iPick Idea (KPN) - TIPS Industries (BSE Code : 532375) (Listed on NSE too)

In our Indian Stock Market, its very rarely we get to invest our money on a potential Blockbuster Film. That too if the film is a multi starcast and has Salman khan in it with the film releasing on EiD festival weekend

The film i am talking about is Race 3. Salman and Eid factor, combined with thriller/suspense/action genre and Race franchisee along with mega starcast and Remo Dsouza as director, makes this movie one of the most anticipated release of 2018.

The stock in concern is TIPS INDUSTRIES, producer of Race 3 Movie.

This company belongs to Taurani brothers and they have themselves hit a jackpot when they signed Salman Khan for Race 3 last September 2017 for production under Tips Industries.

Tips Industries : Market cap : 164cr

Stock price : Rs. 114

Race 3 release date : Eid 2018 (June 15, 2018)

Race 3 starcast: Salman khan, Anil kapoor, Bobby deol, Jacqeline fernandes, Daisy shah, Saqib Saleem

Race 3 Director: Remo Dsouza

Race 3 Music : Vishal Mishra, Pritam, JAM8, Meet Bros, Vicky Raja, Hardik Acharya & Shivay Vyas

All past salman movies have earned on average min 500cr at the boxoffice (domestic+international combined) (except Tubelight, which was commercial type of cinema).

Potential of Race 3 earnings :

Indian Box-office : Min Rs. 250cr - Max 400cr nett (Eid weekend - 3 days alone, can fetch Rs. 120cr domestic pening)

Overseas Box-office : Min Rs. 200cr - Max 300cr nett excluding China collection (Eid weekend - 3 days alone can fetch Rs. 100cr overseas opening) (Salman’s last release Bajrangi Bhaiijan fetched Rs. 294cr in China alone in Mar 2018)

Satellite Rites : Approx Rs. 75 - 100cr nett (As per media reports, producers are expecting Rs. 150cr from only satellite rights, although the deal is not yet completed)

Music Rights : Approx 25cr nett

Production cost: Rs 100-125cr nett

Considering above and deducting production cost, Race 3 will earn atleast minimum to minimum Rs 500 cr (if film is only HIT and maximum it can earn greater than Rs. 1000 cr if film is a BLOCKBUSTER.

This net profit is going to reflect in balance sheet of Tips Industries in April-June 2018 Quarter and if we assign even lowest PE of 10 (Closest Peer : Eros trades at 26PE, Walt Disney in US trades at 15 PE) to the company, then this company definitely deserves much much much much higher Mcap than current Mcap of Rs. 165cr.

About Tips Industries : Tips Industries was established in the year 1975 as small shop in the market of Lamington Road.[4] In 1975, the Taurani brothers traded in LP’s (Long Playing Phonograph Records) for three of the biggest companies in India – HMV (now Saregama), Music India (now Universal Music Group) & CBS (now Sony Music). In 1990, Tips Industries set up its first manufacturing facility at Palghar, Thane.

Tips Industries is one of the largest corporate houses in the field of music and films. Its main area of interest is music production, promotion and distribution, now also in films. It has the highest number of gold and platinum discs to their credit in comparison with any other record label in India. Its team of distributors serve more than 1000 wholesalers across the length and breadth of the country who, in turn, serve more than 400,000 retailers.

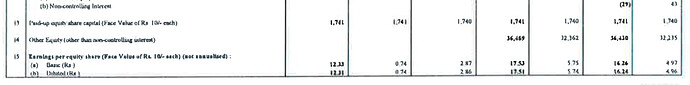

Financial Details :

Quarterly Results Figures in Rs. Crores

Mar 16 June 16 Sep 16 Dec 16 Mar 17 June 17 Sep 17 Dec 17

Sales 33.37 16.72 10.58 7.30 12.42 10.08 12.56 10.29

Expenses 31.58 6.74 3.83 4.73 21.54 4.91 4.61 5.40

OP 1.79 9.98 6.75 2.57 -9.12 5.17 7.95 4.89

OPM 5.36 59.69 63.80 35.21 -73.43 51.29 63.30 47.52

Other Income 1.75 0.82 0.69 5.56 12.35 0.34 0.62 0.44

Depreciation 0.38 6.97 3.80 3.80 0.37 3.41 3.46 3.45

Interest 2.90 2.81 2.81 2.55 2.06 1.97 1.90 1.68

PBT 0.26 1.02 0.83 1.78 0.79 0.13 3.21 0.20

Tax 0.05 0.21 0.27 0.68 0.16 0.01 0.68 0.05

Net Profit 0.21 0.81 0.56 1.10 0.63 0.12 2.53 0.15

Risk Analysis -

- This is a short term pick for next 3months as the film pipeline after Race 3 is not there till 2020.

- Low Liquidity, so one has to tread carefully once one gets the desired returns.

- If the content is very bad (extremely low chances), maybe the stock will not perform (Highly LOW Chances)

Disclosure : I have personally invested in this stock. Please contact your financial advisor before investing.