No matter who or how big you are there’s no predicting the demand swings in commodities, all companies can do is to have a strong balance sheet to weather the storm when it appears, which i think Thirumalai has done very well going by its balance sheet condition.

Agree. At least a “Profit Warning” was expected from a credible ethical management. Very disappointing.

In the management update, management does not expect any improvement in Margins to previous levels in the near future. Looks like profit margins for last two years were flash in the pan and in future, Dec 18 qtr profit margin levels are the new normal.

Management may want to position the company as a Speciality Chemicals Company. But PA and MA , both pure commodity chemicals contribute more than 90 % of topline and bottomline. Speciality chemicals like food acids etc contribute miniscule sales and profits.

It would be helpful if management provides investors breakup of sales and profits from PA, MA and Speciality chemicals.

Until then, investors have to consider the company as a commodity chemical manafacturer susceptible to wild swings. So PAN (SE ASIA) - OX (INDIA) Spread is the critical thing to watch. At present, the spread is less than Rs.7 per kg, whereas it was over Rs.29 per kg in 2018 and H1 in 2019.

Not holding anymore.

Do not hold and do not track Thirumalai Chemicals but just to give a little idea of how things work since some of the folks I know are downstream consumers of HDPE/PP/LLDPE/PVC.

Most of the downstream consumers of HDPE/PP/PVC (or for that matter most commodities) carry a stock of 1 to 2 months. During times when crude falls significantly most of these downstream consumers try to deplete inventory as much as possible. Now most of the companies mfg HDPE/PP/LLDPE/PVC (Reliance/Gail/Finolex/IOC) are aware of this as this could lead to rising inventory and combining it with falling crude prices could result in significant inventory losses. Further a rising inventory could somewhere down the line lead to a dumping kind of scenario leading to a much bigger fall in prices. So how do these companies solve this? Most of these companies come up with a policy called ‘Price Protection (PP)’. From the day PP begins to the day PP ends the companies charge their customers the lowest price in that period. This does impact the margins but ensures that there is no inventory build up.

Although I do not track Thirumalai and do not have any view on the company and the management I do think we should cut some slack and not be too harsh on Thirumalai’s management specifically on this issue.

DIscl: No holding, no buy/sell.

so shouldn’t we buying when this spread is low and sell when the spread is high? Is there a way to track this PAN-OX spread? In the AR speech available in their site, the mgmt did warn explicitly that they are still a commodity company and the 1st qtr results should not be multiplied by 4!!

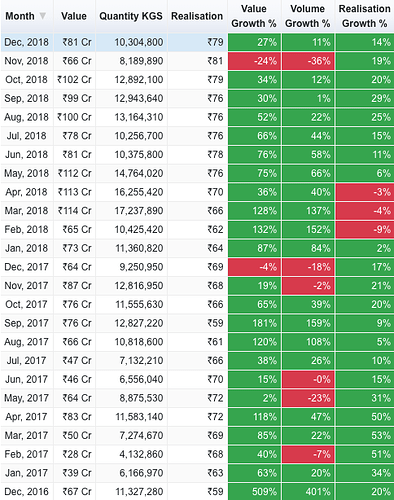

Based on Nov '18 imports of Phthalic Anhydride, I had contended that demand was dropping and the management had mentioned that it was temporary thing as “people just sat on their hands and stopped buying for a month and a half” due to the price volatility. It looks like the management was right and I was wrong based on the December numbers.

Margins might still normalise but Q4 may not be as bad as Q3 perhaps. Looks like the worst is in the price.

Disc: No holdings or trades in the last 1 year. Not interested. Just correcting my assumption based on new inputs.

IMHO, Demand has improved but margins have not. PAN imports of more than 10000 MT per month is very high. Compare that with average monthly sales of PAN of Thirumalai (11000 MT and IGPL 13000 MT). It appears to be dumping / aggressive imports at wafer thin margins .

The spreads between Phthalic Anhydride and raw material Orthoxylene has not improved. In December, PAN price is Rs.79 per kg and OX is Rs.76 per kg which means a spread of only Rs.3 per kg. Compare this with spreads of over Rs.25 per kg in 2017-18.

December is when the duty protection ended

The last quarter result includes December and December was lower than any months in previous quarter

I think Jan will really show what effect the imports with duty protection will have on profits

Thanks for the wonderful work you have been doing across this forum .

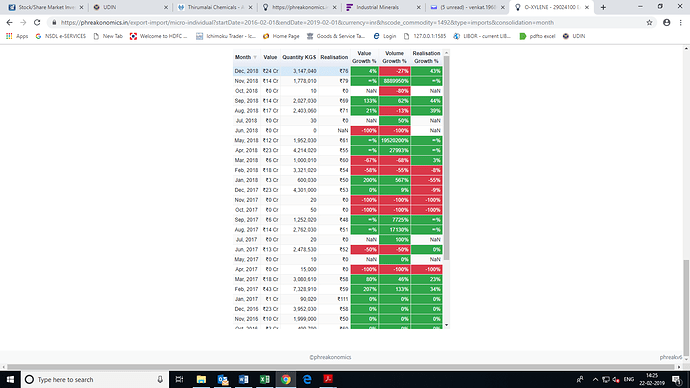

I just wanted to check if anyone has the latest update on the existing spreads between PAN and o-xylene … the jan-19 data on your website suggests that the RM export price was around ( 58/kg ) , assuming that represents the price at which igpl and thirumalai also source their raw material purchases , what we need is the selling price of PAN which I guess has remained around 70/kg ( source again being same data ).

So joining the 2 , is it a fair assumption that spred is now around 10-12 rs /kg or am I missing something here .

Demand wise the imports volume of pan did increase in Jan while the exports of o- xylene remained flat which suggests indian producers could utilise the raw material ? I wonder if this is beginning of some recovery for the 2 large players ?

Phreak , could you please also advise by when feb19 data will be available to review this hypothesis ? Thanks

Disclosure - no position, tracking igpl and thirumalai for some time to build up position .

Feb-19 data www.phreaknomics.in for PAN and o-xylene prices continues to project a weak trend from a end realization and strong raw material prices .This possibly corelates to the weakness seen in the underlying equity prices for both igpl and thirumalai… If we extrapolate the weak quarterly numbers from the paints playeesn ( Kansai nerolac declaring no’s yesterday ) things may not be looking great for the sector ?

To add , has anyone seen the impact of end of anti dumping duty on the sector yet ? Secondly what could be the reason for the weaker realisations for pan ( 65-68 rs / kg) when raw material o-xylene has seen increase presumably due to increase in crude prices .Does this point to an absence of pricing power despite the duopoly in this sector ? Valuation wise both look interesting with strong balance sheets but not inspiring confidence on sustained profitability .

Would appreciate any contradictory/other views ? Thanks

Disclosure- still not invested but exploring given the string balance sheet , duopoly and lack of debt with good customer profile …

Sir, based on whatever understanding i have from various sources, the spreads for Q4 are around the same levels as Q3 (slightly better) but from April onwards, the spreads have increased significantly (from $105/MT to $150-160/MT) based on IGPL Prabhudas Liladher Report.

PL-MidCap_SmallCapDay_PostConferenceNotes_16-4-19-PL.pdf (2.8 MB)

Further, the company have procured 1 month inventory (vs 15 days earlier) in April 2019 when the crude oil price started to rise as Reliance (the main supplier has taken a maintenance shutdown) and hence, they have been more or less protected from the recent rise in crude oil price post Iran sanctions.

What recovery? Even IG Petrochem, mentioned in the broker/advisor report dated 16th April, has margins down to pre 2016 levels. Exited.

Both IGPL and TCL have applied to Govt for imposition of safeguard duty. Means margin under stress.http://www.dgtr.gov.in/sites/default/files/Initiation%20-%20PAN%20safeguard%20Eng.pdf

Thank you. The ministry atleast is finding that there is primafacie truth in what both the applicants have stated. It is affecting the domestic industry. Any idea how long this investigation by the Ministry will take ?

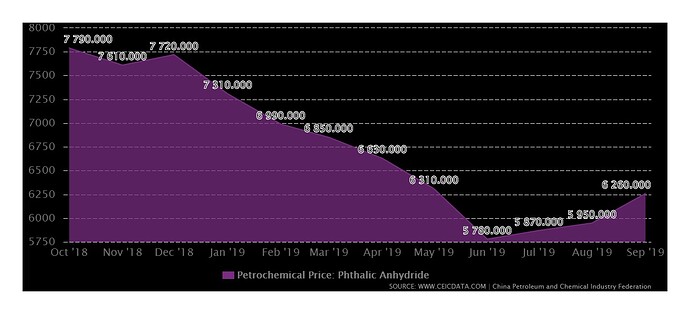

Got the data from CEICdata.com. The prices of Pthalic Anhydrid is on the upward curve from June 2019. with softening of Crude prices and improvement in finished goods, hope Thirumalai chemicals will be able to post better results than Q1

Can we get the data for the raw material , Orthoxylene? Spread is the most important factor

Can anyone help me understand how this will impact the chemical industry as a whole ? Will this benefit Indian exporters?

As per the media reports : Government is expected to offer tax incentives of 100 per cent for the first five years while the same will be limited to 75 per cent for the next five years and 50 per cent for five years thereafter.

Import duty on chemical used in plastic, Phthalic Anhydride, all set to increase for longer periods of time. DGTR recommends increasing the duty on imports from Korea to the level of Most Favoured Nation applied rate.

IG Petrochemical, Thirumalai Chemicals filed the application. https://t.co/6l0LXmzKPK

Maybe that is the reason both stock are flying