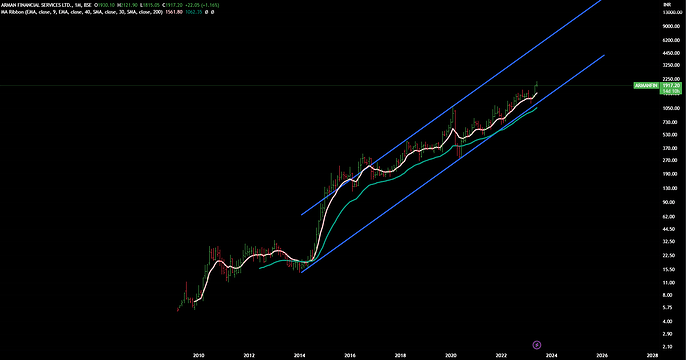

Target as per elliot waves

Arman Fin

EW counts in this chart are little complex, hence not sharing.

Just use the channel on monthly chart - the target can come anywhere between 5 -6 k .

This is a monthly chart , so no expectaions on short term basis. This can take 3-5 years to play . For us 2.5 to 3 X in 5 years is a decent return for core-portfolio as it comes to be more than 20% CAGR.

Monthly Chart

Elliot wave is very fascinating sub part of technical analysis,anysource orbook that could be useful to learn the subject

Books might not be helpful. You need to find some good practitioner as constant feedback is required. And it might take 1-2 years to attain a decent level of expertise- passing though different market phases is also important.

Hi…U had replied for one of my query regarding Tejas networks months back…could u pls share your view now as price is reaching ATH

June 20th Update

1.PB Fintech

2.PayTm

3.ZenTech

4.Sonata Software

5.Sandur

6.Ujjivan

7.Equitas

8.Dynemic Products.

9.Aarti Pharma (special situation )

10.GRSE

11.Apcotex

12. Carysil

13.Mahrastra Seamless

14.Newgen

15.Wabag

16.Neuland Labs

17. Cochin Shipyard

18. Arman Fin

19. Suyodaya

20. Shriram Finance

21 .HDFC AMC

22. Swaraj Engine

23.Car Trade

24 .Xpro

25.Happiest Mind

Exits : Camlin Finechem ,Apollo Sindoori -Relative strength is lower vs Market

New Entries : HDFC AMC, Happiest Mind ,Shriram Finance

- 2 Tracking postions -MSTC , Isgec Engineering ,

90% Invested.

No Buy Sell reco

I don’t find Godrej property in the list ? Is it sold off due to lower strength?

Oops…it is there. Missed it in while posting the portfolio.

can you please share your views by looking at the Chart of Aarti Drugs and IDFC ltd.

TKS. How is Bharat Rasayan placed now ? Bottom formed ?

How id Suryoday & Fivestar business finance placed brother?

@StageInvesting - Request you to please let us know why is it mentioned Aarti Pharma (Special Situations)? because of the de-merger?

Yes, it was demerger. Mid & large cap mutual funds had to sell Aarti Pharma and it provided a mismatched opportunity.

large cap mutual funds had to sell Aarti Pharma and it provided a mismatched opportunity.

Aart Pharma came up with a investor presentation now. I think their growth projection ~15% range didn’t enthuse the market much. Any views ?

I guess the opportunity still exists as there has been not much price action in the stock. It is yet in the discovery phase right? Open for other views

When you put that box Wave 3 = Wave 1 , how do you draw that box ? Is it based on the exact price difference between top & bottom of wave 1 or is it the box height ? What is the chart scale used here ? Arithmetic scale will give the price delta while log scale will not . So , how do you do that ? Which is correct to use arithmetic or log scale while drawing out that Wave 3 target box ? Also , sometimes fibonacci multiple of Wave 1 length is used for Wave 3 . So , how do you draw that ? Do you use arithmetic scale or log scale chart for this ?

Boxes are made on log charts.

Just draw the box from bottom to top of a wave and jsut copy/paste it where bottom of the copied boax coincides with the level from where the new starts.

Bharat Rasayan

It is still in sell -mode on weekly/monthly charts.

Suryodaya , FiveStar

Both look good …Sfirst one is our portfolio also . Latest Portfolio shared on June 20th.

Thanks for confirming that Box is drawn on log chart. I have seen many practising this using aritmetic scale chart . In that case the box height is just the price delta of Wave 1 & therefore it becomes insignificant in higher waves 3 or 5.

One more query if you could help on this. I have seen many saying wave 3 extension to be 161.8% of wave 1 or sometimes 261.8% , 461.8% which are fibonaaci numbers. Now these extensions are nothing but extension of price delta of wave 1 if I understand it correctly.

In practise , which one is more used ? Wave 3 = Wave 1 ( log chart ) or the above fibonacci extensions of wave 1 ( which is extension of price delta ) ?