Tilaknagar Industries has turned around in a major way. Having been invested for the last 2 years, I have tried to capture the turnaround story and investment thesis in the note below.

However, I have since exited the stock as back-to-back resignations of Company Secretary & President - Corporate Governance & Compliance (both with immediate effect) a few weeks ago didn’t give comfort.

Thank you to Mr Shayne John for the initial idea and main investment thesis which I was able to build on. Discussions with him gave me a lot of clarity in understanding/developing conviction in the Tilaknagar Industries story.

Tilaknagar Industries Limited (TIL)

Current Market Price: Rs. 142.5 (closing price as on 30/06/2023)

Market Capitalization: Rs. 2,703 crores

https://www.screener.in/company/TI/consolidated/#top (Financials)

Investment Summary

-

Business on a Much Firmer Footing : Infusion of substantial liquidity after years of acute shortage of working capital, restructuring of debt, good demand environment and execution has led to significant improvement in the Balance Sheet and strong revenue/profit growth which is expected to continue.

-

Alignment of Incentives: As part of the debt restructuring arrangement to turnaround the company, Edelweiss Asset Restructuring Company (EARC) owns an equity stake (4.28%) and a Board seat. They’re here to raise the value of their equity!

-

Valuation: As per media reports at the time, French liquor giant Pernod Ricard attempted to buy a 15%-20% stake in TIL in 2014, valuing it at between 4x-5x revenue. This was at a time when the company was overleveraged and significantly margin-impaired compared to their global peers! While significant re-rating has happened since the EARC agreement over the past 2-3 years, the stock still trades at 2.3x revenue.

About the Company/Business Model

Founded in 1993 by the Dahanukar family and now led by Amit Dahanukar, Tilaknagar Industries (TIL) is the market leader in Premium Brandy. The company has a dominant presence in South India (accounts for 60% of alcohol consumption in India) and is known for the Mansion House brand.

The company has 20 manufacturing units (4 owned and 16 contract manufacturing units) and owns 15+ Brands. TIL is primarily involved in branding and distribution and caters to the premium IMFL category. Brandy accounts for ~90% of the company’s revenue. Also ~90% of the company’s revenue is from South India.

Industry

The 2 dominant segments in the Indian liquor industry are Indian-Made Indian Liquor (IMIL) and Indian-Made Foreign Liquor (IMFL). In FY 23, the IMFL segment grew by 14% in volume terms. Whisky is the largest category in the IMFL segment, contributing 63% of industry sales in FY 23, followed by Brandy which accounts for ~20% of industry sales.

In recent years, there has been an increasing trend of premiumization. In FY 23, premium liquor (categorized as products priced at above Rs. 1000 per 750 ml bottle) sales grew by 48%. The trend of premiumization is expected to continue and leading liquor companies are increasingly focusing on the premium segment.

Barriers To Entry

Brand power and brand loyalty are tangible elements in the liquor industry. Mansion House is a powerful brand in its key markets and it will not be easy to supplant MH, even if a competitor embarks on an incentive blitz to the sales channel. That’s an important barrier to entry.

Lost Decade

The trouble began in FY 14, with a series of issues adding up:

-

Overleveraged balance sheet - Debt/EBITDA & Debt/Equity were 4.9x and 1.4x respectively. Out of the roughly Rs. 800 crores of debt in FY 14, Rs. 500 crore was working capital debt.

-

The company’s only bottler in Tamil Nadu (an important market) went into trouble and supply had to be stopped. Likewise, Kerala (another key market) had ordered the closure of bars.

-

Inflation in ENA prices (key raw material) and inability to pass on the same due to price controls.

In the following years, revenue declined sharply from Rs. 824 crores in FY 14 to Rs. 458 crores in FY 16 and the TIL reported massive losses. The lack of cash flow meant that the company had to take on even more working capital debt (which increased to Rs. 815 crores in FY 19). Interest costs surged from Rs. 64 crores in FY 14 to Rs. 184 crores (28% of revenue!) in FY 19. TIL was unable to service the demand for its products due to the massive liquidity crunch.

Debt Restructuring Agreement & Signs of Turnaround

In 2017, EARC started accumulating the distressed debt of TIL from existing creditors. In 2020, a debt restructuring plan was announced wherein total loan of Rs. 523 crore was restructured at Rs. 344 crores at an interest rate of 9%. Also, TIL alloted 1.39 crore shares at Rs. 24.36 to EARC. A series of fund infusions followed - Lotus Trust Investments (Rs. 126 crores at Rs. 53/share), TIL’s channel partners (Rs. 85 crores at Rs. 72/share), Think India Investments (Rs. 100 crores at Rs. 99/share).

Meanwhile, TIL also settled its dues with the other creditors - outstanding debt of Rs. 265 crore was settled at Rs. 95 crores with Bank of India, outstanding debt of Rs. 287 crore was settled at Rs. 102 crores with SBI. Likewise, the company reached settlements with Standard Chartered Bank, IDBI Bank and DCB Bank.

As a result, debt decreased from Rs. 1111 crores in FY 19 to Rs. 702 crores in FY 21. At the same time, interest costs reduced significantly from Rs. 184 crores to Rs. 71 crores. With this combination of lower debt/interest costs, improved liquidity (with the series of fund infusions), strong demand and strategy to focus on the fast-growing premium Brandy segment, the business was on a firmer footing. Now execution was the key.

Big Strides in FY 22 & FY 23

TIL was able to grow revenues from Rs. 549 crores in FY 21 to Rs. 783 crores in FY 22 and further to Rs. 1164 crores in FY 23 (for context, FY 14 revenue of Rs. 824 crore was the highest before Covid - in the 7-8 years after, revenue was stuck in the Rs. 500-Rs. 700 crore range). After 8 years, the company finally turned profitable in FY 22, closing with EBITDA/PBT (adjusted for exceptional items) at Rs. 112 crores/Rs. 27 crores respectively. In FY 23, EBITDA grew further to Rs. 137 crores and PBT grew exponentially (aided by operating leverage and reduction in interest costs) to Rs. 72 crores.

More importantly, there was a big improvement in the company’s balance sheet - net debt reduced from Rs. 654 crores in FY 21 to just Rs. 210 crores in FY 23 and interest costs came down from Rs. 71 crores to Rs. 40 crores in the same period. Currently, Debt/EBITDA is at 1.5x compared to 12x in FY 21. Further, the company’s net worth, which had been negative for the prior six years, finally turned positive in FY 23.

Future Outlook

TIL aims to be near net debt free by FY 24 and aims to grow revenues at 15%-20%. Profitability was impacted in FY 22 & FY 23 due to inflation of key raw materials, ie. barley, glass and packaging material. Therefore, profitability is likely to grow faster than revenue in the coming years.

-

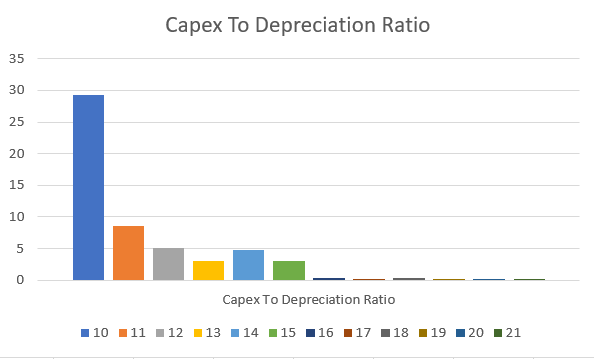

TIL had incurred 90% of the capex for its grain-based distillery many years ago but the project had remained unfinished due lack of funds. Being a non-core business, the company entered into an agreement with Globus Spirits (largest manufacturer of Grain-ENA) in 2022 to upgrade and operate the plant at optimal efficiencies. The service fee which will be paid to Globus Spirits is linked to the EBITDA generated - a smart arrangement to incentivize higher capacity utilization of the plant. TIL expects meaningful EBITDA contribution from this plant in FY 24.

-

During the last AGM, Mr Amit Dahanukar (MD) spoke about East and North-East India being the focus area for TIL during the next 2-4 years. Back in 2014, TIL had acquired IMFL brands from IFB Agro at Rs. 21 crores. These brands belong to various categories such as gin, vodka and rum and are popular in states like Odisha, West Bengal and Assam. Now that TIL has enough liquidity, they’re looking to ramp up production and sale of those brands, which would help the company reduce its dependency on brandy. This is especially pertinent given that the dispute over rights to the Mansion House brandy brand continues. Further, McDowell’s No. 1 (among the leading brandy brands) is owned by Diageo, a company with vastly superior resources.

-

As the market leader in premium brandy, TIL is focused on growing the category by focusing on the young, aspirational audience. The company has launched Flavoured Brandy in Telangana & Puducherry and the response so far has been encouraging. They are targeting further product launches in the premium category (Rs. 1000+/750 ml bottle).

-

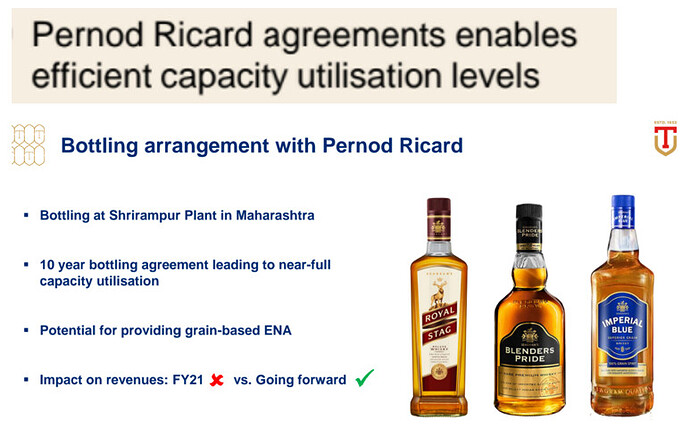

TIL has signed a 10-year agreement with Pernod Ricard to manufacture its products. Production started last year and there is possibility of extending this arrangement to more states in the near future.

-

In 2021, TIL’s Mansion House outsold Diageo’s McDowell’s No 1 to become the country’s biggest brandy brand by volume. In 2022, Mansion House became the world’s fastest growing brandy and second fastest growing alcoholic beverage brand, across categories, globally.

Valuation

The leading liquor companies in India operate in the higher margin and branded IMFL segment. The top-3 listed liquor companies, ie. United Spirits, United Breweries and Radico Khaitan trade at between 5x-6x revenue. This is in contrast to the market leader in the IMIL category, Globus Spirits, which trades at around 1.5x revenue. As India develops and disposable incomes rise, the share of IMFL sales is expected to increase (as consumers switch from cheaper IMIL to IMFL). Further, the top-3 listed companies are backed by MNCs. For these reasons, there is a large valuation gap.

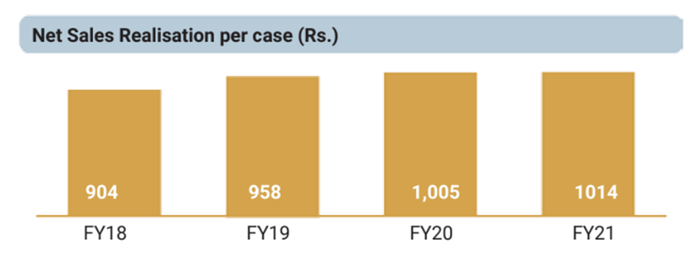

TIL majorly operates in the premium brandy category, with Net Sales Realizations per case at Rs. 1197. This is a promising segment given the higher growth and profit margins. The value of the company in the eyes of foreign players as well as large domestic players is evident from the past - In 2014, Pernod Ricard was looking at buying a 15%-20% stake in TIL at a valuation multiple of 4x-5x revenue (2014 revenues were the highest before Covid). More recently, the bottling arrangement between TIL and Pernod Ricard could be seen as a step closer to a possible acquisition deal in the future. Further, TIL’s merger with its subsidiaries is possibly a step to simplify the holding structure and get the company ship-shape for an acquisition.

Again, as per media reports at the time, Allied Blenders was also in talks to acquire TIL in 2014 but the deal fell through. Since then, they have been keeping close tabs on the developments, as acquiring TIL would give them complete rights to the Mansion House Brand in India.

Key Risks

-

There has been a long-standing battle between Netherlands-based Herman Jansen (global owner of Mansion House Brandy brand) and TIL related to the Mansion House brand in India - TIL claims Herman had de facto ceded the brand 30 years ago but Herman countered that the arrangement was never legally formalized and moved courts in 2008. In 2014, Allied Blenders (ABD) acquired 50% brand ownership from Herman Jansen, although Tilak remains the sole manufacturer and seller of MH in India. Although the initial verdict was in favour of TIL, the legal battle with ABD/Herman Jansen continues.

-

Pledged holding remains high at 78%. However, the improvement in business, significant debt reduction and plans to be net debt-free in the next 18-24 months is key here.

-

There is a general mistrust of the promoters of TIL following a decade of mismanagement. However, EARC’s presence, both as a creditor and a shareholder who has board-level oversight of the management gives a lot of comfort.

Disclosure

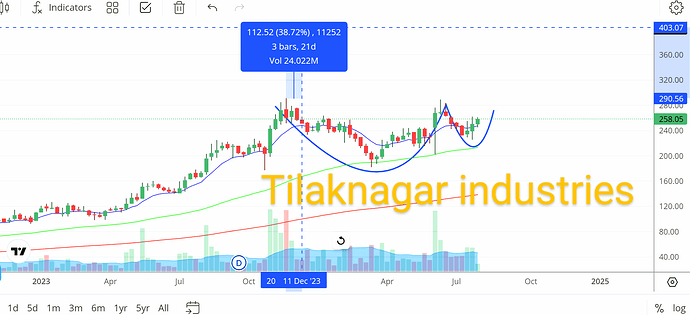

Invested in TIL since September 2021, when the stock was at Rs. 40. Averaged up along the way at Rs. 55-60, Rs. 85-90, Rs. 100, Rs. 110-115 and Rs. 120-125 based on steady conviction build up and seeing the turnaround story playing out. After the recent rise to ~Rs. 150, the stock became a top holding with a nearly 20% allocation. Over the past month, have sold a significant part of my initial holding. It is now the second-largest holding.

Edit: As also mentioned above, I have exited the stock since writing the report as back-to-back resignations of Company Secretary & President - Corporate Governance & Compliance (both with immediate effect) a few weeks ago didn’t give comfort.

But now, further debt repayment is being done through cash flows

This has led to sharp decrease in finance costs:

Management commentary regarding intent to turnaround is very positive