Sharing few latest charts based on my learning on combining Stage-Based investing with Elliot Waves method.

Would request contributions from other EW and Stage Based Investing practitioners.

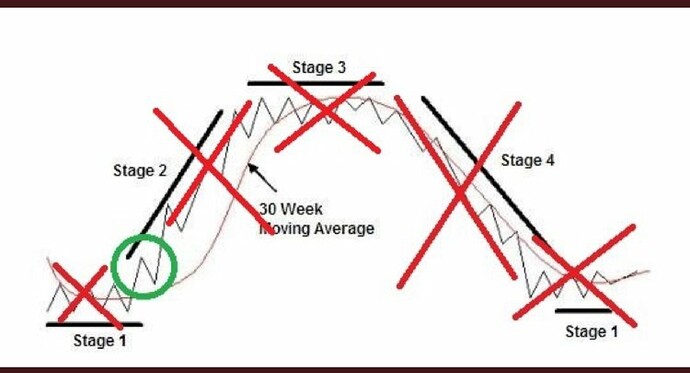

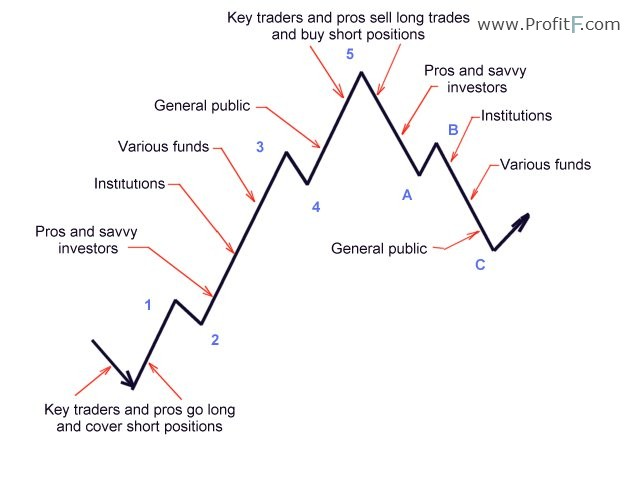

For starters, just sharing 2 images wrt Stan Weinstein Stage Based investing rules as well basic EW theory .

Stages in Price-Life-Cycle

Stage Investing method is good for long term investments and is based on tracking price movement on weekly charts wrt 30 weeks moving average.

The best entry in a stock is when it breaks out in Stage 2 and exit should be made when it enters Stage 4.

Stages are clear in the above pic.

Elliot Wave Theory:

Elliot Waves principle is based on mass-psycology principle and as per this theory ,every stock moves in 5 waves (up or down ) and then corrects in 3 waves (a,b,c)

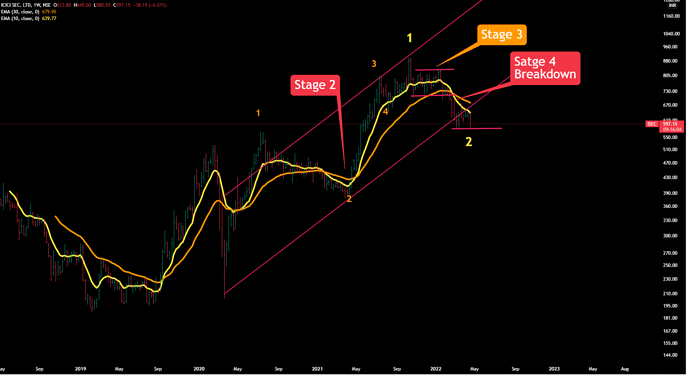

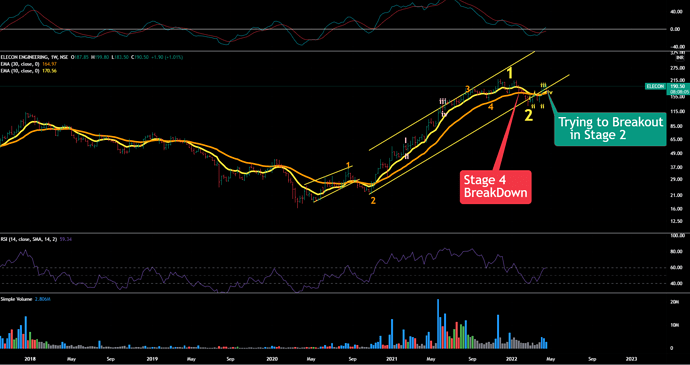

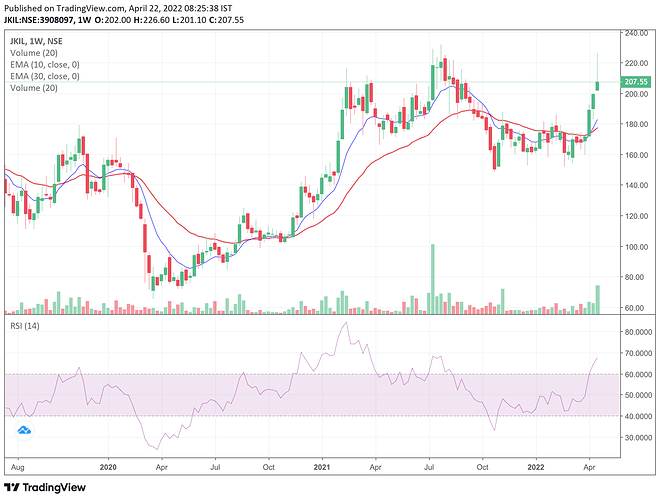

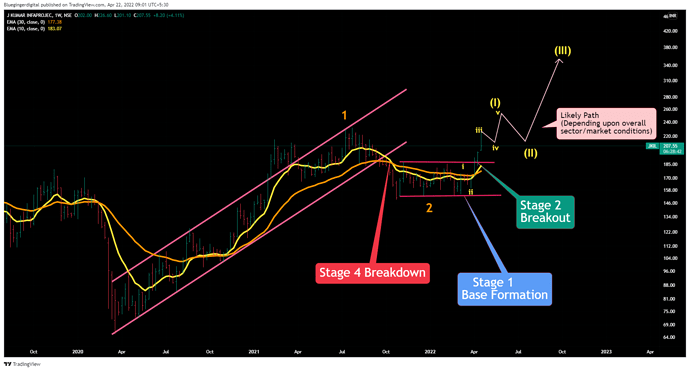

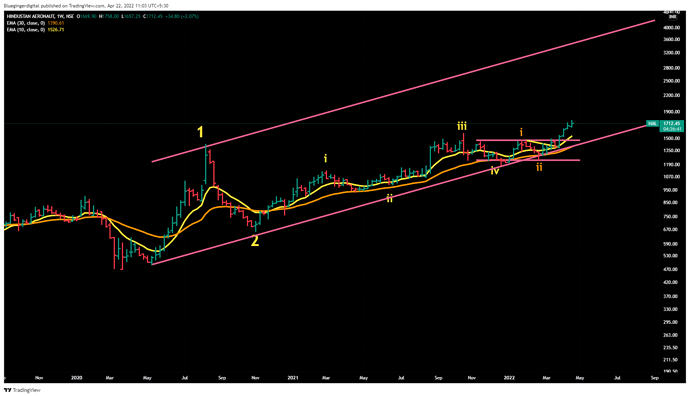

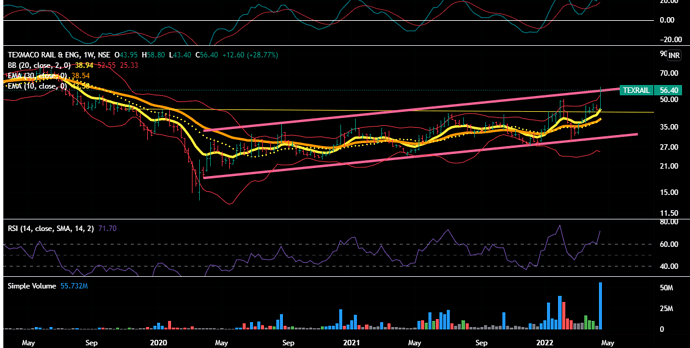

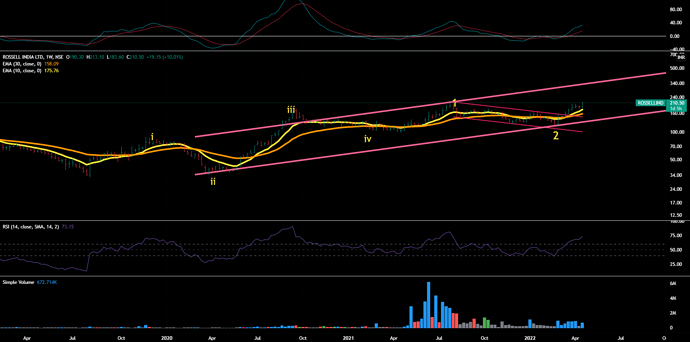

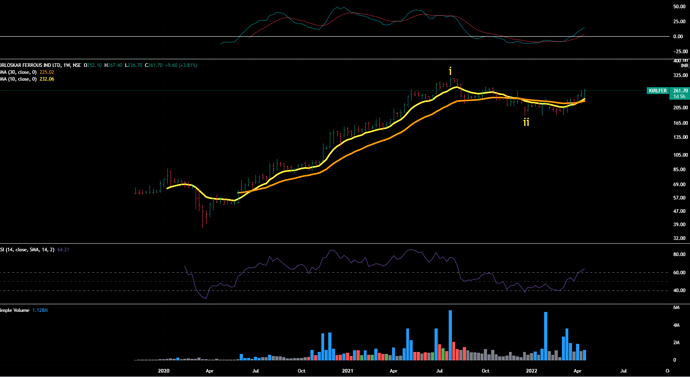

Here are few examples of stage based and EW method.

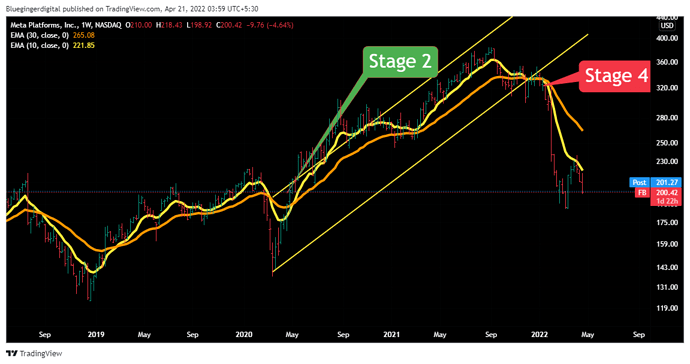

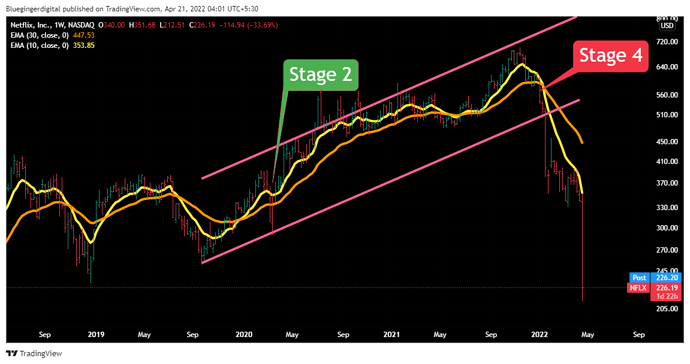

**Sell in Stage 4 or when 5 Elliot waves are complete **

One of the key rule is that you don’t buy or stay in any stock that is in Stage 4.

Because you don’t know how far it would go in to correction-phase.

FB & Netflix are 2 recent examples (charts are given below)

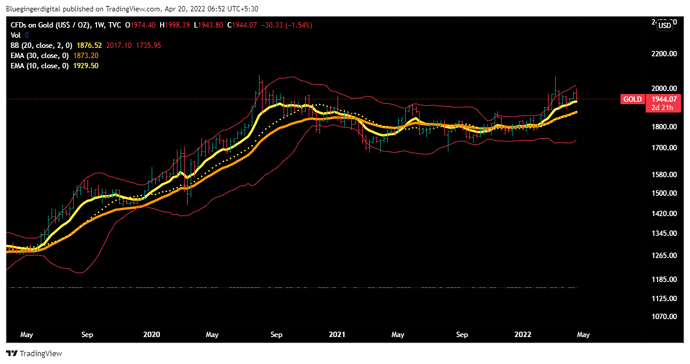

Buy when the stock enters in Stage 2 or new impulsive EW starts:

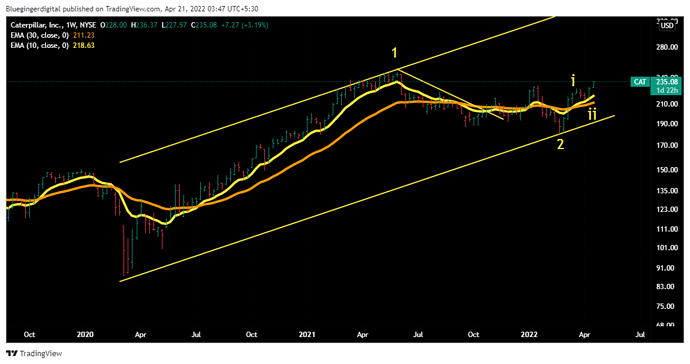

Combining Elliot Waves with Stage-based investing :

The following chart is of CaterPillar - a US based company involved in farm machinery, construction etc etc.

Here one can see how these 2 methods can be combined - stage-analysis + Elliot Waves.

Caterpillar is in Stage 2 and now also in bigger Wave 3 . EW can help in calculating the future targets - for example , CAT (CMP -235) may go upto 500 in coming months as per equality principle of EW .

Again all of these are probability set-ups. Risk management is key whether one invests on the basis of fundamentals or by doing technical studies.

Would love to hear the views of other technical analysts who follow these methods.

if I’m wrong!!!

if I’m wrong!!!