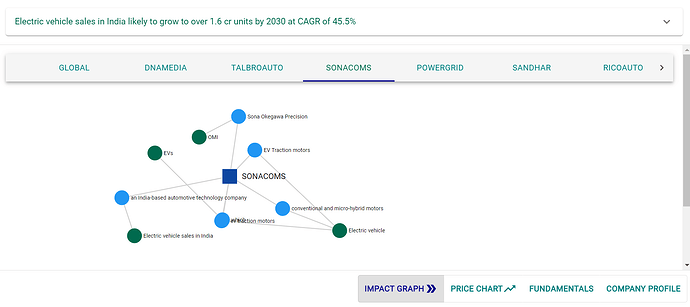

In the dynamic world of stock markets, a company’s performance is often closely intertwined with significant industry developments and government initiatives. Such is the case with Sona Comstar (NSE: SONACOMS), a company that designs, manufactures, and supplies systems and components for the automotive industry in India and abroad. Recent developments in the EV space indicate a promising outlook for the company, suggesting that Sona Comstar is well-positioned for growth and poised to positively impact its stock price.

Sona Comstar, formerly known as Sona BLW Precision Forgings Limited, specializes in the design, manufacture, and supply of systems and components for the automotive industry, with a particular focus on electric vehicles. The company offers a wide range of products tailored to meet the needs of conventional and electric passenger vehicles, commercial vehicles, and more. Sona Comstar’s headquarter in Gurugram, India, positions it strategically at the heart of India’s automotive industry.

Electric Vehicle Sales Surge in India:

The Indian government’s strong push towards electric vehicles (EVs) is a game-changer for companies operating in the automotive sector. The announcement that electric vehicle sales in India are likely to grow to over 1.6 crore units by 2030 at a Compounded Annual Growth Rate (CAGR) of 45.5% is a significant catalyst for Sona Comstar. This growth trajectory indicates an increasing demand for EV-related components and systems, precisely the products that Sona Comstar specializes in.

Sona Comstar’s expertise in manufacturing EV traction motors and motor control units places it at the forefront of the EV revolution. With the government’s ambitious EV targets and the demand for electric passenger vehicles, commercial vehicles, and more, the company is well-poised to capitalize on this burgeoning market, which is set to positively influence its stock performance.

India’s Thriving Automotive Industry:

A report forecasting India’s automotive industry to be worth a staggering $1 trillion by 2035 is another substantial indicator of growth. This assessment includes a substantial portion of $400 billion from design, development, and technology segments. As a key supplier to the automotive industry, Sona Comstar stands to benefit significantly from this expansion.

The report also highlights that India’s automotive manufacturing sector will require an investment of $100-150 billion until 2035 to reach the $600 billion mark. Sona Comstar, with its wide range of products such as differential assemblies, drive motors, e-axles, and more, is well-positioned to cater to the evolving needs of the automotive industry.

Moreover, as the country strives to become a global automotive hub, the demand for advanced automotive components and systems, which are Sona Comstar’s specialty, will continue to rise. This could lead to a substantial increase in orders and revenue for the company, positively impacting its stock price.

Milestone Achievement in EV Traction Motors:

Sona Comstar’s recent milestone of crossing 100,000 EV traction motor productions in August showcases the company’s capacity and capability. The rapid pace at which the company doubled its production within just four months is an impressive feat, indicating efficient operations and strong demand for its products.

This achievement not only underscores the company’s ability to meet the growing demand but also reinforces its position as a key player in the EV component manufacturing sector. Investors are likely to take notice of this milestone, potentially increasing the demand for Sona Comstar’s stocks as a result.

In conclusion, Sona Comstar, with its extensive product range and strong presence in the automotive industry, is well-prepared to capitalize on the burgeoning electric vehicle and automotive markets in India. The positive news items, including the government’s EV push, the thriving automotive sector, and the company’s own milestone achievement, are all strong indicators that can drive investor confidence and, in turn, positively impact the company’s stock price. As India continues its journey towards a greener, more advanced automotive industry, Sona Comstar stands as a beacon of growth and opportunity for investors.

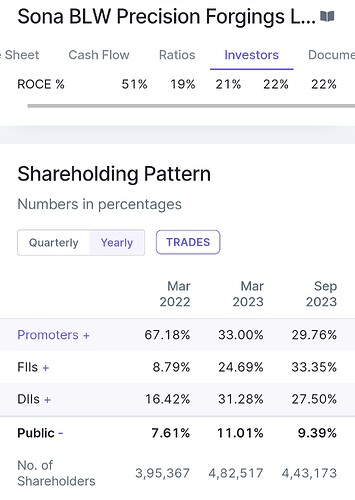

Solid Financial Performance Bolsters Sona Comstar’s Stock Outlook

In addition to the promising developments in the Indian automotive and electric vehicle sectors, Sona Comstar’s financials provide further reason for optimism. The company’s robust financial performance over the past five years has solidified its position as an attractive investment opportunity.

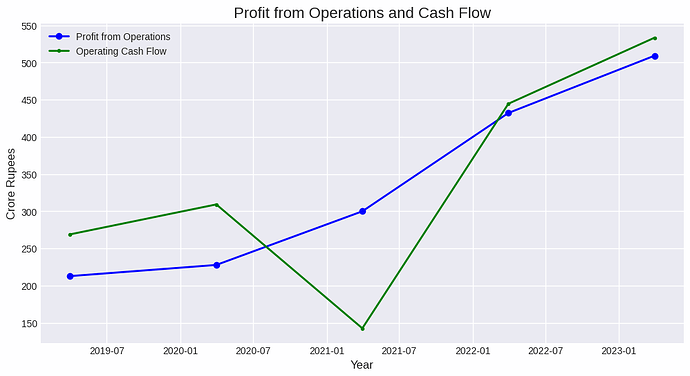

1. Stellar Profit Growth

Sona Comstar’s profit growth over the past half-decade has been nothing short of impressive. With a remarkable 139% increase in profits, the company has demonstrated a compounded annual growth rate (CAGR) of 19%. This consistent profit expansion reflects the effectiveness of the company’s strategies and its ability to capitalize on the evolving automotive landscape. Investors typically favor companies with a history of profit growth, as it indicates a strong foundation for future success.

2. Healthy Cash Flow Position

The company’s strong cash flow position further reinforces its financial stability. Over the last five years, Sona Comstar has seen its cash flow increase by a substantial 98%, achieving an impressive CAGR of 14.6%. Adequate cash flow is vital for a company’s day-to-day operations, as well as for making investments in research, development, and expansion. This robust cash flow trend demonstrates Sona Comstar’s financial prudence and its capacity to invest in growth opportunities without straining its resources.

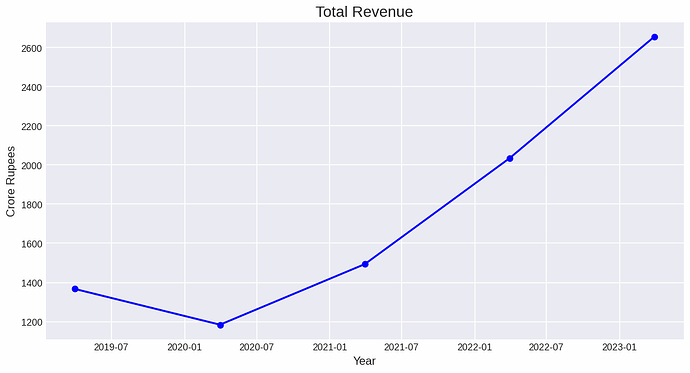

3. Impressive Revenue Growth

Sona Comstar’s revenue growth has been nothing short of phenomenal. Over the past five years, the company has achieved a remarkable 94.5% increase in revenue, with an astonishing CAGR of 114.2%. Such rapid revenue expansion is a testament to the company’s ability to capture a growing market share and meet the demands of a dynamic industry. As the Indian automotive sector continues to evolve, this growth in revenue positions Sona Comstar as a major beneficiary of the industry’s expansion.

4. Debt-Free Status

One of the most noteworthy financial attributes of Sona Comstar is its debt-free status. Operating without debt is a significant advantage, as it eliminates the burden of interest payments and reduces financial risk. This prudent financial management not only contributes to the company’s stability but also frees up resources that can be reinvested in research, development, and business expansion.

Conclusions

In summary, Sona Comstar’s financial health is an essential factor that adds to the appeal of its stock. With strong profit growth, healthy cash flows, rapid revenue expansion, and a debt-free status, the company exhibits a high degree of financial stability and resilience. This financial strength is pivotal in enabling the company to capitalize on the burgeoning electric vehicle and automotive sector in India.

Investors looking for a well-rounded investment in a company that is both financially sound and poised to benefit from a thriving industry may find Sona Comstar an attractive prospect. The combination of promising industry developments and robust financials make Sona Comstar’s stock an enticing option for those seeking long-term growth potential in the Indian automotive and electric vehicle sectors.

References:

Electric vehicle sales in India likely to grow to over 1.6 cr units by 2030 at CAGR of 45.5%

Indias automotive industry to be worth $1 trillion by 2035: Report

Sona Comstar crosses 100,000 EV traction motor production milestone in August

Disclaimer: The article is not a recommendation or advice as to whether any investment is suitable for a particular investor.