With the recent fall in prices, I am slowly increasing risk in my portfolio. A lot of commodity and cyclical businesses are trading at very low valuations. My thought process at this point is to increase my portfolio allocation to the more risky commodities/cyclicals. I am doing this by using 1% cash left in the portfolio and reducing the position size of Reliance Industries from 6% to 4%. The cyclical positions are shown below:

- Shrimp exporter (2%): Avanti feeds

- Airlines (6%): Indigo

- Real estate (9%): Kolte Patil (5.5%), Ashiana Housing (3.5%)

- Commerical vehicle (1%): Ashok Leyland

- Steel (1%): Maithan alloys

Basically, I have added 1% position size in Real estate (0.5% increase in Kolte and Ashiana). I have created 1% position in Ashok Leyland and Maithan alloys. The rationale for them are:

- Ashok Leyland - CV is a highly cyclical business, @amey153 explains this beautifully in his blogpost . Key risk for me is the capital allocation policy of Hinduja group, which is probably why the stock is down 24% today. Also, they lost their key man to Eicher last year. But its trading at low cyclical valuations and should do well when CV cycle turns (sometime in the next 3 years)

- Maithan alloys - Detailed rationale is posted here Maithan Alloys Ltd - #232 by harsh.beria93

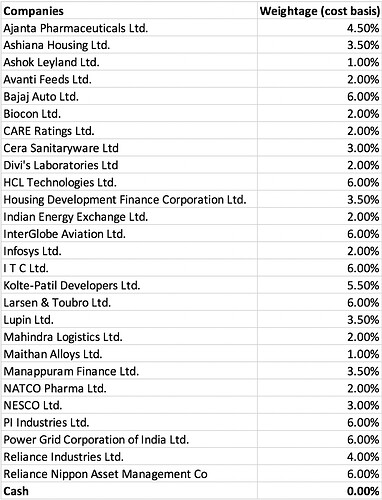

The updated portfolio is: