- Few pointers why i would delay the investment in this company

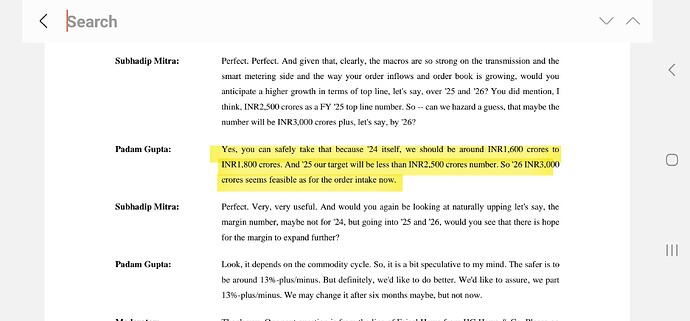

Data centre Chennai data centre commissioning pushed from sept23-dec23 to now march 24

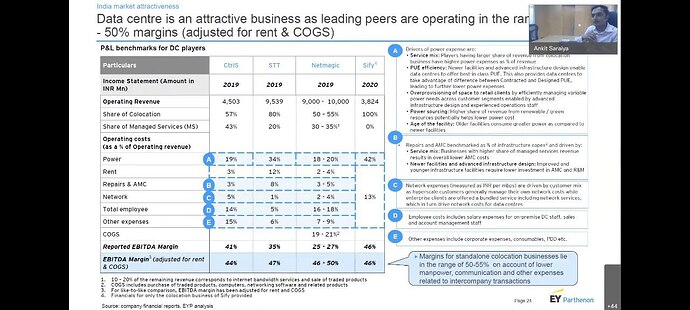

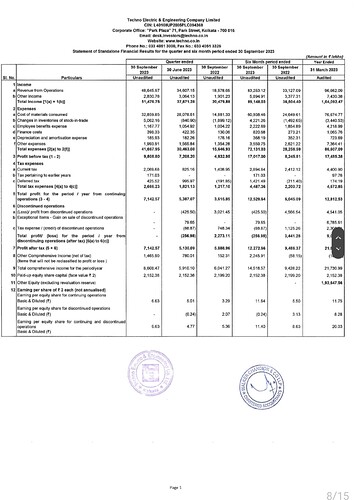

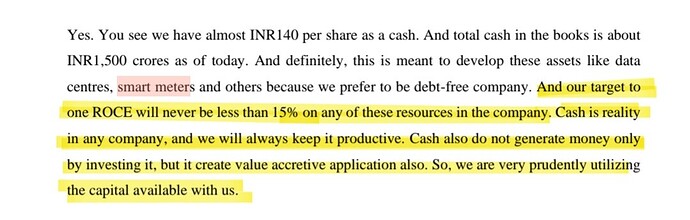

data centre and AMI business is pulling the numbers down on a consol level

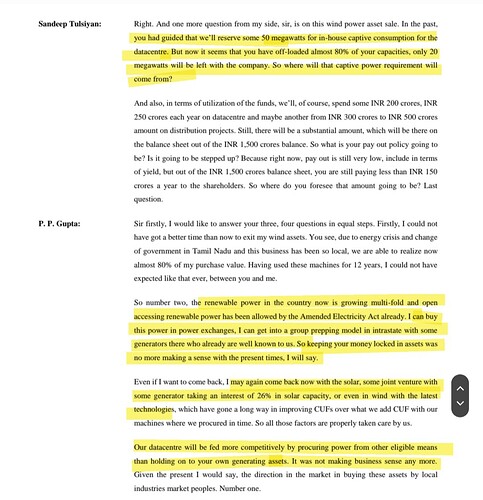

all the investments in data centres and AMI is not generating any revenue so mostly the kicker will come from q4 fy23 or maybe q1 fy24

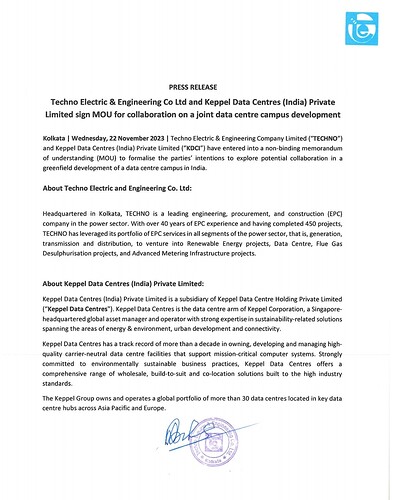

but i guess the price may shoot before that if they get some strategic investor to do a JV or Buyout the data centre business

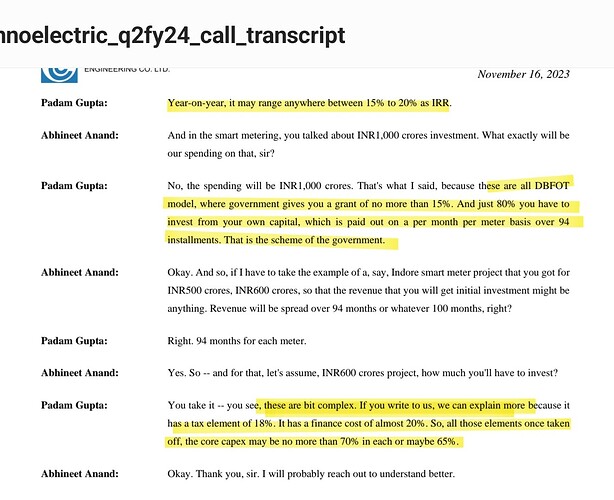

Techno can also be a good pick as it caters to all the themes which are currently in momentum namely power transmission,Smart meter,Data centre etc