Anyone tracking Alkali Metals Ltd.? The Co. specializes in Sodium derivatives & one can see a steady improvement in numbers. Can the Co. contribute in the development of Sodium-ion batteries, which is gaining in acceptance as a potential option to lithium batteries. Its early days but the potential is immense.

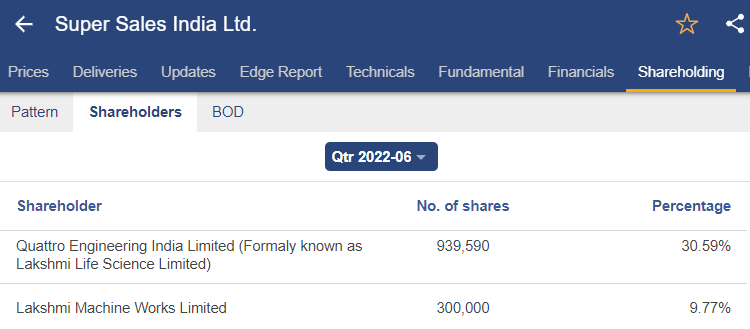

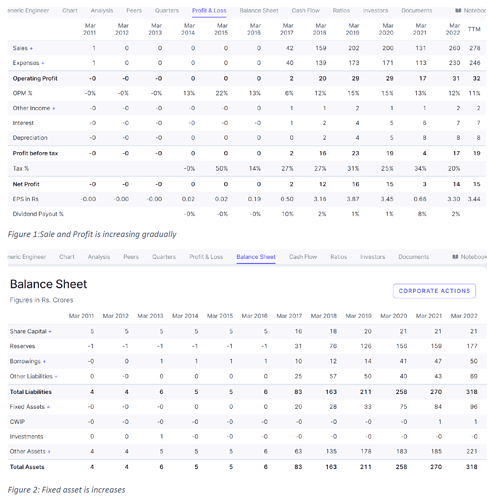

Recently I was looking into the financials of a stock: Super sales India Limited. Details will be found in the screener (Super Sales India Ltd financial results and price chart - Screener). Interesting company is in all-time low PE. Though the sales, cash flow, and NP is continuously increasing. I have recently invested some money in it. Any comment on the stock? Thank you

SUPER SALES is Lakshmi Machine Work company handling the sell side transaction, so a sales/trading entity.

but the annual report 22 shows it has a cotton yarn business, which is around 80% of rev. What I understood is that 2.5% holding of Laxmi machines are held by Super sale.

Yes Laxmi also share holder of supers sale.

The CEO of Albert David has resigned resulting about 10% correction in the stock price since recent high. CEO resignation may not necessarily be a shocker as current CEO will be around until December which will provide board to select another suitable candidate.

file:///C:/Users/manohpatil/Downloads/452746dd-00cd-4bde-94ec-42e48f8c22db%20(1).pdf

Alkali Metals also manufactures Sodium Azide, which is used in the making of Air Bags. Another potential area of growth, given the recent awareness towards safety in case of accidents.

Is any one still tracking Scandent Imaging? Seems promoter has sold some quantity. Any updates about it?

GENCON is a construction company whose share price has constantly decreased for the last four years though the sales and fixed assets are gradually increasing.

The credit report says:

Strong revenue visibility: Successful track record of project execution has led to healthy orders of around Rs 817 crore as of March 2022, to be executed in the next two-three years. This provides strong revenue visibility over the medium term and will help scale up operations.

However, I have not understood why this is going negative. Any idea on it?

for ROE 7.36 % business the PE of 9 seems reasonable enough. they have been earning ROE below the cost of capital consistently.

Hi,

Just came across a company ‘Sreechem resins limited’. Manufacturing refractory binder resins. Company catering to steel plants.

Mcap - 52 Cr

PE ratio - 9.62

Sales growth 5 years - 25%

Profit growth 5 years - 69%

Debt to equity - 0.69

Promotor Holding - 21% (Negative)

ROE- 34%

Cash flow positive and significant improvement in working capital in last few years.

Please share your valuable inputs if anyone is tracking this company.

Thanks.

Do you have any idea about what is that newly developed product they have mentioned in AR, it’s merits & demerits? All they said is newly developed product is approved by Tata steel and getting repeat orders.

Any idea what is the “newly developed product”, that is doing all the wonders for them but has remained unnamed in the latest AR? That phrase has been mentioned 10 plus times mostly in relation to remuneration increase of directors and good results inspite of the doom and gloom of chinese flooding of phenolic resins .

Also why’s promoter holding so low for such a small company? Definitely a deal breaker for me unless there’s something more to it.

Currently nothing much info available in public domain. Yes the past annual reports are all copy paste, only the numbers got changed. But something has really changed since last few quaters that is why company start generating above avg ROE. Might be some ban on raw materials of refractory to reduce dependence on china. Still trying to find the information.

There are many example currently where earnings expanded bcoz of restrictions or shipping issues(from china). we need to be aware and cautious of such companies.

Do check historical margins before taking a call

Look at the cash flows

Last 5 years -

Cumulative EBITDA: 126 crs

Cumulative Cash Flow from operations (ebitda after working capital changes): -13crs!.. meaning the company hasnt earned any cash though it shows profits on income statement

Cumulative FCF: -132crs

Cumulative FCFE: -156crs

The huge cash deficit is filled by 50cr debt increase and 100cr through equity issuance.

In short, the company is quite the cash guzzling machine! ![]()

I have not seen such horrible cash flow numbers on any company yet

Here’s a talk by dr. prashant mishra on youtube.

He routinely finds small/micro cap gems and also shares very detailed threads on finding them.

He was also very vocal about the rampant medical charity fund raising frauds that happen.

Good observation. These businesses are usually capital intensive and cash guzzling. From FY 2021 Cash from operating activity has become positive. This is very positive. From the credit rating on can guess that this may improve in the future. credit rating: Rating Rationale. (Disc: Invested)