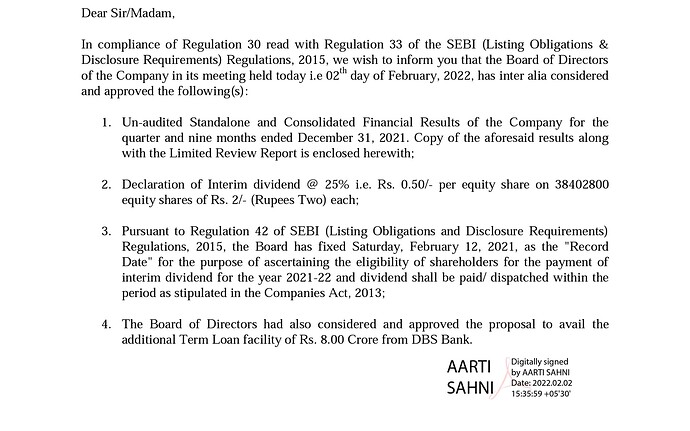

It is for companies like Shivalik bimetal limited that the power of a community like VP comes out. Even when there is very minimal information shared by the company, the community is able to take the small tidbits shared, information around clients, information around the industry, competitive intensity & build an investment thesis which is compelling. For that, my deep note of thanks to the community of VP.

To take Dev’s work forward, i think its useful to analyze Vishay’s numbers & concall commentary for a Q in order to understand shivalik’s execution better (especially in times of distress where even for the best of us, a 30%-40% fall can make one question conviction)

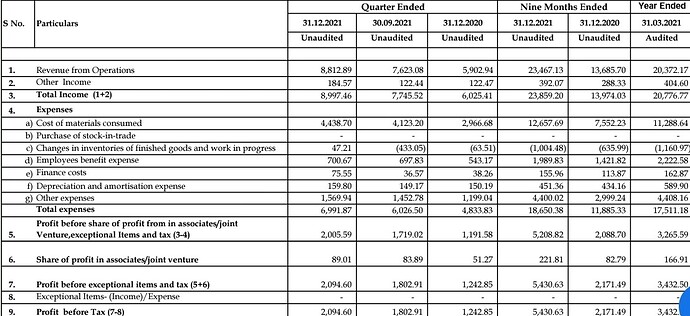

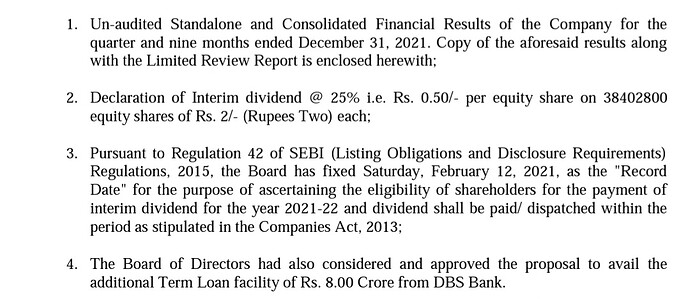

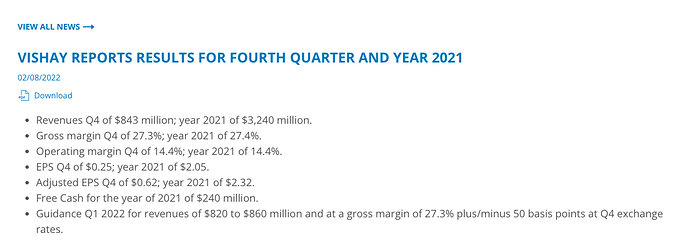

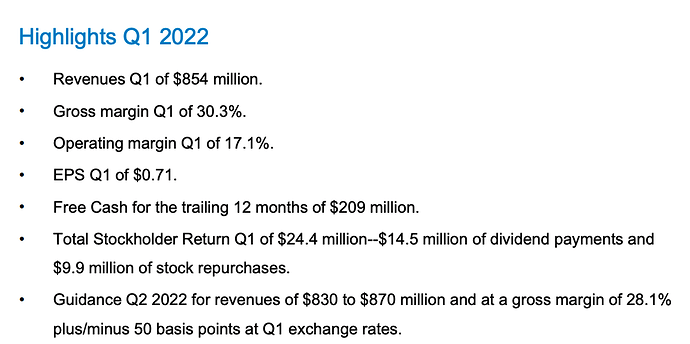

To begin with, VIshay’s overall revenue of 854M$ in 1Q22 is towards the higher end of the guided range in 4Q21

In fact, the gross margins have also expanded to 30% much higher than the guide of 27$% in 4Q21

Now it is important for shivalik investors to understand

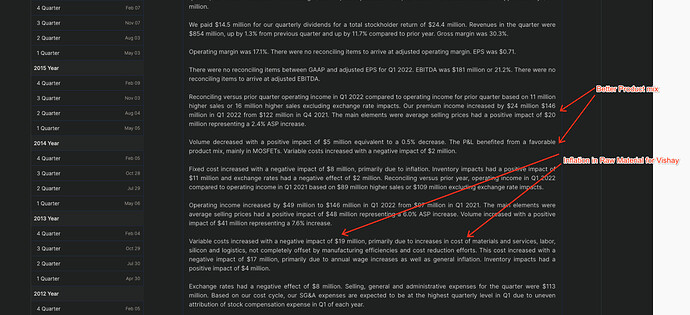

why Vishay’s gross margins expanded. Was it due to better product mix, higher selling price or squeezing suppliers like Shivalik? The concall gives us a good idea about this piece.

As we can see from the concall, gross margins went up due to better product mix & higher selling prices. But vishay did suffer from higher raw material inflation which has some correlation with shivalik’s ability to pass on prices to vishay in 1Q22 as well.

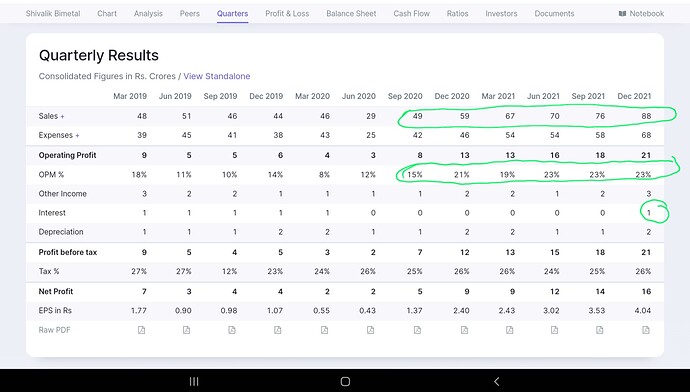

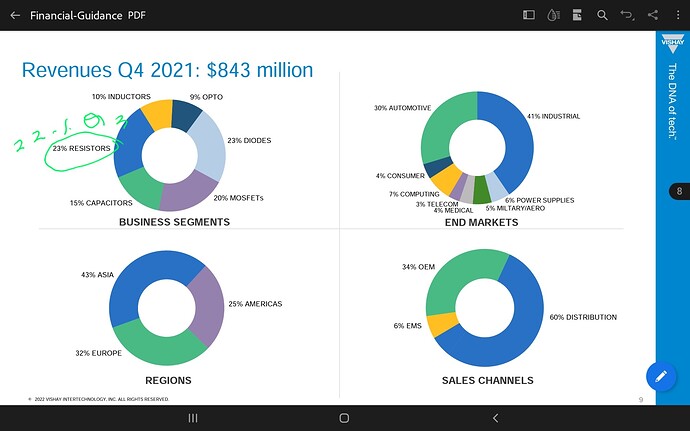

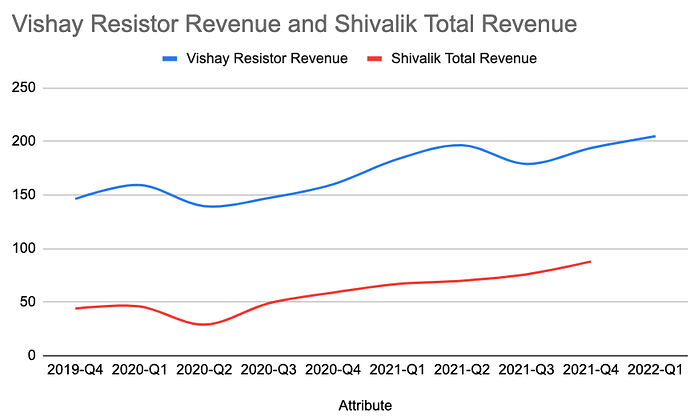

On to segment analysis. I looked at the last 8-9 Q of data for vishay (resistor revenue) & Shivalik. The correlation in the graphs is brilliant. See the graphs.

Now see the correlation calculated in google sheets:

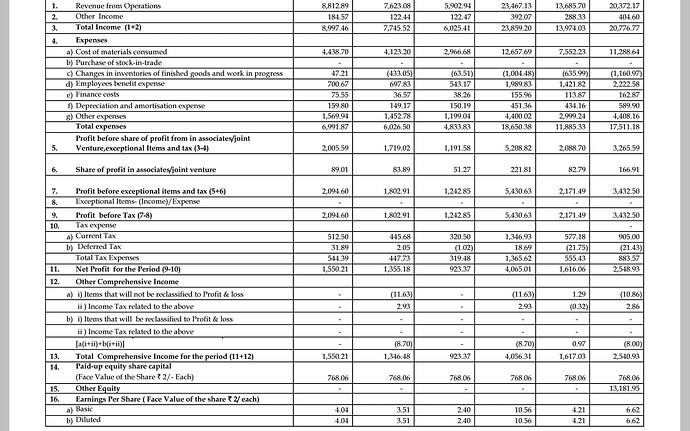

| Attribute |

Vishay Resistor Revenue |

Shivalik Total Revenue |

| 2019-Q4 |

146.4 |

44 |

| 2020-Q1 |

159.38 |

46 |

| 2020-Q2 |

139.68 |

29 |

| 2020-Q3 |

147.2 |

49 |

| 2020-Q4 |

160.08 |

59 |

| 2021-Q1 |

183.6 |

67 |

| 2021-Q2 |

196.56 |

70 |

| 2021-Q3 |

179.08 |

76 |

| 2021-Q4 |

193.89 |

88 |

| 2022-Q1 |

204.96 |

|

|

|

|

| Correlation (Until 2021-Q4) |

0.908304665 |

|

The correlation is fairly high. The QoQ growth in Vishay revenues should translate to QoQ growth for Shivalik. In fact, even the slope of the lines are similar.

Another very interesting thing to observe is that while vishay resistor revenues dipped in 2021-Q3, Shivalik did not. This could show one of two things:

(i) Vishay’s supplies from other resistor suppliers reduced, but not from shivalik

(ii) Shivalik’s revenue is getting less dependent on Vishay.

We shall find out in FY22 annual report which one it is, but definitely either conclusion is good well for Shivallik (either it has supplier strength or is diversifying revenues; i prefer the latter though).

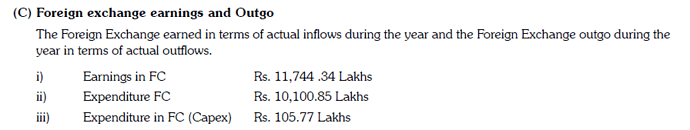

Another important thing to note from the sheet is that resistor as % of sales have been in the 22-26% band generally over last 2 years (increase from 22 to 24 was only mean reversion. Can it secularly go beyond 26% in the future? Need to better understand vishay to answer that).

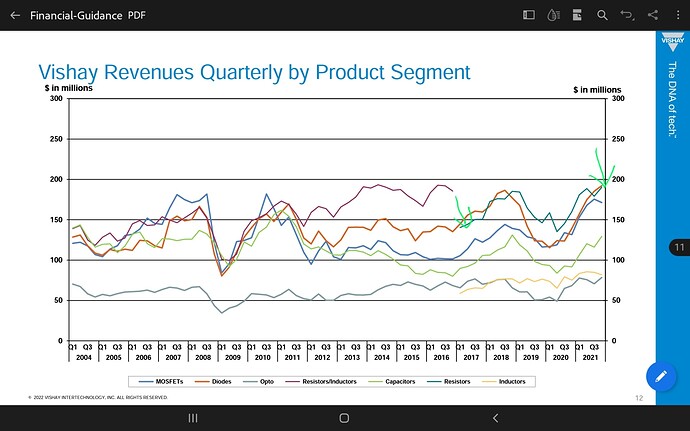

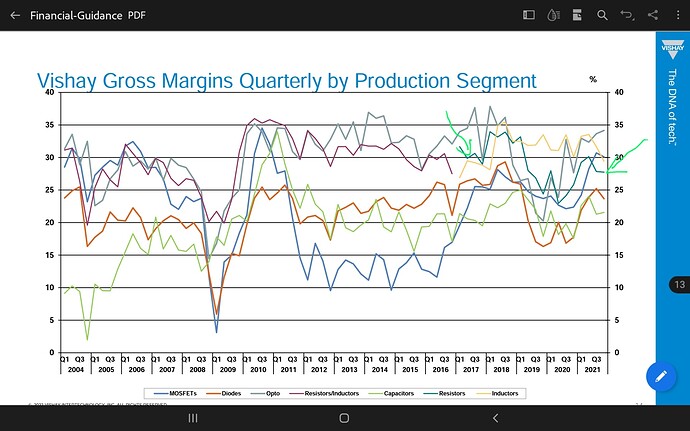

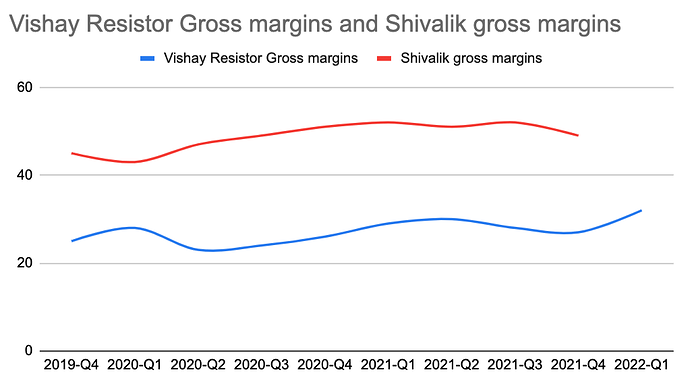

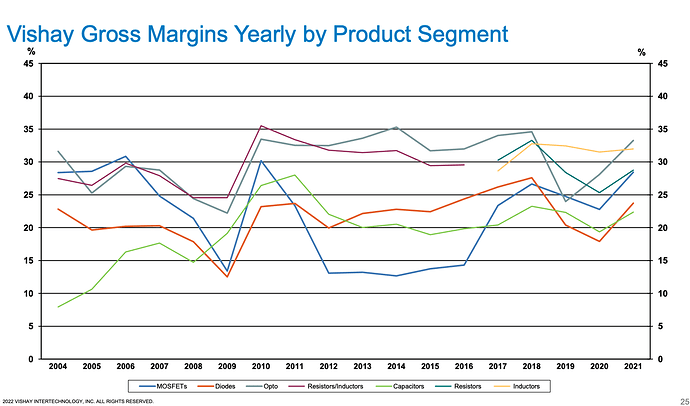

While correlation between Vishay resistor revenues & shivalik revenues is very strong, the correlation between the vishay resistor gross margins & shivalik gross margins is weaker at 0.37. So it is much harder to predict how shivalik margins can be predicted from Vishay resistor gross margins.

It is also to be noted that the correlation if we consider latest data (2Q-2020 onwards) is much higher at 0.81)

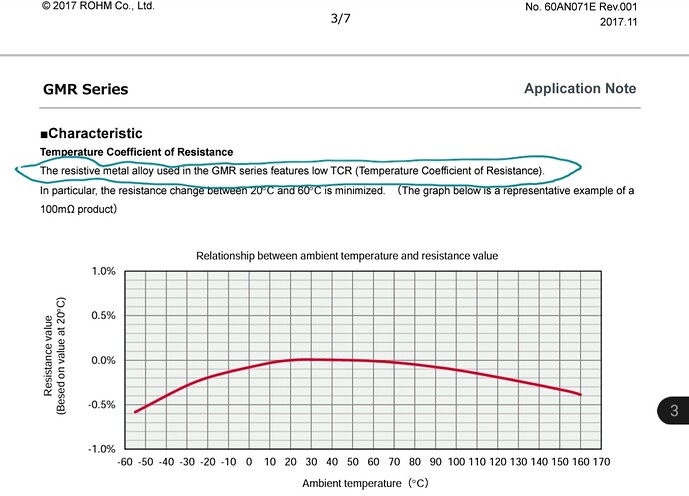

In general thinking from 1st principles, generally the change in margins should actually be correlated not inverse correlated. The reason is that generally pricing changes are absorbed by entire supply chain (OEM, Tier 1, Tier 2, Tier 3, Tier 4) together as a unit. My measured prediction is that VIshay’s resistor pricing power would be shared with Shivalik & we might be GM expansion in q4fy22 (though these things are hard to predict as the weak correlation shows).

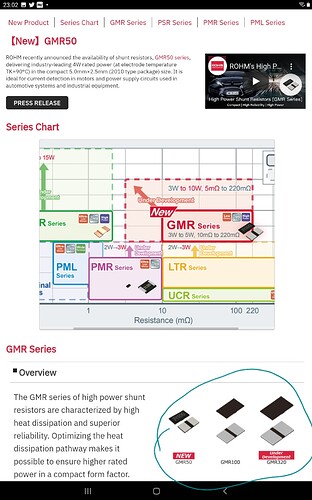

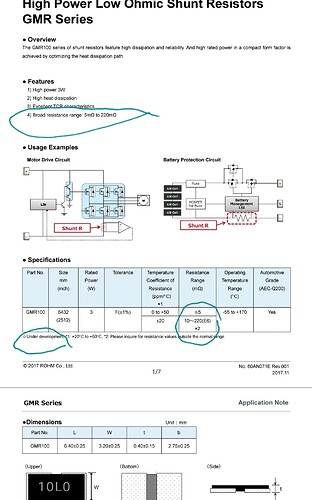

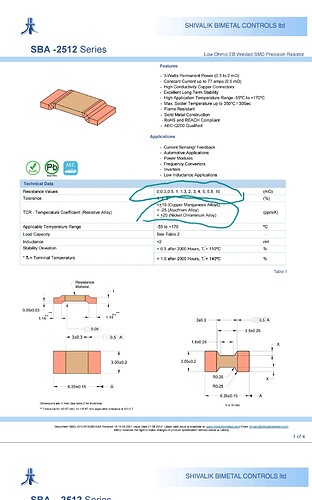

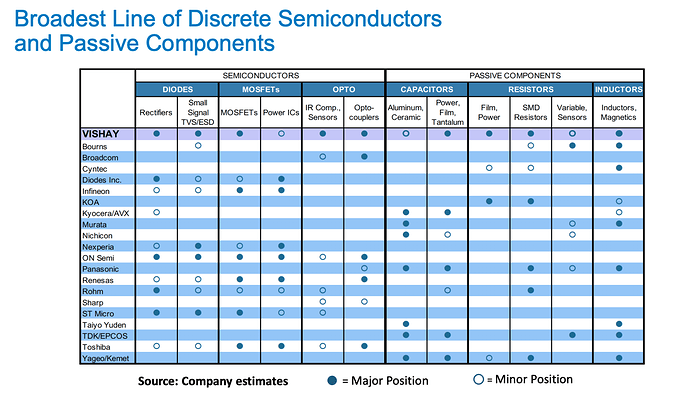

There is another very important thing to understand, the right to win here for shivalik is closely tied to Vishay (at least for the time being). Hence, what we should be doing is a vishay vs competitor competitive analysis. Just a glimpse from the investor presentation shows us that Vishay is the only one with a wide range of resistors (power, SMD resistors, Variable, Sensors)

No other competitor (at least as per vishay, we need to do our own due diligence) has the kind of broad line of resistors that vishay has.

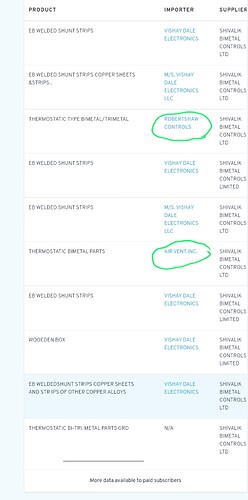

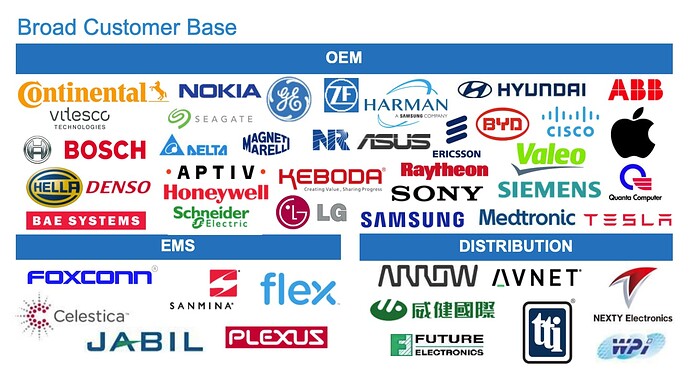

Even in general Vishay’s line of semiconductors & passive components is highest. The reason this matters to us as Shivalik interested investors is that to an Apple, Nokia, Sony, ABB, BOSCH, Samsung, GM, ZF, Tesla, it is much easier to deal with 1 supplier rather than dealing with multiple suppliers.

Btw that was not a random laundry list of companies, all of these are clients of Vishay (& thus of shivalik). It is insanely hard for CO of shivalik’s size to bypass vishay because vishay acts as an aggregator of these electronic components & that is their value add. They make supply chain, sales, marketing easy (or non existent) for shivalik. To shivalik an electronic component costs 50 rupees. They sell it at 100 rupees. Vishay sells it at 145 rupees (45 rupees mark up). TO Shivalik, this is the cost of outsourcing their Sales & marketing & complex supply chain management.

Perhaps if shivalik becomes 10x larger in fundamentals it can think about bypassing vishay completely (some OEM might still be interested in tying up for Shivalik directly because that way this 45 rupees can be split between shivalik & OEM or tier-1 supplier.

This complex dynamic of whether & to what extent shivalik can or will bypass vishay to establish direct relations with OEM or Tier-1 supplier needs to be better understood through industry scuttlebutt in my opinion because it can have a heavy influence on where shivalik lies on the growth-profit curve.

Continue to supply larger share of wallet to vishay, growing with them, or bypassing through a difficult, effort consuming process which can lead to better gross margins. Most likely reality will turn out to be somewhere in the middle.

Zooming out a little & looking at Vishay resistor (resistor + inductor pre 2017) gross margins over the years, we see that Vishay’s peak margins here have been around 35%in 2010. Not there yet, but getting there (30% in this Q).

Shivalik’s gross margins would be much harder to predict imo because of changing product mix, changing client mix (tier K vs tier K+1 supplier, smart meter vs BMS) but volume growth should probably not be a problem with a secular switch to EVs throughout the world accompanied with secular shift to smart meters (i expect revenue contribution from former to be much much higher in steady state because people replace cars much more frequently than they replace the electricity meter @ their homes)

link to analysis sheet:

Disc: Have a small position studying.