Let us begin with a brief overview of the industry. Private sector health insurance can be divided into two segments- group (bought by corporates for employees) and retail (bought by individuals for themselves/their family). The group segment is characterized by lower brand value, lower customer loyalty, and higher claims ratios. On the other hand, trust and brand, as opposed to merely least price, play a much larger role in the retail segment. Notably, retail is ‘bottom up’- the individual decides the sum insured, insurer etc., as opposed to group which is ‘top down’.

As can be seen from the data below, individual business also has higher per-person premiums.

The private sector health insurance industry can also be categorized by type of insurance provider, i.e., general (non-life) insurer and standalone health insurer (SAHI). SAHIs are, as the name suggests, pure-play health insurance companies, as opposed to general insurers, who also offer other non-life products, most significantly motor insurance.

Market share

One key nuance of health insurance (versus, say, motor insurance) is that premium pricing and sum assured would appreciate with time. Combined with high renewal rates in health, this means that the lifetime value of a health customer is significantly greater than the LTV of any other non-life customer.

Further, retail health has three broad distribution channels- agents, banca, and online aggreggators. Agent-based channel accounts for the majority. It is crucial to note that the agent model is high-touch and relationship-based, as oppossed to online aggregators and banca, which are transactional outcomes.

Agent attrition rate is lowest for SAHIs

Through Care Health’s Q1FY23 numbers (below), one can also get a broad idea of the premium per policy across different channels- policies sold through individual agents are presumably more granular as opposed to brokers (group business with higher ticket sizes).

Star Health & Allied Insurance Company Limited (‘Star’) is a retail-focused SAHI (India’s first SAHI), started in 2006 by Mr. Venkatasamy Jagannathan. He was previously CMD of United India, and he started Star after his retirement.

Star is the market leader in the retail segment, with market share of >30% and accretion market share of >50% as of Q1FY23. Star has the largest agent network in retail health, at 5.67 lakh as of Q1FY23.

Star’s premium-per-agent is the highest among SAHIs

By looking at retail health premium per person covered, one can get a broad indication of target customer segment. E.g., from the data below, one can infer that Cholamandalam GI probably targets high-income consumers while SBI GI probably targets the mass market. Most others (including Star) are somewhere in between.

Star also has a wide hospital network; among this, pre-agreed hospitals (hospitals with better, negotiated pricing) have a lower claims amount, and is growing as % of total cashless claims in Star’s network.

Star operates on a low-cost business model, as is evident from their low opex to GWP ratio (lowest among SAHIs).

Also, Star’s opex to GWP % and opex per person covered is reducing with time

Star’s claims management is entirely in-house; this gives them control over costs, preventing fraud, and lowering turnaround time.

Star has among the highest renewal ratios for any health insurer worldwide. At >96% ‘gross retention’ plus any ‘expansion ARR’ (borrowing from SaaS), one can imagine what Star’s ‘net revenue retention’ might be.

Indications of strong ‘expansion ARR’

Indications of strong ‘expansion ARR’

As regards Star’s underwriting quality, we find that- a) their underwriting surplus per person covered has been rising and b) Star has consistently been in surplus even on an NPE minus 1 year forward claims basis.

Star’s market share (and accretion market share) has continuously been growing. Here and here are good sources for tracking monthly data (including accretion market share) for Star and competitors.

Geographically, many semi-urban/Tier II/III cities have been growing at a rapid pace for Star, suggesting a massive untapped addressable opportunity. Also, Star recently announced a partnership for expanding its distribution in rural markets.

They are also systematically exiting unprofitable group business where pricing is inadequate.

Star is also proactively adopting various digital initiatives

Now coming to the key negatives and risks. Firstly, even though individual agents are a large component of retail health (where Star is the leader), banca/other corporate agents is an important channel too. A simple Ctrl+F on this site (only a rough proxy, not a perfect indicator) shows that Care Health has 147 corporate agents (Star is 2nd with 82). Niva Bupa Health is at 40, ManipalCigna Health at 55, Aditya Birla Health at 52 and so on. Each bank is allowed to tie-up with upto three SAHIs. As seen from the data, Care (not Star) is the leader in the corporate agents (CA) channel.

Although, it does seem like Star is increasing its focus on banca, since CA/banca has been its fastest-growing channel in recent quarters. Further, Star announced a banca partnership with IDFC First Bank recently.

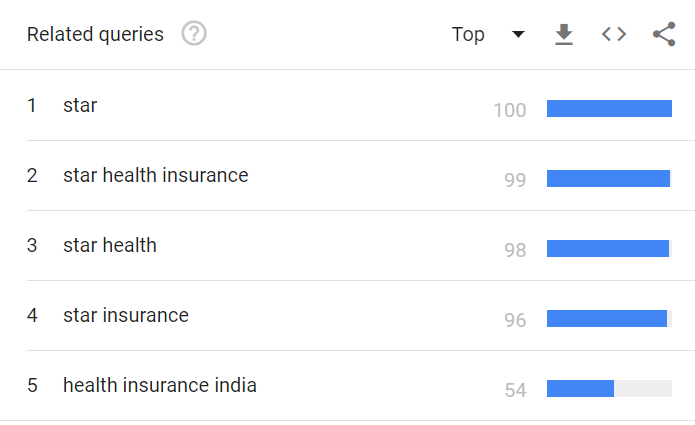

Competition from Care also presents a second dimension of risk; a Google Trends search shows that Care has gained mind share post-Covid. Further, Care’s hospital network is comparable, perhaps even greater than Star.

Another negative is that Star’s commissions per agent and commissions as % of GWP have been increasing (see below); while this data can be interpreted in many ways, one plausible hypothesis could be that Star needs to give higher commissions to drive growth (perhaps it is more of ‘push’ based demand).

Finally, looking at global precedents, we find that United Health Group has been a tremendous value creator. Here are some interesting snippets from UHG’s 1997 annual report.

Customer centricity

Data monetisation plans

Value migration from group to retail

Disc- no holdings as of now but planning to buy sometime in next few weeks. I am not a SEBI registered investment advisor. Please consult your financial advisor before taking any decision. This post is for educational purposes only.