what do you think about jash engg

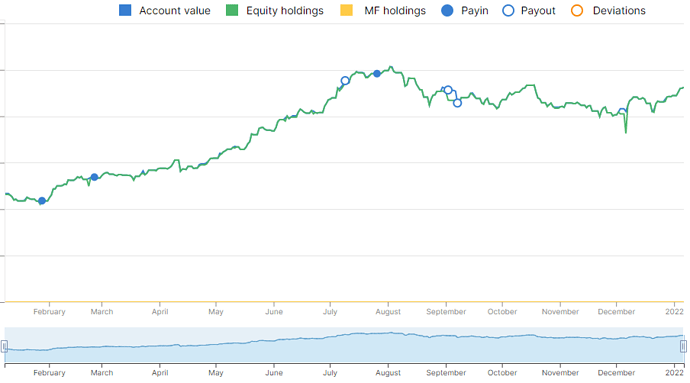

Latest folio status:

Again at ATH.

Note – Table sorted by “% of Total"

| Company name | Last price | Cost per share | % of Total | Total return % | Current return % |

|---|---|---|---|---|---|

| RACL Geartech Ltd | 728 | 252 | 7.3 | 208 | 189 |

| Tips Industries Ltd. | 2170 | 861 | 6.0 | 153 | 152 |

| Shakti Pumps (India) Ltd. | 683 | 537 | 6.0 | 57 | 27 |

| Pix Transmissions Ltd. | 972 | 454 | 5.8 | 125 | 114 |

| Expleo Solutions Ltd. | 1740 | 632 | 5.5 | 196 | 175 |

| Manorama Industries Ltd. | 1473 | 739 | 5.1 | 157 | 99 |

| Bajaj Steel Industries Ltd. | 912 | 450 | 4.8 | 162 | 103 |

| Laurus Labs Ltd. | 526 | 324 | 4.3 | 281 | 62 |

| Kopran Ltd. | 319 | 143 | 4.3 | 164 | 123 |

| KPR Mills Ltd. | 715 | 315 | 4.1 | 134 | 127 |

| Dynemic Products Ltd. | 626 | 394 | 3.9 | 79 | 59 |

| Steel Strips Wheels Ltd. | 799 | 859 | 3.6 | -7 | -7 |

| Sandur Manganese & Iron Ores Ltd. | 2439 | 1998 | 3.5 | 22 | 22 |

| Bajaj Healthcare Ltd. | 402 | 238 | 3.2 | 105 | 69 |

| Shivalik Bimetal Controls Ltd. | 383 | 294 | 3.1 | 31 | 30 |

| Fairchem Organics Ltd. | 1743 | 1574 | 3.1 | 10 | 11 |

| Globus Spirits Ltd. | 1487 | 1276 | 3.0 | 19 | 16 |

| Godawari Power & Ispat Ltd. | 279 | 248 | 2.7 | -18 | 12 |

| Optiemus Infracom Ltd. | 303 | 363 | 2.5 | -16 | -16 |

| Praj Industries Ltd. | 372 | 372 | 2.4 | -1 | 0 |

| Dish TV India Ltd. | 18 | 21 | 2.4 | -17 | -17 |

| Steel Authority Of India Ltd. | 112 | 132 | 2.4 | -13 | -15 |

| Meghmani Organics Ltd. | 107 | 114 | 2.3 | -15 | -6 |

| Meghmani Finechem Ltd. | 758 | 772 | 2.3 | -2 | -2 |

| Valiant organics Ltd | 1240 | 1365 | 2.3 | -5 | -9 |

| Vipul Organics Ltd | 163 | 156 | 2.1 | 175 | 4 |

| Marksans Pharma Ltd. | 61 | 79 | 2.1 | -23 | -23 |

DISCLAIMER : this is not investment advice, I am not a sebi registered investment advisor

please do your due diligence before investing

Hi Sushant,

I took a short look at Jash engg, did not like it much. From their latest update published, there is an order backlog of 450 Cr, which is just above the TTM turnover 315 Cr. Yes, the sector seems good, hence the decent valuation but do not see much upside left perhaps. I wonder if water control gates etc. are really such a big thing? Their profitability seems terribly cyclical going by their past record.

Cheers!

Vikas

DISCLAIMER : this is not investment advice, I am not a sebi registered investment advisor

please do your due diligence before investing

It makes sense to add reasoning, since conviction is what we strive for, to make educated entry/exits, amidst the market melee. Will start writing in more detail about my holdings in descending order of folio weight.

1 .

RACL Geartech

This was one among some other gems (Sandur, Shivalik, GPIL etc.) picked up by way of tracking @ayushmit. Yet, it seemed to me, for quite a long while, too expensive for what was a 250 Cr market cap company then. The idea is that they have demonstrated punching much above their weight. The valuation naturally follows for such tremendous scope of fast growth given their tiny size. Sona comstars’ huge valuation being a decent comparable case, though not size wise.

The story in short is a turnaround driven by technocrats taking over their company, given a tremendous boost by a chance meeting with Kubota. Japanese engineering standards are what the world follows. Mathworks, a company I worked for, supplies the world-standard automotive software tooling (Simulink) used by all auto companies. They slowly learnt to follow the Toyota quality method, our CEO would swear by it.

Precision gears are the essence of EVs, simply because, electric motors run very silently and at much higher RPM, and a reduction gear is needed between the motor and the driven wheels. Noisy gears are simply not an option here. Europe is going way ahead of other markets in EVs, just look at the market data. This is the export market RACL caters to, esp. BMW seems much ahead of the rest of the pack.

The company shows varied engineering capability and once integrated in top auto company supply chains they get all kinds of support from their customers to ensure long-term results. Current valuations are again a worry, but it looks like the company can keep doing incremental capex, and keep growing as a steady compounder. With its engineering and global customer network strengths, valuations will likely sustain for long period of growth that should continue.

DISCLAIMER : this is not investment advice, I am not a sebi registered investment advisor

please do your due diligence before investing

- Tips industries

The music industry revenues changed quite a bit due to a Mumbai high-court order separating internet streaming from regular broadcast.

Streaming revenues are going to increase, the only question is if the content library remains contemporary and popular enough to compound earnings. Saregama seems a better bet because of size, the idea behind Tips was to find a better bargain in the industry.

Management shows signs of improving, top-level professionals might be brought in. The film biz is going to list separately and is looking at OTT content with rights sold beforehand than regular box-office release model which had been the focus so far.

Pending deals with some streaming platforms and drive for content creation will be good growth drivers. Stock may be on the play-list for long ![]()

DISCLAIMER : this is not investment advice, I am not a sebi registered investment advisor

please do your due diligence before investing

UPDATE:

Micro finance companies, like Ujjivan seem cheap, but I have just bought Ugro capital, it is MSME focused, on co-lending model mostly, listed in nov 2017, via buy of a shell company. Micro fin will keep funding NPAs for next 1-2 years, I just went for newish model of lending. Just trimmed about a dozen, most from SAIL, Optiemus, RACL and Shakti. Just put 2.5% of total capital

The idea for Ugro is that the entire team is from Religare which had to wind up since Ranbaxy brothers did fraud and killed it, none are involved like the brothers now in Tihar. They have tied up with lazy top PSU banks like SBI, BoB and are basically loan agents with their own money (20-30% of loan etc.) also involved.

DISCLAIMER : this is not investment advice, I am not a sebi registered investment advisor

please do your due diligence before investing

- Shakti pumps

Business of submersible pumps mainly, for agricultural use, value-added through pump solarization package with electrical control and solar panels. (not the cells)

This has been waiting for a long time, on the large-scale launch of PM-KUSUM scheme. Theoretically, the scheme would have solved problems of renewable energy and water for agriculture in one shot. Reduced discom losses and saved the grid from overload. But maybe the situation is more complicated to fix.

Funds for the scheme were finally allocated and even used, a few tenders even took off in 2020-21 but the next round is slow to arrive, delayed by a malicious court case which was thrown out by the courts about a quarter ago. Meanwhile the old tender has been extended, problem is the prices were not revised. The story has been delayed by half decade and may never be fully realized.

The plus point is that states are copying the scheme and avoiding the central branding. Though combined finances would have meant more success. If the idea is so great it might have decent adoption even without govt subsidies.

Now comes news of EV motor venture. Makes some sense given electric submersible motors are highly durable since they come with few year warranties and Shakti has good repute. To fix a submersible would mean to pull up the entire depth of bore-well pipes and wires etc. and re-build it again. Not as simple as fixing of a surface pump. They are also compact and powerful.

This may take time though, the expenditure may not be so great since around 50% capacity is idle.

DISCLAIMER : this is not investment advice, I am not a sebi registered investment advisor

please do your due diligence before investing

UPDATE:

Exited SAIL, added to Rajapalayam mills

Rajapalayam looks technically strong, trying to break ATH, added capacities in 2020 which did not contribute so far due to pandemic issues, Ramco group company, bit lazy, but group cross holdings are double current market cap, cotton is going to be a big thing going forward if they manage the cotton raw-material trading without trouble. Rajapalayam is adding more capacities, coming online soon, seems poised to grow. Chinese cotton is going to be banned soon, they say slave/prison labour is used, US already passed law related to Xinjiang province. Closer examination reveals Rajapalayam to be like a holding company more than a textile company, not that bad since the other companies of the group, Ramco cements, Ramco industries and Ramco systems are doing well, and their shares are decently positioned, so holding company should also do well. Cement is a really strong trend, industry is running to full capacity and adding more. Ramco industries does roofing and other sheet materials, another record trend but may moderate, since demand is linked to agricultural/rural uses. Ramco systems is a mystery, but may make a decent recovery soon, apparently they did not get paid for some projects.

SAIL was the weakest link, PSU, lazy, commodity cycle peak, analysts are hinting at China coming back once olympics are over. Something had to go away, that is all, to raise money, SAIL looks strong technically also. Steel looks good also but SAIL may be near top of cycle, given Chinese real-estate just crashed, and India is lukewarm and world-wide cycle may be about to turn with increase in interest rates soon, also infra spending may slow down. Still invested in GPIL and Sandur in steel sector. When buying SAIL, thesis was target of an ATH+ level almost, wishful thinking maybe, and the lowest growth prediction, bet was on a fancied steel super-cycle based on infra spending, too much guess work, apparently raw-material costs such as coking coal and ore etc. are driving up costs so margins are not great. PSUs usually distribute dividends and may not be great bets for capital appreciation. Govt forces them as the biggest shareholder to pay it dividends, they do not care since dividend is tax free for govt but we pay regular income tax rate on it.

Hence 28 stocks in folio, difficult to get convinced about stories, people sell them as high-quality, long term, compounder. I cannot put that much trust in my mother, the way people write about a business. I only see a trend and a relative safe under-valuation, and trust it with a small amount of my money. It is easy to pump stocks saying high-quality, long story, to keep people riding the gravy train even after earnings and price mishaps, until they tire and forget. All the while hiding your own holding details.

Also sold little of RACL, Tips and Dish TV, to make Rajapalayam ~2.5%

RACL and Tips have become 3x, looking little overvalued, Dish TV is a complex situation, since it is broadcast company, ministry must give sanction for all senior positions, hence directors appointment can be stone-walled by promotors who are politically connected, DD free-dish is competing well and also Airtel and Tata-sky, tariffs have been highly regulated and become cheaper, accounts are murky, the only plus is that the cash generation is huge and is cheap even though can be a biz in decline due to OTT.

My weak links are, in order of decreasing weakness:

- Optiemus, potential is great, but it may take years.

- Marksans, or any pharma which is not growing at decent speed will look bad compared to the previous year

- Dish TV, as stated above

- Valiant organics, too slow to commercialize capex which finished 1 year ago, casts doubt on their quality

Will drop or pare them if any other better one is found.

DISCLAIMER : this is not investment advice, I am not a sebi registered investment advisor

please do your due diligence before investing

Agree that Tips looks slightly overvalued now, but still significantly cheaper than Saregama. Plus the demerger special situation is likely to play out soon. That said, Saregama is probably a more sustainable long term growth story with deeper pockets for content acquisition, especially after the QIP, and the professional management team. Assuming that there will be no incremental capital from music deployed into other businesses.

I am planning on swapping Tips for Saregama if the relative valuaiton becomes 1/2.5.

I had bought when the relative market caps were 1/5, which is already down to 1/3.5. Your thoughts on this approach?

Full portfolio Vineet Jain portfolio

Hello @vikas_sinha : Have you studied Ambika Cotton Mills? They are also into Cotton

Saregama may indeed be better, as stated, Tips was like a cheaper substitute, given valuation gap. But I would not switch, even if the gap narrows down, though I think it may not to your desired level. Tips has a simpler business, and demergers usually give a kick. I do not put too much weight on management speech making ability, IDFC bank would have been a rocket, maybe even India inc., by that measure. A cheaper valuation has safety of disappointment perhaps.

Yes, found Ambika while tracking @ayushmit so you seem to be in good company

I do not understand how the cotton cycle margins would behave. Also capacity utilization and expansion are not clear. Given company and management quality it does seem at a good valuation though. Maybe I do get interested.

@vikas_sinha what are your views on the catalogue owned by Zee limited? Especially the newer media that is enriching Zee portfolio. Do you foresee a similar value unlock possible there? How does Sony acquisition factor into this equation?

Thanks for your diligent engagement eth the community here. Much appreciated.

The situation is more complicated, can be gauged from the number of questions you have posed  I have not followed the context to be able to answer, avoided coz of news-flow related run-up, though now it seems to be providing an entry point. A simple answer would be a Zee+Sony combine does look quite strong.

I have not followed the context to be able to answer, avoided coz of news-flow related run-up, though now it seems to be providing an entry point. A simple answer would be a Zee+Sony combine does look quite strong.

Rights is a poor solution overall, but it does show fairness to all current holders and also shows the interest of promotor in adding capital at the current valuation. Q3 is weak simply because of wind-mill income falling drastically, textiles did better but power from the wind-mills is almost an equal contributor to profits!

I thought I read some update somewhere about some maintenance, indeed it cannot be the wind speed or power sector slowdown

- Pix transmissions

This would fall under the category of capital goods (rubber belts), very well covered thanks to @RajeevJ (as also gems like Kopran etc.) The essence is the stickiness of the sales, since majority is covered under regular/preventive maintenance capex of end-users, as nobody wants production shutdowns due to unpredictable breakdowns. So belts are regular consumables of various kinds of machinery, with stocks being kept and regular replacements occurring. Once customers are gained they would observe the quality over time and expectedly not change vendors much.

This is a company that managed to sell-off its hoses division to a reputed MNC at a considerable premium, so it seems to have pedigree. Exports markets seems to be growing and quality seems good enough for global competition. They may benefit from China+1 sourcing and are increasing capacities by 50%+ in coming FY. Since belts come in many shapes and sizes, they recently tried to streamline and reduce logistics costs by spending on centralizing their warehousing. Such a business deserves a decently elevated valuation, given regular sales, decent moat and margins with some in-built safety, with scope for growth esp. via exports to large, developed markets (targeting US sales).

DISCLAIMER : this is not investment advice, I am not a sebi registered investment advisor

please do your due diligence before investing

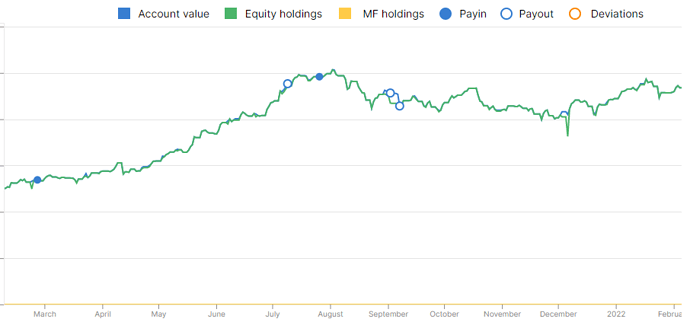

Latest folio status:

Finally crossing mid-october 2021 ATH repeatedly since 1st week of january 2022.

Note: withdrawal (payout) worth 8% of folio value done in past year, divided into 5% for taxes and 3% for living expenses (incl. car and furnishing of new house).

’

Note – Table sorted by “% of Total"

| Company name | Last price | Cost per share | % of Total | Total return % | Current return % |

|---|---|---|---|---|---|

| Pix Transmissions Ltd. | 1050 | 454 | 6.1 | 146 | 131 |

| Tips Industries Ltd. | 2235 | 862 | 5.9 | 168 | 159 |

| RACL Geartech Ltd | 619 | 252 | 5.7 | 179 | 145 |

| Bajaj Steel Industries Ltd. | 1004 | 450 | 5.3 | 183 | 123 |

| Shakti Pumps (India) Ltd. | 592 | 538 | 5.0 | 42 | 10 |

| Expleo Solutions Ltd. | 1558 | 632 | 4.8 | 170 | 147 |

| Manorama Industries Ltd. | 1337 | 740 | 4.5 | 141 | 81 |

| Laurus Labs Ltd. | 529 | 326 | 4.2 | 288 | 62 |

| KPR Mills Ltd. | 716 | 315 | 4.1 | 134 | 128 |

| Kopran Ltd. | 301 | 143 | 3.9 | 155 | 111 |

| Shivalik Bimetal Controls Ltd. | 479 | 294 | 3.8 | 64 | 63 |

| Fairchem Organics Ltd. | 2073 | 1574 | 3.6 | 31 | 32 |

| Sandur Manganese & Iron Ores Ltd. | 2567 | 1998 | 3.6 | 29 | 28 |

| Steel Strips Wheels Ltd. | 803 | 856 | 3.5 | -7 | -6 |

| Dynemic Products Ltd. | 562 | 395 | 3.5 | 64 | 42 |

| Bajaj Healthcare Ltd. | 410 | 238 | 3.3 | 109 | 72 |

| Godawari Power & Ispat Ltd. | 324 | 248 | 3.1 | 0 | 30 |

| Globus Spirits Ltd. | 1504 | 1276 | 3.0 | 20 | 18 |

| Vipul Organics Ltd | 218 | 156 | 2.8 | 210 | 39 |

| Meghmani Finechem Ltd. | 932 | 772 | 2.8 | 21 | 21 |

| Praj Industries Ltd. | 430 | 372 | 2.8 | 15 | 16 |

| Ugro Capital Ltd. | 222 | 215 | 2.7 | 3 | 3 |

| Meghmani Organics Ltd. | 112 | 114 | 2.4 | -11 | -2 |

| Valiant organics Ltd | 1162 | 1365 | 2.1 | -11 | -15 |

| Dish TV India Ltd. | 17 | 21 | 1.9 | -24 | -21 |

| Optiemus Infracom Ltd. | 290 | 361 | 1.9 | -24 | -20 |

| Marksans Pharma Ltd. | 57 | 79 | 1.9 | -28 | -27 |

| Rajapalayam Mills Ltd. | 1075 | 1299 | 1.8 | -17 | -17 |

DISCLAIMER : this is not investment advice, I am not a sebi registered investment advisor

please do your due diligence before investing

Hello

I bought this co at around Rs 450 but could not hold on to it

Ny funda was totally based on the product as I agree that vbelt is a very important spare for any factory

My point is how u get that conviction on such companies which are closely held and pass very little information to the public

out of your current pf which are the top 5 stocks that are near earning or growth triggers or can which do you feel will outperform the market by a good %. loved your thread