https://www.screener.in/company/530475/consolidated

About the company

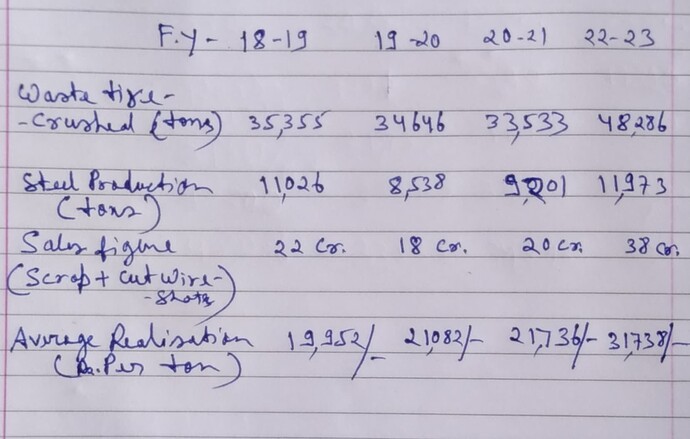

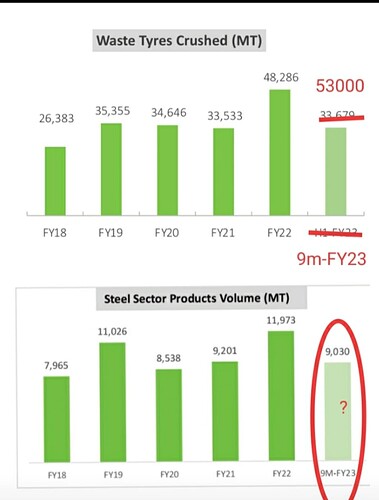

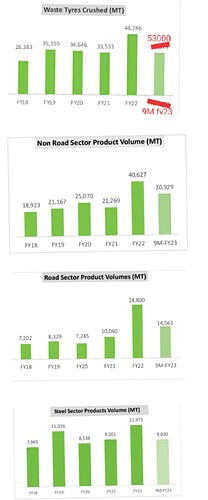

Tinna Overseas Ltd. (formed in 1987), now renamed Tinna Rubber & Infrastructure Limited (TRIL), is involved in the business of bituminous products and specialises in bitumen modifiers of various types such as crumb rubber, polymer-modified bitumen and bitumen emulsions. The company also has a crumb rubber manufacturing facility in five of its existing plants. It has manufacturing facilities at Panipat, Kaalamb, Haldia, Chennai and Wada. However, due to the slowdown in the infrastructure industry in the past few years, it has diversified its product mix to reduce the dependence on the sector. Its current product profile includes ultra-fine tyre crumb, high tensile reclaim rubber, carbon steel shots, steep scrap, CRMB and bitumen emulsion.

NOTE: Kala-amb facility in Himachal was closed in past month and machinery + staff relocated to Panipat as rationalization and debottlenecking move.

Q3 FY23 con call transcript: https://www.bseindia.com/xml-data/corpfiling/AttachLive/a49d2e7a-aa45-4c82-a7e4-4e4fd3163ec6.pdf

Q3 FY23 investor presentation: https://www.bseindia.com/xml-data/corpfiling/AttachHis/55be877f-703e-4027-8b76-1961c152ecc1.pdf

Key drivers and their description

Strengths

-

Extensive experience of promoters – The promoters have been involved in the manufacturing of rubber-derived products for more than two decades and have gained a thorough knowledge of the market. Their long presence in the industry has helped the company understand the industry dynamics, while continuous focus on research and development has helped it establish strong relationships with key customers.

-

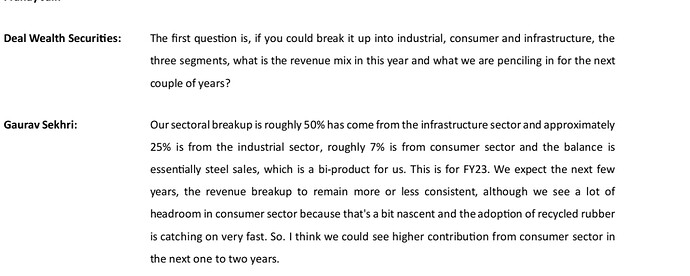

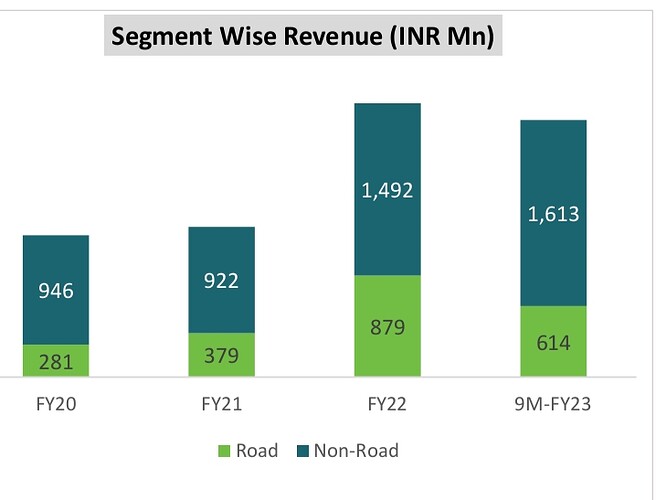

Diversification of product and consumer mix – The company has diversified its product profile to include reclaim rubber, high grade crumb rubber, cut wire shots, etc. It has also added some highly reputed tyre companies in its customer profile and has received approvals for raw material supply to them. This has aided it in increasing the sales volume and in turn, its revenues. TRIL recorded an OI of ~Rs. 130.07 crore in FY2021 and ~Rs. 173.13 crore in 9M FY2022.

-

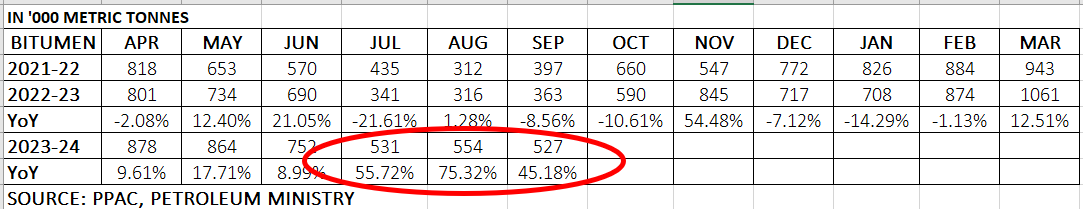

Favourable demand prospects - With the traction in infrastructure sector and construction of expressways and highways, the demand prospects for TRIL remain healthy. Going forward, the healthy orders in hand, including an annual offtake agreement with IOCL, should lead to revenue growth for the company.

Challenges

-

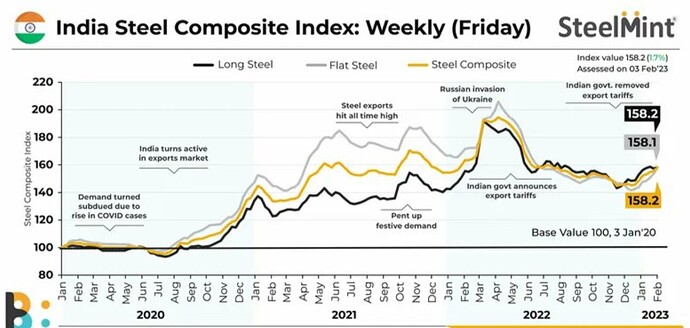

Volatility in raw material prices affecting margins – TRIL’s profitability remains exposed to the fluctuations in raw material prices and foreign currency rates as a sizeable proportion of the raw material requirements is met mainly through imports. However, the company has been trying to mitigate the risk by reducing its dependence on imports and procuring raw material domestically. Further, the company has some pricing power which allows it to pass on some of the raw material price variability to its customers.

-

Stretched working capital cycle exerting pressure on liquidity – The company has moderate-to-high working capital intensity, which impacts its liquidity as reflected in the almost full utilisation of its working capital limits. Hence, due to very low cushion in limits and limited cash balances, its overall liquidity profile also remains stretched. However, the working capital cycle has improved with NWC/OI of ~25% in FY2020 and ~22% FY2021 compared to ~39% in FY2018. TRIL had external term loans of ~Rs. 31.36 crores on its books as on March 31, 2021. The Indiabulls loan was taken over by SBI in December 21 at 4% less interest rate and has been repaid fully by SBI. Indiabulls has paid around Rs. 1.17 crore of the disputed interest back to the company. TRIL had paid the instalment of Indiabulls on December 10 on time and thereafter the SBI EMIs have been on time too. While a major repayment (Rs. 7.12 crore) is due in FY2022, the repayment burden is expected to reduce after FY2023.

Investment thesis:

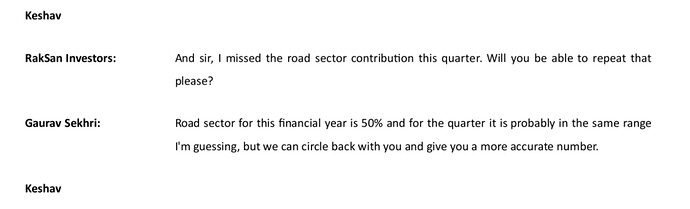

Company growth seems to be hinging on road surface CRMB, they keep harping the point that this has longer life and better quality, not sure of the initial costs. Overall road (re-)surfacing market may show decent growth. Govt regulations may change to enforce higher usage.

Rubber recycling overall may ride also on environmental concerns, rules seem to be enforcing 100% recycling in phases. Tinna has just started a facility in the gulf for crushing tyres. They have a subsidiary in europe which was part of a bigger strategy but so far is limited to importing waste tyres. The company seems to be looking at more internationalization.

The guidance is for 25% topline cagr for next 5 years, with limited short-term capex, justifying debottlenecking and streamlining as enough for next 1-2 years. For bit longer term they are looking at both acquisition and greenfield options.

They are the pioneers and leader in a fragmented and competitive market, though some of their (fine ground rubber) products seem to be not matched by others in the market.

RISKs:

It maybe that the regulations do not suit the company. Waste imports may be banned or duties may be unfavorable. Tyre companies may take a bigger role in recycling themselves if forced by rules. Market is fragmented and margins may stay low due to this. Rubber commodity cycle may turn unfavorable to support valuation, though company may be positioned to enjoy fairly stable margins despite such cycles. Infra growth and road laying may not last for much longer at current growth rates. Oil price decline may not suit CRMB usage.

Disclosure: much of the content is taken from ICRA credit rating report of march 2022 which upgraded it from Default rating for details see point 2 in “Challenges” above. I own this company at average buy price of 380 after waiting for some months. I am not SEBI registered analyst/advisor, and this is not a stock recommendation.