As of today, I initiated a 2% position in VF Corp. They own very renowned brands like North Face, Vans, Timberland, Dickies and Supreme. I am a big fan of their North face brand which produces very durable sports accessories.

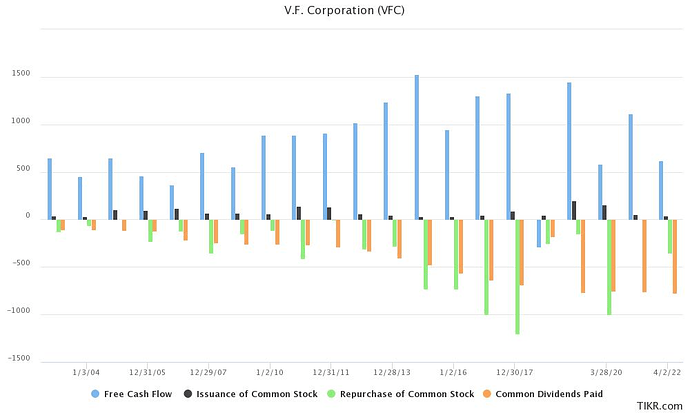

This is a 100+ year old company with a history of profitable growth and growing dividends. They return most of their free cashflows via dividends or buybacks (see below).

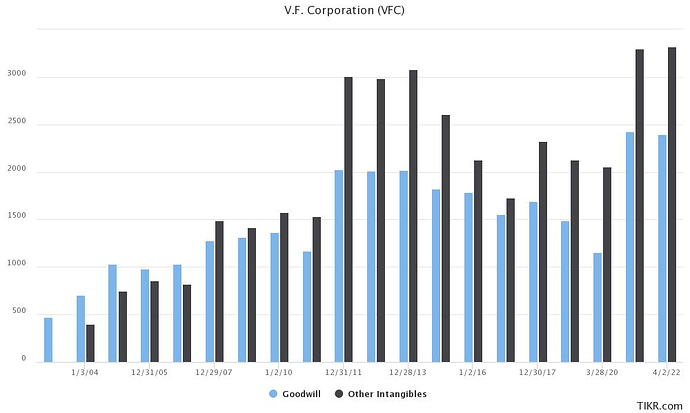

With current recession fears, stock has gone down a lot and is trading at 2012-13 levels. However, their core brands are very strong. In last few years, they have grown via inorganic expansion, with the last one being a $2bn acquisition of Supreme brand in 2020. Most of their manufacturing is outsourced to China, as a result of which most of the balance sheet is working capital + intangibles.

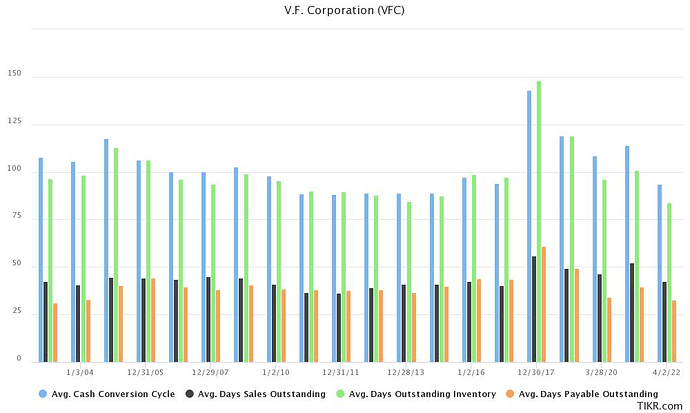

Receivables are generally set-off against payables, and company funds inventory from their own book (3-4 month of working capital). Given their strong positioning, working capital has been well managed over years.

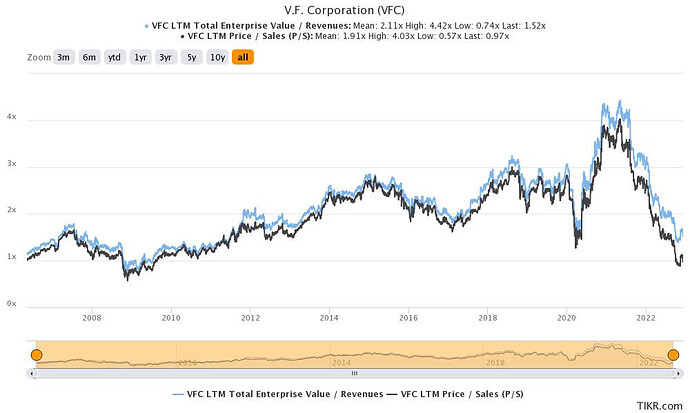

In terms of valuations, the only time they traded at lower multiples (on EV/sales) in the last 15 years was during 2008-09 crisis.

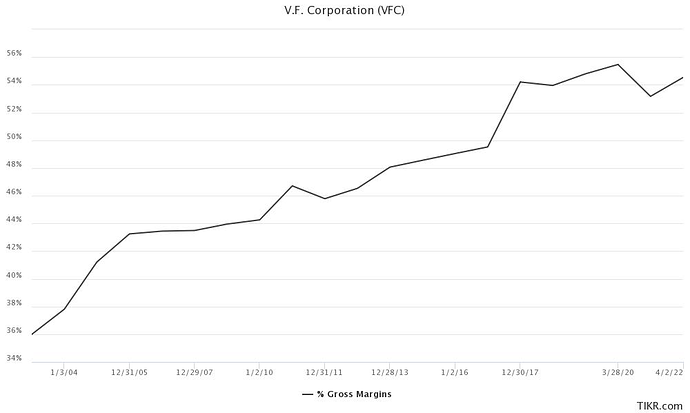

However, since 2008-09, their gross margins have improved significantly. So I do not think that current valuations are very demanding.

I will scale up position if valuations go down to 2008-09 levels. If this position doesn’t work out, I will blame @rajanprabu as he brought up this idea. If it works out, I will take the credit ![]()

Updated portfolio is below and cash reduces to 18%.

| Companies | Weightage |

|---|---|

| AB InBev | 5.00% |

| Berkshire Hathaway | 10.00% |

| Disney | 5.00% |

| Fairfax India Holdings | 10.00% |

| Markel Corporation | 5.00% |

| Philip morris | 2.00% |

| Uber Technologies Inc | 2.00% |

| UBS ETF CH-SMI | 5.00% |

| Vanguard Emerging Markets Stock Index Fd | 10.00% |

| Dropbox Inc | 2.00% |

| Netflix Inc | 5.00% |

| Suzuki Motor | 5.00% |

| Starbucks | 5.00% |

| Inmode Ltd | 2.00% |

| DWS Group GmbH & Co. KGaA (DWS) | 2.00% |

| 5.00% | |

| VF Corp | 2.00% |

| Cash | 18.00% |