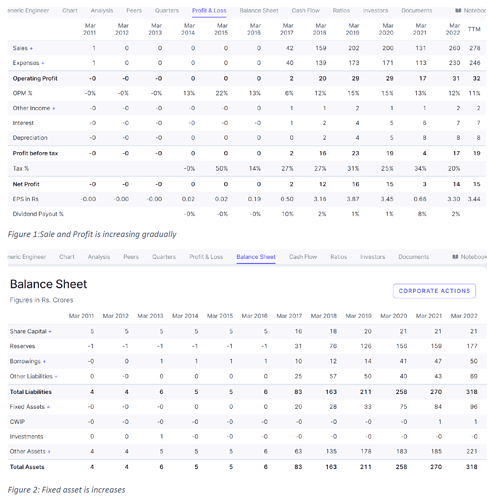

GENCON is a construction company whose share price has constantly decreased for the last four years though the sales and fixed assets are gradually increasing.

The credit report says:

Strong revenue visibility: Successful track record of project execution has led to healthy orders of around Rs 817 crore as of March 2022, to be executed in the next two-three years. This provides strong revenue visibility over the medium term and will help scale up operations.

However, I have not understood why this is going negative. Any idea on it?