SME Holdings as on 13/09/2024:

| Stock | Cost % | Latest % | Avg Holding Period |

|---|---|---|---|

| Qualitek Labs | 10.53% | 15.77% | 58 |

| Holmarc | 15.08% | 14.76% | 198 |

| Trust Fintech | 12.06% | 12.84% | 43 |

| K2Infra | 14.35% | 9.04% | 9 |

| Aurangabad Distill | 6.04% | 8.56% | 351 |

| Chaman Metalics | 6.42% | 7.51% | 193 |

| Vision Infra | 10.02% | 7.36% | 1 |

| Delaplex | 10.27% | 6.42% | 12 |

| Knowledge Marine | 1.08% | 5.78% | 767 |

| Bondada Engineering | 8.32% | 5.61% | 15 |

| Kotyark Industries | 2.60% | 4.07% | 599 |

| Tanvi Foods | 3.22% | 2.29% | 1 |

The average holding period for Qualitek, Holmarc, Trust Fintech and Chaman Metallics is lower than actual due to tax harvesting. In all 4, I have entered on the day of listing and later on bought and sold.

Thesis for new additions:

- Qualitek Labs: Companies with 20%+ growth guidance for next few years - #213 by Dhvanit_Merchant17.

On top of the mentioned post here, the company is operating cash flow positive and has been investing significant amount on setting up their labs.

Their Fixed assets have increased from 14 cr in FY 23 to 30 cr in FY 24 (majorly capitalized after RHP date, i.e. after Jan 24 and before Mar 24) and is further expected to be at 42 cr in FY 25 (30 cr + 7 cr WIP + 5 cr from IPO funds).

Once they achieve operational efficiency in their newly established labs, it will act as a significant boost in bottomline PAT, although it may take 12-18 months to achieve that.

- Trust Fintech:

The company is into CBS software for co-operative banks in Maharashtra and is slowly adding new banks under its clientele. This provides a one-time decent revenue and a longer-term revenue for maintenance, bugs and updates since changing CBS for banks is a cumbersome task.

Moreover, from IPO funds they are developing CBS and LOS software for North America and Latin America. This may or may not work but their domestic revenue is enough for them to sustain and any revenue from these markets will boost their top line.

Recently, the company has also won small order from Indian Bank. This is a one-time order but they have started tapping the PSBs.

Investor Presentation:

TRUST_13082024111802_NewIntimationtoNSEInvestorMeet130824.pdf (nseindia.com)

H2 Results:

Company heavily capitalized their employee expenses, resulting into decent Profit and Loss. Had it been not capitalized; the company would be at nil profits. Moreover, they will continue to capitalize it in H1 FY 25 also.

Peers:

They have considered NPST and Veefin as their peers, but Trust’s customers are completely different from NPST and Veefin and also Trust do not have heavy tech implementation comparatively and thus do not command the same valuations as its peers and might never will.

- K2 Infra:

This company was in my watchlist, and I recently bought it after going through it’s AR and RHP. The thesis solely depends on their ability to execute their order book which the management has given timeline of 15 months.

Further: The SME portfolio - #110 by Dhvanit_Merchant17.

The valuations are overvalued, and the execution of the order book will dictate the valuations and price of the company.

- Vision Infra:

Proxy to NHAI capex. The company is into renting of road equipments. Having reviewed the RHP, the company looks decently valued amongst its peers.

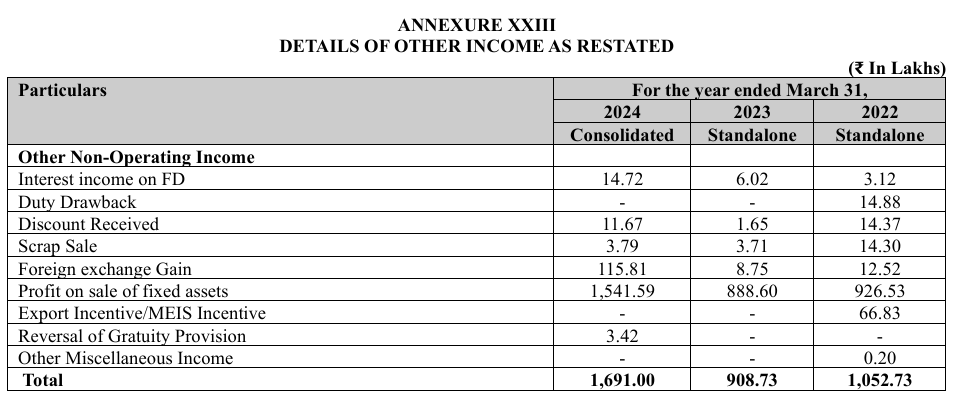

The negatives here are high debt and the profit arising from sale of fixed assets. It constitutes more than half of its PAT which is very high considering the nature of the income being one-time.

-

Delaplex:

Good business at good valuations. I had purchased it earlier in June but sold it due to some cash crunch and re-entered at the same price a month later. -

Tanvi Foods:

The company faces significant liquidity crunch.

They finally started production of the new manufacturing unit. The construction started at least 4 years prior.

The price has fallen quite a lot and valuations are completely off the mark.

The company also has significant inventory levels.

The production and sales from the new unit will command its future, else it is going towards mediocrity with the burden of fixed overheads from new plant.

New unit details:

3753d325-ac10-43a2-8406-bc5b90702aa9.pdf (bseindia.com)

Update on Bondada engineering:

I had sold the company in January with the reasoning of high valuations and it proved to be a big mistake. I have re-entered the stock, albeit at even higher valuations but they have started execution, and they routinely receive big orders.

Regarding previous high allocated holdings:

-

Omfurn:

I exited from Omfurn just before their FPO listing because of their poor subscription figures and high liquidity post FPO listing. I completely exited post H2 results. -

PNGS Gargi:

Once the holding turned into long term, I exited due to continuous trading at expensive valuations. The exit was just before their preferential issue.

My portfolio under SME stocks is at around 60%.

Average Holding Period post tax harvesting is 188 days.

From the previous post, I have exited in many of them post their sub-par H2 FY 24 results.