Hey everyone,

I’ve been digging into Raymond Realty (NSE: RAYMONDREL) since it spun off from the parent company, and I think it’s an interesting one for us to discuss. We often find some hidden gems in demergers, and this one has a few things that caught my eye.

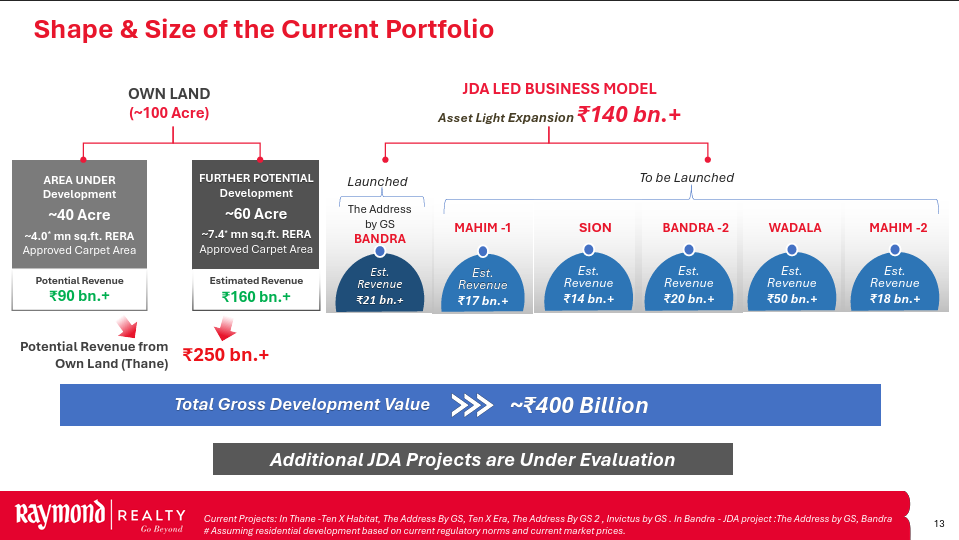

What we have here is a company with a massive, valuable land bank that’s now shifting gears to a more aggressive, asset-light growth model. It’s a pretty unique setup.

1. A Bit of Background

So, Raymond Realty is the real estate division of the Raymond Group, which started back in 2019 to make the most of their land in Thane. To really unlock its value, they demerged it, and it started trading as its own company on July 1, 2025.

How they’re playing it:

They’re not your typical developer that buys up land and sits on it. Their plan is to be asset-light, focusing on Joint Development Agreements (JDAs).

- The Cash Cow: They’ve got a huge 100-acre piece of land in Thane that’s already being developed. This is what’s bringing in the money right now.

- The Growth Engine: All their future plans are pinned on the “JDA Led Capital Light Business Model,” mostly around Mumbai.

Who’s in charge:

Gautam Singhania is the chairman, and he’s been the driving force behind this move. The day-to-day is handled by Harmohan Sahni, the MD & CEO, who’s been in the real estate game for over 30 years. It’ll be interesting to see how they manage their money as they grow.

2. What’s Happening in the Market

The real estate scene in India has cleaned up a lot since RERA came in. People are more confident about buying, and even with interest rates creeping up, the demand is still there.

RRL is all in on the Mumbai market, which is a beast of its own.

- Thane: This is their turf. It’s a fast-growing area with a ton of new infrastructure coming in. They’re a big deal there, claiming that one in every three homes sold in Thane is theirs.

- Going Premium: Their projects in Thane, and the new ones planned for Bandra, Wadala, and Sion, are all in the premium and luxury space. These buyers aren’t as worried about interest rates.

It’s a tough market, though, with big names like Godrej, Oberoi, and Prestige all competing for the same deals. But having a clean slate and a well-known brand gives RRL a foot in the door.

3. How the JDA Model Works

The JDA model is a smart way to grow without needing a ton of cash. Instead of buying land, they team up with landowners.

- The Developer’s Job: They handle all the headaches—getting approvals, building, and selling.

- The Landowner’s Job: They bring the land to the table.

- The Deal: They split the profits or the finished properties. This means they can get projects off the ground much faster, which leads to a much better Return on Capital Employed (ROCE). RRL is hitting a 26% ROCE, which is way above what the traditional guys are doing (6-18%).

But there’s a catch:

- You’re relying on your partners, and things can get messy if there are delays or disagreements.

- The profit margins on JDA projects are usually a bit lower, but you make up for it by doing more projects with less money.

From what I can see, RRL is using its brand to get a bigger piece of the pie in its JDA deals.

4. The Numbers

RRL is still in its early days, but the numbers are looking pretty good.

- Booking Value: ₹2,314 crore

- Revenue: ₹2,313 crore

- EBITDA Margin: ~20%

- Net Debt: -₹233 crore (They have more cash than debt)

- ROCE: 26%

How they stack up against the competition:

| Company | Market Cap (₹ cr) | Net D/E | ROCE (FY25) | P/NAV (Est.) |

|---|---|---|---|---|

| Raymond Realty | ~4,240 | Net Cash | 26% | ~0.6x |

| Godrej Properties | ~86,300 | ~0.4x | ~15% | ~1.4x |

| Kolte-Patil | ~4,950 | ~0.3x | ~18% | ~0.8x |

Export to Sheets

What’s it worth?

Let’s break it down:

- The Thane Land: This could bring in ₹25,000 crore in revenue over time. After costs and discounting, it’s worth about ₹4,500 crore today.

- The JDA Projects: These could generate ₹14,000 crore, with RRL’s share being around ₹11,500 crore. After costs, that’s worth about ₹1,955 crore today.

- Cash in the Bank: They have ₹233 crore in net cash.

Total Value = ₹4,500 cr + ₹1,955 cr + ₹233 cr = ~₹6,688 crore Value per share = ~₹1,006

With the stock trading at ~₹638, that’s a 37% discount to what it could be worth. The market is clearly worried about whether they can pull it off.

What could happen?

| Scenario | What it means | Value per share (₹) |

|---|---|---|

| Bear | Delays, weak sales, lower margins | ~₹750 |

| Base | They deliver as planned | ~₹1,006 |

| Bull | They’re faster and more profitable than expected | ~₹1,250 |

Export to Sheets

5. The Technicals

The chart is showing some promising signs after the big drop since it listed.

- The Bottom Is In? The stock seems to be building a base. The selling has dried up, and now it’s a waiting game.

- Double Bottom: There’s a clear “Double Bottom” pattern around the ₹611-₹625 level, which is a classic sign of a reversal.

- Momentum Is Shifting: The RSI is showing a bullish divergence, which means the selling pressure is easing.

- The Big Boys Are Buying: There have been some big volume spikes on green days, which tells me that some institutional investors are quietly buying in.

6. The Risks

- Can They Deliver? This is the big one. They’ve done well in Thane, but can they handle a bunch of new projects all at once?

- All Eggs in One Basket: They’re only in the Mumbai market, so if there’s a slowdown there, it’ll hit them hard.

- Interest Rates: If rates go up too much, it could hurt the housing market.

- Partnerships: JDAs can be tricky, and a bad partner can cause a lot of problems.

7. My Take

I think Raymond Realty is a bet on the management’s ability to execute. They have a great setup with a debt-free balance sheet and a huge discount to their potential value.

The market is giving you the high-growth JDA business for free right now because it’s worried about the risks. If they can start launching their new projects and show some strong sales numbers in the next 6-12 months, I think we’ll see a big re-rating.

What to watch for:

- Sales Numbers: They need to get their annual sales up from the ₹2,000-2,500 crore range to over ₹4,000 crore after the new projects launch.

- Cash Position: They need to stay debt-free. That’s their superpower.

What do you guys think?

- Is the management team ready to handle this kind of growth?

- Is the Raymond brand strong enough to compete with the likes of Oberoi in the luxury market?

- Is the current discount fair, or is the market missing something here?

Disclaimer: I own this stock. Please do your own research.