@Rafi_Syed: I am summarizing my understanding of the agri value chain, mainly focusing on agrichemical companies dealing with insecticides, fungicides, herbicides, and plant growth regulators. I am not including seeds or tractor companies.

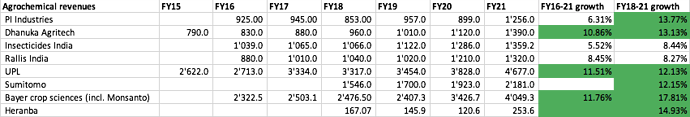

1. Domestic marketing companies: Traditionally, Indian agrichem companies would forge partnership with innovator MNCs (mostly Japanese, American and European) to launch exclusive products, whereby active ingredients (AIs) were procured from the MNCs. In this so called in-licensing arrangement, Indian companies would pay royalty on sales, in addition to buying AIs from the MNCs. A number of Indian players adopted this strategy (Rallis, Insecticides India, Dhanuka, etc.). This strategy is asset light in nature as formulation mostly involves mixing of different ingredients in a given proportion (making fixed asset turns of 8-10x). However, the downside of this strategy is that its not scalable beyond a given point (around 1’300-1’400 cr. of domestic sales). Here is domestic agchem revenues of large agchem players.

Its very clear that all Indian companies (PI, Dhanuka, Insecticides, Rallis) have struggled to scale beyond 1’300-1’400 cr of domestic sales. MNCs who have a larger product offering due to their global R&D along with better brand recall (I am considering UPL as a MNC here) have been successful in going beyond 2000 cr. Bayer numbers look very high because it includes Monsanto’s seeds business, for UPL ~10% contribution would be seeds (so domestic agchem would be ~4000 cr.).

Once a large domestic scale is reached, companies face usual vagaries of monsoon, government policy, etc. making sales growth in-line with nominal GDP growth. However, this business is super capital efficient as shown in the return ratios of companies like Dhanuka (30%+ ROCEs leading to high dividend payouts and buybacks).

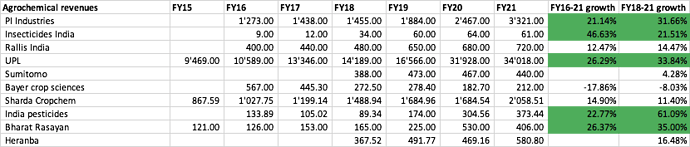

2. Exporters of AIs: In the last few years, this space has garnered a lot of attention due to shift of market share from China to India. A large number of companies have been doing well here. There are largely two business models that exist here, i) Export of generic off-patent AIs and (ii) Export of patented AIs by collaborating with MNCs. In the second category of patented exports, PI is the only successful player with some others like Bharat Rasayan and Astec Life trying to crack this business model. This line of business is very sticky and high margin in nature. Below is agchem exports of major Indian companies.

Generic or patented, exports have grown for everyone. Even MNCs such as Sumitomo have started using India as their base to manufacture AIs. Fastest growth players (20%+ sales growth) are Bharat Rasayan, India Pesticides, PI Industries, UPL (through acquisitions), Insecticides India (although on a small base). If we only consider off-patent AI exports, most players have scaled to 400-600 cr. kind of annual sales. PI with its unique business model has scaled beyond 3’300 cr. and is in a very different league.

In this business model, capex is of utmost importance making it capital heavy unlike domestic formulators who only need to setup a strong marketing engine.

3. Global marketing companies: Global agchem marketing companies build a portfolio of finished formulation of agrichemicals by registering in different countries, and sell them as per demand from the respective countries. Two such listed companies are UPL and Sharda Cropchem, who derive a significant proportion of revenues through outsourced manufacturing. Sharda Cropchem has a unique business model, where they do not manufacture AIs or formulations but procure it from different suppliers and supply it as per demand from various markets. Sharda has grown sales at ~18%+ rates over the past decade. In this business model, money is spent in registering products which is both time consuming and expensive (3-30 cr. per product depending on the geography). Once a company has a large portfolio of registered molecules, their job is to procure from manufacturers according to demand schedule and manage working capital. So capex is in form of molecule registration (and not machinery management) and working capital management is important to generate reasonable cashflow (to fund further registration). This business has very good economics (20%+ ROCE). To showcase how scalable a marketing business can be, revenue per employee for Sharda is ~13.69 cr. in FY21 (vs 0.42 cr. for HCL Tech and 0.32 cr. for TCS).

Here’s the summary of the three business models

Domestic marketing: High return ratios + asset light + strong working capital management + limited growth (beyond 1’300-1’400 cr.)

AI export: Asset heavy + Product concentration risk + strong growth with a large market (PI has scaled to 3’300 cr.+) → return ratios is a function of product profile

Export marketing: High return ratios + very high registration costs + strong working capital management + strong growth with very large runway (UPL has scaled to 34’000 cr.+)

Now lets see how market is currently valuing these business models.

Domestic focused companies: Market values MNCs much higher than Indian players. Sumitomo, Bayer trade at 25x+ EV/EBITDA and 5+ EV/sales (basically at branded FMCG kind of valuations). The remaining (Rallis, Insecticides, Dhanuka) trade at 1-2.5x EV/sales or 10-20x EV/EBITDA.

AI exporters: These are currently in market fancy and trade at 5x+ EV/sales or 20x+ EV/EBITDA. Also, these companies as a group (PI Ind, Bharat rasayan, Astec Life, India pesticides) have shown higher growth rates than domestic focused companies (so premium valuation is for a reason). In this lot, the cheapest companies are Meghmani Organics and Heranba and that has to do with corporate governance doubts in the minds of market participants.

Global marketing: Both UPL and Sharda Cropchem trade at very modest multiples (9x EV/EBITDA for UPL and 5.5x EV/EBITDA for Sharda). Similar to generic pharma, market is currently not assign a high multiple for formulation exporters. I find this to be the most opportunistic space because both UPL and Sharda are growing at high rates (15%+ sales growth) and are not in fancy (UPL probably because of governance doubts and Sharda because of their different business model which involves intangibles and is clearly not understood by the market).

My approach

Clearly the most exciting space (in terms of growth) is that of exports. In AI exports, I like PI’s business model the most. However due to high valuations, I have reduced my allocations over time (from 6% in 2018 to 2% currently). Bharat Rasayan is also at an interesting juncture, if they are able to crack the MNC business (like PI did) their valuation might expand. In terms of new listings (India Pesticides, Heranba), I find India Pesticides as more interesting. However, in the paucity of a public market track record, I will prefer Bharat Rasayan (as both are trading at similar valuations).

My bigger bet is on Sharda Cropchem which is growing at very high rates and have built in operating leverage (in terms of higher possible sales per molecule). Also, their margins are at decadal low levels, so a revival in margins will have disproportionate impact on earnings (and they are cheap even at current margin earnings). So Sharda can benefit from margin expansion + multiple re-rating, that’s why my higher allocation.

This is a very rough mental model that I have built, I will be very happy to discuss more specifics and dive into more granular discussion.