This is my first thread on the Forum. I would appreciate the feedback of senior people and would also invite fellow members to research more on this company.

I am grateful to @Vivek_6954 as I came to know about this company through the thread Vivek Gautam Portfolio. Also, the scuttlebutt done by @DrArvind gave me the conviction to read more more about the company and it’s history.

About the Company and Business

The Promoter, Sanjaybhai D. Bhuva commenced the business of production of different types of Ice-cream, Mango Shake, Lassi & milk product etc. under a sole proprietorship M/s. Shree Shital Industries in the year 2000. Subsequently, sole proprietorship was converted into a partnership firm under the name M/s. Shree Shital Industries, pursuant to partnership deed dated June 17, 2013. Further, the name of the partnership firm was changed to Shital Cool Products on

September 11, 2013. Shital Cool Products was thereafter converted from a partnership firm to a Private Limited Company under Part IX of the Companies Act, 1956 with the name of Sheetal Cool Products Private Limited and received a certificate of incorporation from the Registrar of Companies, Gujarat, Dadra and Nagar Havelli on October 14, 2013. The Company was subsequently converted into a public limited Company pursuant to special resolution passed at the Extra-ordinary General Meeting of The Company held on July 24, 2017 and the name of The Company was changed to Sheetal Cool Products Limited. A fresh certificate of incorporation consequent upon conversion to public limited Company was issued by the Assistant Registrar of Companies, Ahmedabad dated August 10, 2017.

The Company is currently involved in producing and processing of milk and milk products, snacks and bakery items. The diversified product portfolio enables them to cater to a wide range of taste preferences and consumer segments, including adults and children. They sell the products under the brand “Sheetal” to a number of distributors and super stockists. It also has a franchise model to increase the visibility of our Company. Company has seen strong growth under the vision, leadership and guidance of our promoters, Bhupatbhai D. Bhuva, Dinesh Kumar D. Bhuva, Sanjay D. Bhuva. They have good industrial knowledge and experience, which enable us to carry the processing in an efficient manner.

Currently, the company has a manufacturing unit spread over an area admeasuring around 5314.66 square meters (approximately) at Amreli, Gujarat and the registered office is also situated at the same location. The unit is well equipped with wide range of machineries and other handling equipment to facilitate smooth manufacturing process. As on date of this Draft Prospectus, the Company has employed 22 employees (including skilled, semi-skilled) and 275 personnel on contract basis. It imparts continuous training to the employees, which helps the organization stay abreast of the rapidly changing preferences and taste of consumers. The company is ISO 22000:2005 & ISO 9001:2015 certified in respect of manufacture of Ice-cream, milk & milk products, mango ras, lassi, curd, flavoured milk, masko, wafers, namkeen, fryums and bakery products. The products undergo a quality check, to maintain precision in the results.

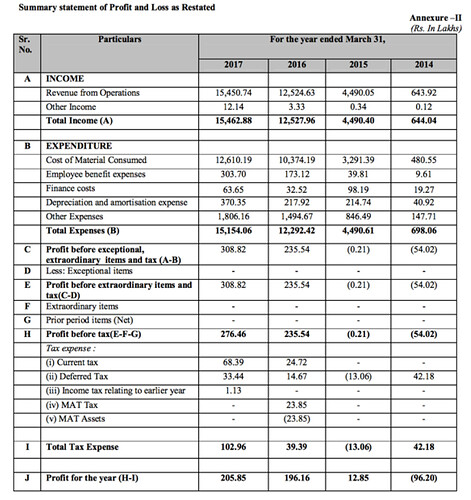

The restated total income for the Fiscal ended March 31, 2015, 2016 and 2017 was Rs. 4,490.40 Lakhs, Rs. 12,527.96 Lakhs and Rs. 15,462.88 Lakhs. The restated profit after tax for the Fiscal ended March 31, 2015, 2016 and 2017 was Rs.12.85 Lakhs, Rs. 196.16 Lakhs and Rs.205.85 Lakhs.

Location

Purpose Location

Registered office GIDC Plot No.78,79 &80, Amreli, Gujarat-365601

Manufacturing Unit GIDC Plot No. 75, 76, 77, 78, 79 & 80, Amreli, Gujarat-365601

Products:

Wide range of products as mentioned below:

• Milk and Milk product: Products comprises of ice cream, pasteurized milk, flavTheed milk, yoghurt, lassi, chaas, sweets and many more.

• Snacks: Snacks portfolio of products comprises of potato chips, banana chips, extruded snacks (fryums), other namkeen including bhujia, salted peanuts, salted pulses and many more.

• Bakery: Bakery portfolio of products comprises of variety of breads, pav, khari, cake and many more.

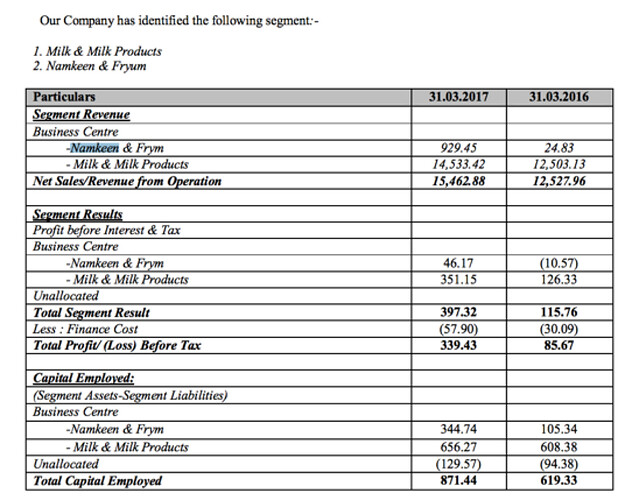

(Major revenue coming from Milk and Milk products. Current margins are low, EBIT Margins for Namkeen and Fryms ~5%, for Milk and Milk products ~2.5%)

Financials

P&L statement

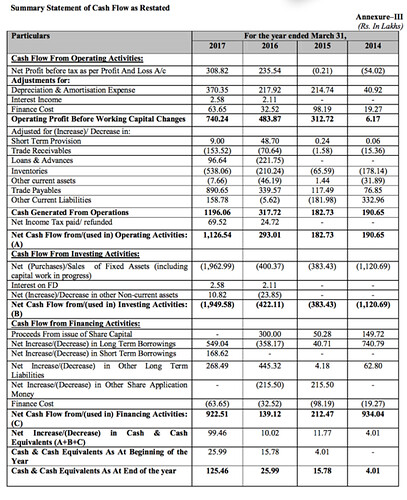

Cash Flows

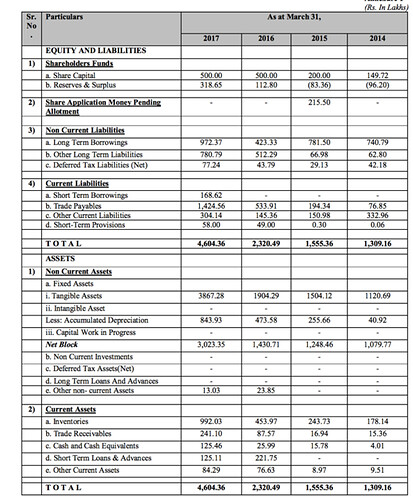

Balance Sheet

Net block is increasing pretty fast, which suggests that company is continuously increasing its capacity.

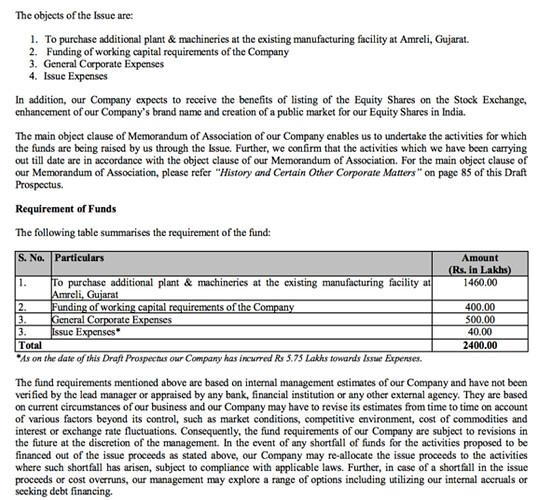

Objects of the Issue – Purchase of additional plant and machinery is the key object

Assuming all these plants and machinery goes to net block, the net block is going to increase by 40%

Company is expecting ~3X jump in receivables (2018 compared to 2017). This directionally suggests that company is planning siginicant jump in turnover.

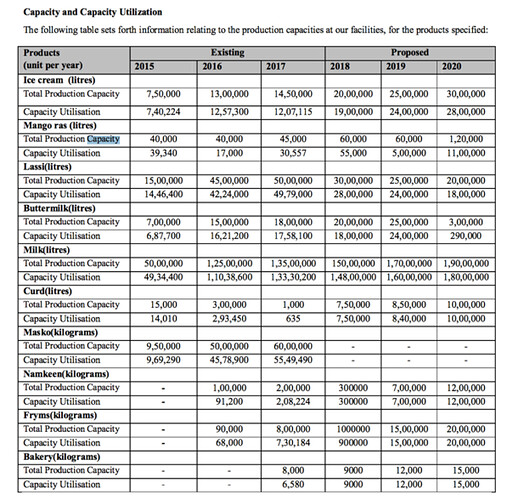

Capacity Expansion and Utilisation plans

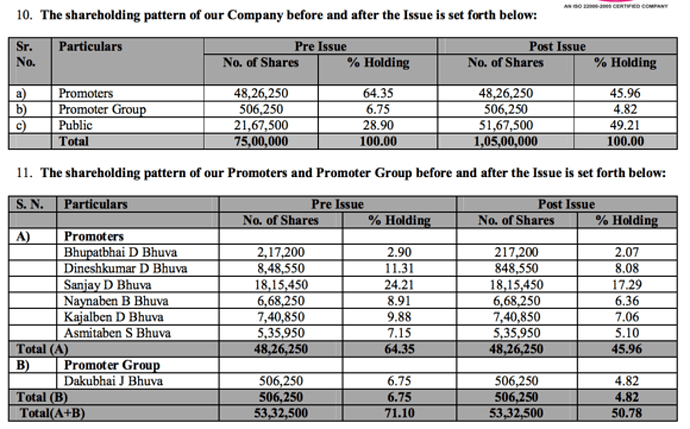

Shareholding pattern after IPO – Promoter holding just marginally above 50% post IPO

Scuttlebutt

The company seems to be providing quality and packaging at par with companies like Vadilal, but at a cheaper price.

Good feedback on promoters- going by some scuttlebutt done by @DrArvind

Not much reviews about ice-cream available online. But one-of the parlors on Zomato had pretty happy customers

https://www.zomato.com/ahmedabad/sheetal-dairy-ice-cream-vasna/reviews

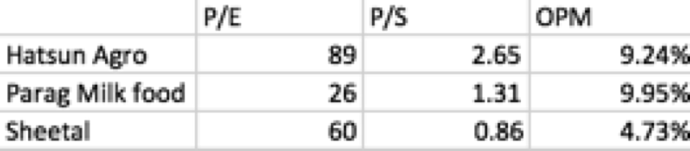

Valuation compared to peers

With net profit of 2.06 crores, and current EPS of 2.06 as well, company is trading at a PE of about 60. If you look at P/S, it is available at a P/S ratio of .86

The company has witnessed good capacity utilization in the past and should do good with positive rural consumption story. Company is also looking to launch premium products and expand beyond to more markets.

It is looking to double it’s ice-cream capacity by 2020 and triple the namkeen+fryms capacity to 3 times.

The increase in capacity should aid in margin expansion.

My understanding of positives/negatives

Positives

• Hardworking 1st gen promoters

• Cheaper compared to peer looking at P/S (0.86)

• Focusing on rural markets – Rural consumption tailwinds

• Summer season to kick-off

• Expanding product portfolio – getting into snacks, premium ice creams

• Good customer reviews – (though limited scuttlebutt info)

• Low margins, (new plant) capacity increase should aid margin expansion

Negatives

• Pricing of products is lower compared to established players – lack of pricing power, one of the reason of low margins

• Debt on higher side (13.7 crore debt – 9.7 cr long term, 3.9 cr short term). D/E of 1.67

• High competition in ice cream business

• SME liquidity issues

Discolsure: Invested and looking to add more