Rs 2 lakh in terms of likely acceptance ratio and return. Also I understand the promoters (holding 73.1%) are also going to participate in the buyback offer…

I guess the acceptance ratio in that scenario turns out against. As promoters are participating hence post assuming increase in 30% of retail investor, the number of non retail shareholding would be around 90%-91%. While buyback of total quantity is 9.85%, of which (around 85%) 8.4% remains for non retail investors.

Hence 8.4% for 90% gives the theoretical acceptance ratio of 9.3. Not the probability of non retail investor to participate in the buyback is high.

My father had 100 shares of Indian Toner since IPO time, I asked him to offer all shares. All shares got accepted. Participation was very low or extra small investors got preference in unsubscribed portion? Where I can check buyback subscription information?

In today’ week market stock is up 6%.

Subscription information is not declared usually. During the tender date there is generally a theoretical acceptance ratio declared by the company. Further when you bid entire shares the net subscription is informed by the company (Minimum theoretical acceptance + Share from Unsubscribed portion).

Unsubscribe shares again comes back into you demat account

NIIT buyback offer announcement came with record date of Feb 24th, that too it was announced on Feb 12th. The buyback process/tendering is not started, and stock price is falling since then.

News paper ad as per SEBI regulations: https://www.bseindia.com/xml-data/corpfiling/AttachHis/331af560-a586-41e3-9891-2cf2cbb11eee.pdf

So it looks like a company can announce buyback, list ad in news paper as per SEBI, and indefinitely delay the tendering process. Is it acceptable practice? If so it is big con for the investors who are investing for the buybacks. Am I missing something? Seniors kindly help with the right understanding.

Infosys Buyback 2021

Infosys’ board meeting for buyback is scheduled on 14th April 2021. Last buyback was through market route.

While it is beneficial for the company to opt for market route as average purchase price is relatively lower; tender route is more beneficial for investors due to payout at a fixed rate for the quantity accepted in the buyback. It becomes even more lucrative for small investors due to high acceptance ratio.

Incase founders are keen to offload shares or the company plans to reward it’s shareholders, it could be through tender route this time. We will get clarity on the buyback route and size on 14th April.

Disclosure: Invested

97adac91-3229-4293-838f-d89926addc68.pdf (185.4 KB)

Buyback of Nucleus software

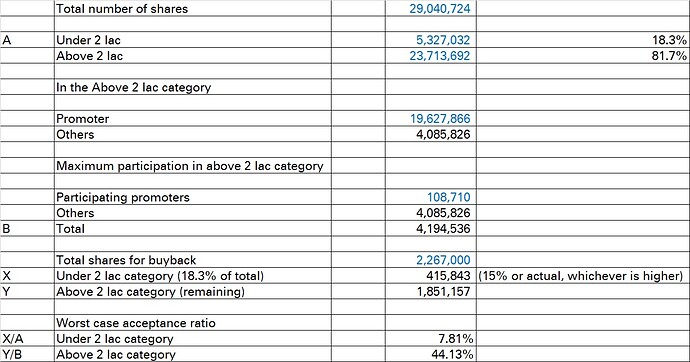

Can someone check my analysis and validate. It looks like a super arbitrage opportunity.

| Total shares | 29040724 |

|---|---|

| Promoters | 19627866 |

| Non promoters | 9412683 |

| Promoters willing to tender | 107926 |

| Total possible Tender shares | 9520609 (Non promoters+promoters willing to tender) |

For retail

| Total buyback shares | Retail quota | Retail quota %age | Total potential retail shareholders | Acceptance Possibility (Retail quota/total potential retail shareholders) |

|---|---|---|---|---|

| 22,67,000 | 3,40,050 | 15% | 53,27,000 | 6% |

For non Retail

| Non Retail buyback shares (22,67,000-3,40,050) | Total potential non retail shareholders willing to tender | Acceptance Possibility | |

|---|---|---|---|

| 19,26,950 | 41,93,609 | 46% |

46% AR is if all the non-retail is participating. In reality it should be much much higher.

Current arbitrage is 18% ( buyback price= 700 CMP= 590)

Thanks for bringing it up, Vishal. Please see my analysis below. It’s pretty much the same apart from a slight difference in the retail quota which does not have any material impact on your core hypothesis.

The only notable point in this scenario is that the benefit of non-participation of promoters in the buyback proposal is not percolating to the retail category because they do not belong to the promoters’ category, resulting in lower acceptance ratio for that category. This seems to be a loophole in the law or we are missing something (unlikely as the posted documents confirm a separate category for small shareholders).

The blue coloured entries are factual entries taken from BSE uploaded documents. Remaining are dervied entries

I think the right way to calculate is this - the total number of shares being bought back is 2.3 million and total number of shares participating is 9.5 million (ex of non-participating promoters). So the minimum acceptance ratio is ~24% - the distinction between retail and non-retail will not matter in this case. The actual ratio will be higher since some people will not participate or will not tender all shares.

Hi Everyone, new to this thread. I am a relatively novice investor.

I wanted to ask if the Escorts open offer could be one such situation.

The CMP is 1848 and the open offer is for 2000. So, to me it seems like a 8% assured return

Opportunity. I bought it at 1650 on the day the open offer was announced on the basis of this and have received a 12% return from it already. Is my assumption correct that there is still a guaranteed upside?

Below link has more details. Minimum 53% of your shares are guaranteed to be accepted at 2000. More % might be accepted at 2000, if others do not participate.

Hey Chaitanya just did a quick math.

You have spotted Open Offer at right time. AS at the price of 1650 the margin was pretty good.

However as mentioned in the offer, all public shareholder can apply.

Hence theoretically 1 out of every 4 shares should get tendered. However it seems obvious that not all FII & DII will take the exit from open offer. While presence of certain big investor such as RJ, Serum, Kubota should not take exit easily.

As of now I would suggest you can as you get more than 80% of the return before the tender date you should plan for exit. Else try booking half of the profits now. As the prices turns down before offer date you can again re-enter and can play the open offer trade.

Thanks Vishal, Why do you think that the price will fall before the open offer date?

No, I was just assuming the worst case scenario. In Special Situation case, I prefer to look at technical analysis to take out reasonable exit point. And Escorts being in FNO, Option data itself representing price target of 2,000.

If the price comes near to 2,000 (2-3% up-down) I usually prefer exit, as these 2-3% usually don’t turns out exact. There is inherent risk post open offer of price to come below 2,000 which will block remaining quantity for favorable exit.

While all these process take much of the time. Hence prefer to get exit before 2-5% range & if the price falls further to your exit, then you can again re-enter the stock.

Ok, got it. Thanks Vishal.

TCS Buyback

TCS has today announced “Pursuant to Regulation 29(1)(b) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, this is to inform you that the Board of Directors will consider a proposal for buyback of equity shares of the Company, at its meeting to be held on January 12, 2022.”

Going by the previous track record, buyback should be through tender route.

Discl: Invested

Do not know if this is the right place to raise this issue. I have observed that Shivam Auto’s right issue is in progress. But rights renunciation is quoted at 80 when the share is ruling at 50. How is it possible ? Anybody observed this? Am interested to know views of the seniors.

The record date for TCS buyback is 23rd Feb. What is the last day to purchase the shares to be eligible for buyback?

21st Feb will be the last date as 22nd Feb will be the Ex-Date.

hi, wat will taxation be? since it is offline and there is no stt? as per income or debt?