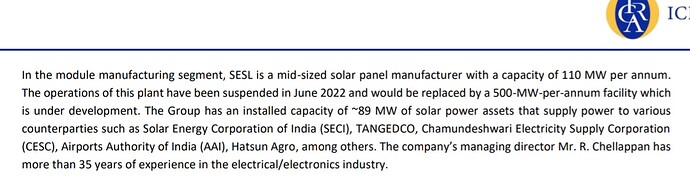

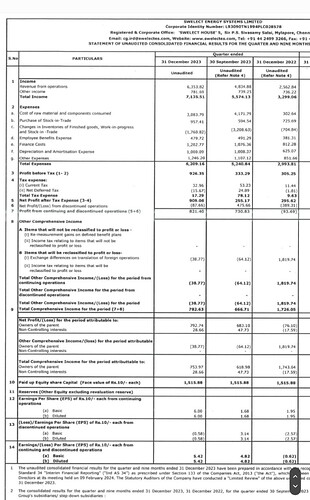

Swelect Energy Systems Limited is a solar power systems company with presence in solar PV module manufacturing, EPC

services for solar power plants and solar power generation. The subsidiaries of SESL have been incorporated to develop and

operate certain solar power plants of the Group

Some useful information from its Annual report.

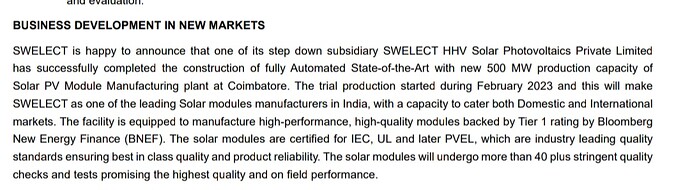

● New 500 MW production capacity of solar PV module manufacturing plant at Coimbatore…

( Earlier capacity was 110 MW )

Trial production for this 500 MW plant started in February 2023

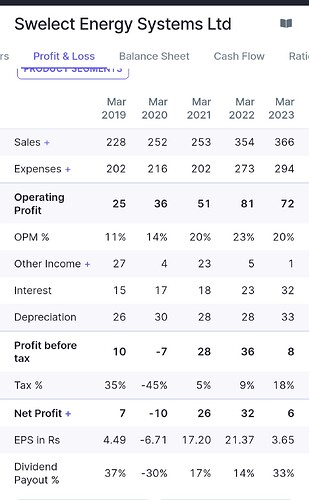

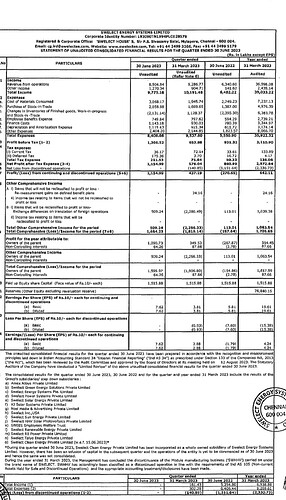

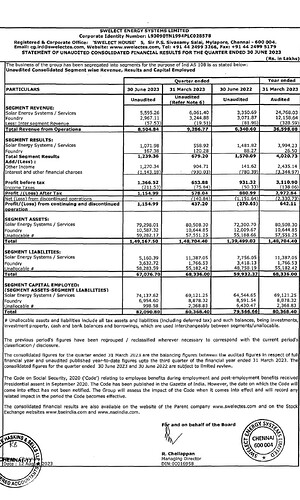

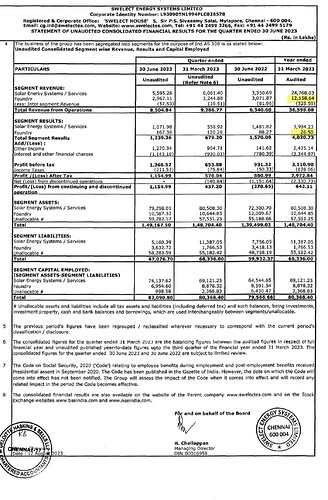

● Topline was lackluster from 2015 ( 222 Cr.) to 2021 ( 253 Cr. )

However in 2022, there was a big jump of about 40% - 354 Cr.

- In my view new production plant of 500 MW could be a game changer in accelerating its topline growth…

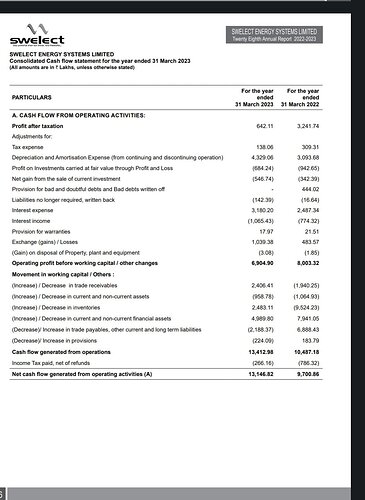

● Net CFO ( Consolidated )

Fy 22 = 97 Cr.

fy23 = 131.46 Cr.

Current Mcap: 675 Cr.

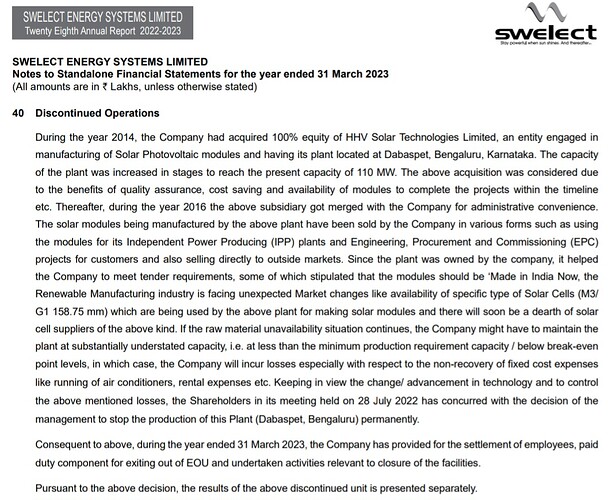

● Company stopped it’s production of it’s plant in Bangluru ( 110 MW ) in 2022 - due to “unavailability of specific types of Solar cells”

The plant was operational since 2014.

Side effects & risk of change in technology ![]()

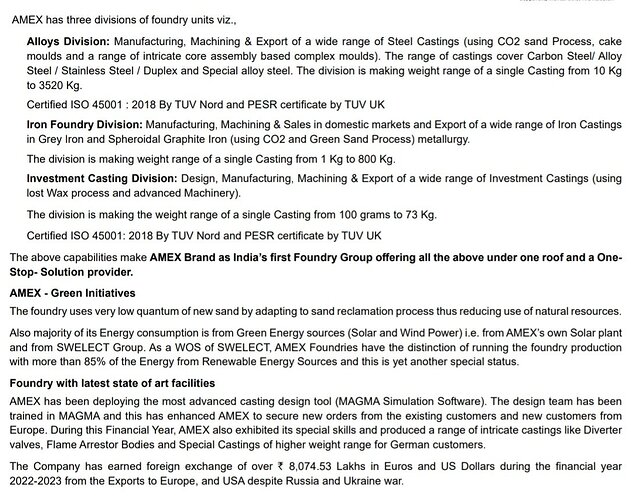

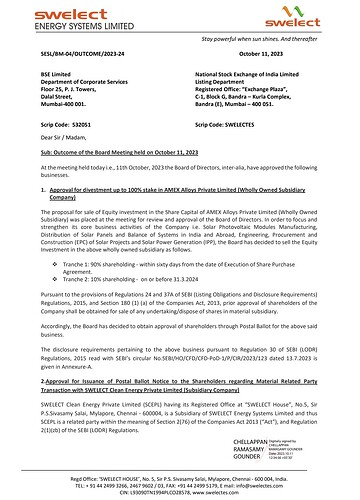

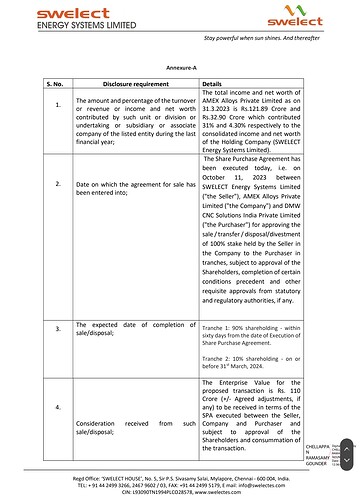

● Its subsidiary - Amex Alloy pvt. ltd.

Three division - Alloys, Iron Foundry Investmenr casting

“India’s first foundry group offering all the above under one roof & one stop shop solution”

80 Cr. Revenue in export from this subsidiary…

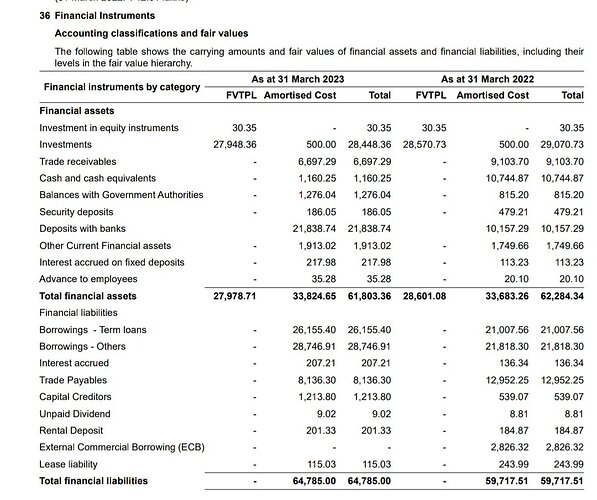

● Consolidated Financial instruments by catagory.

Debt - 549 Cr.

Investments - 280 Cr.

Deposits & cash balance - 250 Cr.

● Also on technical charts, stock price is consolidating since last 15 years, finding resistsnce at around 450 levels. Currently at the resistance level.

Disc: I have invested in this stock recently. About 2% of portfolio.My views are biased.

This is not an investment advise. Do your own research.

Note: There was another thread on this company on VPFORUM, however, I found that it was closed long ago and there was no option of reply on that thread, so I have created a new one.