Just got this notice on Ishan Dyes… more or less confirms the story that there is a huge shortage and everything is being sold out

Sorry I don’t want to make it into a vipul thread but while we are discussing vipul organics probably they have utilised substantial capacity because they are raising funds for cash flow

We know that if you are selling, most of your buyers won’t pay you advance. You have to buy inventory of raw materials and then once goods are sold your customers will pay you in 30 days.

So you need to carry cost of manufacturing and inventory cost for around 45-60 days.

Most of the time a small increase in production can be handled without excess cash via bank overdraft however a large 6 times production increase probably difficult to manage.

I don’t think they were expecting uplift of capacity at the levels they have now so this cash shortage might not have been planned.

We will know on Saturday as they are meeting on Saturday. I think tomorrow on news price might fall and give a chance to buy…

A company of 82 Mcap got an order for 40cr. This is huge. They are booked for whole year. Looks very good for dye industry. Shree Pushkar and Asahi songwon may also show same sort of results.

How do you view the fund raising plan announced yesterday

- Why would they go for fund raising when they have already completed capex?

- The announcement also mentions ‘working capital requirement’ - why would a company dilute equity for working capital when it can be funded via debt?

- This is second dilution in 2020 post the merger in May’20. Your views on this

Is it a possibility that the promoters feel, the company is very undervalued currently, and knowing the demand and the upcoming performance, want to load up on the stock.

Your views are welcome.

What kind of dyes do they produce that commands almost Rs 6lakhs/MT? Dyes realization for Shree Pushkar has been between Rs 2.5 to 3 lakhs / MT.

I strongly feel we have had enough discussion of dyes here

I don’t want to take over @aniketk9 thread

I’ll start a thread as I read all bse filings with selenium so it’s easy to discuss this and other prospective expansions or special scenarios like aarti or navin contract manufacturing

I think expansion for the sake of expansion is not a good use of capital - society capital and company capital

I do apologise for digressing

vipul organics is a long term bet for you or a short term? ,revenues have been growing substantially for the last 6 years,new capex, insider buying.Reason for asking is is this industry cyclical or the growth is throughout industry(on screener the peers are showing negative sales growth Quarterly does this company have some moat).

Also read annaul reports and other stuff found the company is investing in another plant in gujrat for pharma business (can you shed some light on this).

Thanks in advance

Credit Rating is says issue not cooperating… Is this a red flag?

Vipul Organics Limited: Issuer not cooperating, based on best-available information; Ratings continues to be ‘CRISIL BB/Stable/CRISIL A4+ Issuer not cooperating’ 30 Jun 2020 from crisil

I think it’s a red flag

Debt has reduced since March balance sheet

Also I don’t understand how Crisil works

Does a company have to pay crisil fees even if they don’t have intention of applying for new loans in the near future

Credit certifying companies have historically done a poor job of checking financials properly before issuing a certificate

They are also unlikely to have qualified accountants working for them doing the analysis

Even audit companies with qualified ca have failed to properly check company financials for some other companies. Auditors have unfettered access to every part of the business guaranteed to them by law and they charge a bigger fee than crisil

Some investors have proven more uncanny in detecting fraud by simply reading the balance sheet and cash flow

So I tend to look at crisil report with a bit of skeptism

I will hold for at least a year by which time they would have used all new cwpex

Hi @edwardlobo

Thanks for sharing your ideas,

Initially when I checked financials I pass this easily but after some deep-dive I found very interesting things happening in Dyes & Pigment sector worldwide.

Disc : Vipul Organics now 18% of my portfolio

There have been some movements in my portfolio :

-

Alufluoride : Exited completely with a 90% overall profit in three separate tranches. Holding period was less than 30 days. The trigger had played out and it’s Q3 numbers will be abysmal, also it had reached my price targets.

-

Entered GNA Axles in end of December at 255 : The group has been in the auto component industry since 1946. GAL markets its products through a common marketing network at the group level providing a whole range of products including axles, gears and shafts under one roof. The company has been long associated with its clients. The association with some of the domestic clients has been since the commencement of company operations. Furthermore, over the years, the company has increased its focus on exports with clients in USA, Europe, Asia Pacific, Mexico, Brazil, etc. Exports contributed ~65% of the total operating income in FY20, compared to ~54 % in FY19. The company has been supplying to some of the export clients since 2000. Long and established relationships with clients provide revenue stability to the company. Apart from supplying directly to the Original Equipment Manufacturers (OEMs), the company also provides components to the tier-1 suppliers.

The company was undertaking two capex projects including setting-up of a new unit for manufacturing of axle shafts for LCVs, Small Pick-ups and SUVs and for enhancing its existing manufacturing facilities at a total cost of Rs. 170 cr. funded through term loan of Rs. 150 cr. and remaining through internal accruals. Both the projects have been completed, within the time & cost estimates. Post capex, the manufacturing capacities of the company have increased to ~6 million pieces per annum from the pre-capex capacities of ~4 mn pieces per annum.

Exited 25% allocation @360 & another 37.5% @400. Intend to keep GNA Axles for at least two more quarters, if not more.

-

Entered Sarla Performance Fibres at 23 :

The company has established track record of operations for more than two decades in the yarn

manufacturing industry. The company manufactures specialized high tenacity yarns which has a wide

range of application and used in the manufacturing of automotive seat belts and trims, airbags, upholstery, dress, casual & athletic footwear, leather goods, soft luggage, lingerie, swimwear, etc. The company earns ~52 percent of its revenue from export and balance from the domestic market. The company has developed a diversified and reputed customer base, which spreads across 40 countries. The reputed clientele includes Hanes Brands, Gildan, American & Efird, Delta Galin, Coats & Jockey, Vardhaman, SBM, etc.

During FY2019-20, the company has expanded its manufacturing facility in India by additional 4800 tonnes per year high tenacity twisting capacity in Dadra, Gujarat

Two triggers lined up for Sarla. 1) Textiles policy 2) New Airbags rule which makes it compulsory to have airbags for front passengers in all vehicles. Sarla does help in manufacture of airbags.

Sarla is not a long term call but a pure short term trigger based play. Hoping to exit with 50-100% returns in next 3-6 months.

-

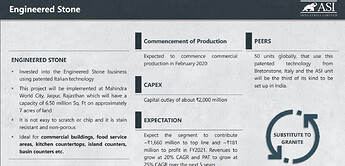

ASI Industries - Entered at 13.45 : “ASI Industries is the world’s largest stone mining company and the only listed player in the India :

The company has ~46% market share in the stone mining industry

The company has ~46% market share in the stone mining industry

Mainly engaged in mining and processing of Kota and other

Mainly engaged in mining and processing of Kota and other

natural stones

Holds the largest quarries in the world spread across 10 sq kms at

Holds the largest quarries in the world spread across 10 sq kms at

Ramganjmandi, situated in Rajasthan

Produces over 12 million square meters of Kota stone every year

Produces over 12 million square meters of Kota stone every year

Acquired Al Rawasi Rocks and Aggregates L.L.C, Fujairah U.A.E

Acquired Al Rawasi Rocks and Aggregates L.L.C, Fujairah U.A.E

(having lime stone quarry & stone crusher unit) for a consideration

of AED 21.71 million (USD 5.915 Million)

The end user of the industry is the real estate, construction and

The end user of the industry is the real estate, construction and

Infrastructure”

2 triggers :

- Mining policy

Exited 40% holding @19. Will keep remaining for a potential 2x rise in next 1-2 quarters.

-

Vipul Organics - Entered at 110 with a 50% allocation for now :

Playing the expansion story in Vipul Organics. Dyes & intermediaries should have a decent Q3 and a good Q4. I still prefer Shree Pushkar as a long term story. Waiting for a drop to 110 levels for Shree Pushkar to enter big. -

Mangalam Organics - Entered at 404 :

After having entered Kanchi Karpooram for capacity expansion play, Mangalam Organics seemed like a decent pick with rising camphor prices and an almost 2.5x capacity expansion which was already done. Eventually will keep only one of them based on how they perform. -

WPIL - Entered at 500 :

65 years in designing, developing, manufacturing, erecting, commissioning and servicing of pumps & pumping systems. Manufacturing operations in India, the United Kingdom, Italy, France, Switzerland, South Africa, Zambia, Australia, and Thailand.

Business verticals:

Engineered pump division

Standard pump division

Infrastructure division

They have been on an expansion spree and with the upcoming budget, hoping for a boost for infra stocks, among which WPIL seemed fairly valued. They do have some concerns of being cyclical and related party transactions. So will be assessing whether to hold on for longer than 2 quarters.

No better place to get more information than : WPIL Ltd: Fundamental Analysis - Dr Vijay Malik & WPIL Ltd - Global Water Pumps

- Mayur Uniquoters - Entered at 288.6 :

“ MUNI has seen a sustained demand pickup since August. The automotive

segment is reviving but footwear remains a drag.

The company is now an approved vendor for Volkswagen India and will start

supplies from Q4FY21.

MUNI has got approval from BMW for material supply which should begin

from 2022.

Supply to Mercedes, South Africa, will begin in Q4FY21.

Product sampling is underway at the new PU plant and production will be

ramped up over the next 12 months. The plant is currently producing 30-40k

metres/month and ramping up by 10k/month. It can produce ~0.4mn/mtr

per month and earn revenues of Rs 1.25bn-1.5bn annually on full ramp-up.

The government has increased import duty on PU material to 22%, thus

reducing the price gap between imports and domestic manufacturing.

MUNI is working with Ford and Chrysler to get approval for PU usage in the

automotive industry.

The company has taken a 5% price increase in October and another 5-7%

hike in November due to rising raw material prices. It plans to take a price

increase in December as well.

MUNI is adding its seventh PVC line. The current plant can produce 2.7-

2.8mn metres annually. The target is to reach 2.8-2.9mn metres of PVC

sales in FY22.

Management is increasingly opting for backward integration in order to have

better control over cost.

MUNI has announced a buyback of 0.75mn shares (~1.65% of total equity) at

Rs 400/sh through the tender route.”

Multiple triggers lined up for Mayur Uniquoters over the next few quarters.

-

Happiest Minds - Entered at 355 : Pure Q3 results play.

-

Transpek - Entered @1560 :

The company caters to various industries, such as polymers, agrochemicals, plastics, performance materials, coatings, pharmaceuticals, personal care, and flavours and fragrances. Furthermore, overseas markets, including the US, South Korea, and Europe, contribute 80% to the revenue. Competent promoters, decent valuations and consistent performance was the reason for the purchase. They might not give 50% return in a year but can give 15-20% CAGR over a longer period. -

Oriental Carbon(OCCL) - Entered at 815 :

Tracking all tyre ancillaries and like 3 of them - OCCL, Phillips Carbon and Rajaratan Global. Missed the ride on the other two. Did have tracking positions in Phillips Carbon @130 but could not go for the jugular.

https://occl-web.s3.ap-south-1.amazonaws.com/wp-content/uploads/2020/11/OCCL_Q2-H1-FY21_Investor_Presentation.pdf - This covers most of the basic information required.

Domestic Share of 55% - 60%

Global market share of ~10%

Trigger is 16% capacity expansion in Q1 FY22.

-

Shivalik Bimetal Controls - Entered at 63 :

EV and electronics play. Expansion to be completed by Q1 FY22 which will be a big boost. I feel the budget might also have some positives on this front. For more info : Shivalik Bimetal Controls Ltd - #150 by ayushmit -

VIP Industries - Entered at 345 (50% allocation) :

One of the two listed luggage companies in India. Bangladesh operations give it an edge over Safari but Safari’s growth has been faster. I would prefer Safari on a longer term perspective. Once travel starts, these travel oriented stocks will run, I am expecting things to improve from Q1 FY 22 onwards. Felt the price was right so entered with a 6-9 month perspective.

-

Oriental Veneer - Entered 50% allocation at 45 :

Budget play - Railway oriented stock.

The company had completed a capex of ~40 cr to boost production capacity of wagons and is already running at > 50% capacity. Will exit in 1-2 quarters. -

Vikram Thermo - Entered at 185 :

Vikram Thermo wants to become one of the world’s largest pharma excipient manufacturers. They are a manufacturer, marketer and exporter of various pharmaceutical excipients, and provide solutions in Film Coating / Enteric coating and Sustain Release / Control Release formulations to pharma industry. The company has two product categories:

1). Diphenyl Oxide (DPO): The company started its business in 1984 at Chhatral, near Ahmedabad with the launch of DPO. DPO has following applications: in heat transfer fluid; reaction solvent in the manufacturing of API and as perfumery compound in cosmetics.

2). Drugcoat (Methacrylic acid copolymer): In addition to DPO, the company also started the production of its Drugcoat line of products that is basically a polymer used in tablet coating for enteric/film coating. It is also used for sustained release, transparent coating, moisture barrier coating, etc. Variants of Drugcoat are used based on the requirements - solid dosage, liquid dosage, high pH, low pH, all pH, etc.

Trigger : The Co. is in the middle of a major expansion of about 20 crs due to be completed by March 2021.

- Cords Cables - Entered at 48 :

PE just 7.9

EPS Rs 8.16

Price / Book just 0.44

Book Value 109.3

![]() Key Beneficiary of various schemes of Govt.

Key Beneficiary of various schemes of Govt.

![]() Company has posted fabulous results in FY20, it posted EPS of Rs 8.16

Company has posted fabulous results in FY20, it posted EPS of Rs 8.16

-

Amal - Entered at 188 : Pure Q3 and Q4 result play

-

Monte Carlo - Entered at 232 :

- Textile policy benefits

- Q3 is it’s best quarter

- Integra Engineering - Entered at 35 :

Integra Engineering India Limited has come a long way since it commenced operations in 1987. Its comprehensive manufacturing facilities offers a unique blend of products as well as services to transport and power sectors. The operations are dependent on core sectors and their performance. The products primarily cater to Railway Control Systems as well as Contract Manufacturing for Indian railways.

Current production includes electro-mechanical relays, cable harnesses, wiring plates, fuse auto change over systems and mechanical enclosures like Power Converter, Traction Converter, Hotel Load Converter as well as Auxiliary converter. Recently introduced I-panel (own product), a unique product offering modularity as well as alternate to existing products is taking longer than expected time to make establish in the market. Consequently, it had to undergo changes by way of offering an alternative to meet market specific requirements.

History :

- INTEGRA Engineering, formerly Schlafhorst Engineering India Ltd., was founded in 1981 as Padmatex Engineering Ltd. and was earlier part of the Saurer and later Oerlikon Group.

- INTEGRA Holding has acquired a majority shareholding in Schlafhorst Engineering in January 2011, with the goal of strongly growing the business. Subsequent to the acquisition the company was renamed into INTEGRA Engineering India.

- INTEGRA India Group Co. Ltd. which was established as Joint Venture with ABB in 1987 under the name of INTEGRA Hindustan Control was merged with INTEGRA Engineering in June 2012.

Product Portfolio :

- The company offers the manufacturing and assembly of solutions in apparatus and equipment fabrication, assemblies or individual components.

- Railway Signalling Relays as well as Textile Machinery (Draw Frame).

- Engineering & Manufacturing for OEMs.

Trigger : Budget

-

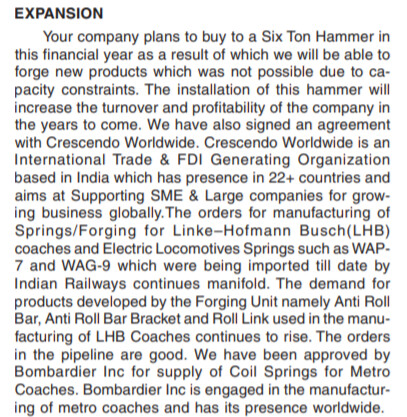

Frontier Springs - Entered at 314 :

"Established in 1981, Frontier Springs Ltd. started with the production of Leaf Springs and Laminated Bearing Springs for Automobiles and Railways. Steadily as the railways modernized, so did we and within a few years had expanded our plant to accommodate the high demand for Coil Springs for wagons, coaches, and locomotives for the Indian Railways and many more clients.

Although, our experienced team can design springs using design software by Institute of Spring Technology, Sheffield as per the specifications given by the clients, we have been preferred manufacturers for the following springs with the Indian Railways-

Springs for LHB Coaches

Suspension Coil Springs for Freight Stock

Suspension Coil Springs for Coaching Stock

Suspension Coil Springs for Diesel and Electrical Locomotives (EMD, WAG 9, WAG 7, etc.)

CLH and VLH Coil Springs for Power Sector (BHEL)

Frontier Springs Ltd. comprises three different units all working in synergy to fulfill the demands of clients and also developing new products periodically.

Spring Division- In Kanpur, Uttar Pradesh and Paonta Sahib, Himachal Pradesh

Forging Division- In Kanpur, Uttar Pradesh

Colour Coated Roofing Sheets Division- In Paonta Sahib, Himachal Pradesh

We adopt updated technology throughout our processes of manufacturing which is why Frontier Springs Ltd. is always moving forward and has systematically grown over the years. Our fully equipped laboratory is one such example of our willingness to adopt all the latest techniques that science has to offer in our Industry."

Trigger : Budget and Expansion

- Fermenta Biotech - Entered at 312 :

"– In Q2FY21 company has completed backward integration project at its Dahej plant to manufacture cholesterol. From Q3FY21 company will start using inhouse cholesterol coming out of said backward integration project. By FY22 company plans to use completely inhouse manufactured cholesterol as RM for producing VD3 and there will be no external dependence on that.

– Cholesterol currently forms 45 % of total RM cost for the company and the said backward integration project will generate savings of ~20-25 % on cholesterol purchase cost which basically means from FY22 onwards company should see ~300 basis points expansion in profit margins because of said backward integration project.

– Company plans CAPEX of ~150-250 cr over next 2 years. Funding will be via internal accruals and debt.

– Company is actively looking at avenues to monetise its real estate assets and use the funds raised out of that for its future expansion plans in nutraceutical/pharma API business."

- By Mahesh Shah on Valuepickr

Post Budget I will be targeting companies with triggers in Q4 FY21 & Q1 FY 22.

Could you share some light on Vikram Thermo and any views on Indo Borax

Hi Akshay,

I have not researched Indo Borax, so cannot comment on it. What more information would you like on Vikram Thermo? Would suggest you go through Vikram Thermo.

I dont bother much with the credit ratings as long as the the cash flows and debt and some fundamental check points tick my list, in a country like india accounting and books are not always accurate and this point has been mentioned by mohnish pabrai as well we have seen recent examples like yes bank ,dhfl and countless others sugurcoating there books and with triple A+ credit ratings .

The reason i like the company is the turnaround in cycle coupled with still being profitable with out capacity utilization of capex and if credit rating problem can easily be offset by the fact that there is heavy insider buying which should clear doubts that something is wrong in the books

Hey sir

I don’t understand why alufloride’s results is bad @aniketk9 you mentioned thay results will be bad, so how can you told?

Are Results bad because of companies plan shut down because of expansion?

They had a planned shutdown

Is probably consider around 180 range if it falls

Ishan dyes a competitor of vipul gaves spectacular results, hope vipul organic does the same together with expansion of 6X

Good result by Vipul organics,

Going forward I expect economies of scale to kick and OPM, ROE & ROCE to improve significantly over next 2 years