Sundaram clayton and Sundaram finace are 70% over last year lows so either markets still believe in the integrity of the management or may be it is Euphoria making the stocks buoyant, I believe the markets reaction to SF de merger has been positive so far. The growth path is clearly visible and all the subsidiaries are in fast lane. It is a buy on dips.

The holding company has listed on NSE. Any views on fair value.

It was valued at 150 by MSCI Small Cap index after allotment but before listing. Looks like we’ll see successive lower circuit days until this value is reached. However the acquisition cost for the two (SFL & SFHL) are 93.89% and 6.11% according to the notice on February 22.

By this logic, the fair value might be closer to 110~120. Looks like there is a steady queue of sellers every day on this counter until we see such levels.

TT Srinivasaraghavan of Sundaram Finance speaks about COVID-19 impact

T T Srinivasaraghavan, managing director of Sundaram Finance Ltd, said, “We live in the time of great uncertainty and the overall outlook for the economy is not promising. The first half of the year is likely to be muted but a major thrust on infrastructure spending and a favourable monsoon could revive sentiments in the later part of the year.”

Disc: Invested

On Q4FY20 Profit Slump:

Typically, most retail borrowers and small transport operators bring their accounts up-to-date at the year end, with a view to keeping their credit history relatively clean and start the new financial year on a clean slate. The lockdown essentially affected the recovery of dues from delinquent accounts, resulting in a higher credit cost during the quarter. This explains the drop in net profit for the quarter.

On Liquidity & Fund Raising Plans:

Fortunately, liquidity has been more than comfortable for us. We have raised approximately ₹3,500 crore in recent weeks and pricing has been quite favourable. Our fund raising plans will depend on the trajectory of economic recovery.

Disc: Invested

Is this a good stock to enter currently in light of corporate restructuring moves and potential value unlocking by TVS group :

https://timesofindia.indiatimes.com/business/india-business/tvs-group-set-to-announce-restructuring-of-holding-company/articleshow/76862320.cms

Made a big allocation to Sundaram Finance yesterday.

Technically, the stock is coming out of a 5 year long consolidation and turning bullish on long term charts. The stock price may go up significantly in the next 2-3 years.

Fundamental triggers are…

-

The exposure to commercial vehicles is the lowest in a very long time. As economic activity recovers, it can get better n better and get reflected in higher topline.

-

Srei equipment finance is in huge problem. That gives an opportunity for sundaram finance to grow in construction equipment finance. As it is the demand in this sector is up as told by Mr Srinivas Raghavan on TV. The latest budget emphasis on infrastructure can act as a tailwind.

-

New MD is appointed. May not be as conservative as the out going MD in ramping up the topline

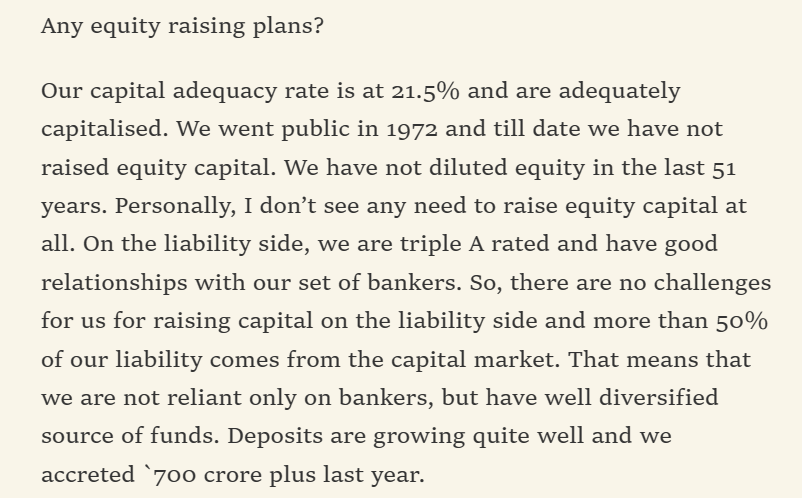

our growth is not comparable to peers, as you have rightly pointed out. Unlike other NBFCs, we have not raised any equity in the last 50 years, building up a balance sheet of Rs 35,000 crore just through retained earnings. Though there is nothing wrong with raising equity, ours has been a model of steady and sustained growth, without suffering the volatility that often accompanies large investments. We have conducted our business the way we are comfortable. It is a thing of choice.

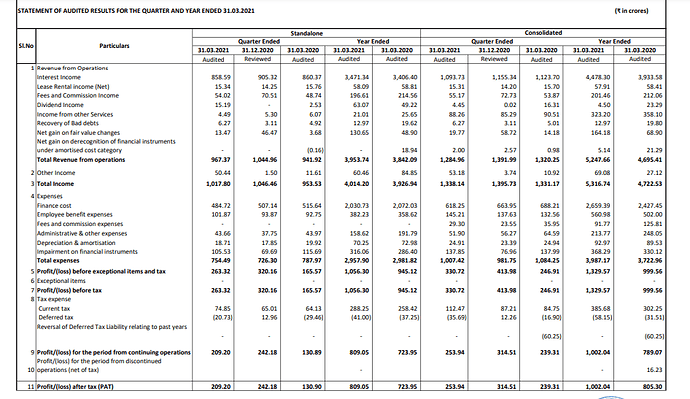

Quarterly results came out late y’day post market…It is one of those steady results,exactly as portrayed by SrinivasaRaghavan, above

Link to results https://www.bseindia.com/xml-data/corpfiling/AttachLive/40167D83-C2AE-40A7-B8E0-FF88E74F6C81-194459.pdf

There was a time, when I used to see how actively VPr threads are updated & followed, during the results season, as a measure of how good the firm is. These days, I don’t track it that much.

(PS - After my quarterly result update in May, this is the next update !!)

31 MFs and 129 FII/FPIs are invested here and the institutional interest is strong. Just that the general hoopla of results in twitter, FB, whatsapp group is low key !!

Sundaram finance result came out post market today. Another steady result.

Anyone can share inputs on the reason for the big push in share price in feb2021 from 1650 levels to 2800 levels in one month

Have invested a small amount, interested to add looking at management quality and steady performance. But unsure whether the valuation is high i.e.whether the positives are priced in.

Thanks in advance.

discl: invested. Trying to evaluate whether to add.

A rare initiating coverage report!

sale growth is not so remarkable since last few years, even though capital management is impressive.

Wondering why the stock has been badly battered…

The loan disbursement hasn’t moved a needle in FY 22e. around 30,000 Crores…

In fact the AUM dipped marginally from 30,888 to 29,500 crores on yearly basis. However disbursements increased.

“Disbursements for FY22 recorded a growth of 13 per cent to ₹13,275 crore as compared to ₹11,742 crore recorded in FY21. “We regained share across most asset classes and grew our core business by 23% year-on-year, closed the year with best-in-class asset quality levels despite adversity, and delivered double-digit profit growth,” said Harsha Viji, Executive Vice Chairman, Sundaram Finance”

With the CV cycle on the upturn why loan disbursement hasn’t picked up… though management was confident that H2 FY 22e will be much better.

Thinking of a comparison with Cholamandalam and how they managed growth in tough year.

Positives:

Q4 showing a spike in NP…

Promoter holding increased 2.5% from 36% to 38.5%

FII (Vanguard) reduced stake by 2.5% which was absorbed by DII completely…

P/B of 2 it is reasonably priced

Credits : MyValuePicks

Interview: @RajivCLochan, MD, Sundaram Finance

AUM growth:

![]() Around 15-16% CAGR for last 20 years

Around 15-16% CAGR for last 20 years

![]() Aim to take it bit further around 16-20%

Aim to take it bit further around 16-20%

![]() Q4 tends to be a strong quarter

Q4 tends to be a strong quarter

IDBI Capital on SFL 2.pdf (1.0 MB)

Hi Rohitji

Good to read the interview with MD SFL. I am attaching the latest research report by IDBI where in they made a buy call . The financials are good and its a fundamentally strong stock as per my limited knowledge. But I count find much volume in this script though it has performed very good last month . I am confused whether to enter now ? Appreciate if you can put your thoughts ? Thanks in advance