Did anyone attend the EGM yesterday? Please share the summary of the proceedings if anything significant was mentioned.

Nothing major.

They expect 12% CAGR in refractories till FY25.

Same commentary as parent call. Dalmia acquisition complement RHI because of Cement and western operations. 300000 T capacity.

You should look at the results, margins were hit. RHIM CEO :

" there has been pressure on the margins due to foreign exchange fluctuations and further increase in the cost of the traded goods arising out of the energy cost hikes in Europe as a fall out of the war

RHI Magnesita’s global mgmt is walking the talk. They are investing pretty heavily in India.

We need to compare what others, especially Vesuvius are doing in India.

Some points from the RHI Magnesita EGM:

-

Project Milan has been initiated to complete integration with the acquired companies. By April 23, new organizational structure will be ready.

-

We now have 500,000 TPA capacity of which 150,000 TPA is unutilised capacity, which is enough for the next 3 to 5 years.

-

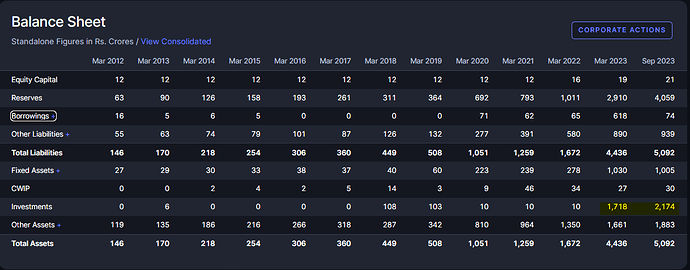

Currently the acquisitions have been funded through a 1-year bridge loan.

-

We do not plan to borrow Rs.5,000 crores – it is only an enabling provision.

-

We are now 72% steel and 28% industrial (i.e. non-steel which includes cement, glass etc.) after Dalmia acquisition which is a more balanced portfolio compared to earlier when we were more weighted towards steel.

-

We have saved 3 to 5 years by doing this acquisition. Dalmia has 5 plants and going the organic route would have taken a lot of time to recreate what Dalmia already has.

-

Why equity dilution - If we borrow, it also increases the parent’s leverage due to consolidation. The parent is also on an acquisition driven growth and hence they have to manage their own leverage also. If we take ECB loan from parent, there is 5-year lock in as per current rules which results in significant exchange risk.

-

We can still do some more small acquisitions even now.

-

Goodwill amount - not yet finalized. May be known by April.

-

Capex plans – Planning Rs.300 to Rs.350 crores capex for Dalmia modernization, Rs. 100 crores per year for maintenance capex thereafter

-

We are seeing very strong growth going ahead. All steel makers like Tata, Arcelor Mittal, Jindal etc. are talking about doubling their production. Steel sector is expected to grow 6 to 7 % CAGR, cement even faster in double digits like 10 to 11 %. We will grow more than the market.

-

No rights issue since the size is not all that big.

Promoters seem to have offloaded 10 % of holdings on to general public. Anybody knows the reason? any management commentary on that?

Lot of questions in the concall around overpaying for Dalmia and the rising debt due to that. Didn’t see a clear response from management. Will this put a significant dent in the balance sheet due to the repayment of interest on debt undertaken?

RHIM’s parent company, Netherlands based RHI Magnesita N.V. is in the midst of a takeover offer from Ignite Luxembourg Holdings (owned by a US based PE fund Rhone Holdings VI LLC). On 30th May 2023, Ignite announced an offer to buy upto 20 % of RHI Magnesita’s o/s shares, listed on the London Stock Exchange at GBP 28.50 per share, a 20 % premium to the then prevailing market price. The offer size has since been raised to 29.90 % of the o/s capital. If the offer goes through, Rhone also intends to demand a representation on the company board.

Interestingly, Rhône had been a long-term investor in Magnesita Refratários S.A., a Brazil based mining group which was merged with RHI in 2017 to form the present day RHI Magnesita. Rhone had exited RHI Magnesita in 2018, but is seeking to re-enter the stock now.

The RHI Magnesita Board has taken a stance that the offer undervalues the company, with the offer price being at a discount to the company’s 5-year share trading range, as well as is lower than most of the analysts’s target prices. The Board feels the company’s share price does not yet reflect the full benefits of the several organic and inorganic initiatives taken by the company in recent times.

Austrian entrepreneur Martin Schlaff is the largest shareholder in RHI Magnesita with a 28.4% stake with a clutch of financial investors holding the rest.

RHI Magnesita declares H1 CY2023 results. Global CEO says H1 represented challenging conditions in all the geographies “with the exception of India” and calls India “the world’s fastest growing refractory market”. He has also provided important updates on the operational synergies promised during the recent acquisitions, and technology transfer from US / Europe to India.

hy-results-2023-26-jul-23.pdf (rhimagnesita.com)

Meanwhile, Vesuvius India – the other major refractory player in the country - has declared strong results yesterday with sales up 23 % and profit up 79 %.

Hi @Chandragupta, studies much of the fundamentals from your chain and from the annual reports. Something I am not so sure is the entry point, do you think this is a correct entry point? Do you there is margin of safety at this level? Any thoughts would be appreciated.

This is important but can be easily missed by a casual observer.

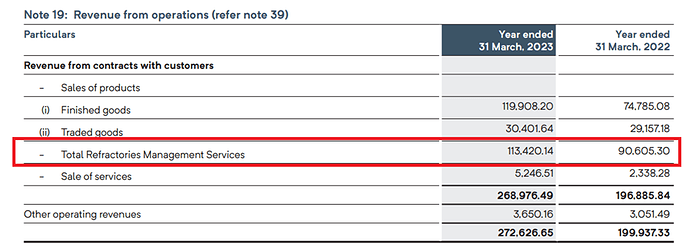

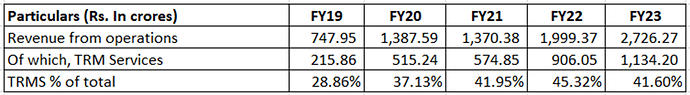

A large part of RHIM’s revenues come from ‘Total Refractory Management Services’ (TRMS).

Under TRMS, the company does not just sell goods but provides comprehensive ‘solution’ to the customer. Revenues from TRMS have grown rapidly in recent years, up from 29 % of revenues in FY19 to more than 40 % in FY23.

But what is TRMS? Refractories are not just homogenous products that are produced on an assembly line and shipped to the customers. They need to be tailored to customers’ end use application, such as depending on the shape and size of the furnace / kiln, quality of ore used, type of the steel to be produced and so on. This is a specialized job, and under TRM Services, RHIM posts its own resource at customer plant who manages the task.

Now comes the interesting part. Revenue from TRMS is recognized not based on quantity of refractory sold but the quantity of steel produced by the customer.

More the steel produced with the same amount of refractory; more will be RHIM’s revenue. This way, RHIM’s interest gets perfectly aligned with the customers’ interest. TRMS earns higher margins and yet the customer is happy to pay more because the entire task is getting outsourced and he is paying for the output rather than the input. Imagine a refinery pricing its fuel based on the milage you get. He has an incentive to produce better & better fuel, and you do not mind paying more since you are driving longer. This is very different from the usual “sale of goods” where the buyer and seller are locked in a perpetual zero-sum game, and one party’s gain becomes another party’s loss.

The parent’s formidable R&D setup helps produce such products, which maximize customer output. Smaller players cannot compete in such a market and are rapidly losing ground. This is where the moat in this business comes from. The latest Annual Report shares several examples of how research and technology is driving business growth.

(Disc: Invested)

Company has achieved fairly fast integration of the large acquisitions, and new growth drivers have begun to emerge. Volumes have grown, margins have improved, debt has reduced, and management is talking about selective expansion and modernization in the months ahead. Overall, a steady quarter for RHI Magnesita.

Highlights from the Q2 FY24 concall:

-

On sequential basis versus previous quarter, revenue grew by 6% on the back of 8% rise in shipments. EBITDA margin improved by 70 basis points to 15.3%. Capacity utilization improved 67% overall in the current quarter, up from 64% in previous quarter on a consolidated basis.

-

Traded volumes are 30% of revenue this quarter. Last year it used to be 50%. Ultimate target is to reduce it year by year.

-

Margins - Standalone RHIM, we will be maintaining the margins at 15% - 15.5%. Flow control products margins will be 18 to 20 %. Flow control historically is above 25 % of total market size in the country. In the coming quarters, there will be pressure on selling price as the RM prices have corrected, but if we talked about margin in percentage term, we would like to keep this margin intact.

-

Exports - Are around 10% to 11% of revenues currently. All of that comes from RHIM standalone plants. We want to double exports in the next five years’ time.

-

Iron making division - We announced a special vertical, independent vertical for iron making division. Head by one of our original leaders, Sanat Ganguli and a dedicated team for that. So that will be the focus area in coming days for us. This diversification should not only reduce our dependence on steel sector but also help broaden our market share globally. This comes from Seven Refractory, which was joint venture and which we in July acquired 100%. Almost 70 million tons of steel is produced through blast furnace. So, this is a big market which we were not representing and now we have focused, and we will be pursuing this very seriously. That is a big step forward. We think we can grow exponentially over there. That will be a game changer.

-

RHIMIR (i.e. Dalmia) - The volume growth should go up by more than 10% in the coming quarters. Margins are now above 13 % and they would be maintained. With this acquisition, the product mix base has changed dramatically. We have some products which is having a low selling price, low margin, which in percentage wise impact our bottom line. But if you talk about absolute value contribution, it is phenomenal. The company will be spending some Rs. 200 crores, Rs. 300 crores over two years at the plant for renovation and refurbishment. With this, capacity will not increase, but we will replace 10 presses with two new presses state of the art. So that will help us to reduce our fixed cost absorption and improve productivity, improve consistency of quality of product and reduce the scrap rate. Margins will also improve. Reaching 85 % - 90 % capacity utilization will take four - five years’ time here.

-

Jamshedpur - This is a flow control plant. So, there we are operating at 50% capacity level. There we will increase our capacity, our sales, and that will help us to mitigate a lower margin of IR plants. With Hi-Tech, we have made inroads in Tata Steel and Nilachal Ispat. Jamshedpur margin should be around 20% to 21%. Our colleagues from other regions, like East-Asia and Europe have visited this plant. Maybe next six months is a trial period and then probably we’ll start getting commercial orders for export.

-

Magnesia bricks (Cuttack plant) - We are having a capacity of above 30,000 ton in India, which we will be producing and selling. Still, about 50,000 tons to 60,000 tons is coming from abroad. And we have a plan to enhance the capacity of our Cuttack plant from 30,000 tons to 45,000 tons to 50,000 tons. And in coming days, if the market remains like that, we would like to have one more plant or one more line in the existing plant. And maybe on the West coast also. These are import substitution products.

-

Growth - Post the acquisitions, we are focusing on increasing our share of industrial and other non-steel segments through product diversification. Some of these products along with higher flow control products would also fetch better profit margins. Low to mid-teens kind of growth rate as a trend growth rate is absolutely possible. We are aiming at growing at about 8% by volume. So, in the next four years or five years’ time we would like to have at least 35 % to 40 % market share. Also, I would not rule out the possibility of inorganic growth as well in coming day, said Mr. Sagar. One analyst pointed out that in the next two to three years, 30-million-ton steel capacity is coming up in India. Another analyst pointed out that if we look at the quarterly numbers of the steel companies, volume growth has not been more than 6 % - 8 %, whereas the industry, all the large refractory players have reported strong volume growth across all the players. Management said this is because import substitution is picking up.

-

Bigger customers coming up with new plants are asking for total solution, including robotics, automation etc. Company is working on that and talking to two to three customers on these lines.

-

Rajgangpur plant - will be modernized in the next two to three years. Delivery lead time for equipment is 8 to 14 months, so it will happen in 2025.

(Disc.: Invested)

In the next three years, RHI Magnesita group to move their global I.T. operations from Europe to India. More in this interview:

https://www.fortuneindia.com/long-reads/the-conversation-stefan-borgas-ceo-of-rhi-magnesita/114931

do we feel that the technicals are underperforming currently? If yes, is that due to valuations alone? thx.

RHI Magnesita India Limited Q3 & 9M FY’24 Earnings Conference Call February 14, 2024

- On blended EBITDA, the margin was adversely impacted due to investment in increasing skilled workforce and higher year till date bonus provision, which together offset the benefit from lower material cost.

We recently announced plans to close down our Bhilai plant, which is under RHI Magnesita India Refractory Limited, this plant comprises hardly of 0.07% of our consolidated revenue. It’s net worth is hardly 0.04% of our consolidated revenue. This plant is much smaller than the other plant under RHIMIRL and produces only one product which can be made at a larger scale at our Rajgangpur unit more effectively. Therefore, this move will help the cost efficiencies, economies of scales and overall consolidation.

We also announced plans to amalgamate RHIM Seven Refractory Limited into RHIMIRL. This move aims to consolidate the refractory business acquired from Dalmia Bharat Group at one place and effectively managed well under one entity. We expect this to enhance value, expand net worth, provide a competitive edge, reduce cost and streamline the corporate structure

-

About macro view of strategy, as mentioned in the past, one of our key focus area is increasing our share, industrial and iron making and value added products through product diversification and bringing synergies from our acquisitions. We are actively taking the initiative to consolidate all our operations and improve internal efficiencies. RHI Magnesita aims to leverage its expertise, capacities, and market vision to capitalize on market opportunities.

-

The benefits of the recent acquisitions are reflected in the form of higher production and shipments as well as more diverse product portfolio. These moves position the company to cater to a wider range of end-applications.

Where they are invest money?

In recent concall MD and CEO of RHIM Parmod Sagar also told that EBITDA is decreasing due to investment. Can anybody tell me

From what I recollect from the concall,

- Company exceeded their KPI targets set by the parent, making them eligible for more than 100 % bonus. Since provision is made only for 100 % bonus at the start of the year, balance provision for entire 9 month period was made in Q3, leading to higher employee costs. This creates a one-time bump in Q3 which will not recur in future quarters.

- Interest cost is higher due to adverse movement of the EUR to INR exchange rate. But this is a fully hedged loan and hence the excess will be reversed in future over the tenure of the loan.

- There was a workers’ strike in one of the factories. However, the management held their ground and after 9 days, the workers resumed work unconditionally. But 9 days production was lost in the process. Now the relations with the workers union are cordial.

- Company held back shipments to a customer who was delaying payments, leading to 5 % lower sales. The customer has now started making payments on time and shipments have resumed.

Thus, though the gross margins have improved, all of the above have led to lower EBIDTA and net margins. But as we can see, all the above are one offs which will hopefully not recur or get reversed in future.

Source - Business Line 11th March Title “‘Expecting ₹10,000-cr investment in steel PLI next fiscal’”

their M&A has created situation where they may lose business from SAIL and other large steel makers as now it is one combined business bidding for refractories as opposed to RHIM, DOCL, Hitech being three different bidders and this impact is likely going to show up from June, as per the latest earnings call.

Besides refractory space in general is under pressure, see fall in IFGL also (#2 by sales). And the high PE in RHIM (albeit one time due to M&A hit to bottomline) is probably causing some stress.

Thanks Utsavg. Can you please elaborate the M&A point a bit more in detail? How would they loose business? My confusion is arising because I would imagine, with fewer players, this would give them pricing power and greater market share. Also, the demand is likely to increase due to infrastructure push. Wondering what am I missing.