Hi Anshul… Thanx for pointing out on the taxation part… I have very limited knowledge on rules regarding corporate taxes… Can u please elaborate more on that? Thanx…

When a company operates in losses for some years, it doesn’t have to pay taxes for the subsequent profit years till the time they don’t cover their losses.

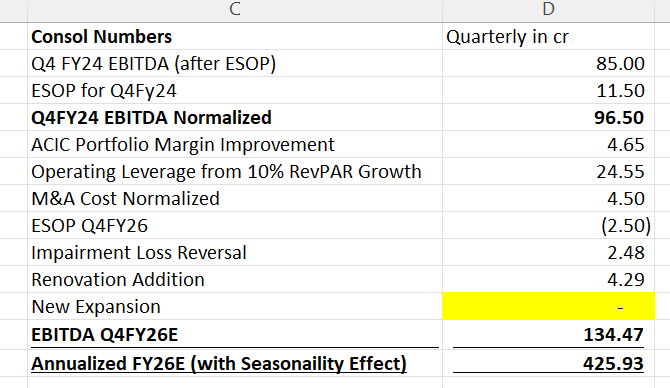

On a very conservative basis, I think they can do atleast 425cr of EBITDA (without accounting for any expansions and only assuming 10% RevPAR Growth

ACIC 950 rooms were already integrated in Sept 23 quarter. Dec 23 and Mar24 Q have the revenues from acic integration.

Samhi will only add 350 rooms in Q3 FY25.

Why ebitda would go from 2758 to 4470 in one year.

More like 3300 to 3700 it should be.

I see in the concall the guidance in revenue is 1000 crore of March 24 + 10%

This is in the transcript

"And on top of that if the market delivers another 10% revenue growth "

++ to add to above point on ebitda

last year ebitda is 275 crore

FY 25 would be

275 +

40 crore from esop saving +

4% * 275 = 11 crore from corporate g & a +

10% revenue growth might result in 14% ebitda growth = 275 * .14 = 38.5

Total = 275 + 40 = 315+11 = 326 + 38.5 = 366 crore roughly for FY 25

ev/ebitda multiple of 16 gives 6222 crore valuation

Which is very close to the current enterprise valuation

4200 + 2153 debt = 6353 crore

Okay i get it now.

Samhi has reported two ebitda for FY 24

275 is standalone

348 is consolidated pre esop. for FY 24. (including acic)

In the kotak securities analysis sheet shared above it mentioned 275 for fy 24

so i got confused.

I will redo the calculation with 348 ebitda for FY 24

For FY 25

FY 25 would be

348 +

4% * 348 = 13 crore from corporate g & a + same for esop

10% revenue growth might result in 14% ebitda growth = 348 * .14 = 48

348 + 13 + 13 + 48 = 422 crore ebitda for fy 25 with no tax

422 * 16 = 6752

current enterprise value is 6353.

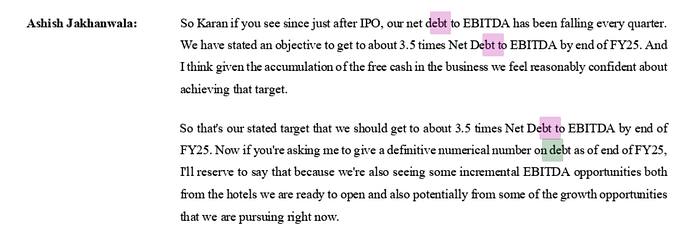

Guidance for debt at fy 25 end is 3.5 debt/ebitda i.e 3.5 * 422 = 1470 ~ 1500 crore

So market cap can be = 6750 - 1500 = 5000 crore

i.e roughly 23 to 25% upside from current levels.

The Kotak report also uses the Mumbai land parcel as a basis for the target price. Given the uncertainty around reflecting in the PnL by a certain date, it’s best to ignore the target and arrive at a valuation independently, like you’ve done.

Any specific reason for giving 16x ev/ebitda multiple to samhi?

Currently it is trading at ev/ebitda multiple of 21x and Charlet at 35x and debt/ebitda of Samhi is 4x and for Charlet is 3x

in fy 25, Samhi should have ebitda 422 so the EV= 422*21 =8862

market cap can be = 8862- 1500 = 7362 crore

so 84% upside. If market plans to give even higher multiple (less likely) the price may appreciate more.

Thoughts?

I am taking the screener number of EBITDA for my ease, my calculations will apply to 348 as well. its for the purpose of assigning a EV/EBITDA multiple

Despite the fact that there are higher chances of rerating than derating because of continued strong performance, lets assume it stays 21x

Here is how I calculate it Moreover, they have guided for 200 crores of interest cost and the cost of debt is 10% so the debt should be around 2000 crores(more or less the same at current levels)

10% revenue growth is too harsh, ACIC portfolio will have good margins+ a margin expansion of 4%

and 300 rooms or so are being added to the portfolio in next few months. So according to the management, 100 crore of EBITDA will be added just from these two.

Moreover, REVPAR willl be in the low double digit numbers, lets be conservative and say 10%

This is operating leverage at play and it will straightaway fly to the EBITDA

So, 267+100+30= 400 crores.

a 21x multiple gives 8400 crores crores of EV/EBITDA. Reduce 2000 crores as Debt and you get an upside of 50% for the next year.

1)Why not comparing with its peers ,since big players are getting over 30x why samhi will get only 21x?

2)I read the history of other big players when they were in loss, during those period they are getting P/S of 4-5x where Samhi Hotel are currently valued at , once they turnaround they started valued at a P/S of over 10 , So if same things happens to Samhi as well and valued at P/S of 10 with the Sales of 1150(15%Growth) it should be traded at mcap of 11500 which is around 2.5x , so there should be upside of 150%.

I’m I missing something?

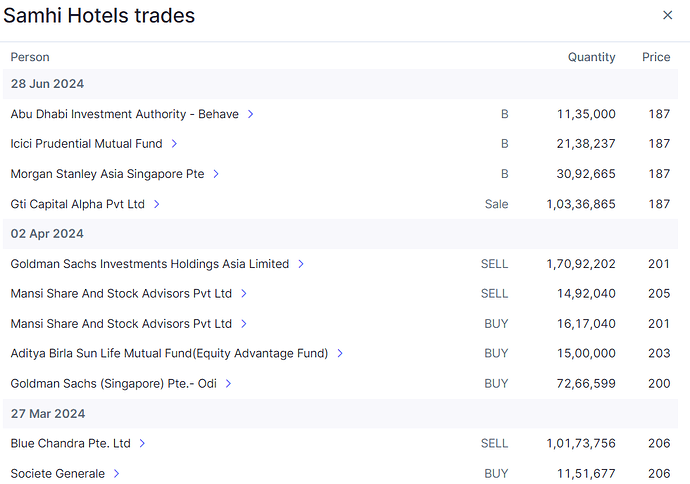

the nature of holders in Samhi are weak. Most of them are PE funds who hold significant stake in the company and they tend to exit after IPO. I think one just exited a while back. So there will always be a supply overhang and that is what’s restricting the movement of Samhi currently imo.

So because of this, I would want to consider a lower multiple(that doesn’t mean we won’t get rerating surprises ![]() )

)

Do check lemon tree and similar. Also the hospitals. I am no expert but I think this is normal in the industry. Unless you are old institution sitting on prime real estate assets, you require huge capital to scale.

Capital intensive sector with long gestation period requires multiple stakeholders to bear the risk.

Some of them happen to be PEs who want exit but I have seen some sitting on their holdings for years.

Management said they are targeting 3.5x Net debt/EBITDA by the end of FY25 and the Interest cost for FY25 will be 200cr as the interest rate is 9.8%, hence the net debt is 2000cr. Current cash balance is 260cr, assume the cash balance is same next year as well and the generate cash flow is being used to bring down the debt.

Net debt at the end of FY25 = 2000-260 = 1740cr

EBITDA = 1740/3.5 =497cr

Considering valauation of 21x EV/EBITDA: EV= 10440cr

Market cap = EV-debt = 10440-2000 = 8440cr

upside of 2x

Note: Samhi hotel is trading at the lowest valuation in its peer group. With improved balance sheet the valuation perhaps either remains same (21x) or increases, and less likely to decrease.

When management said Debt to ebitda they are referring to long term borrowing only which is 1560cr as of now.

Correct me if I’m wrong

folks also must factor in the accounting writebacks , that management has mentioned in the recent call , some impairment reversal coming in this year , some deferred tax benefits coming in next year , will only add to earnings momentum , and ADIA also buying in most blocks , some selling overhang needs to go for stock to head higher , valuations give comfort , but we just hope the industry doesent see any major shocks , mostly returns in this will come quick when price discovery starts , better to stay invested rather than time this one.

Modelling Samhi Hotels - Complexities around the business

Highlighting some of the risks-

Accounting:

- You cannot go with directly PAT here, because there can be chance of again write offs. ( Only Ebitda is predictable )

Write-Offs:

- Samhi has history of write-offs

Business Model Risks:

- Samhi has sold of few hotels in 2023 why ?

Expansion Delay:

-. Samhi is having ongoing expansion of hotels which are not up in past 3 to 4 years ? Why it’s being delayed.

Caspia Pro Hotel , Bangalore expansion, Hyatt Regency etc…

ACIC Portfolio: ( Good or Bad )

One of the bad side is they have diluted lot of equity,and got the land bank in Navi Mumbai and that’s written off ( 70cr )

Good part - They have added 950+ keys.

Shares in Supply :

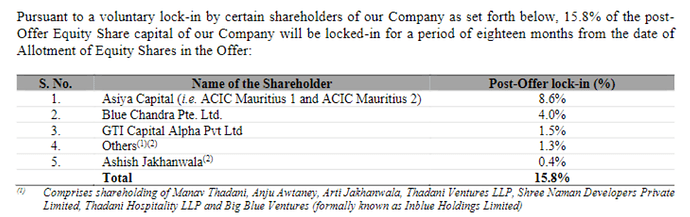

Lock-in of shares is also near March 21st 2025

Some of the risks you have highlighted are not just risks but the nature of business or the inherent risk.

-

Lock-in period ending is not a problem at all, there is a lot of demand of Samhi shares among FII/FPI/DIIs and will be absorbed easily. Refer so many block deals in the past.

-

Pending renovation- last 3-4 years were the worst for the hotel industry, hence no point of adding and new inventory or renovation. That was industry wide and not just for Samhi.

-

Hotel sold - are you it was Samhi who sold the hotel as I didn’t see its name in the news.

-

Write offs : you are correct about it but saying they have history of write off could be an exaggeration. All the soon to be profitable enterprises generally do some write offs. Refer Zomato.

Having said that, there are limited number of companies driven by best in class management, good governance. Maybe that’s why some of the best FIIs have invested in the company and continuously increasing the stake.

Invested so somewhat biased.

Hi Deepak,

I truly respect the management for creating a niche and building a 1000cr company.

I am just highlighting some of the risks which has to be kept in mind or think in those direction as well.

Because I didn’t see anyone pointing these risks.

And to answer your question: Yes samhi sold the hotel companies in 2023.

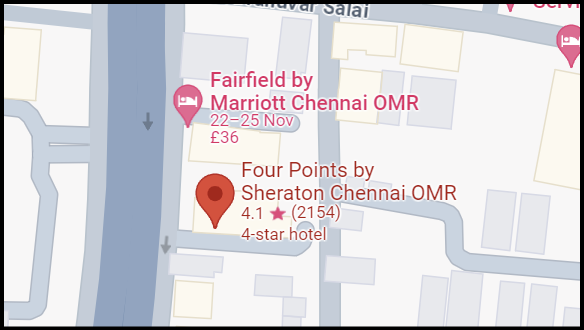

Samhi sold two hotels in 2023: one in Ahmedabad, and one in OMR Chennai. This is because they acquired hotels in the ACIC portfolio that were in nearly identical locations as these hotels.

For example, they sold the Fairfield by Marriott, Chennai (OMR), and acquired Four Points by Sheraton, Chennai (OMR) in the ACIC portfolio. These two buildings share a wall.

Similarly in Ahmedabad, the two hotels are separated by a ten minute drive. Ahmedabad is a very volatile market with 4000 keys of supply. Crucially, note that the two hotels acquired with the ACIC portfolio are in the same market segment (upper mid-scale) as the two sold. It doesn’t make sense for a Samhi to have this much exposure to multiple hotels in the same segment in this small a market, compared to a Bangalore which is a 17,000 key market.

Today, Samhi has three hotels in Ahmedabad in three different market categories.

In one year post acquisition, ACIC portfolio does an EBITDA margin of around 38%. This means they did the acquisition at around 12-13x FY25 EV/EBITDA net of the land written off. I think it’s a sign of prudent management to be honest and provision for a disputed land up front. They are confident of winning a favourable judgement here, which could result in a writeback of 70 Cr. There is no more downside to the land parcel now post provisioning.

D: invested, biased, largest position in my portfolio. No recent transactions.

Shares in Supply :

Lock-in of shares is also near March 21st 2025

Actually only 15.8% of the shares o/s are locked in for a period of 18 months, i.e. till March 2025. Beyond this 15.8%, pre-IPO and anchor investors are free to sell and they have been selling through the last few months.

Blue Chandra and GTI Capital have in fact already sold down to their 18 month lock-in levels. So the selling overhang is not a March 2025 event, its already very much underway.

ACIC Portfolio: ( Good or Bad )

One of the bad side is they have diluted lot of equity,and got the land bank in Navi Mumbai and that’s written off ( 70cr )

The land issue was unfortunate but as Chinmaya pointed out I think the ACIC acquisition happened at a fair valuation. Not cheap (as you can imagine in the middle of a strong hotel upcycle), but fair, at around 13x EVEBITDA considering ACIC’s FY24 EBITDA nos. So I don’t think over-dilution happened.

Expansion Delay:

-. Samhi is having ongoing expansion of hotels which are not up in past 3 to 4 years ? Why it’s being delayed.

Caspia Pro Hotel , Bangalore expansion, Hyatt Regency etc…

Not sure if they have addressed this in the DRHP or the concalls, cannot recall. If I had to guess I would think it was due to a drag in free cash due to high debt and Covid. Hopefully these assets will be rebranded and functioning by H2 FY25 as management has guided.

Disc: Invested and biased.