Hello,

I wrote a short note to make sense of valuations for Sanghvi as they stand today.

I took a tracking position about 4 weeks back (Disclaimer : Invested) and was exploring whether valuations and the business potential justify further accumulation.

Even some basic research indicates that P/E may not be a great way of looking at Sanghvi simply because High depreciation lowers the optical earnings but cash conversion as seen from CFO/Sales is very respectable.

A better way to look at valuations might be EV/EBITDA (Even better Price / CFO but not discussed here)

EV/EBITDA

There are 2 ways we can look at the EV/EBITDA based valuations here :

Historically

Sanghvi Movers Went through 3 major cycles (including the current one) over the last 14 years.

From the chart given above, it is evident that :

Between 2011-2013, When the co’ hit a peak EBITDA of 300 Cr+, EV/EBITDA was ~ 3.3X

Similarly, in 2017 when TTM EBITDA hit ~ 325 Cr, EV/EBITDA was in the range of 4-5 X

And today, as we speak TTM EBITDA is at a recent high of Rs. 257 Cr with a higher EV/EBITDA of 9.45X (unlike in the previous 2 cycles, for many reasons this not a peak. yet.)

Now, there are a couple of things to take from this :

Firstly, we can see a general trend of higher EBITDA Peaks in every successive cycle, which correspond with higher EV/EBITDA multiples (3x to 4-5x to 9.5x)

No reason this should continue : It’s an observation.

Although, this observation seems to align with a standard pattern seen in some of the better players in a cyclical Industry (Check Sugar Industry, Maithan Alloys etc) where each successive peak is higher than the previous peak, and each successive bottom is usually higher than the previous bottom.

So, higher tops and higher bottoms.

And these higher tops and bottoms are observed in Earnings (or EBITDA), Stock prices & Valuation Multiples (E.g - EV/EBITDA)

Taking these observations from the past and applying On a Forward Basis, let’s see how numbers can pan out for Sanghvi.

Today, TTM EBITDA is at Rs. 257 Cr (March 23Q), which is nowhere close to the previous peak of ~ Rs. 325 Cr.

This is indicative of the fact that the co’ can sweat out Rs. 325 Cr of EBITDA at least (or more) from the existing Gross block.

But, What is the link between the Gross Block & EBITDA?

Well, Cranes form the Gross Block for Sanghvi and it reports (or communicates) its performance in terms of Yields it can earn on the Gross Block.

In 2023, the yield on Gross block of ~ 2300 Cr was ~ 1.65 % per month [(Revenue/Gross Block)/12] Where FY23 Revenue was Rs. 456 Cr.

Which means in FY23 it earned a yield of around 19.6% (on Gross Block) and it has guided that this can go up to 2%/month or 24%/year/

24% of Rs. 2300 Cr is Rs. Rs. 552 Cr.

That turns out to be a Y-O-Y Revenue growth of 21%

Bear in mind that this 21% Revenue Growth is assuming there is no additional creation of Gross Block (think : Cranes bought/leased) but since there is actually an expected capex of Rs. 260 Cr, Growth may be higher than 21% !

In the interest of conservativeness, assume 21% Y-O-Y Revenue Growth.

And since EBITDA margins are expected to be in the zone of 65% (3 year Avg - Check Graph below), this means EBITDA next year could be around Rs. 358 Cr.

That means for a Revenue Growth of 21%, we get an EBITDA growth of ~ 35% which is not surprising given Sanghvi exhibits high operating leverage.

This also means that PAT Growth is likely to be even higher.

Let’s say it’s 50% PAT growth. To get a more precise figure one can do a modelling exercise.

That means, on a forward basis - EV/EBITDA is around 7x and Leading P/E equals ~ 14x

If numbers turn out to be better than we assumed (most likely the case), on a forward basis EV/EBITDA and P/E do not seem as expensive as they do today.

They are definitely not anywhere in the ‘What a discount !!’ category

In fact, I wrote this note in the afternoon of 10th July and later that night Sanghvi updated the Stock Exchanges with this :

- Additional orders of Rs. 150 Cr, out of which 44% will be executed in this year.

Here’s what this means :

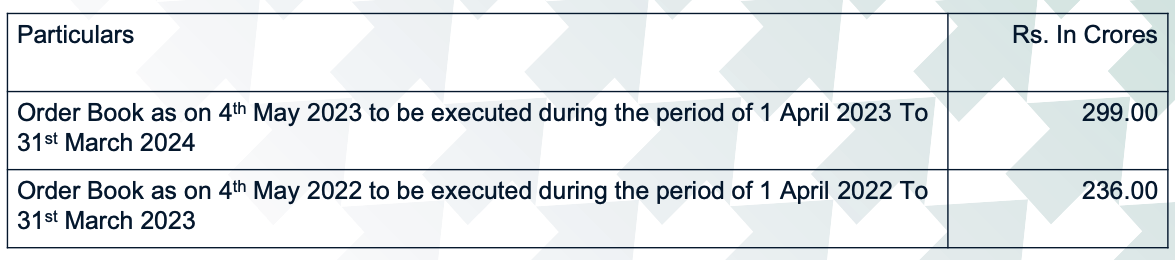

As on March 23, Sanghvi had an outstanding order book of Rs. 299 Cr to be executed in the current FY, this was up 26% from the previous year.

We’re just done with the first quarter of the year, and the company has added 66 Cr worth of orders to be executed during the year, bringing the Total Order book to be executed in FY24 to 365 Cr.

That’s a Revenue Growth potential of Rs. ~55% on a yoy basis.

For those who are wondering if the order book was only Rs. 236 Cr in FY23 why the reported Revenue for FY23 was Rs. 456 Cr, that’s because of older orders being executed + jobs taken on during the year on a short term basis.

The bigger point here is that there seems to be some linkage between order book growth and Revenue Growth.

So If for the 21% Revenue Growth assumption, which we estimated would bring in 35% EBITDA Growth and ~ 50% PAT Growth, a 50% Revenue Growth might bring in much higher EBITDA and even higher PAT Growth.

Even if EBITDA & PAT Grow by 50%, and bear in mind this is seriously conservative given that Sanghvi has high operating leverage built into its business model, we’re looking at :

EV/EBITDA = 6.33 x [ Median - 5.4 x] Vs. Current EV/EBITDA = 9.1x

Price / Earnings = 14 x [ Median - 9.6 x] Vs. Current P/E = 21.1 x

Which, again, are not exactly mouth-watering valuations but are not as optically expensive as they seem today.

As a cautionary note, let’s be clear there are a bunch of assumptions that have gone into these back of the envelope calculations and I strongly recommend you decide for yourself if they make sense or not.

Another way to Value the Co’ would be on a Cash Flow basis, such as Price to CFO.

Anyway, if the above numbers don’t make sense please feel free to share why not and why there’s a better way of looking at this situation.

Lastly, I believe this up-cycle in Sanghvi (& Wind Power Sector) is entirely dependent on the extent to which this cycle could go on (Duh)

In the past, markets have been very efficient at pre-empting Sanghvi’s future performance and despite expected bullish numbers over the next year, if signs of slowing growth/order booking emerge the stock can be hammered down real fast.

On the other hand, if more wind projects are awarded AND execution of these projects keeps up as well, and as a consequence we see higher order booking by the co’, the current price may even seem reasonably cheap in retrospect.

It’s not a no brainer kind of buying price but probabilities are in favor of continuance of this up-cycle.

In my limited wisdom, this is how I see Sanghvi Movers valuation as of today. I could very well be wrong, Please don’t consider this as a recommendation.

Please feel free to add more on How to best value Sanghvi.

Thank you

Rahul

First Principles Investing